Ramp is ramping up M&A: acquires AI startup to expand further into procurement 💸; The future of InsurTech? Allianz acquires struggling Luko💰; Rising credit card delinquencies 📈

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a regular 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Visa's strong Q1 2024 results and outlook despite macroeconomic headwinds 📈 [analyzing the latest data & graphs & taking a big picture view + some bonus deep dives into Visa]

Apple Card thrives 5 years in, but what's next? 🤔 [is it a failure?; how it’s performing & what’s next + tens of bonus reads and deep dives]

PayPal’s strategic investment in crypto transfer platform 💰 [what’s the value here & why it makes sense + bonus reads & deep dives into PayPal]

The only way is up? Fidelity marks up the value of Elon Musk's 𝕏 by 11% 🤑 [a holistic overview of the latest developments & why they matter + some bonus deep dives]

Regional banks' struggles open door for FinTech partnerships 🏦 [+ a deeper dive into the Microsoft of Banking]

SEC is likely to approve spot Ethereum ETFs. What should investors expect? 🤔 [what’s happening + one graph every investor should memorize]

Goodbye, Paytm? Paytm Payments Bank's demise and the future of digital payments in India 💳🇮🇳 [the demise & the future of digital payments in India + some bonus reads]

Venture Capitalists amass a whopping $311 billion in dry powder 😳 [latest data & what it means for startups and FinTechs + some bonus resources to help you get funded in 2024]

As for today, here are the 3 phenomenal FinTech stories that were transforming the world of finance as we know it. This was another huge week in the financial technology space, so make sure to check all the above stories.

Ramp is ramping up M&A: acquires AI startup to expand further into procurement 💸

The deal 🤝 Finance automation startup Ramp is aggressively expanding its product suite through mergers & acquisitions (M&A).

After two previous purchases aimed at improving customer support and negotiated savings, Ramp has just acquired Venue, an AI-powered procurement platform founded in 2022.

Let’s take a look and see why it matters.

More on this 👉 While financial details were not disclosed, the deal gives Ramp procurement capabilities to add to its existing offerings of corporate cards, expense management, accounts payable automation, and business travel.

Venue specifically helps companies manage vendor relationships and costs - an area ripe for AI implementation to eliminate inefficiencies.

The crazy part? The company sold itself less than 2 years after launching and before even needing to raise a Series A round 🤯 The remarkably fast exit reinforces Venue's ability to solve real pain points and build products people actively want to use. Bravo.

The traction 📈 The acquisition comes on the heels of Ramp launching improved procurement features such as bi-directional contract integration, dynamic intake forms, enhanced purchase orders, collaboration tools, and spend analytics.

With Venue's founding team leading Ramp's new procurement unit, the company aims to further automate workflows like custom approval workflows and PO management.

And even without it Ramp already processes over $10 billion in annualized accounts payable spend, which marks a 10x increase in two years 🤯 Ramp states its goal is to become a "one-stop-shop" for financial operations software.

With Venue under its umbrella, the FinTech giant is definitely one step closer to that.

✈️ THE TAKEAWAY

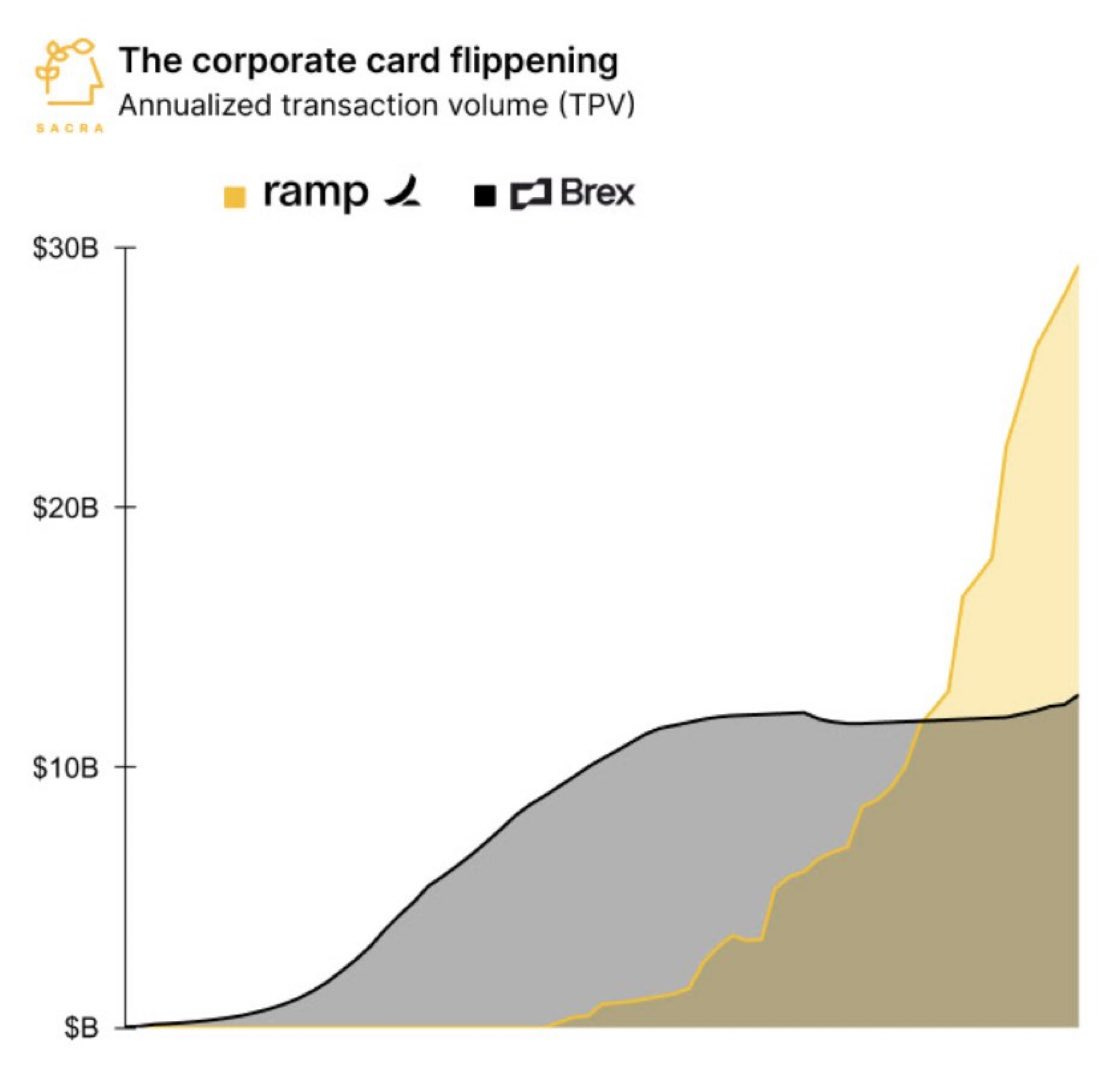

Looking ahead 👀 On a macro level, the procurement enhancements and Venue acquisition indicate Ramp's desire to compete with incumbents in the space such as Coupa and Concur. Additionally, the company's continued investment in AI and automation points to a future where technology eliminates tedious back-office tasks. If successful, Ramp would significantly disrupt legacy providers and potentially emerge as the financial OS for modern businesses. Finally, although this is 100% a payments play, it well coincided with what I wrote about last week about FinTech M&As - incumbents and well-capitalized startups are eager to snap up niche, unique technologies, and talent. On a micro level, this yet again widens the gap between Ramp and Brex:

ICYMI: Once a FinTech darling, Brex lays off 20% as growth slows & burn rate remains high 😳 [uncovering all the details to see what this tells us about the future of Brex & the broader FinTech ecosystem]

The payments industry faces a pivotal year amid tighter funding and more M&A 💸 [tighter funding & more M&A on the horizon, where the focus should be + some bonus reads]

The future of InsurTech? Allianz acquires struggling Luko💰

The news 🗞️ French InsurTech startup Luko has sold its home insurance business to Allianz Direct, a digital subsidiary of the German insurance giant, for €4.3 million.

This comes after Luko entered judicial reorganization proceedings in June 2022 due to mounting debt from its rapid expansion efforts.

Let’s take a quick look.

More on this 👉 Luko has raised €72 million since its founding in 2018 with ambitions to become a leading European insurtech. However, the company took on debt as it expanded to Germany by acquiring Berlin-based insurtech Coya and dove into new lines of business like unpaid rent insurance in France.

As funding dried up, Luko was forced to sell assets and find a buyer for its core home insurance operations.

After a months-long process involving multiple bidders, the bankruptcy judge approved Allianz Direct's offer as the best option to maintain jobs and continue serving Luko's 230,000 policyholders.

As part of the deal, Allianz will invest €25 million to restructure Luko's business and work towards profitability by 2027.

✈️ THE TAKEAWAY

Looking ahead 👀 While the acquisition likely disappoints those hoping Luko would thrive independently, it saves the company from dissolution. Meanwhile, Allianz gains a digital foothold in the French market, while preserving Luko’s brand and team. Win-win? Win-win! However, competing with Allianz’s existing agents on pricing could prove challenging, and this remains one of the biggest open questions as part of this M&A. Looking at the big picture, the saga serves as a cautionary tale for InsurTechs looking to rapidly expand product lines and geographies without proven economics. Remember - you will either die trying or get eaten alive.

Rising credit card delinquencies 📈

New data 📊 More than ever, credit card delinquencies are highlighting economic inequalities in America, according to a new report.

Let’s take a quick look.

More on this 👉 A recent report from the Federal Reserve Bank of New York found that while 75% of high-income consumers had access to credit cards in Q3 2022, only 59% of low-income consumers did.

This limited access restricts low-income families' ability to withstand personal financial disruptions.

The report also showed that delinquencies have risen across the board since 2020, exceeding pre-pandemic levels by Q3 2022.

However, delinquency rates were higher in low-income areas. Over half of low-income and moderate-income households were rent-burdened in 2021, spending over 30% of their income on housing costs.

With less discretionary income, these groups are more vulnerable to debt spirals when emergencies arise.

Additionally, lower-income homeowners were less likely to refinance mortgages between 2020-2021, missing out on reduced rates and costs. Other research shows credit card debt is now common across generations, with over 50% of Gen Xers, millennials, and Gen Z reporting that they carry balances month-to-month.

✈️ THE TAKEAWAY

Looking ahead 👀 As interest rates and prices continue climbing, household debt will likely keep rising unevenly across income levels. Without better access to affordable credit, many low-income families may struggle to stay financially afloat in the years ahead. Policymakers should thus consider proposals to expand credit access and provide relief to these disproportionately burdened households. Otherwise, this might start a downward spiral…

🔎 What else I’m watching

PayPal cuts ✂️ PayPal PYPL 0.00%↑ is laying off around 2500 employees, about 9% of its workforce, as new CEO Alex Chriss aims to boost competitiveness and address a falling share price. In a letter to staff, Chriss said the "right-sizing" will enable PayPal to move faster in delivering for customers and driving profitable growth. The cuts, to be made through direct layoffs and unfilled roles, come after PayPal missed key targets last year under former CEO Dan Schulman. Its stock has dropped over 20% since January 2022. Chriss took over in September determined to reshape PayPal amid intense competition and a tricky macro environment. A prior round of 2000 job cuts was unveiled last year for similar reasons. ICYMI: PayPal was expected to “shock” the world. Instead, they shot themselves in the foot 🥲

Klarna’s money story 💸 Somewhat ironically after its own financial troubles, Klarna is bringing back a feature showing customers their 2023 spending history and nudging them towards money management. Dubbed Money Story, it lets users identify peak spending months, top purchases, and the most common categories from the Klarna app and card data. With budgets squeezed, Klarna found November was the top month for deferred payments, aligning with holiday peaks. The insights for each user include prompts to utilize Klarna's in-app money tools like budget trackers. Raji Behal, Klarna's Western Europe head, says by "gamifying" the normally dull task of managing finances, the goal is to inspire people to optimize 2024 spending. Essentially, Money Story provides a Monzo Wrapped-style annual roundup to potentially spur better money habits via Klarna's suite of planning features. ICYMI: Klarna launches subscription service ahead of expected IPO 💳

More GenAI 🤖 Mastercard MA 0.00%↑ is supercharging its fraud detection capabilities with generative AI that evaluates relationships between transaction entities to predict risk. The new Decision Intelligence Pro solution layers AI enhancements onto Mastercard's existing 143 billion annual transaction scoring. In under 50 milliseconds, it sharpens the data provided to banks on whether a payment is likely fraudulent. Initial modeling shows a 20% average boost in detection rates, up to 300% in some cases. This better protects consumers and reduces false declines of legitimate transactions. President Ajay Bhalla says generative AI is transforming speed and accuracy to anticipate fraud and build trust. The launch follows Mastercard tapping GenAI for personalized retail recommendations. Turbocharging algorithms with the latest AI unlock next-level insights from assessing a trillion data points.

💸 Following the Money

Widely mocked NFT project Pixelmon raises $8M in seed round including Animoca Brands.

Bitcoin-based cross-chain swaps protocol Portal has secured $34M in seed funding from investors, including Coinbase Ventures, Arrington Capital, OKX Ventures, and Gate.io.

London-based Pivot Finance, a platform that provides real estate loans, raised €81M in funding from investors including Foresight Group and Quilam Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is dope. So much value for money. Upgrading to paid and Linas, please keep on doing what you do!

Brilliant as always - thanks!