Revolut officially hits $45B valuation, making it Europe’s most valuable startup 🦄🇪🇺; MetaMask & Mastercard launch crypto debit card 💳🦊; Wise up to tap India's $32B remittance market 🇮🇳😤

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

Nubank 2Q 2024: Latin America's digital banking juggernaut continues profitable expansion 😤💜 [analyzing the most important numbers, uncovering what they mean so you can see why NU is just too good to be ignored + lots of bonus dives inside]

Payoneer: undervalued growth story or fairly priced FinTech giant? 🤔💸 [diving deeper and unpacking the latest numbers to see why Payoneer might be worth your time and money in 2024 + some bonus reads inside]

Adyen's unified commerce prowess keeps on delivering 😤💸 [breaking down the key numbers, why they matter & why you should be bullish on Adyen + a bonus read inside]

Paysafe: a payments phoenix rising from the ashes. But can it soar? 🤔📈 [breaking down the key numbers, strategic outlook & what’s next for Paysafe + a collection of bonus deep dives into FinTech stocks you can’t afford to ignore]

Grab's Supersized Ambitions face profitability hurdle 👀📲 [breaking down their Q2 2024 numbers to see what they mean & why Grab might be worth your time and money in 2024]

Global Payments’ Q2 2024: undervalued FinTech powerhouse poised for solid upside 🤑📈 [analyzing the latest numbers, what they mean & why this FinTech powerhouse is massively undervalued]

dLocal’s Q2 2024: emerging markets payments pioneer faces turbulence 👀📊 [unpacking dLocal’s Q2 2024 most important numbers, what they mean & what’s next + bonus deep dives into two of the biggest FinTech gems in LatAm]

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This is the most packed and thrilling week in the whole of 2024 so far, so make sure to check all the above stories.

Revolut officially hits $45 billion valuation, making it Europe’s most valuable startup 🦄🇪🇺

The news 🗞️ British FinTech giant Revolut has secured a $45 billion valuation through a secondary share sale. This valuation marks a substantial increase from the company's previous $33 billion valuation in 2021, solidifying Revolut's position as Europe's most valuable private technology company.

Let’s take a closer look at this and see why it matters.

More on this 👉 The share sale, which provided liquidity for Revolut employees, was led by investors Coatue, D1 Capital Partners, and existing backer Tiger Global. The transaction allowed eligible employees who have been with the company for at least a year to sell up to 20% of their vested share options at $865.42 per share.

But that’s not it.

This valuation milestone comes on the heels of Revolut's recent acquisition of a UK banking license in July 2024, ending a prolonged three-year regulatory process.

The license enables Revolut to accept customer deposits and offer products such as loans and credit cards in its home market.

ICYMI: Paradigm shift: Revolut finally receives its long-awaited UK banking license paving the way for the new era 😳🏦 [what it’s all about & why it matters + a ton of bonus reads inside]

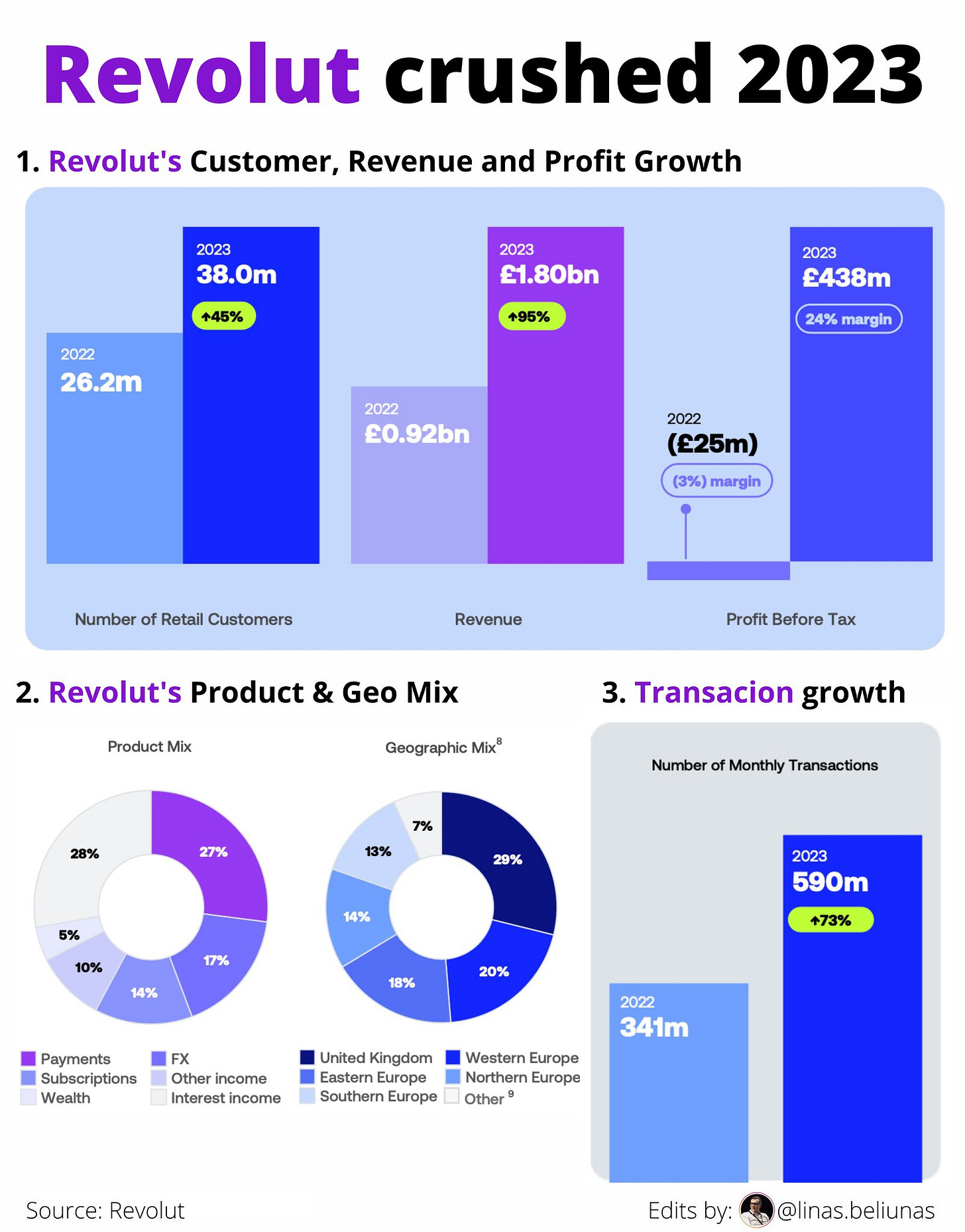

Zoom out 🔎 We can’t look at this in isolation. We must zoom out. And once we do, we remember that Revolut's financial performance has been impressive, with the company reporting pre-tax profits of £438 million in 2023, a significant turnaround from a £25 million loss the previous year.

Revenues nearly doubled to £1.8 billion, reflecting the company's strong growth trajectory.

ICYMI: Revolut’s 2023 financials: a FinTech rocket with astronomical growth, but regulatory asteroids loom 🚀☄️ [breaking down the key facts & figures, uncovering the most important numbers & what’s next for Revolut + bonus deep dives into Starling Bank, Monzo and JPMorgan]

What’s also interesting is that the $45 billion valuation positions Revolut as the UK's second-most valuable bank, surpassing traditional giants like Barclays, Lloyds Banking Group, and NatWest, and trailing only HSBC HSBC 0.00%↑.

ICYMI:

This yet again underscores the increasing influence of FinTech companies in the traditional banking sector.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this valuation is all about setting the stage for a potentially lucrative initial public offering (IPO). While Revolut has not officially announced IPO plans, the UK government is reportedly keen to convince the company to list in London rather than New York. I’m pretty sure it will go for NYSE... 👀

Zooming out, with this elevated valuation comes heightened expectations. Revolut will need to continue its strong financial performance and successfully leverage its new banking capabilities to justify its lofty price tag. And it is quite lofty since at $45B, the British FinTech giant is valued at 20x its 2023 revenue. For the perspective, its closest home rival Monzo is currently valued at 19x while payments giant Stripe is at a mere 4.86x. Interestingly enough, Nubank NU 0.00%↑ - probably the best-run bank & tech company in the world - would be valued at around 8x (based on their 2023 financials) 👀 So either Revolut is significantly overvalued or public markets don't love NU enough.

But either way, FinTech is back 🚀

ICYMI: Starling Bank’s latest financials: soaring profits, but gathering clouds 🌤️ [breaking down their latest annual report, uncovering the most important numbers & what’s next for Starling + a bonus deep dive into Monzo & why it’s super exciting]

Monzo’s first profitable year and high-growth opportunities ahead 🚀 [breaking down the key numbers & what they mean, looking at what’s ahead + a few bonus dives into Monzo]

Nubank 2Q 2024: Latin America's digital banking juggernaut continues profitable expansion 😤💜 [analyzing the most important numbers, uncovering what they mean so you can see why NU is just too good to be ignored + lots of bonus dives inside]

MetaMask unveils crypto debit card, bridging Web3 and traditional finance 💳🦊

The news 🗞️ MetaMask, the popular Ethereum wallet, has launched a pilot program for its new crypto debit card in collaboration with Mastercard MA 0.00%↑ and FinTech platform Baanx.

This card allows users to spend cryptocurrency directly from their self-custodial MetaMask wallet for everyday purchases, marking a significant step in bridging the gap between Web3 and traditional finance.

Let’s take a quick look at this.

More on this 👉 The MetaMask Card functions like a traditional debit card but enables users to spend their crypto assets wherever Mastercard is accepted. Unlike many existing crypto cards that require transferring funds to a third party before spending, the MetaMask Card allows users to maintain control of their assets until the moment of payment, preserving the self-custodial nature of the wallet.

Initially available to a limited number of users in the European Union and the United Kingdom, the pilot program offers digital-only cards with plans for broader distribution later this year.

The card currently supports USDC, USDT, and WETH cryptocurrencies held on the Linea blockchain, a layer-2 network developed by ConsenSys.

One notable aspect of the card is its integration with Apple Pay and Google Pay, allowing for immediate use in mobile payment scenarios. This feature enhances the card's practicality for everyday transactions, further blurring the lines between crypto and fiat currencies in daily life. Nice!

✈️ THE TAKEAWAY

What’s next? 🤔 MetaMask Card marks another step in the evolution of cryptocurrency adoption and usage. By enabling direct spending of crypto assets without the need for intermediary conversions or bank accounts, MetaMask is addressing one of the key barriers to mainstream crypto adoption. That said, the ease of use provided by the MetaMask Card could attract more mainstream users to the platform, potentially accelerating the adoption of Web3 technologies. More importantly, this move positions MetaMask as more than just a wallet, potentially evolving into a comprehensive financial services platform within the Web3 ecosystem. And we shouldn’t forget Mastercard here either. By partnering with MetaMask, one of the most popular crypto wallets, the payments giant is solidifying its position at the forefront of crypto-fiat integration. This move yet demonstrates Mastercard's commitment to embracing blockchain and digital assets, rather than viewing them as competition. Looking ahead, we can expect MetaMask to expand the card's availability to more regions and potentially support additional cryptocurrencies and networks.

ICYMI: Mastercard’s Q2 yet again proves the payments powerhouse is poised for continued growth 🚀 [breaking down the key numbers, what they mean & what’s next for Mastercard in 2024 + a bonus deep dive into its biggest competitor Visa]

Wise gears up to tap India's $32 billion remittance market 🇮🇳😤

The news 🗞️ London-HQed FinTech giant Wise is poised to make a significant move in India's burgeoning remittance market. After a brief pause to upgrade its infrastructure, Wise plans to resume signing up new customers in India within the next few months.

This strategic decision comes on the heels of obtaining a license from the Reserve Bank of India (RBI) that allows the company's users to send larger amounts of money overseas.

Let’s take a quick look at this.

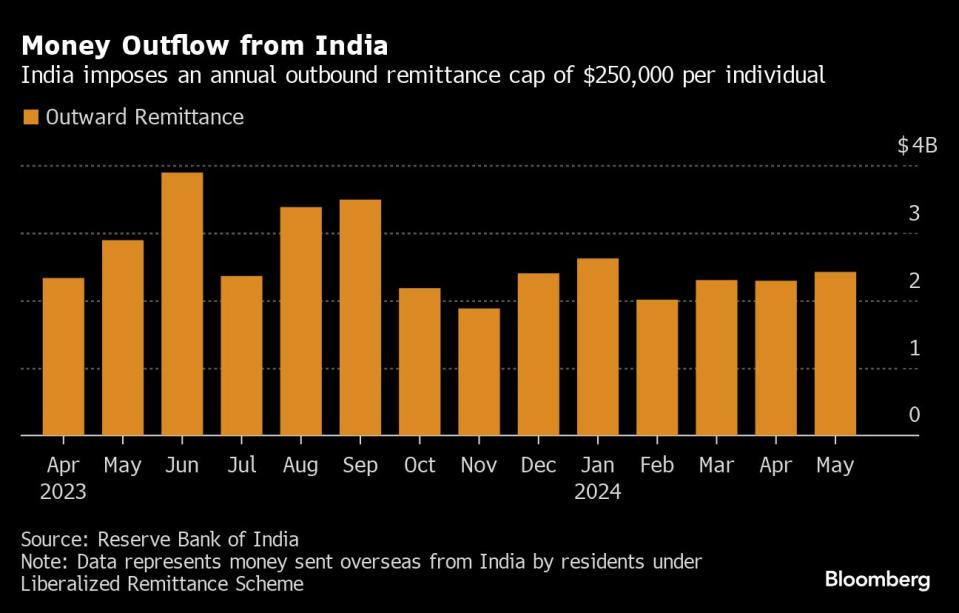

More on this 👉 India's outbound remittance market has seen substantial growth, reaching $32 billion in the year ending March 2024, up from $27 billion the previous year. This increase is primarily driven by payments for travel, education, and family expenses. Wise aims to capture a larger share of this market by offering a fast, affordable, and transparent cross-border payment solution.

The company's expansion in India follows the removal of a previous $5,000 per transaction cap, which had been in place due to regulatory restrictions. Wise is now upgrading its back-end processes to comply with tax and reporting rules mandated by the new Authorized Dealer 2 license from the RBI.

Cross-border money movements are currently dominated by banks in the country. Wise's competitive edge lies in its lower fees, with an average global fee of 65 basis points, significantly undercutting traditional banks in India.

✈️ THE TAKEAWAY

What’s next? 🤔 Wise’s success in India could significantly boost its global market share and revenue, as the Asia-Pacific region already contributes about 20% of its total earnings. If it follows its long-term growth strategy by attracting and retaining price-sensitive customers (which I’m more than sure it will do), Wise will definitely challenge the dominance of major Indian banks in cross-border transactions, which in turn may lead to increased competition and innovation in the sector. Looking ahead, we might expect other global FinTech players to follow Wise's lead, seeking to capitalize on India's growing digital payments market. This could lead to a more diverse and competitive landscape, benefiting Indian consumers with better services and lower costs for international transactions. Yet, we must note that navigating India's regulatory environment will remain a challenge for FinTech firms. The country's strict capital controls and tax regulations may continue to pose hurdles for foreign companies.

ICYMI: Wise continues its cross-border FinTech dominance 📈😤 [analyzing Wise’s latest trading update & what it tells us from investment POV + a bonus dive into this FinTech champion]

🔎 What else I’m watching

Russia Cancels AmEx Subsidiary's Banking License 🛑 Russia's central bank has canceled the banking license of American Express's AXP 0.00%↑ subsidiary in the country, following the company's request. AmEx suspended operations in Russia two years ago in response to the conflict in Ukraine. The move comes after President Vladimir Putin approved the liquidation of AmEx's local subsidiary. AmEx was among several financial services firms, including PayPal, Mastercard, and Visa, that halted services in Russia following the Ukraine conflict. ICYMI:

Mastercard Expands Open Banking for Lending with Argyle 🏦 Mastercard MA 0.00%↑ has partnered with Argyle to enhance its Open Banking for Lending initiative, offering income and employment verification for 95% of the US workforce receiving direct deposits. The update aims to improve lending decisions and integrate more individuals into the digital economy, particularly the 19% lacking traditional credit histories. The partnership enables digital verification through connected bank accounts or payroll systems, streamlining the lending process and reducing manual document collection. Mastercard's Cash Flow Analytics and Balance Analytics tools further support inclusive lending by assessing financial health trends. ICYMI: American Express’ Q2 2024: premium profits in a slowing economy, but valuation remains questionable 🤔💸 [breaking down their Q2 2024 numbers, what they mean to see whether AmEx is worth your time and money in 2024 + some bonus deep dives into AmEx]

Klarna Launches Balance and Cashback Features 💰 Klarna has introduced two new features, Klarna Balance and Klarna Cashback, in 12 countries across Europe and the US. Klarna Balance allows users to store funds and earn cashback rewards for shopping or receiving refunds. Klarna Cashback rewards shoppers with a percentage of their purchases at participating retailers, with rates up to 10%. These features aim to drive customer loyalty and inform spending decisions. Klarna continues to expand its offerings, having launched the Klarna Card in the US in April 2024. ICYMI: Klarna's growing IPO ambitions: Swedish FinTech giant eyes 2025 US listing 🤑📈 [what’s happening & why it matters + a bonus deep dive into Klarna]

💸 Following the Money

Ion Protocol, a liquidity protocol for staked and restaked assets, has raised an additional $4.8M from Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital, and SevenX Ventures, among others, bringing its total funding to $7M.

Scotiabank has announced it will acquire a 14.9% stake in American regional bank KeyCorp for $2.8B.

Yuze, a UAE-based, SME-focused fintech, has raised $30M from Osten Investments to expand into new markets. Yuze’s digital platform offers a suite of financial services, including business accounts and card programmes, to small businesses, e-traders, and freelancers via partnerships with banks and financial institutions.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Great read as always - thank you!

Great read. Thanks for sharing