Visa expands stablecoin offerings 🪙⛓️; Wise shareholders approve move to US markets 🇬🇧👉🇺🇸; JPMorgan to acquire Apple Card partnership from Goldman Sachs 🍎💳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Agentic AI Survival Guide 🤖📚 [from autonomous workflows to enterprise-grade security & strategy, these resources will take you from curious observer to informed builder in the age of Agentic AI]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

AI Agents & MCPs Starter Pack: 10 Curated Repos to Learn, Build, & Scale Autonomous Agents 🤖 [from zero to builder - this toolkit has everything you need to master the agentic future of AI]

FinTech's Maturation Moment: how AI and sustainable growth are reshaping financial services 🤖📈 [breaking down the new FinTech report with key trends, latest developments & massive untapped opportunities + bonus deep dives into top challenger banks, top AI startups & their pitch decks, Agentic AI survival guide & more!]

PayPal's AI-Powered Renaissance: a compelling value play trading at a historic discount 🤖📉 [breaking down the FinTech giant’s Q2 2025 financials uncovering the most important facts & figures, what they mean, what’s next and why PayPal today represents an exceptional long-term investment opportunity + other deep dives & resources inside]

Ramp accelerates AI Finance revolution with $500M funding round 😳💸 [why it matters & what’s the bigger picture here for both Ramp & FinTech as a whole, what to expect next + bonus Agentic AI Playbook for Finance, Ultimate Beginners Guide to AI, and B2B Growth Playbook inside]

Robinhood’s Q2 2025: The Great FinTech Transformation 👏📈 [deep dive into their latest financials, unpacking the most important facts & figures, whether Robinhood is worth your time & money this year, and what’s next for the FinTech giant]

Visa’s Q3 2025: the unshakeable digital payments fortress trading at premium valuations 😤📈 [deep dive into Visa’s latest quarterly financials, breaking down the most important facts & figures, what they mean and whether Visa is worth your time & money right now + Agentic AI & Stablecoin resources inside]

The Only Capital Investment Template You’ll Ever Need 💸 [turn raw numbers into smart investment decisions - in minutes]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Visa expands multi-blockchain stablecoin offerings 🪙⛓️

The news 🗞️ Payments heavyweight Visa V 0.00%↑ has significantly expanded its digital settlement infrastructure by integrating three additional stablecoins and two new blockchain networks into its payment platform.

The financial services giant announced support for PayPal's PYUSD, the Global Dollar (USDG) issued by Paxos, and Circle's euro-denominated EURC stablecoin. Additionally, the company has extended its blockchain coverage to include Stellar and Avalanche networks, joining its existing support for Ethereum and Solana.

Let’s take a look at this.

More on this 👉 This expansion represents a strategic evolution in Visa's approach to digital payments, creating what the company describes as a "multicoin and multichain foundation." The enhanced infrastructure now enables settlement across 4 different stablecoins and 4 blockchain networks, providing clients with solid flexibility in cross-border transactions and digital asset management.

The timing of this announcement aligns with significant regulatory developments in the United States, particularly the recent passage of the GENIUS Act, which establishes the first comprehensive federal framework for stablecoin regulation. This legislation has catalyzed institutional interest in digital assets, with the stablecoin market reaching approximately $266 billion in total value. Solid!

But Visa's commitment to blockchain-based payments extends beyond settlement capabilities. Since initiating USDC settlement operations in 2023, the company has processed more than $225 million in stablecoin volume. The integration of euro-backed stablecoins particularly enhances Visa's global reach, complementing its existing treasury infrastructure that supports over 25 traditional fiat currencies.

Zoom out 🔎 The competitive landscape in digital payments is intensifying rapidly. Mastercard has reportedly tokenized 30% of its transactions and established partnerships with cryptocurrency platforms. Meanwhile, major corporations, including Amazon and Walmart, are exploring proprietary stablecoin initiatives, recognizing the potential for reduced transaction costs and faster settlement times in international commerce.

ICYMI: Amazon and Walmart explore stablecoin launch to bypass Visa & Mastercard fees 😳🪙 [why this is huge & what it means for the future of Finance & FinTech + bonus list of the ultimate resources on stablecoins]

Financial institutions are also positioning themselves strategically within this evolving ecosystem. JPMorgan has partnered with Coinbase to enable direct account linking and reward point conversion to USDC, while Bank of America has indicated plans for stablecoin integration. Industry analysis suggests that on-chain stablecoin transaction volumes have already surpassed those of traditional payment processors, signaling a fundamental shift in payment infrastructure. Slowly, then suddenly.

ICYMI: Citi's solid Q2 2025 earnings & digital asset strategy: a bid to lead the stablecoin revolution 🪙🏦 [breaking down the most important financial facts and figures, what’s next, and uncovering Citi’s brilliant stables strategy + the ultimate list of stablecoin resources inside]

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, Visa's expanded stablecoin capabilities position the company at the forefront of a transformative shift in global payment infrastructure. More importantly, this move suggests several significant implications for both Visa and the broader financial technology sector. First, the integration of multiple blockchain networks creates a more resilient and versatile payment ecosystem that can adapt to varying technological preferences and regulatory requirements across different jurisdictions. As traditional financial institutions increasingly recognize stablecoins as legitimate settlement mechanisms, Visa's solid investment in this infrastructure provides a competitive advantage in capturing emerging market opportunities. The next phase of development will likely focus on interoperability solutions that enable seamless value transfer across different blockchain networks and stablecoin types. Visa's partnerships with established stablecoin issuers like Circle and Paxos suggest a collaborative approach that could accelerate mainstream adoption while maintaining regulatory compliance. Furthermore, the company's expansion into euro-denominated stablecoins indicates preparation for a multi-currency digital future where regional stablecoins may become preferred settlement mechanisms in specific geographic markets. This positioning could prove crucial as central bank digital currencies emerge and require integration with existing payment infrastructure. Looking ahead, the competitive response from other payment processors and financial institutions will now likely only intensify, potentially leading to industry-wide standardization efforts and enhanced consumer choice in digital payment options. Visa's proactive approach to blockchain integration hence positions it advantageously for this evolving landscape while maintaining its traditional payment processing strengths.

ICYMI: Visa’s Q3 2025: the unshakeable digital payments fortress trading at premium valuations 😤📈 [deep dive into Visa’s latest quarterly financials, breaking down the most important facts & figures, what they mean and whether Visa is worth your time & money right now + Agentic AI & Stablecoin resources inside]

Wise shareholders approve move to US markets despite co-founder opposition 🇬🇧👉🇺🇸

The news 🗞️ Wise, the London-based FinTech giant valued at £10.5 billion, secured overwhelming shareholder approval for its planned relocation to US stock markets, marking a significant victory for CEO Kristo Käärmann over opposition from his co-founder.

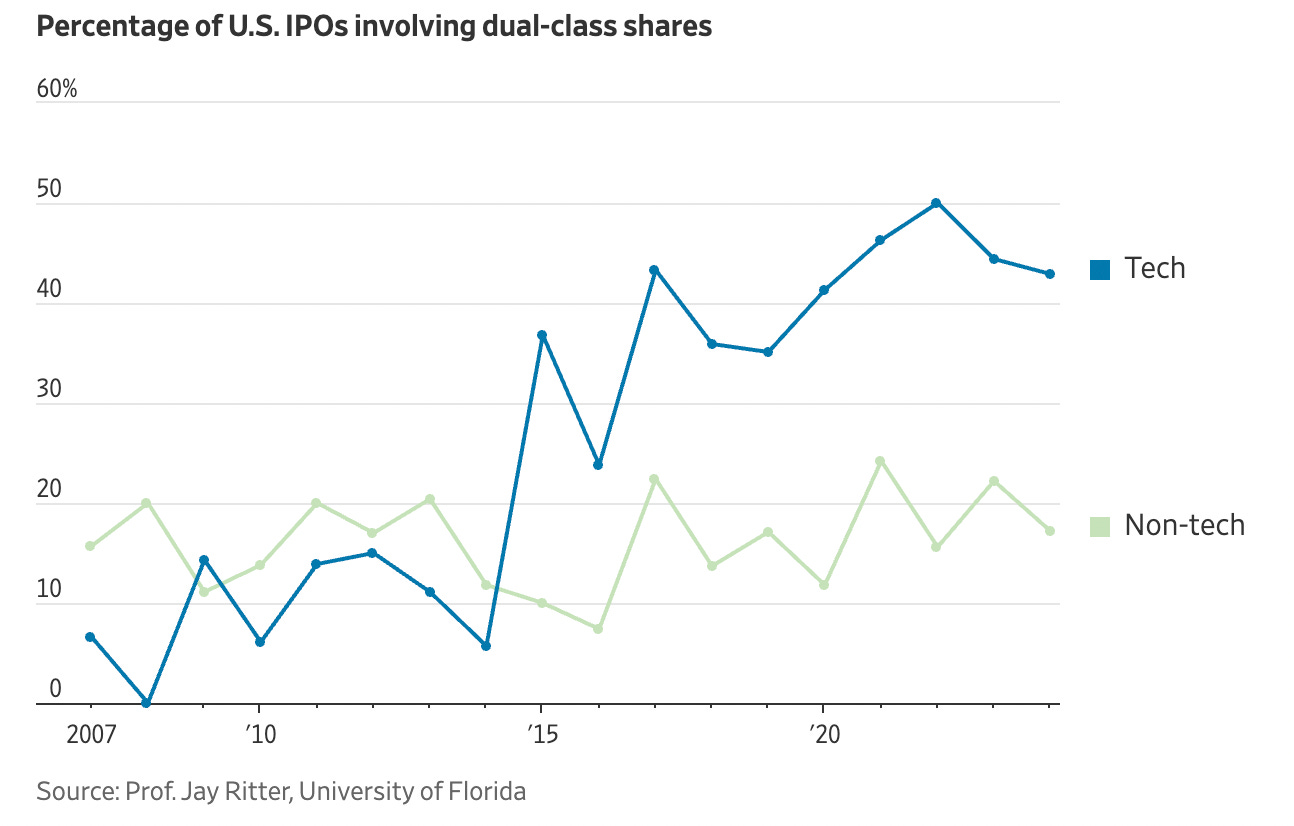

Approximately 85% of shareholders voted in favor of the proposal, which combines two contentious elements: moving the primary listing from London to New York and extending the company's dual-class voting structure until the mid-2030s.

Let’s take a look at this.

More on this 👉 The approval represents a decisive resolution to a high-profile corporate governance battle that pitted Käärmann against Taavet Hinrikus, his co-founder, who departed the company but retains a 5.1% stake through his investment vehicle Skaala. Hinrikus had argued that bundling the US listing with the voting rights extension was undemocratic and lacked transparency, advocating for separate shareholder votes on each issue.

Under the current dual-class structure, Class B shares held by founders and early backers carry 9 votes each, compared to 1 vote for Class A shares held by public investors. This arrangement, originally scheduled to expire in 2026, will now continue for another decade, allowing Käärmann to maintain control over nearly 50% of voting power despite owning just 18% of the company's equity. Zuck is proud here. ;)

Wise's leadership justified the US move by citing superior market valuations and liquidity in American tech markets. The company, which processes approximately £145 billion annually for 16 million users worldwide, believes the relocation will provide access to a broader investor base and potentially boost its market valuation.

The decision reflects broader dissatisfaction with London's capital markets, as several major companies have recently shifted their primary listings to New York.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Wise's successful relocation effort may only accelerate the exodus of high-growth companies from London to US markets, potentially further undermining the UK's position as a global financial center. For FinTech companies specifically, this creates another precedent that American markets offer superior conditions for accessing capital and achieving higher valuations. Additionally, the approval of extended dual-class voting rights, despite significant opposition, suggests that institutional investors remain willing to cede governance power in exchange for exposure to promising technology companies. This outcome may embolden other tech leaders to seek similar arrangements, potentially reshaping corporate governance norms across the sector. Speaking of Wise specifically, the next critical phase involves obtaining UK court approval for the scheme of arrangement, expected in Q2 2026. Success would complete the company's transformation into a US-listed entity while preserving founder control through the mid-2030s. This extended timeline provides Käärmann with substantial runway to execute his strategy of aggressive expansion in cross-border payments while maintaining operational independence from short-term investor pressures. Well played! Zooming out, the broader implications extend beyond individual company decisions to questions about regulatory competitiveness and market structure. UK (and equally European) regulators may need to consider more substantial reforms to retain high-growth companies, while US markets continue to demonstrate their magnetic pull for global technology leaders seeking optimal conditions for growth and value creation.

ICYMI: Wise's New York migration indicates deepening crisis for London's capital markets 👋🇬🇧 [London’s growing challenges, what it means for the future of Wise & FinTech per se + bonus deep dive into Wise & why you aren’t bullish on them enough]

JPMorgan to acquire Apple's troubled credit card partnership from Goldman Sachs 🍎💳

The news 🗞️ JPMorgan Chase JPM 0.00%↑ is nearing completion of what would represent one of the largest credit card portfolio transfers in recent banking history, as the financial giant moves to acquire Apple's AAPL 0.00%↑ credit card program from Goldman Sachs GS 0.00%↑.

The potential agreement involves approximately $20 billion in outstanding balances and would further cement JPMorgan's position as the dominant credit card issuer in the United States.

Let’s take a look at this.

More on this 👉 The negotiations have accelerated in recent months, with Apple reportedly designating JPMorgan as its preferred partner to replace Goldman Sachs. This development marks the culmination of a troubled partnership that began in 2019 when Goldman Sachs launched the Apple Card as part of its ambitious but ultimately unsuccessful foray into consumer banking.

As written earlier, Goldman Sachs has been actively seeking to exit the Apple Card business for over two years, driven by mounting losses and operational challenges. The partnership has proven particularly problematic due to the card's high concentration of subprime borrowers, with 34% of balances held by customers with credit scores below 660. This compares unfavorably to JPMorgan's 15% subprime exposure and even Capital One's 31%, despite that institution's specialization in subprime lending.

On top of that, the Apple Card's unique structure has created additional financial headwinds for Goldman Sachs. Unlike traditional credit cards, the Apple Card does not charge late fees, eliminating a significant revenue stream that typically helps offset losses from delinquent accounts. Combined with a delinquency rate of approximately 4%, compared to the industry average of 3.05%, these factors have made the portfolio less attractive to potential acquirers.

Regulatory scrutiny has further complicated Goldman's position. The Consumer Financial Protection Bureau imposed $89 million in penalties on Apple and Goldman Sachs for failures in dispute handling and misleading consumers about interest-free payment plans. These operational missteps have damaged the partnership's reputation and increased compliance costs.

Zoom out 🔎 We can remember that several major financial institutions, including American Express, Synchrony Financial, and Capital One, were initially considered as potential successors to Goldman Sachs. However, these competitors withdrew from consideration, largely due to concerns about the portfolio's credit quality and unique operational requirements. The challenging economics of the Apple Card, with its combination of high-risk borrowers and limited fee income, has deterred many traditional credit card issuers.

For JPMorgan Chase, acquiring the Apple Card portfolio therefore represents both an opportunity and a strategic challenge. The bank would gain access to Apple's loyal customer base, potentially cross-selling additional financial products and services. However, JPMorgan is reportedly demanding significant concessions regarding how the card is serviced and managed, suggesting a more disciplined approach than Goldman's initial arrangement.

For Apple, partnering with JPMorgan would provide operational stability and expertise that Goldman Sachs struggled to deliver in the consumer banking space. JPMorgan's established infrastructure and experience with large-scale credit card operations could resolve many of the service issues that plagued the Goldman partnership.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, this transaction signals several important trends in the financial services industry. Goldman Sachs' retreat from consumer banking reflects the challenges traditional investment banks face when expanding into retail financial services. The specialized skills, technology infrastructure, and risk management capabilities required for consumer lending differ significantly from institutional banking expertise. For JPMorgan Chase, successfully integrating the Apple Card portfolio could demonstrate the bank's ability to manage complex partnerships with technology companies. As financial services increasingly intersect with technology platforms, this capability will become increasingly valuable. Meanwhile, Apple, as noted earlier, would gain so much-needed operational stability and expertise. Zooming out, the deal may also encourage other tech companies to explore similar partnerships with established financial institutions rather than attempting to build their own banking capabilities.

ICYMI: JPMorgan Chase’s Q2 2025: a capital fortress poised for digital assets & stablecoins (r)evolution 😤🪙 [unpacking the key financial facts & figures, what they mean, breaking down JPM’s stables & digital asset strategy, and what to expect next from the banking heavyweight + bonus deep dives into Citi, the ultimate stablecoin resource list & more reads inside]

🔎 What else I’m watching

RBC Enhances Credit Decisions with AI 🤖 Royal Bank of Canada (RBC) is leveraging its proprietary AI model, Atom, developed by its AI research unit Borealis, to improve credit adjudication and loyalty program personalization. Atom, trained on billions of client transactions, aims to generate $700 million to $1 billion in enterprise value by 2027. The model enhances credit decisions by incorporating complex data, including transaction histories and non-traditional sources, benefiting clients like newcomers. It also personalizes the Avion Rewards program, increasing redemption rates and cost savings. ICYMI:

FIS Partners with Circle 💱 FIS has partnered with Circle to enable US financial institutions to transact in USDC, facilitating domestic and cross-border stablecoin payments. This collaboration follows new US stablecoin legislation promoting digital asset integration with traditional finance. FIS, which processes $9 trillion annually, will integrate Circle's blockchain infrastructure with its Money Movement Hub, offering real-time payments and enhanced fraud detection. ICYMI:

Group Payments Simplified 💸 Block’s Cash App has launched "pools," a new feature designed to streamline group payments. This tool allows users to easily manage and track shared expenses, such as vacations or gifts, in one place. Pools support contributions via Cash App, Apple Pay, and Google Pay, and are currently available to a select group of users, with broader availability planned soon. Key features include proactive payment collection, integrations with multiple payment solutions, easy progress tracking, and seamless end-to-end payment flows. Organizers can create a pool, set a goal amount, and invite members to contribute, simplifying the process of group payments. ICYMI: Jack Dorsey Block's S&P 500 debut 🥳📈 [why it matters for Block & what to expect next + bonus dives into Block inside]

💸 Following the Money

Private equity due diligence platform Keye launches from stealth with $5M Seed round.

Hong Kong-based financial conglomerate ZA Global has led a $40M Series A2 round in local stablecoin issuer RD Technologies.

Brazilian financial infrastructure fintech QI Tech has raised $63M in a Series B extension funding led by General Atlantic.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

I must say, this really makes me wonder how many professionals in traditional finance are quietly scrambling to keep up with what’s happening on-chain behind the scenes. Visa’s move feels like the tipping point - no longer a pilot project, but full-blown infrastructure-level strategy.

Linas , where do you think retail banking players are truly lagging - tech, mindset or regulation?

(For those building authority on LinkedIn in FinTech:

↪️ Break down these updates in plain language - your audience craves clarity

↪️ Turn each major headline into a carousel explaining who benefits, who loses, and what’s next

↪️ Tag relevant journalists, analysts or insiders when you post commentary to spark replies)

Brilliant read - thank you again for all your work sir