Top FinTech stories of 2023, a year of AI 🤖

"You can't connect the dots looking forward. You can only connect them looking backward" - Steve Jobs

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 225k+ FinTech leaders:

The financial technology industry is constantly evolving and throughout the years it has definitely changed the world and the way we interact with banks, consume, spend our money, and do business.

2023 has undoubtedly been a year like no other. It was the year of artificial intelligence and AI-powered innovation.

So today - more than ever before - we can argue that it’s not FinTech that changed the world but the world that has transformed FinTech.

Was it for the better or worse? I invite you to read this reflection of mine and connect the dots yourself.

Below are the top FinTech stories of 2023, the moments that define the whole year. Looking back at the highlights and lowlights of the world of finance and technology provides you with lots of lessons and food for thought. This year, I learned a lot. I hope you did (or will do - after reading this) too.

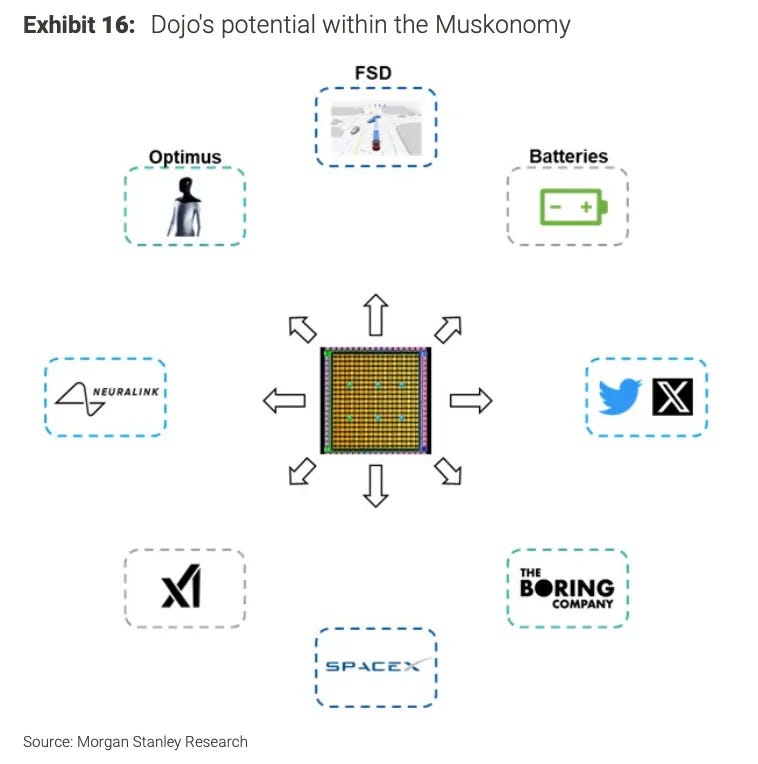

#1 Tesla could become the most powerful AI company in the world disrupting Finance & FinTech forever 🚘💸

I must repeat this again - 90% of people might not realize this but Tesla TSLA 0.00%↑ is a FinTech. And now this unconventional FinTech is developing its own Supercomputer called Dojo that would not only be a significant catalyst for the automaker. More importantly, it could make Tesla the most powerful AI company in the world. And with that comes major implications for the future of Finance, FinTech, and InsurTech. But we need to start from the beginning to understand it all:

Tesla could become the most powerful AI company in the world. Here’s how it will disrupt Finance & FinTech forever 🚘💸 [+ more bonus reads inside]

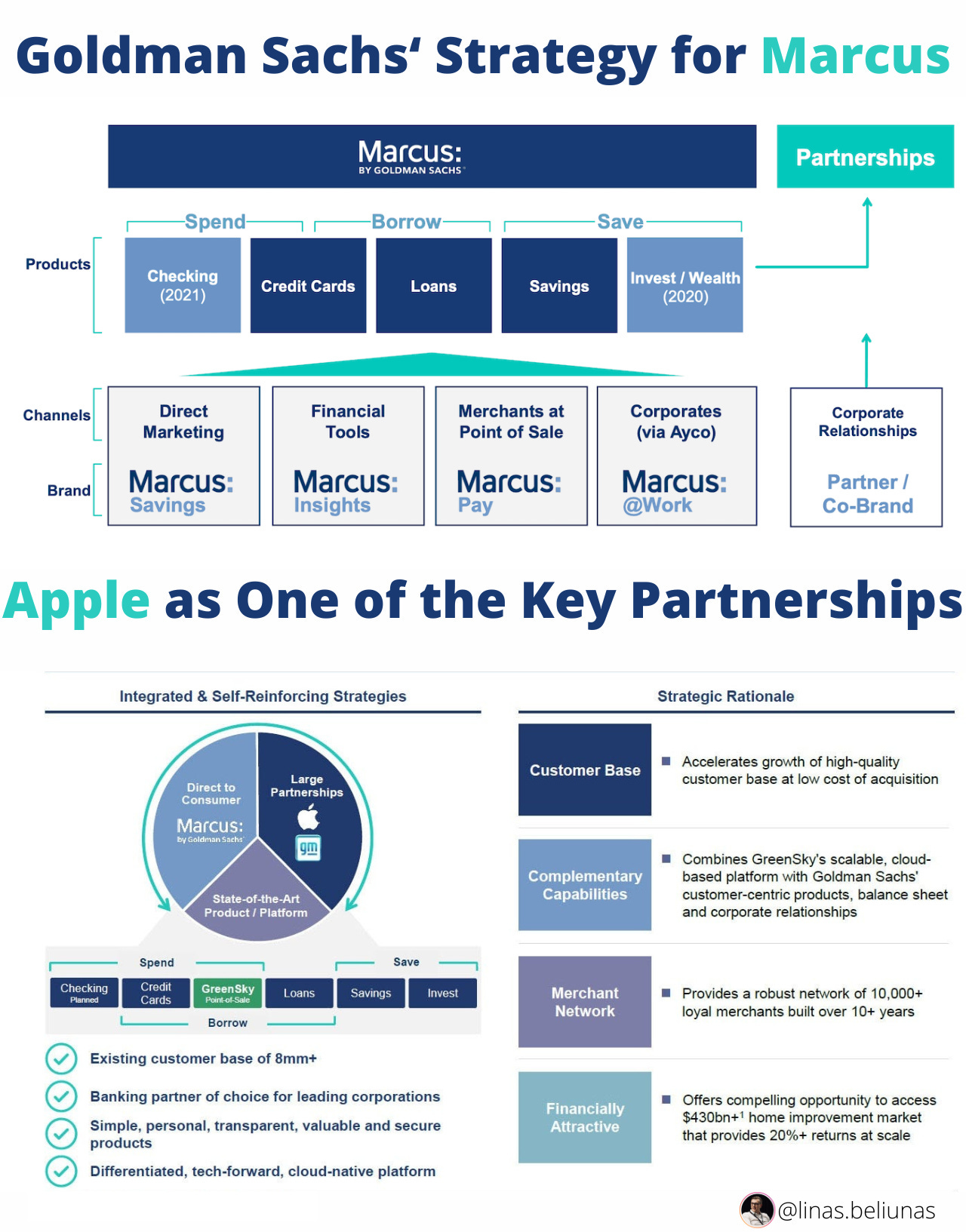

#2 Apple and Goldman Sachs break up 💔

After 4 years of struggle, it’s finally over. Apple AAPL 0.00%↑ has recently decided to terminate its credit card partnership with Goldman Sachs GS 0.00%↑, delivering the final blow to the investment bank's ambitions in consumer lending. The tech giant proposed exiting the contract that covers their joint credit card and savings account in the next 12-15 months. Launched in 2019, the Apple Card was intended to be a pillar of Goldman's shift toward consumer banking. Go deeper and learn more about what didn’t work out and what’s next here:

End of an era: Apple is shutting down its credit card partnership with Goldman Sachs 😳

Apple’s uncertain future after Goldman Sachs split. Who will partner with Apple Card now? 🤔 [+ lots of bonus reads inside]

#3 BREAKING: Binance 👀

Forbes did it again! Crypto exchange giant Binance and its founder Changpeng Zhao aka CZ have agreed to pay over $2.7 billion (initially - over $4B) in fines after admitting to anti-money laundering violations and sanctions breaches. Zhao stepped down as CEO immediately and pleaded guilty to charges related to the company's failure to prevent unlawful transactions. Go deeper into this craziness with all the details, data + what it means for the industry & what’s next here:

BREAKING: Binance. CZ to step down & Binance to pay $4.3 billion in fines 🤯 [+ more bonus reads inside]

#4 PSD3 is finally here 🇪🇺💳

Earlier this year, the European Commission introduced proposals for the Payment Services Directive (PSD3) and a Payment Services Regulation (PSR), as well as a legislative proposal for a framework for financial data access. These proposals aim to modernize the current PSD2, ensuring that consumers can continue to make secure electronic payments within the EU while having a greater choice of payment service providers. This is big news for FinTechs and the future of financial services. Go deeper and learn what this means & what might come next here:

PSD3 is finally here, and it can be a game-changer 🇪🇺💳

#5 AI is transforming Finance 🤖💸

2023 was the year when generative artificial intelligence (AI) and large language models (LLMs) took center stage. The financial services industry wasn’t left out here either as banks, credit unions, and FinTechs are all exploring the uses of generative AI like ChatGPT beyond just chatbots. From Blackrock BLK 0.00%↑ to Mastercard MA 0.00%↑ and JPMorgan JPM 0.00%↑ - everyone’s trying to leverage AI to improve their operations, cut costs and get ahead of the competition. This will only intensify in 2024. Go deeper and learn more here:

Generative AI will make Finance Autonomous 🤖💸 [taking a big picture view on the changes taking place now & what’s next + more deeper dives into AI & Finance]

Game-changer: the first Open-Source Financial LLM is finally here 🤯

Bonus: The insurance sector is more and more exploring the benefits of AI 🤖

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

JPMorgan is developing a ChatGPT-like AI service for investors 😳 [+6 more reads]

#6 Klarna is making itself great again 👛

Swedish FinTech goliath and Buy Now, Pay Later (BNPL) pioneer Klarna has engineered an impressive financial turnaround over the past year. Hence, it’s not surprising the FinTech unicorn has started to signal that it’s gearing up for a possible IPO in 2024. The BNPL giant could aim for a $15 billion to $30 billion valuation and launch its IPO as early as the first half of next year 😳 And last year everyone (myself included) was discussing whether Klarna would survive another year… Learn more about their latest numbers, how we got here, and what’s next + a look at how leveraging AI Klarna is building the Google of Shopping here:

Klarna's remarkable comeback: how the FinTech giant went from valuation collapse to potential 2024 IPO 📈

#7 Adyen got beaten hard 🤕

Dutch payments giant Adyen shocked investors in August by badly missing its internal growth targets, wiping over €12 billion off its market value in one day. It still hurts though… But since then it has regained investor confidence and reset expectations, became a bank in the UK (this is huge!), and secured a major partnership with Klarna, among other things. Go deeper and learn more about why I’m bullish on Adyen and believe it’s still underrated:

Adyen to boost Klarna's growth as acquiring bank 🚀

Adyen just became a bank in the UK 🇬🇧🏦 [why this is huge for the future of Adyen + a deep dive into undervalued FinTech giant]

#8 Monzo is exciting again 🚀

After a difficult period, British challenger bank Monzo seems to be exciting again. That’s why Google's GOOGL 0.00%↑ parent company Alphabet is in advanced talks to acquire a stake in British digital bank Monzo through its investment arm Capital G. The deal could see Monzo valued at over £4 billion in a funding round of between £300-500M. Huge. This potential investment from Alphabet comes as Monzo appears to be awakening after a period of relative calm. The bank made waves with early innovations but entered a lull as new CEO TS Anil settled in. Now Monzo seems to have strapped a rocket to its brand with new offerings in savings, cashback, and investments, among other things. Go deeper to learn why it’s important and what’s next for Monzo here:

Monzo is exciting again: Alphabet to invest £300-500 million in a funding round valuing the digital bank above £4 billion 🤯 [+ a ton of bonus reads]

The foray into wealth is finally here: Monzo launches investments 💸 [a deeper dive unpacking this pivotal move for Monzo + more bonus reads]

#9 Apple to transform smartphones into financial powerhouses 📲💸

Apple AAPL 0.00%↑ just made a huge breakthrough in running LLMs on iPhones. This will not only transform AI adoption forever. Also, it can soon set new standards in FinTech. You have to think about the following:

- Advanced, AI-powered Siri

- Real-time language translation

- Sophisticated AI-driven features in photography & augmented reality

- Complex AI assistants and chatbots running directly on your device, with no compromise to privacy.

And this is just the tip of the iceberg. Go deeper and learn about the dawn of AI-driven finance with Apple at the center here:

The dawn of AI-driven finance: how Apple can transform smartphones into financial powerhouses 📲💸

Apple now runs one of the largest neobanks in the world 🤯

#10 Elon Musk to replace your bank account within 1 year 😳

We already know that Elon Musk has grand plans to transform X into the central hub for users' financial lives aka the Everything App. What we didn’t know was that Elon plans to do that within the next year. During an all-hands meeting in October, the world’s richest man reportedly told employees that X will offer a full suite of banking and money services so comprehensive that you won't need a bank account by the end of 2024. That’s very ambitious. Go deeper, uncover current struggles, and see where the BIG potential is here:

Elon Musk wants X to replace your bank account within a year 😳

And that’s a wrap. 2023 was a wild year in FinTech. Let’s see what madness 2024 will bring 🥂

If you found this useful, first - go Premium:

P.S. don’t tell anyone but join the leading FinTech community today and save 20% on your subscriptions. Prices are going up in January for all new subscribers.

Then - share it with others and spread the word:

Thanks for sharing! Awesome read!

This is priceless. Subscribing for the full version now!

Thank you.