Global Payments' $24B Worldpay M&A reshapes payment processing landscape 😳💸; Revolut wants to challenge AmEx with a new credit card strategy 😤💳; Kraken bridges Crypto-TradFi divide 📈👀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

AI Must-Reads: The Essential Guide to Winning in the Age of Intelligent Transformation 📚🤖 [360+ pages of must-read AI reports transforming today's leaders into tomorrow's visionaries]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

Europe's Top 1,400+ VC & PE Firms to Accelerate Your Startup Funding 🇪🇺💶 [your ultimate directory to high-impact investors, tailored funding, and explosive growth opportunities ]

JPMorgan's fortress capital & diversification excellence position it for outperformance amid mounting economic uncertainty 😤 [deep dive into JPMorgan’s latest Q1 2025 financials, breaking down what they mean & what’s next + bonus reads on how JPM is leading in all things AI & more resources inside]

Goldman Sachs demonstrates fortress-like resilience: trading prowess offsets volatile landscape in Q1 2025 😤🏦 [deep dive into Goldman’s Q1 2025, unpacking the most important numbers, what they mean & what to expect next + bonus deep dive into JPMorgan & their latest financials]

American Express’s Q1 2025: premium positioning continues to drive outperformance 💳📈 [breaking down the most important Q1 2025 numbers, what they mean, and whether AmEx is worth your time and money this year + bonus deep dives into their biggest competitors out there]

Revolut alumni want to disrupt payment industry by making stablecoins mainstream 💸🪙 [a quick look at Bleap and its USP & why it matters + bonus deep dives into stablecoins & their transformative potential]

Wise rides 28% volume surge to £39.1B in Q4, sets sights on trillion-dollar money movement 📈💸 [unpacking their latest numbers and why they matter + a bonus deeper dive into Wise & how it aims to become the network of the world’s money]

Global 6,200+ Investor Database to Fast-Track Your Funding in 2025 💸 [shorten your fundraising time, find your perfect investors, and close rounds faster]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another big week in the financial technology space, so make sure to check all the above stories.

FinTech Deal of the Year: Global Payments' $24B Worldpay acquisition reshapes payment processing landscape 😳💸

The BIG News 🗞️ Payments giant Global Payments GPN 0.00%↑ has just announced the $24.25 billion acquisition of Worldpay in a complex three-way transaction that will significantly reshape the payment processing industry.

Simultaneously, the company will divest its Issuer Solutions business to Fidelity National Information Services aka FIS FIS 0.00%↑ for $13.5 billion, creating what was described as a pure-play commerce solutions provider.

Let’s take a quick look at this, see how it will change the payments game, and what to expect next.

More on this 👉 The transaction involves Global Payments acquiring Worldpay from its current owners: private equity firm GTCR, which holds a 55% majority stake, and FIS, which retained a 45% stake after selling the majority position to GTCR in 2023.

GTCR will receive 59% of its consideration in cash and 41% in Global Payments stock, resulting in approximately 15% ownership of Global Payments after the deal closes. Not too shabby!

"The acquisition of Worldpay and divestiture of Issuer Solutions further sharpen our strategic focus and simplify Global Payments as a pure play merchant solutions business," said Global Payments CEO Cameron Bready in a statement.

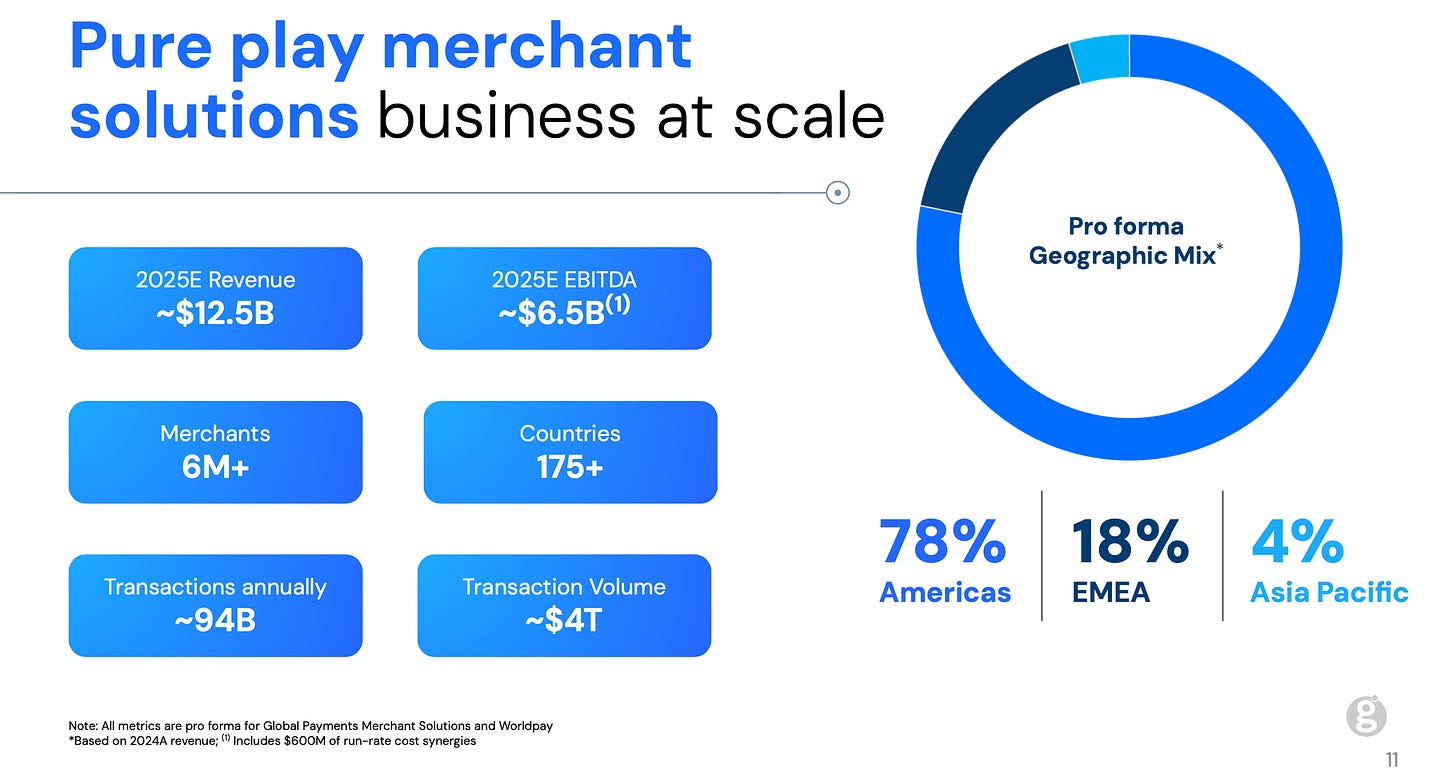

The combined entity will operate at a significant scale, serving over 6 million merchant customers, processing 94 billion transactions annually, with transaction volume of approximately $4 trillion across 175 countries. Solid! 👏

More importantly, Global Payments anticipates achieving substantial synergies from the deal, projecting $600 million in cost savings and at least $200 million in revenue enhancements.

We can remember that Worldpay & Global Payments were the top 3 & 4 merchant acquirers in the US last year:

Now the combined entity will be no. 1 😳

Zoom out 🔎 Markets reacted differently to each company's position in the transaction. While FIS shares rose nearly 9% following the announcement, Global Payments stock dropped approximately 17-18%, reflecting investor concerns about the strategic shift and integration challenges.

When it comes to FIS, acquiring Global Payments' Issuer Solutions business strengthens its core banking services segment with enhanced credit capabilities. The acquisition is seen as "strategic and accretive" and the FIS executives emphasized it would deepen relationships with financial institutions and corporate clients.

The transaction represents the latest chapter in Worldpay's complex ownership history. Founded in 1989 as part of UK bank NatWest, it has changed hands multiple times, including an acquisition by FIS in 2019 for approximately $41 billion before being partially divested to GTCR in 2023.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this megadeal signals ongoing consolidation in the payments sector as established players seek to compete with nimble FinTech disruptors. For Global Payments, the transaction represents a strategic bet on the merchant solutions segment, particularly in higher-growth areas like e-commerce and digital payments. On the other hand, the deal creates a more focused but potentially more vulnerable Global Payments. As some analysts have pointed out, the company already faces "integration risks" from previous strategic shifts, and this additional transformation adds to those concerns, potentially leading to merchant client attrition amid the changes. Looking ahead, the payment processing industry likely faces continued pressure from specialized FinTechs targeting specific vertical markets. Global Payments' acquisition of Worldpay provides scale but doesn't necessarily address the competitive threat from companies like Toast TOST 0.00%↑, Clover (from Fiserv), and Square XYZ 0.00%↑ that have gained market share through sector-specific solutions. Finally, the extended closing timeline - projected for the first half of 2026 - also creates uncertainty, as regulatory scrutiny of large FinTech mergers has intensified. As the payments landscape continues to evolve, further consolidation seems inevitable. Just imagine Adyen merging with Stripe for a sec… 👀

ICYMI: Adyen’s H2 2024: payments processing powerhouse continues to show industry-leading margins 😤💳 [breaking down their latest H2 2024 financials, what they mean & what’s next + bonus deep dive into Adyen’s competitors]

Revolut wants to challenge American Express with a new credit card strategy 😤💳

The news 🗞️ European FinTech giant Revolut is making a strategic move into the rewards-based credit card market, positioning itself as a direct competitor to established players like American Express AXP 0.00%↑ .

The company, which boasts over 50 million customers globally, is in the early stages of developing a points-based credit card that will leverage its proprietary RevPoints loyalty system launched in mid-2024.

Let’s take a closer look at this, see why it matters, and what could come next.

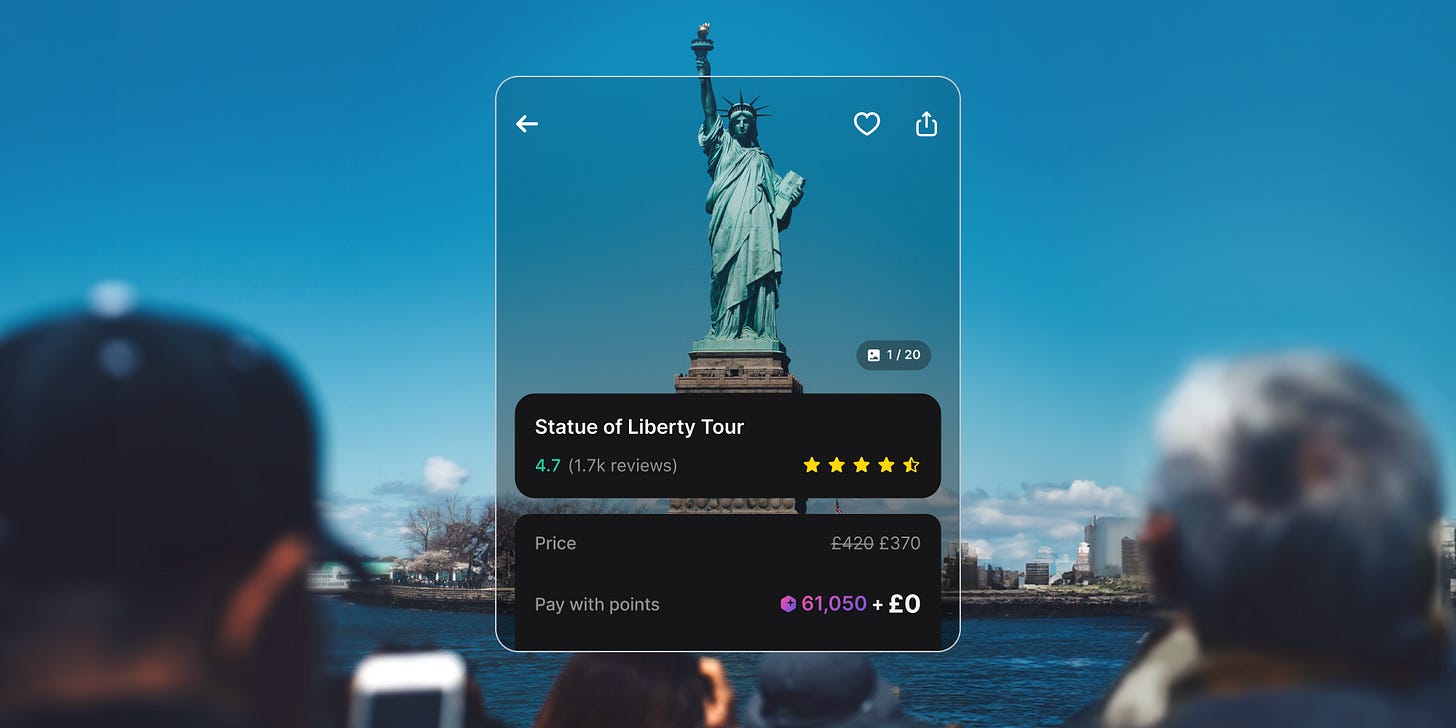

More on this 👉 According to multiple sources, Revolut plans to create differentiated credit card offerings across its subscription tiers, building upon the RevPoints system already available to debit card users.

Currently, Revolut customers earn RevPoints through debit card purchases, which can be redeemed for gift cards from major retailers like Apple AAPL 0.00%↑ and Amazon AMZN 0.00%↑ or exchanged at a 1:1 ratio with popular airline miles programs.

This development represents Revolut's latest expansion beyond its core offerings of multi-currency accounts, competitive exchange rates, and investment options in stocks and cryptocurrency. Recent years have seen the fintech giant venture into diverse financial products, including pet insurance, and reports indicate plans for an AI-powered financial assistant and mortgage products.

As of March 2025, Revolut's valuation has reached $48 billion, following an 85% increase in Schroders Capital Global Innovation Trust's stake. This significant rise from its $45 billion valuation in 2024 signals growing investor confidence, with some pushing for another secondary share sale that could elevate its valuation to $60 billion.

Zoom out 🔎 The European credit card rewards market presents a unique opportunity for Revolut. Unlike North America, where rewards-based credit cards are ubiquitous, Europe's market has developed more cautiously, with consumers traditionally favoring debit cards and bank transfers. American Express has long dominated the European rewards space, with few significant challengers emerging in recent years.

On top of that, regulatory fragmentation across European countries has created complexity for pan-European financial service providers, but Revolut's digital-first approach and established multi-currency infrastructure position it well to navigate these challenges. Rather than directly replicating American Express's model, Revolut appears to be developing a hybrid approach that blends traditional credit card rewards with modern digital banking capabilities.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Revolut's entry into the rewards-based credit card market could significantly reshape the European financial services landscape. By leveraging its existing customer base and digital infrastructure, Revolut has the potential to democratize access to premium credit card rewards that have traditionally been available only through established players like American Express. Additionally, this move represents a broader trend of fintech companies expanding beyond their initial disruptive offerings into more traditional financial products. However, Revolut's approach brings digital innovation to these conventional services, potentially forcing incumbents to accelerate their own digital transformation efforts. Looking ahead, we can expect Revolut to emphasize the seamless integration of its rewards credit cards with its broader ecosystem of financial services. This could create compelling value propositions for customers who already use multiple Revolut services. Additionally, Revolut's planned AI-powered financial assistant could potentially offer personalized recommendations to maximize rewards earning and redemption, further differentiating its offering from traditional credit card providers. Promising.

ICYMI: FinTech Growth vs. Compliance: Revolut's €3.5M fine again exposes industry challenges 😳🛡️ [what it’s all about, why it matters & what to expect next + more bonus reads about Revolut inside]

Kraken bridges Crypto-TradFi divide with stock and ETF trading launch 💸📈

The news 🗞️ Cryptocurrency exchange Kraken has officially expanded beyond digital assets by launching commission-free trading for U.S. stocks and ETFs.

The San Francisco-based firm just announced that customers can now trade over 11,000 U.S.-listed stocks and exchange-traded funds alongside cryptocurrencies through a single unified platform.

Let’s take a quick look at this and see why it matters.

More on this 👉 The new service, made possible through a brokerage partnership with Alpaca, enables users to manage traditional financial assets and cryptocurrencies in one account, similar to platforms like Robinhood HOOD 0.00%↑. More than half of the newly listed assets will support fractional investing, allowing traders to purchase partial shares.

The rollout begins with availability in ten states - New Jersey, Connecticut, Wyoming, Oklahoma, Idaho, Iowa, Rhode Island, Kentucky, Alabama - and the District of Columbia, with plans for nationwide expansion. Kraken also intends to bring the service to international markets, including the United Kingdom, Europe, and Australia.

Zoom out 🔎 This strategic expansion follows Kraken's March announcement of its $1.5 billion acquisition of CFTC-regulated futures trading platform NinjaTrader, signaling the company's broader ambitions. The cryptocurrency exchange has confirmed plans for an initial public offering in early 2026.

"Crypto isn't just evolving, it's becoming the backbone for trading across asset classes, such as equities, commodities and currencies," said Arjun Sethi, Kraken's co-CEO. "Expanding into equities is a natural step for us and paves the way for the tokenization of assets."

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Kraken's move represents another significant step in the ongoing convergence of cryptocurrency and traditional finance. This integration creates a more comprehensive financial ecosystem that could reshape how investors interact with various asset classes. More importantly, the expansion positions Kraken to compete more directly with established brokerages while leveraging its crypto-native advantages. As regulatory clarity improves under the more crypto-friendly Trump administration, we may see accelerated innovation in this space. Zooming out, the future implications are substantial. While Kraken isn't yet offering tokenized equities (yet), this move creates the infrastructure necessary for the eventual blockchain-based trading of traditional securities. Tokenization could enable faster settlement, 24/7 trading capabilities, and more efficient cross-border transactions. Looking ahead, we can expect other major cryptocurrency exchanges to pursue similar multi-asset strategies. The industry appears to be moving toward comprehensive financial platforms where the distinctions between traditional and digital assets become increasingly blurred, potentially creating more seamless and accessible investment experiences for retail investors globally.

ICYMI: Robinhood unleashes AI-powered banking revolution: from doorstep cash to digital financial advisors 🤖🏦 [why their latest announcements could change the finance game & should worry traditional banks, what’s next for Robinhood + bonus deep dive into Robimhood & SoFi’s SOFI 0.00%↑ latest financials AND some must-read AI resources inside]

Robinhood's wild Q4: record profits, 88% AUC growth, and global expansion signal a new era of growth 🤑💸 [breaking down their latest Q4 2024 numbers, what they mean, and whether Robinhood is worth your time and money in 2025 & beyond]

🔎 What else I’m watching

Wise Introduces 'Spend with Others' Feature 💸 Wise has launched a new feature called 'Spend with Others,' allowing users to share spending with a group. Available for free to Account customers in the UK, the feature enables users to set up a group of up to five people (including the owner) to split costs and spend together. Each member can add money and use a digital Wise card in over 160 countries and 40 currencies. Only the group owner can withdraw or send funds from the group. ICYMI: Wise rides 28% volume surge to £39.1B in Q4, sets sights on trillion-dollar money movement 📈💸 [unpacking their latest numbers and why they matter + a bonus deeper dive into Wise & how it aims to become the network of the world’s money]

Webull Goes Public 📈 Webull BULL 0.00%↑ Corporation has completed its merger with SK Growth Opportunities Corporation, becoming a publicly traded company on Nasdaq under the ticker symbol "BULL." The merger, approved by SK Growth shareholders on March 30, 2025, allows Webull to expand its global reach and enhance its financial offerings. Webull's platform, launched in 2018, now boasts over 23 million registered users across 14 markets, offering advanced trading tools and an intuitive user experience. This milestone positions Webull to better serve experienced retail investors seeking sophisticated trading partners. ICYMI:

Starling Bank Expands SaaS Platform to the US 🌐 Starling Bank is opening a US subsidiary, Engine by Starling Services US, to offer its tech infrastructure platform, Engine, to mid-tier banks, community banks, and credit unions in North America. The new office, registered in Delaware, will be staffed by a mix of local hires and UK-based product specialists. Starling's Engine platform has already seen success with Salt Bank in Romania and AMP in Australia. The expansion aims to help US financial institutions unify tech stacks, drive efficiency, and encourage innovation.

💸 Following the Money

BKN301, a digital payments and Banking-as-a-Service startup, has raised £18.6M to support international expansion and strategic acquisitions.

South African payment service provider Stitch has raised $55M in a Series B funding round led by QED Investors.

Mexico City-based open finance API platform Belvo has raised $15M in a round led by Quona Capital and joined by Citi Ventures.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Great week in FinTech and even greater read - thank you!