Paradigm shift: Visa just expanded stablecoin settlement capabilities 😳; Is Binance finally having an FTX moment? 🤯; Adyen is now a bank in the UK 🇬🇧🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Your Ultimate Bundle of Profit & Loss Statement Templates 📊 [use this to always keep your financials in check]

Elon Musk continues 𝕏’s expansion into the payments biz 💳 [recap of what’s been done & what’s next + a deeper dive into the build of the most powerful FinTech company ever]

Visa & Mastercard eye credit card fees increase 👀 [what it’s all about + deeper dives into two financial giants & the USP of Open Banking]

Gen Z has the fastest-growing credit card debt of any generation 🤯

Amazon strengthens its digital wallet with new BNPL option 💳

As for today, here are the 3 intriguing FinTech stories that were changing the world of finance as we know it. This week was just crazy in the financial technology space, so make sure to check all the above stories.

Paradigm shift: Visa just expanded stablecoin settlement capabilities 😳

The news 🗞️ Financial technology powerhouse Visa V 0.00%↑ is expanding its stablecoin settlement capabilities to the Solana blockchain and is also working with merchant acquirers Worldpay and Nuvei.

This is a BIG deal, so let’s take a look.

More on this 👉 We must remember that the payments giant has been working with issuers of stablecoins since 2021 and the latest move is part of Visa looking into settlement options to send funds onchain and hence speed up settlement times for their merchants.

By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, Visa helping to improve the speed of cross-border settlement and providing a modern option for merchant acquirers like Worldpay and Nuvei to easily send or receive funds from Visa’s treasury.

Using its own account with USDC outfit Circle, Visa can now manage settlement payouts in USDC to Worldpay and Nuvei who can then route these payments in USDC to their end merchants.

✈️ THE TAKEAWAY

What’s next? 🤔 This development from Visa is a massive one as it has the potential to revolutionize dollar settlements between institutions by taking advantage of crypto's speed and global accessibility. It makes cross-border dollar payments faster, cheaper, and available 24/7. The funds can be sent instantly rather than having to wait days (or sometimes - even weeks). Thus, acquirers (payment processors like Worldpay or Nuvei) can receive funds instantly from Visa after a transaction, rather than waiting days. They can then instantly pay merchants, eliminating settlement risk. More importantly, it not only validates the value of stablecoins for cheaper and faster cross-border payments. Also, this unlocks huge potential across the whole payments ecosystem and can modernize the entire cross-border finance value chain. Zooming out, this means that Visa is not only quietly bringing crypto to one billion users. More importantly, it shows that stablecoins might eventually become the de facto interbank settlement solution via card networks. In other words, Visa is de-banking the banks… 👀 Huge.

ICYMI: Visa & Mastercard eye credit card fees increase 👀💳 [+ more reads & deeper dives]

Game-changer: Visa just made P2P payments interoperable 🤯💳 [one of the biggest payments developments this year!]

Is Binance finally having an FTX moment? 🤯

Following the news 🗞️ Binance, the world’s biggest crypto exchange, is facing significant headwinds. And that’s actually an understatement.

In fact, more and more industry insiders are starting to speculate that we might soon be witnessing FTX 2.0. And that would be catastrophic for the whole crypto industry.

Let’s take a look.

Zooming out 🔎 To connect the dots, you always have to zoom out. Below is a good summary of the major negative events for Binance since December. Seeing everything in one place definitely makes you think:

Is this FUD? Could be. But it definitely makes you question things quite a bit.

Exec exodus 💼 Earlier I’ve talked about the massive executive exodus from Binance. Below is a brilliant summary of Binance leadership departures since early 2021:

Of course, departures, resignations, or layoffs is a natural thing that happens in every industry. Not to mention the vibrant and challenging ones like crypto.

Yet, at some point, you should start questioning how the largest exchange in the world, which processes 90% of the world’s crypto volume, has so much executive turnover? Something’s not right here…

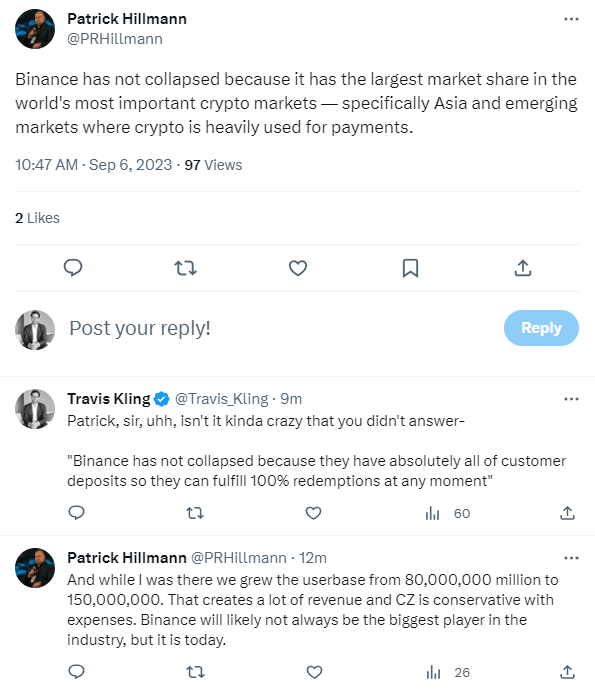

A cheery on top 🍒 If the above wouldn’t be enough, here’s a recent wild response from the former head of PR for Binance:

I will leave this to your own interpretation.

✈️ THE TAKEAWAY

So what’s next? 🤔 We must remember that founded in 2017, Binance is by far the largest crypto exchange in the world. For years it operated without licenses and an official home base, serving traders through its Binance.com platform. As regulators started cracking down on the industry, the company said it would change and become compliant, though it continued to take risks. Now, Binance's challenges are mounting, with probes from multiple global regulators and several lawsuits. These include a lawsuit by the Securities Exchange Commission (SEC) citing 13 counts of securities law violations and another by the Commodity Futures Trading Commission (CFTC). The recent exodus from, legal, compliance, and product units may only hamper Binance's defense efforts, not to mention making business operations increasingly difficult. Zooming out, if Binance would really go down that would undoubtedly be the bottom for the crypto industry, not to mention all the collateral damage and loss of trust in the industry. The only good thing here when looking for parallels with FTX is that the fraudulent exchange collapsed after a $8B withdrawal while Binance was simply unmoved. Will it continue like that? We shall soon find out.

P.S. here’s what you all think:

ICYMI: The aftermath of the FTX collapse could be bigger than the earthquake 🌋 [a recap of what happened]

The mindblowing collapse of FTX-linked stocks 🤯 [+6 more bonus reads]

Adyen just became a bank in the UK 🇬🇧🏦

The news 🗞️ Dutch payment giant Adyen recently obtained a full banking license in the UK from the Prudential Regulation Authority and Financial Conduct Authority.

This license is a significant milestone that will allow Adyen to expand its offerings in the UK market and further strengthen its position as the ultimate financial services platform globally.

Let’s take a look.

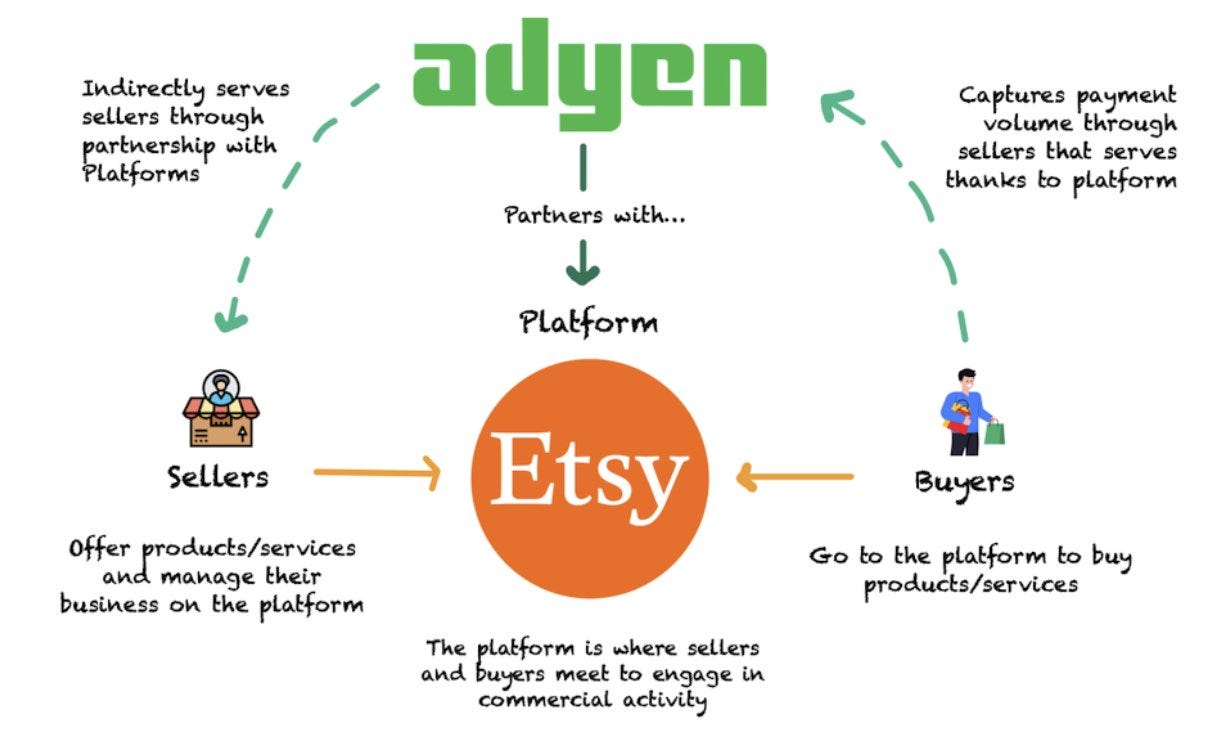

More on this 👉 The UK license solidifies Adyen's position as a local acquirer in the region. By having full control of its services, Adyen can continue providing its trademark speed, flexibility, and reliability that benefit UK customers. Also, the license ensures Adyen can maintain its full suite of services in the UK post-Brexit under the Temporary Permissions Regime.

Additionally, the license enables Adyen to offer its newly launched embedded financial products to UK platform businesses. These products include business bank accounts, debit cards, and cash advances to provide financial services to SMBs directly within platforms.

For example, Adyen is targeting platforms such as eBay and Etsy to provide their SME customer bases with direct access to cash advances when they need them. These are the businesses that have massive potential and untapped growth potential.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, we must again state that the UK banking license represents a key step as Adyen aims to become a full-spectrum financial services provider globally. We can remember that Adyen has already obtained a banking license in the Netherlands and launched real-time payments through integration with the US FedNow system (the only FinTech and a single European player). The UK license therefore solidifies Adyen's footprint in another major market. Looking at the big picture, Adyen is now very well positioned to leverage its global banking licenses and unified platform to embed customized financial services within platforms (as aforesaid Etsy or eBay) and further compete with other FinTech giants like Stripe. Especially when it comes to huge and complex customers that require non-standardised solutions.

Given the recent collapse of its stock price, this development is yet another strong argument for Adyen’s global growth story.

ICYMI:

+ bonus is a deep dive into Adyen + latest analysis of other important FinTech companies

🔎 What else I’m watching

Crypto custody 🔐 South Korea's Hana Bank has teamed up with BitGo to offer clients digital asset custody services from next year. One of South Korea's biggest banks, Hana will offer the services in the second half of next year, tapping crypto custody specialist BitGo's blockchain security technology. BitGo is also set to open a South Korean office after securing regulatory licenses, according to local press reports. We can remember that the US firm recently closed a $100M Series C funding round at a $1.75B valuation. Good move.

More car payments 🚘💸 Car manufacturer Hyundai has launched a system that lets US drivers find and pay for things with their vehicle's touchscreen using securely stored credit card information. The company has partnered with Parkopedia to launch Hyundai Pay's first service, which lets drivers locate, reserve, and pay for parking at 6000 locations - all from inside their vehicle, after an initial set-up. The system will launch with the 2024 Hyundai Kona, with an additional nine models getting it via model year changes or over-the-air updates.

Another one bites the dust… 💨 Upstreet, an Australian fintech that lets shoppers earn fractional shares on purchases, has closed down, according to a message sent to customers and seen by the Australian Financial Review. The closure comes 17 months after Upstreet completed a $3M funding round and two weeks after it celebrated its fourth anniversary with a LinkedIn post stating: "Here is to many more years!" The firm's app and Google Chrome extension let users shop at over 600 brands and earn fractional share rewards. Founded by former McKinsey staffers Christian Eckelmann and Sabine Tejerina, Upstreet also offered a programme for companies to provide their employees with fractional shares.

💸 Following the Money

Qashier, a Singapore-based payments system provider, has closed US$10M in a series A funding round.

Nigerian Banking-as-a-Service platform Anchor has raised $2.4M in seed funding from several prominent investors, including Goat Capital, FoundersX, and Rebel Fund, alongside existing backers Y Combinator and Byld Ventures.

Commonwealth Bank of Australia (CBA) has entered an agreement to acquire the cloud-based invoice lending platform, Waddle.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: