Klarna's HUGE Pivot: Swedish FinTech giant announces crypto interest ahead of IPO 😳; Affirm & FIS partner up to let banks offer BNPL 💳; Stripe & Plaid are embracing secondaries as IPO alternative 👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

10 FinTech and Finance stocks to include in your portfolio for 2025 💼 | Part I [capitalize on the growth and innovation driving Finance & FinTech forward]

AI 100: Top Artificial Intelligence Startups of 2024 🤖💸 [these companies raised $28B already. Find whose backing them, unlock their exclusive pitch decks & learn from the best]

11 Finance & General Purpose AI Agents You Should Try 🤖 [discover the next generation of automated intelligence for money management, data analysis, and beyond]

Robinhood's wild Q4: record profits, 88% AUC growth, and global expansion signal a new era of growth 🤑💸 [breaking down their latest Q4 2024 numbers, what they mean, and whether Robinhood is worth your time and money in 2025 & beyond]

Adyen’s H2 2024: payments processing powerhouse continues to show industry-leading margins 😤💳 [breaking down their latest H2 2024 financials, what they mean & what’s next + bonus deep dive into Adyen’s competitors]

Coinbase’s Q4 2024: solidifying platform play for the mainstreamification of digital assets 🪙📈 [breaking down their latest numbers, what they mean and what’s next for Coinbase + bonus deep dive into its rival Robinhood]

Shopify’s Q4 2024: a commerce & FinTech powerhouse is hitting its profitable stride while maintaining hypergrowth 😤🛍️ [deep dive into their latest financials, breaking down key numbers, what they mean & why you should be bullish on Shopify in 2025]

Affirm’s Q2 2025: a growth story at an inflection point as profitability finally emerges 👏😤 [breaking down their latest numbers, what they mean & what’s next for Affirm]

The Ultimate Collection of Profit & Loss Statement Templates 📊 [supercharge your financial tracking & scale your profits]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 3 fascinating FinTech stories that were changing the world of financial technology as we know it. This was yet another insane week in the financial technology space so make sure to check all the above stories.

Klarna's HUGE Pivot: Swedish FinTech giant announces crypto interest ahead of $15B IPO 😳🔔

The BIG News 🗞️ Swedish FinTech leader Klarna, known for its Buy Now, Pay Later (BNPL) services, has just announced plans to integrate cryptocurrency capabilities into its platform as it prepares for a potential $15 billion IPO in April 2025.

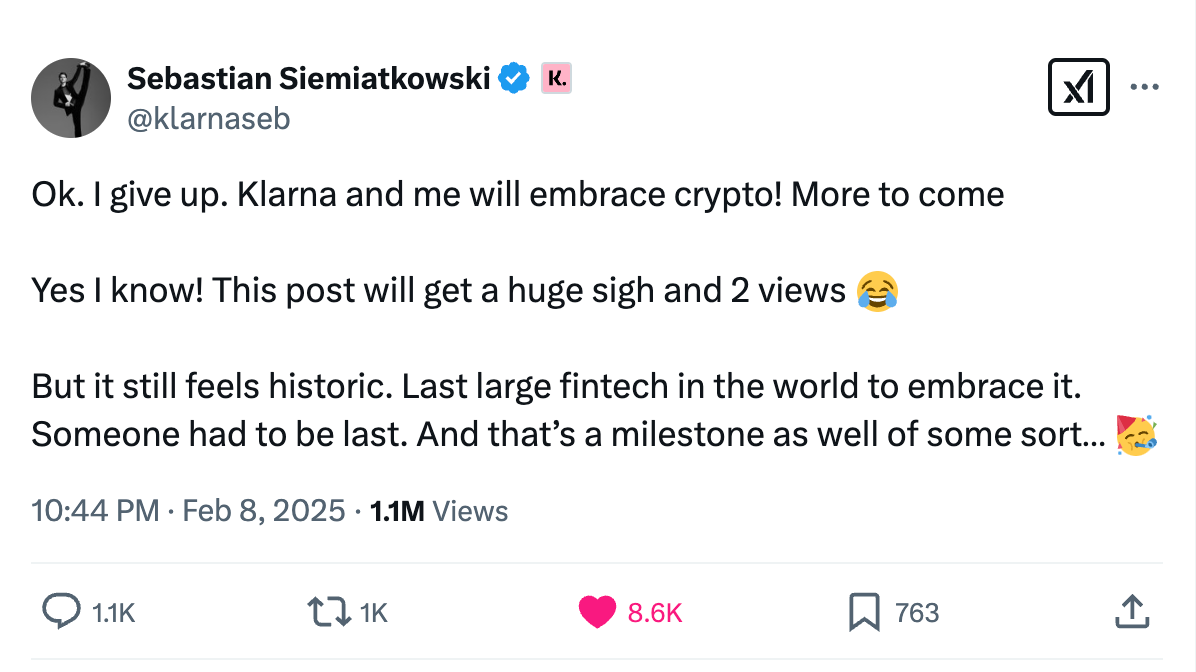

CEO Sebastian Siemiatkowski made the announcement via social media, marking a significant shift for what he described as "the last large FinTech in the world to embrace" cryptocurrency.

Let’s take a closer look at this, see why it matters, and what’s next.

More on this 👉 The announcement comes at a pivotal time for Klarna, which has demonstrated remarkable resilience after experiencing a significant valuation adjustment from $46 billion in 2021 to $6.7 billion shortly after.

The company has since stabilized and is now targeting a $15 billion valuation for its upcoming US IPO, for which it filed with the SEC in November.

Zoom out 🔎 Klarna's cryptocurrency integration strategy appears carefully measured. The company has explicitly ruled out incorporating digital assets into its core BNPL services, suggesting a more conservative approach to cryptocurrency adoption. With a substantial user base of 85 million customers, an annual transaction volume of $100 billion, and partnerships with over half a million merchants, Klarna's entry into cryptocurrency could significantly impact both traditional finance and crypto markets.

Industry experts have proposed various implementation strategies, including stablecoin payment systems for improved settlement processes, wallet integration for cross-border transactions, and potential DeFi lending options.

The company is currently evaluating these suggestions while maintaining a compliance-first approach.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, this development could have several significant implications. First, Klarna's move might trigger a domino effect among remaining traditional FinTech companies that have been hesitant to embrace cryptocurrency. The company's careful, compliance-focused approach could thus provide a blueprint for others to follow. Second, the timing of this announcement, coinciding with their IPO preparations, suggests Klarna sees cryptocurrency integration as a strategic advantage in attracting investors and expanding market opportunities (similar to AI). This could also influence how other companies approach their public offerings in the coming years. Lastly, Klarna's emphasis on separating cryptocurrency services from its core BNPL business might establish a new paradigm for how traditional financial services companies can incorporate digital assets while managing risk and maintaining regulatory compliance. All in all, we can expect Klarna to roll out its cryptocurrency features gradually, likely starting with basic trading and wallet services before potentially expanding into more sophisticated offerings. The success or failure of this initiative will definitely influence the broader adoption of crypto in mainstream TradFi. Gradually, then suddenly, as they say 😉

ICYMI:

Affirm and FIS partner up to let banks offer BNPL 🤝💳

The news 🗞️ Buy Now, Pay Later (BNPL) pioneer Affirm AFRM 0.00%↑ and finance giant FIS FIS 0.00%↑ have just announced a partnership that marks a significant shift in the BNPL landscape.

This collaboration will enable FIS's banking clients to integrate Affirm's pay-over-time capabilities directly into their existing debit card programs, representing the first major initiative to bring BNPL functionality to traditional debit cards.

Let’s take a quick look at this, see why it matters, and what’s next.

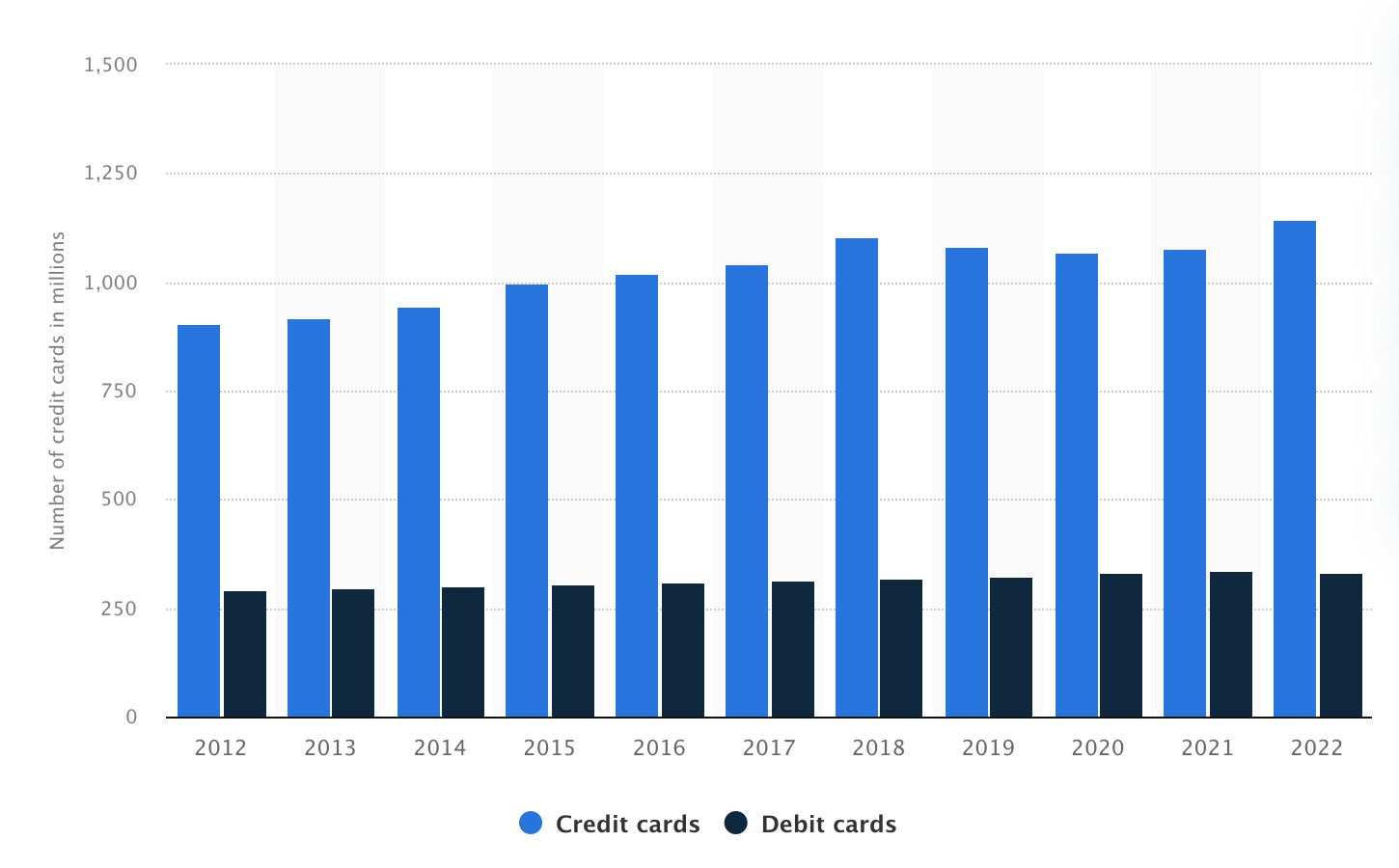

More on this 👉 The partnership addresses a crucial market opportunity, targeting the approximately 250 million debit card users in the United States.

Under this arrangement, participating FIS debit processing banks can offer their eligible customers both biweekly and monthly payment plans through their existing debit cards, eliminating the need for consumers to adopt new payment methods or additional cards.

A particularly compelling aspect of this partnership is the access to Affirm's network of over 335,000 merchants, which includes diverse retailers from travel booking sites to electronics providers. It’s all about the ecosystem 👥

Additionally, banks can unlock merchant-funded financing offers, including 0% APR options and extended payment terms, while Affirm manages the underwriting and servicing aspects. Win-win 👏

The timing of this announcement coincides with Affirm's strong performance metrics, including a 23% year-over-year growth in its active consumer base to 21 million users. The company's existing Affirm Card has shown remarkable growth, with 1.7 million active users representing a 136% increase from the previous year (more on this - below).

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this partnership represents a strategic evolution in the BNPL sector, moving from standalone offerings to integrated banking solutions. This shift could thus accelerate BNPL adoption among traditional banking customers who might have been hesitant to engage with separate BNPL platforms. For Affirm, this partnership opens up a vast new distribution channel through FIS's extensive banking network. The integration with existing debit cards could substantially reduce friction in customer acquisition and potentially accelerate Affirm's growth rate beyond its current trajectory. From FIS's perspective, this partnership aligns with their stated focus on digital transformation and enhances their competitive position in the banking solutions market. The company's emphasis on "Money in Motion" suggests this is part of a broader strategy to capture more value across the financial services value chain. Looking ahead, this deal could catalyze similar integrations across the industry (remember that Klarna just partnered with JPMorgan for a similar deal). Traditional banks that have been watching the BNPL space from the sidelines might feel increased pressure to offer comparable services, potentially leading to more partnerships between BNPL providers and banking infrastructure companies. Watch this space 👀

ICYMI: Affirm’s Q2 2025: a growth story at an inflection point as profitability finally emerges 👏😤 [breaking down their latest numbers, what they mean & what’s next for Affirm]

FinTech giants Stripe & Plaid are embracing secondary share sales as an IPO alternative 👀💸

The news 🗞️ Leading FinTech companies are increasingly turning to secondary share sales as a strategic alternative to public offerings, with both Stripe and Plaid announcing significant employee liquidity programs.

These moves highlight a growing trend among private technology companies seeking to provide value to employees and investors while maintaining private status.

Let’s take a quick look at this and see what it’s all about.

More on this 👉 Stripe, the payments infrastructure giant, is reportedly arranging a new employee share sale that could value the company at $85 billion or higher, marking a significant recovery toward its 2021 peak valuation of $95 billion.

This latest transaction follows a pattern of strategic share sales by the company, including a $6.5 billion buyback at a $50 billion valuation in 2023 and a $1 billion employee share purchase at $65 billion in late 2024. The consistent upward trajectory in these valuations clearly suggests strong investor confidence in Stripe's business fundamentals and a strong future ahead.

Simultaneously, Plaid is working with Goldman Sachs GS 0.00%↑ to facilitate a secondary sale expected to raise between $300 million and $400 million.

However, unlike Stripe's upward valuation trend, Plaid's transaction is anticipated to value the company below its 2021 Series D valuation of $13.4 billion, reflecting broader market adjustments in the FinTech sector.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the increasing prominence of secondary share sales in the FinTech sector signals a significant shift in how large private companies manage employee compensation and investor liquidity. This trend has several important implications. First and foremost, these transactions suggest that major FinTch companies are finding innovative ways to provide liquidity to employees and early investors without pursuing traditional IPOs. This approach thus allows them to maintain operational flexibility while still offering value to stakeholders. Looking ahead, we may see this model adopted more widely across the technology sector, particularly among companies that have reached significant scale but prefer to avoid the scrutiny and regulatory requirements of public markets. That said, the success of these programs at Stripe and Plaid could establish a new paradigm for late-stage private companies. However, the contrasting valuations between Stripe and Plaid highlight the increasing market differentiation between FinTech companies. Companies demonstrating strong revenue growth and market leadership, like Stripe, may continue to see valuation increases through these private transactions, while others may face more conservative valuations reflecting current market conditions.

🔎 What else I’m watching

Tabby Prepares for IPO 📈 UAE-based buy now, pay later (BNPL) platform Tabby has hired banks, including HSBC, JPMorgan, and Morgan Stanley, to prepare for an IPO in Saudi Arabia by late 2025 or 2026. Following a $700 million debt financing round and a $250 million Series D extension in 2023, Tabby acquired Saudi digital wallet Tweeq, expanding its product suite. The company, valued at $1.5 billion, has 14 million users and partners with over 40,000 brands. Tabby received its BNPL permit in July 2023 after graduating from the SAMA regulatory sandbox.

Mastercard Launches AI-Powered AML Service in Asia Pacific 🔍 Mastercard MA 0.00%↑ has introduced Trace, an AI-powered anti-money laundering (AML) service in Asia Pacific. Trace uses large-scale payments data to identify and prevent financial crimes by tracing suspicious activities across a network. The service provides holistic intelligence beyond individual firms' data, addressing the challenges posed by real-time payments and rapid fund movements. Already successful in the UK, Trace is now available in the Philippines, with 36 domestic lenders onboarded through BancNet. The service aims to enhance security, compliance, and trust in the digital economy. ICYMI: Mastercard continues being payments powerhouse with expanding moat & compelling growth runway 💳📈 [breaking down their latest numbers, what they mean & whether Mastercard is worth your time and money in 2025 + bonus deep dives into its competitors]

Citi Flex Pay Integrates with Apple Pay 📱 Citi has introduced its buy now, pay later service, Citi Flex Pay, to Apple Pay. Eligible cardholders can now split purchases of $75 or more into fixed monthly payments directly from their iPhone or iPad, with no additional fees or interest for 3-month plans. Longer plans incur a monthly fee. This integration follows Apple's AAPL 0.00%↑ decision to discontinue its own BNPL service and partner with third parties. Citi Flex Pay offers transparency and convenience, allowing users to earn Citi C 0.00%↑ rewards while managing payments seamlessly. ICYMI: Citi's transformation shows promise, but uncertainty remains 👀🏦 [unpacking their latest numbers what they mean, what’s next & whether Citi is worth your time and money in 2025]

💸 Following the Money

Cyprus-based INXY Payments has raised $3M in an investment round to ease crypto friction for businesses.

Raenest, a Nigerian fintech providing cross-border payments to gig workers and businesses, has secured $11M in Series A funding.

Warsaw-based Wealthon, which provides tailored financial products and services to SMEs, secured €126.2M, consisting of €116M in debt from Fortress Investment Group and €7m in equity from 3TS Capital Partners and angel investors.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is absolutely amazing. Not sure how you keep doing this but please don't stop!