BIG Win: Revolut's path to a UK Banking License likely clears 🇬🇧📱; Coinbase keeps delivering: gains full license in Singapore 🇸🇬; Riding the hype: Visa creates $100M Generative AI Venture Fund 💸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

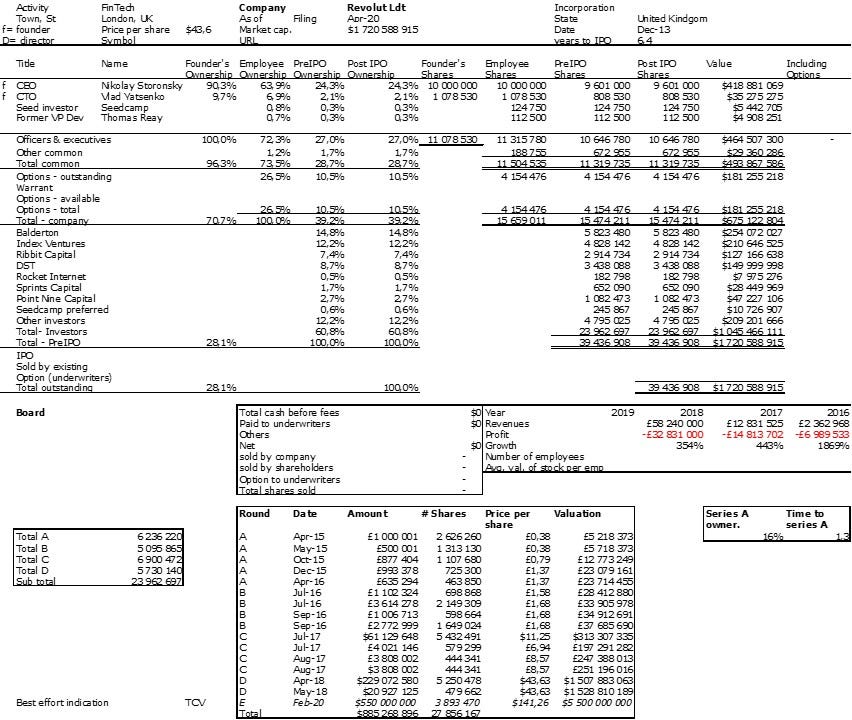

The Ultimate Cap Table Template 📈 [use this as a financial compass to guide you through the equity landscape]

Monzo’s second attempt to conquer US: here’s why the British neobank is more likely to fail than succeed 🇺🇸🏦 [a deep dive with lots of bonus reads]

FinTech M&A is alive: Wagestream buys Keebo 🤑 [why it matters + some priceless M&A resources so you could get things right]

Red Flags at Revolut: FCA investigates suspicious account activity 🚩🚩

Another FinTech M&A: Shift4 acquires SpotOn unit for $100M 💸

As for today, here are the 3 compelling FinTech stories that were transforming the world of finance as we know it. This week was just wild in the financial technology space, so make sure to check all the above stories.

BIG Win: Revolut's path to a UK Banking License likely clears 🇬🇧📱

The news 🗞️ London-based FinTech giant Revolut has moved one step closer to obtaining a long-sought UK banking license after reaching an agreement with key investor SoftBank to simplify its shareholder structure.

This is a big and strong move for Revolut, so let’s take a look.

More on this 👉 The Bank of England has made streamlining Revolut's complex ownership a precondition for granting a full UK banking license, which the company first applied for in early 2021. We can remember that Revolut currently operates in Britain under an EU banking license from Lithuania (this is where they originally started as a bank - first a specialized one and then transitioned to a proper one).

According to reports, the stumbling block has been Revolut's largest backer, SoftBank, which has resisted giving up preferential rights attached to its stake without significant compensation. After months of talks, the two sides have now struck a deal that will see SoftBank's shares converted into a single class along with other investors, removing a key obstacle.

The agreement does not involve any new share issuance to SoftBank nor has a financial impact on Revolut, indicating the Japanese investment giant will not receive special treatment.

Other major Revolut shareholders, including Tiger Global Management, Ribbit Capital, and Balderton Capital, have reportedly already agreed to the share conversion or are in final discussions.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, gaining a UK banking license would allow Revolut to provide the full suite of services offered by traditional banks, including overdraft protections, personal loans, and deposit accounts (aka new revenue streams). It would thus represent a major step in Revolut's maturation since its 2015 founding and allow it to better compete with incumbent banks on its home turf. However, Revolut still faces lingering questions about its financial reporting and compliance procedures. Earlier this year, auditor BDO raised red flags related to Revolut's 2021 accounts. Revolut also recently drew scrutiny from regulators over money released from accounts flagged as suspicious. It doesn’t look good…

ICYMI: Red Flags at Revolut: FCA investigates suspicious account activity 🚩🚩 [what FCA investigation of suspicious account activity is all about + more bonus reads]

On top of that, we must also mention that the approval process for a UK banking license requires sign-off from both the Bank of England's Prudential Regulation Authority and the Financial Conduct Authority (FCA). The lengthy procedure and ongoing questions hanging over Revolut suggest licensing approval may still be months away. Looking at the big picture, securing a UK banking license would definitely boost Revolut's reputation and credibility as it continues rapid expansion across Europe. Also, by being a bank in the UK, Revolut could finally proceed with the long-awaited US bank charter. But similar to Monzo, I just cannot see how they could win in the States…

ICYMI [+ lots and lots of bonus reads]:

Coinbase keeps delivering: gains full license in Singapore 🇸🇬

The news 🗞️ Cryptocurrency pioneer Coinbase COIN 0.00%↑ has received a major payment institution (MPI) license from Singapore's central bank, allowing the crypto exchange giant to offer a wider range of digital asset services in the country.

Let’s take a look.

More on this 👉 The approval enables the largest US cryptocurrency exchange to provide a broader suite of digital asset services to both retail and institutional customers in Singapore. More importantly, it paves the way for Coinbase to tap surging demand for crypto across Asia, even as it spars with regulators in the United States.

Why Singapore? Singapore has emerged as a crypto-friendly jurisdiction, with over 700 Web3 companies based there. Coinbase says 25% of Singaporeans see crypto as the future of finance. To drive local adoption, Coinbase introduced customized products like PayNow bank transfers and fee-free purchases of USDC stablecoin.

We must remember that in 2022, Coinbase has also achieved VASP registrations in Spain, Italy, Ireland, and the Netherlands.

✈️ THE TAKEAWAY

Looking ahead 👀 At the core, the MPI license cements Coinbase's growth roadmap in Asia. The company plans to form partnerships with local banks and regulated financial institutions leveraging the Singapore license. Looking ahead, the approval also provides a blueprint for Coinbase to attract users and build market share across Asia's burgeoning crypto economy. Having said that, it’s not surprising that Coinbase shares ticked higher on Monday, extending robust 2023 gains buoyed by recovering crypto prices. The Singapore license is thus a timely boost as the crypto giant looks to overseas expansion amid its legal spat with US regulators. If the crypto pioneer continues making headway across Asia, its stock could see additional upside through 2023.

ICYMI: It’s all about that Base 'bout that Base, no treble 🎵 [how Coinbase’s Base Blockchain is doing + why it’s a critical part of their "Master Plan"]

Riding the hype: Visa creates $100M Generative AI Venture Fund 💸

The news 🗞️ Financial behemoth Visa V 0.00%↑ just announced a $100 million investment initiative to fund companies developing generative AI technologies for commerce and payments.

This move signals Visa's confidence in generative AI's potential to transform financial services.

Let’s take a look.

More on this 👉 The investments will come from Visa Ventures, Visa's corporate venture capital arm. Visa plans to target early-stage startups building generative AI to enhance business processes, infrastructure, and customer experiences in banking and payments.

Visa has a history as an early AI and payments innovator, using AI for fraud prevention since 1993. Generative AI could hence take Visa's AI applications to the next level across its products and networks. Visa's chief product officer called generative AI "one of the most transformative technologies of our time" that will "reshape how we live and work."

That’s not too far off…

Bonus: The insurance sector is more and more exploring the benefits of AI 🤖

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

JPMorgan is developing a ChatGPT-like AI service for investors 😳 [+6 more reads]

The funding comes amid growing interest but also concerns around generative AI in finance.

✈️ THE TAKEAWAY

Looking ahead 👀 Major banks are actively though cautiously exploring various AI applications. Having said that, Visa's new artificial intelligence fund in a sense legitimizes generative AI's promise in banking and commerce. As discussed earlier, potential use cases here span personalization, process automation, fraud prevention, and much more (see above & below). Looking at the big picture, Visa's Gen AI fund first and foremost demonstrates the technology's momentum in FinTech. By investing in cutting-edge AI startups, Visa basically gives itself a front-row seat that could later (via partnerships or M&As) grant the payments giant access to enhanced security, speed, and convenience across its massive payments infrastructure, not to mention opportunities to develop new revenue streams and thus maintain Visa's competitive edge. Zooming out, we must remember again that as AI becomes more sophisticated, financial institutions will continue finding ways to apply it. The ones who will find these ways faster will ultimately win against those who choose to ignore them. And Visa yet again shows it wants to lead the pack in this frontier as well.

ICYMI: Game-changer: Visa just expanded stablecoin settlement capabilities 😳 [+more dives into Visa]

ICYMI: Generative AI will make Finance Autonomous 🤖💸 [taking a big picture view on the changes taking place now & what’s next + more deeper dives into AI & Finance]

🔎 What else I’m watching

Vaarwel 🇳🇱👋 Cryptocurrency exchange Gemini has announced it will halt operations in the Netherlands due to its inability to meet the regulators’ requirements. Gemini has decided to quit the Netherlands by 17 November 2023, following in the footsteps of Binance. The company cites its inability to meet regulators’ requirements but says it intends to return to the Dutch market. In a letter to its Dutch users on 26 September 2023, Gemini asks them to either withdraw their assets or transfer them to another wallet address, as the platform will suspend its operation in the Netherlands due to requirements imposed by the De Nederlandsche Bank (DNB) on crypto exchanges’ by Nov. 17. More good news for Coinbase I guess…

AmEx innovation 💳 American Express AXP 0.00%↑ is to pilot the use of facial and fingerprint recognition for authenticating users at online checkouts, as per Finextra. The biometric form factor has been added to the card scheme's SafeKey 3-D Secure authentication tool. Fingerprint and facial recognition for SafeKey were developed by using web authentication technologies from the Fido Alliance and World Wide Web Consortium, which are supported on all major Web browsers. A select number of US customers will be eligible for the pilot programme after completing a security validation during the SafeKey checkout process and using a device and browser that support facial and fingerprint recognition. These features will be rolled out to all US cardholders in early 2024.

Best lending initiative 💸 Arf, the global liquidity and settlement platform, has been awarded the Gold PAY360 Award for "Best Lending Initiative."Arf's infrastructure provided $400 million in loans and generated nearly $0.5 billion in on-chain volume within just 10 months. I still have hope in Web3!

💸 Following the Money

Crypto venture firm Andreessen Horowitz led a $24M Series A funding round for the web3 restaurant loyalty app Blackbird.

South African embedded payments platform Stitch has closed a $25M Series A Extension, led by Ribbit Capital.

Swedish account-to-account payments provider Brite Payments has raised $60M in fresh capital as it continues to expand across Europe.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: