OpenAI goes FinTech: acquires personal finance startup Roi 😳💸; Coinbase is pursuing a federal trust charter 🏦🪙; Walmart-backed OnePay is going into crypto 👀🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

The battle for stablecoin dominance, or the largest-ever stables M&A deal in the making 👀🪙 [what it’s all about, who’s fighting for the dominance here and what would it mean for them + bonus list of ultimate stables resources inside]

American Express enters the advertising arena with the launch of Amex Ads 💳📢 [what it’s all about & why it makes sense + bonus reads on other finance giants going into ads]

Samsung partnership gives Coinbase access to 75 million users in a major distribution play 📈🪙 [what it’s all about & why it matters + bonus dive into x402 protocol, deep dive into Coinbase and more reads & resources inside!]

New Era for regional bank consolidation: Fifth Third to acquire Comerica 💰🏦 [what the biggest bank merger of the year is all about & why it signals new era for regional bank consolidation, what to expect next + bonus M&A resources inside]

Revolut targets India’s costly forex market with digital payment platform 📈🇮🇳 [what it’s all about & why it could be huge for the FinTech giant + bonus dives into Revolut inside]

Wall Street bets that prediction markets are the future 😳💰 [we’re witnessing a paradigm shift that could be pivotal + more reads inside]

The AI Voice Startup That Made Speech Borderless 🔊🤖 [how ElevenLabs turned a $2M pre-seed idea into a $6.6B voice empire, and redefined what “human” sounds like in AI]

The Pitch Deck That Won $16M in the AI Agent Gold Rush 🤖💸 [how StackAI positioned itself as the bridge between cutting-edge AI and non-technical enterprises]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

OpenAI goes FinTech: acquires personal finance startup Roi 😳💸

The news 🗞️ $500 billion AI giant OpenAI has just acquired Roi, an AI-powered personal finance application, marking the company’s latest move to strengthen its capabilities in personalized consumer artificial intelligence.

The acquisition follows the emerging pattern of acqui-hires in the AI industry, with only Roi’s CEO and co-founder, Sujith Vishwajith, joining OpenAI’s team.

Let’s take a look at this, understand why it matters, why it could be huge for OpenAI, and what’s next.

More on this 👉 Founded in 2022, Roi developed technology that aggregated users’ financial portfolios across diverse asset classes, including stocks, cryptocurrencies, decentralized finance holdings, real estate, and NFTs into a unified platform.

The application’s distinguishing feature was its customizable AI chatbot companion, which delivered tailored financial insights and investment guidance while adapting to individual communication preferences and goals. Users could personalize their experience by specifying their professional background and preferred communication style, enabling the platform to provide advice that resonated on a personal level.

Zoom out 🔎 The deal represents a continuation of OpenAI’s strategic focus on personalization, following similar acquisitions of Context.ai, Crossing Minds, and Alex throughout 2025. While financial terms remain undisclosed, Roi will cease operations on October 15, 2025, with all user data deleted within 30 days and no information transferred to OpenAI.

The startup had raised $3.6 million from investors including Balaji Srinivasan, Spark Capital, and Gradient Ventures.

✈️ THE TAKEAWAY

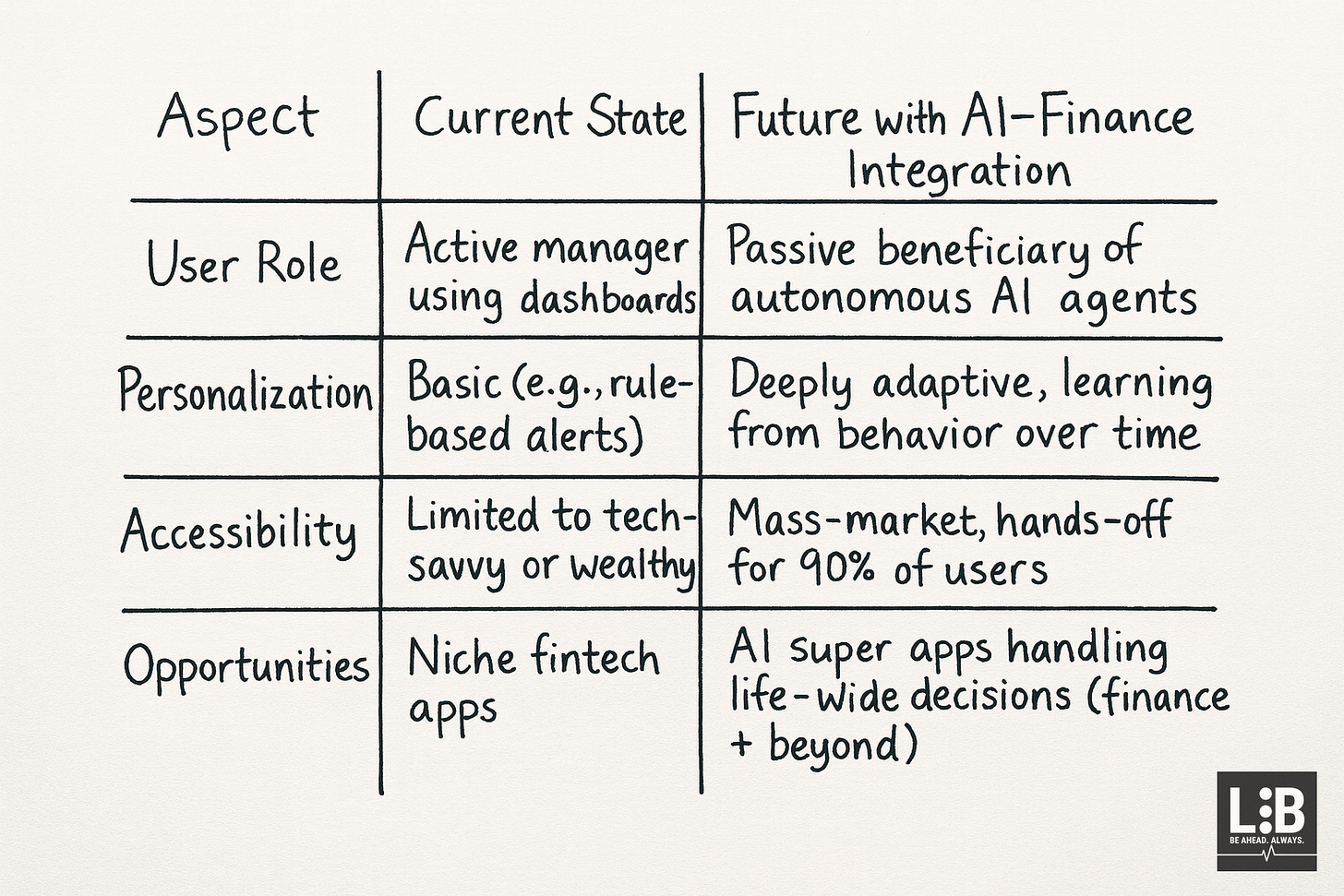

What’s next? 🤔 First and foremost, this acquisition signals a transformative shift in how artificial intelligence may reshape financial services. OpenAI appears to be positioning itself not as a traditional FinTech competitor but as an enabler of deeply personalized financial experiences embedded within broader AI platforms like ChatGPT. The expertise gained from Roi could enhance OpenAI’s ability to deliver customized financial analysis, portfolio optimization, and investment guidance as natural extensions of its existing conversational AI capabilities. Looking at the bigger picture, this move also suggests an evolution from user-facing dashboards toward AI-driven autonomous agents that operate proactively on behalf of users. Traditional fintech applications that rely on active user management may face disruption from AI systems capable of executing trades, managing budgets, and optimizing investments in real time based on individual behavioral patterns and preferences. This transition targets the vast majority of consumers who prefer hands-off financial management over active portfolio oversight.

Zooming out, we must note that the convergence of AI and finance also raises important questions about regulatory oversight, data privacy, and fiduciary responsibility. As AI systems assume greater autonomy in financial decision-making, regulators will likely scrutinize how these platforms manage conflicts of interest, ensure transparency in algorithmic recommendations, and protect users from potential algorithmic errors that could result in financial losses. The financial services industry may need to develop new frameworks for accountability when AI agents, rather than human advisors, guide investment decisions. Looking ahead, OpenAI’s strategic investments in consumer applications clearly suggest that finance represents one component of a broader vision for AI companions that manage multiple aspects of daily life. The company’s recent launches of Pulse for personalized content curation and Instant Checkout for in-app purchasing demonstrate an ambition to create comprehensive AI platforms that seamlessly integrate earning, spending, and investment management. And this could fundamentally reshape the competitive dynamics of consumer technology, shifting value from specialized applications toward integrated AI ecosystems. And OpenAI now wants to be the AI ecosystem ruling them all.

ICYMI: The browser died today: OpenAI and Stripe launch Instant Checkout & the Agentic Commerce Protocol 🤖💳🤖 [why it’s a game-changer that just killed the browser, what’s next & how FinTechs and other finance firms must adapt + bonus deep dives into Shopify, Google’s & Coinbase’s agentic payments protocols, top AI agent startups and more inside!]

Coinbase is pursuing a federal trust charter 👀🪙

The news 🗞️ Coinbase COIN 0.00%↑, the largest cryptocurrency exchange in the United States, has formally applied to the Office of the Comptroller of the Currency for a national trust company charter.

The application, submitted in early October 2025, represents a strategic effort to expand the company’s custody, payments, and settlement capabilities under unified federal oversight rather than navigating a complex patchwork of state-level regulations.

Let’s take a look at this and see what it’s all about.

More on this 👉 The company has emphasized that this initiative does not signal an intention to become a traditional bank. Rather, the charter would enable Coinbase to act as a federally regulated fiduciary, managing digital asset custody and facilitating blockchain-based payments on a national scale.

This builds upon the foundation of Coinbase Custody Trust Company, which has operated under a New York state charter since 2018, providing qualified custody services for major cryptocurrencies including Bitcoin and Ethereum. Federal charter status would streamline oversight for new offerings and enable continued innovation in integrating digital assets with traditional finance.

The timing aligns with increased regulatory clarity following President Trump’s signing of stablecoin legislation in July 2025, which has accelerated growth in the payments sector where Coinbase has established partnerships with companies like Shopify to expand use of the USDC stablecoin.

However, the application faces headwinds from traditional banking trade groups, which have urged the OCC to postpone decisions on similar applications from crypto firms, including Circle, Ripple, and Paxos.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the approval or denial of Coinbase’s charter application will likely establish a critical precedent for the crypto industry’s integration into mainstream finance. Success would validate the regulatory maturation of digital asset firms and potentially accelerate institutional adoption, as federal oversight addresses longstanding concerns about the sector’s perceived risks. This could thus trigger a wave of similar applications from competitors seeking to level the playing field, fundamentally reshaping the competitive landscape. Looking at the bigger picture, a successful charter would demonstrate that regulatory engagement can serve as a growth catalyst rather than an impediment. It may also pressure Congress to expedite passage of the pending market-structure bill, creating clearer frameworks that benefit both traditional financial institutions exploring blockchain technology and native crypto companies seeking legitimacy.

ICYMI: Samsung partnership gives Coinbase access to 75 million users in a major distribution play 📈🪙 [what it’s all about & why it matters + bonus dive into x402 protocol, deep dive into Coinbase and more reads & resources inside!]

Walmart-backed OnePay is going into crypto 👀🪙

The news 🗞️ Walmart-backed WMT 0.00%↑ FinTech company OnePay is preparing to launch cryptocurrency trading and custody services within its mobile banking application by the end of 2025, marking a significant move toward integrating digital assets into everyday retail banking.

The company will enable its approximately 1.5 million users to buy, sell, and hold Bitcoin and Ethereum through a partnership with crypto infrastructure provider Zerohash, which will manage backend operations and ensure regulatory compliance across multiple U.S. states.

Let’s take a closer look at this.

More on this 👉 The integration represents a strategic expansion of OnePay’s evolving financial services ecosystem, which already includes high-yield savings accounts, credit and debit cards, buy-now-pay-later loans, and wireless plans.

Users will be able to convert their cryptocurrency holdings into US dollars directly within the app, then use those funds for purchases at Walmart stores or to pay off credit card balances. This eliminates the need for separate crypto wallets and creates a seamless experience for customers who may lack technical expertise in digital assets.

Zoom out 🔎 OnePay’s positioning is particularly noteworthy given its access to Walmart’s extensive customer base of 150 million weekly shoppers and its current ranking as the 5th most popular finance app on Apple’s App Store, ahead of established players like JPMorgan Chase and Robinhood.

The move aligns OnePay with competitors, including PayPal, Venmo, and Cash App, which already offer cryptocurrency services.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, this development signals another moment for mainstream cryptocurrency adoption in the retail banking sector. Looking at the bigger picture, as traditional financial institutions increasingly embrace digital assets following clearer regulatory frameworks and the election of a crypto-friendly administration, we can expect accelerated product development cycles and more sophisticated offerings that blend conventional banking with blockchain technology. OnePay’s focus on financial inclusion for underserved populations may prove particularly impactful, democratizing access to cryptocurrency investment opportunities that have historically been concentrated among affluent, tech-savvy investors. If OnePay is successful, it could accelerate the timeline for crypto transactions to rival traditional payment methods in volume, fundamentally reshaping how Americans interact with digital currencies in their daily financial lives. Slowly, then suddenly.

ICYMI: Walmart’s mobile plans and further Super App push 📲🏦 [what’s the USP here, why it matters & what’s next for Walmart’s OnePay + more reads inside]

🔎 What else I’m watching

Klarna and Google AI Partnership 🤝 Klarna has partnered with Google Cloud to use its full AI stack, aiming to accelerate innovation and create customer-centric products for its 114 million consumers. The initial focus is on “creative velocity,” using Google’s generative media models to create dynamic digital lookbooks. Klarna will also enhance its image library with AI and use Google Cloud’s AI for security to combat fraud. Klarna has been actively adopting AI, with plans to reduce its workforce through AI efficiency. ICYMI:

US Bank to Custody Stablecoin Reserves 🏦 US Bank has been selected to provide custody for reserves backing Anchorage Digital Bank’s payment stablecoins. Anchorage Digital Bank, the only crypto-native bank in the U.S. with a federal charter, operates under the oversight of the OCC. US Bank, a major global custodian, will leverage its expertise to offer an extra layer of assurance for these stablecoins. Anchorage Digital launched its stablecoin issuance platform in July 2025, ensuring full compliance with the GENIUS Act. ICYMI:

Esma to Oversee Crypto and Stock Exchanges 🏛️ The European Commission is planning to shift the regulation of cryptocurrency firms, stock exchanges, and clearing houses from national watchdogs to the European Securities and Markets Authority (Esma). This move aims to create a more integrated and globally competitive capital market in Europe and address market fragmentation. For crypto, this aligns with Europe’s Markets in Crypto-Assets (MiCA) framework, which currently involves national authorities issuing licenses.

💸 Following the Money

Carta, the software platform purpose-built for private capital, announced it has acquired Accelex, the AI-powered data automation platform focused on alternative investments for institutional limited partners (LPs).

PayPay acquires 40% stake in Binance Japan to bridge crypto and digital payments.

Ukraine’s financial services market is celebrating another unicorn after Fintech-IT Group, the tech company behind one of the country’s most popular online banking services, received an investment to push its valuation beyond $1B.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Another fab read - thank you sir and pls don't stop!

Really intresting how Coinbase is trying to navigate the regulatory landscape with this federal trust charter. The timing is smart since we're seeing more regulatory clarity, but I wonder if traditional banking groups pushing back will slow things dwn significantly. If they succeed, it could really change how institutional money flows into crypto custody services. The competitve dynamics could shift pretty fast once one major player gets federal approval.