The FTX story is getting wilder and wilder 🤯; Challenger Banks 2.0, the Vertical approach 📲; Over 50% of Bitcoin Addresses are now at a loss 😤

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Stripe just killed MoonPay, Ramp, and dozens of other FinTechs 🤯

Genesis' fight for survival, or incoming Crypto Armageddon 😳

Kraken's brutal layoffs: why nobody’s safe & one key lesson 😳

Social Shopping is the future of e-commerce? Klarna thinks so 🙋🏽♀️

As for today, here are the 3 FinTech stories that were making a huge difference this week. This week was crazy, so certainly check out all the above stories.

The FTX story is getting wilder and wilder 🤯

More. And more… 🐇 The FTX story just never stops giving. It’s a maze and a rabbit hole at the same time but it’s too important to be left behind. Let’s take a look at some more shocking things that were recently discovered.

More on this 👉 Here’s what you need to know:

First, a gentle reminder - FTX’s Sam Bankman-Fried cashed out $300M personally during a $420.69M raise from 69 investors, as per WSJ. Just like that 🌪

Another refresher - in February 2022, the Chairman of the Federal Reserve, Jerome Powell met with Sam Bankman-Fried in an hour-long meeting. I guess they discussed interest rates? :)

Sam Bankman-Fried and FTX executives donated $70M to US politicians for midterm elections, weeks before filing for bankruptcy, Bloomberg reports.

Here’s an informative chart showing the global distribution of FTX customers (interestingly, only 2% of them were from the US):

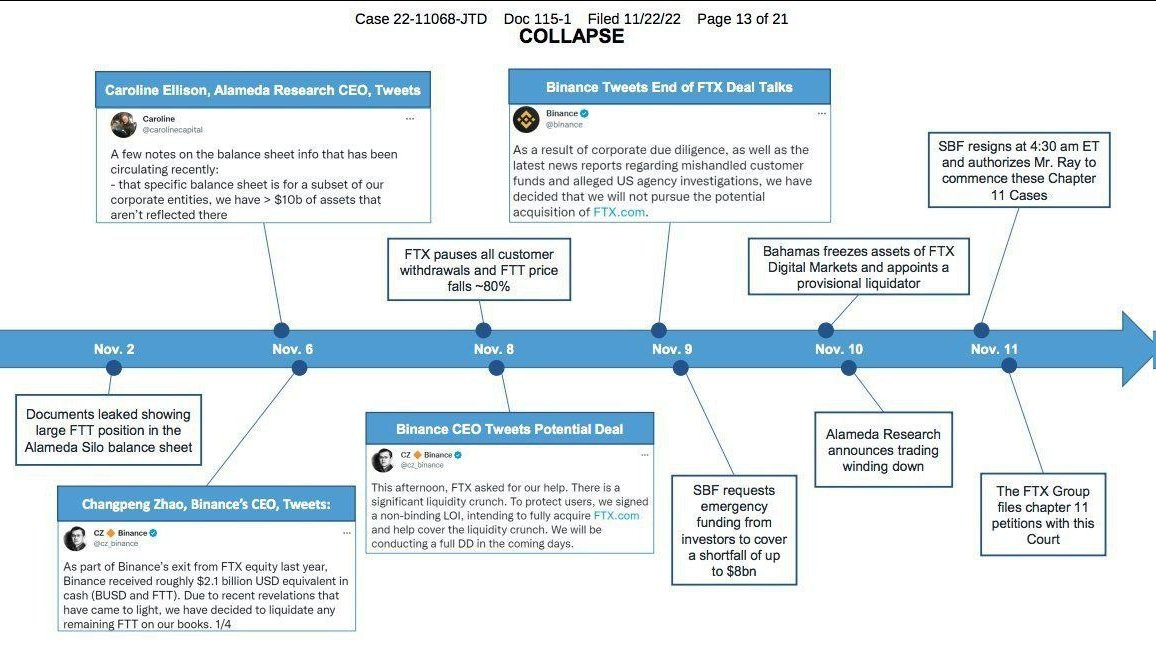

A chronological roadmap of the FTX collapse (it took only 9 days!):

Golden State Warriors face a class-action lawsuit from non-US customers for promoting FTX. An FTX customer who claimed he lost $750,000 after the exchange went bankrupt has filed a lawsuit against the NBA's GSW based on the team promoting the allegedly fraudulent crypto exchange, according to a Reuters report. Even NBA advertised it:

Alameda withdrew over $1.5B from FTX from October 20 to November 2. What’s more, Alameda reportedly withdrew $204M ahead of bankruptcy filing (as per Arkham Intelligence). It seems almost as if they knew what was coming…

8 congressmen tried to stop the SEC’s inquiry into FTX back in March. 5 out of 8 received donations from SBF and FTX from $2,900 to $11,600. Their name and signatures:

CEO of Alameda Research, Caroline Ellison has fled from Hong Kong🇭🇰 to Dubai🇦🇪. I wonder why… :)

Gabe Bankman-Fried — younger brother of SBF — purchased a $3.3M Capitol Hill townhouse in April. The deal was made through Gabe's nonprofit, Guarding Against Pandemics. The organization, aimed at preventing another pandemic, was partly funded by SBF. The move to the US capital was meant to send the message that the FTX founder "and his network were in DC to stay," according to a report from Puck. Just one week before FTX's collapse, Guarding Against Pandemics hosted back-to-back cocktail parties for high-ranking Democrats and Republicans, the New York Post reported. This is the house:

But this is where things get really wild - FTX owned an $11.5M stake in a tiny rural bank in Washington state with just 3 employees. Farmington State Bank in the state of Washington (Farmington is a town of just 146 people), now renamed Moonstone, is the 26th smallest bank in the US — with a single branch and three employees. This is the bank:

FTX invested in the rural bank through its now-bankrupt sister company, Alameda, with an investment of $11.5M (for 10% of the bank) in its parent company FBH in March 2022. The Alameda investment was more than double the bank’s value of $5.7M, reported The New York Times. To put this into perspective - FTX’s investment valued the bank at $115M. Yet, it only had $10M in customer deposits 😳

Why did they do that? 🤔 Well, FTX’s ownership in Moonstone was mainly because they could bypass the requirements of owning a banking license in the US, which is actually a super complex task. That said, money laundering appears to have been FTX’s actual stock in trade 💸

With the bankruptcy procedures in place, Moonstone will continue to operate with its own team, but FTX’s 10% bank will be included in the bankruptcy proceedings and will likely be sold to another party to pay back FTX creditors.

✈️ THE TAKEAWAY

FTX Bad^2 🥶 FTX was supposedly worth $32 billion, it was backed by top-tier venture capital firms and grew into one of the biggest exchanges in the world. Yet, now it’s clear that it was nothing more than a Ponzi. What is worrying is that Tether, the biggest stablecoin issuer, is also somehow connected to the tiny little bank FTX invested in. The fact that regulators allowed this to happen is a complete failure of the oversight mechanism. More importantly, the trust and integrity (as much as it had such a thing) of the crypto industry has been severely comprised.

In case you missed it: FTX is much worse than anyone imagined 🤯🤯🤯

The aftermath of the FTX collapse could be bigger than the earthquake 🌋

Contagion of contagion, or how Genesis could cause Crypto Armageddon 😳

WTF: Binance walks away from FTX takeover 😳🥶

Challenger Banks 2.0, the Vertical approach 📲

The news 🗞 Greenwood, the digital banking startup for Black and Latino people and business owners, has closed a $45M funding round led by Pendulum, an investment firm designed for founders of color.

Cercano Management, Cohen Circle, The George Kaiser Family Foundation, NextEra Energy, Bank of America, Citi Ventures, PNC, Popular, Truist Ventures, TTV Capital, and Wells Fargo all joined the round.

The USP 🥊 Founded in 2020, Greenwood is the digital banking platform for Black and Latino individuals and businesses. Greenwood’s mission is to support financial freedom for minorities through community building, career advancement, and financial services.

Some numbers 📊 Greenwood has signed up more than 100,000 customers to its digital banking platform, where it offers a host of products in partnership with FDIC-insured banks.

It is also building a wider community of more than 1 million members thanks to the recent acquisitions of The Gathering Spot, a private membership network, and Valence, a career development and job recruiting platform.

✈️ THE TAKEAWAY

Going vertical 👉 In the age when most challenger banks are looking pretty much the same while bigger players are moving towards becoming Super Apps, going vertical is definitely the neobanking 2.0. If done right, the vertical approach could be a good differentiator and a solid model to build your neobanking biz - think about better talent, better customer acquisition, and better underwriting here. And these are the key pillars needed to build a solid neobanking proposition. Speaking of Greenwood specifically, there seems to be a big market to address - in 2020 white households held 84% of total household wealth in the US, with Black households holding just 4% despite making up over 13% of the population. That doesn’t seem right.

More here: The verticalization of neobanking continues 📲

Over 50% of Bitcoin Addresses are now at a loss 😤

New data 📊 According to analysis site IntoTheBlock, with the post-FTX exchange implosion dip taking the price down to levels not seen since November 2020, the average purchase price of 55% of all Bitcoin addresses is now below what the owners paid for them.

More on this 👉 That leaves 44% in the black and just 1% at break even, at the price of $16,156 when IntoTheBlock took its most recent snapshot.

Yet, it’s important to note that we cannot say that more than half of all Bitcoin buyers are in the red. The thing is that many people have more than one address in their wallets, after all, which makes this data less generalizable.

On the other hand, in the last two years, Bitcoin and crypto, in general, went mainstream attracting a lot of new, smaller buyers who could purchase BTC (and other cryptos) not just through exchanges but also via the likes of PayPal and Twitter founder Jack Dorsey's Cash App. Having said that, it’s actually quite likely that more than half of all BTC owners are indeed underwater.

✈️ THE TAKEAWAY

What this means? 🤔 First, we must note that this new data coincides with a Pew Research study done in the first half of July — when Bitcoin was in the $20,000 range — that found 16% of Americans owned or had owned cryptocurrencies and 46% said their investments had done worse than they expected. What a surprise, huh? Zooming out, it’s a good echo of what I covered last week - a confirmation that a rise in Bitcoin price is associated with a significant increase in new users. This goes on to show again that price is the story. And most people are in a difficult chapter right now.

More: Price is the story, or how retail is adopting crypto 💸

🔎 What else I’m watching

A fund from Binance 👀 Crypto exchange giant Binance has announced that it is committing $2B to an industry recovery initiative as the bear market continues to bite, saying: "As a leading player in crypto, we understand that we have a responsibility to lead the charge when it comes to protecting consumers and rebuilding the industry." The exchange says it has already received 150 applications from companies seeking support. Overall, it is hoped that this effort will help restore confidence in Web3 — and successful applicants will be expected to offer innovation and long-term value creation, a viable business model, and a "laser focus" to risk management. Yet another move to Binance becoming your Crypto Bank 🏦?

Not that hot, huh? 🤔 London-based BNPL unicorn Zilch is preparing to axe up to 10% of its workforce just months after securing an additional $50M in funding. Zilch appeared to be bucking the downward trend in the bruised BNPL market, as incoming regulation and rising interest hit the valuations of competitors like Klarna. We can remember that a $50M funding round in June took the total raise for Zilch's Series C to $160M, bringing its total funding to more than $460M in debt and equity. The raise was unusual for the sector as the firm maintained its valuation in a clearly distressed market. The new wave of redundancies, first reported by London's Evening Standard, comes as firms prepare for the recession by curbing expansionary tendencies and focusing on bottom-line profitability. A good time to reread this: Stripe's “excellent” layoffs and a warning sign for everyone 🌪

💸 Following the Money

Mastercard is acquiring a minority stake in Conferma Pay as part of a wider partnership to push the use of virtual cards for B2B travel payments. Conferma Pay - which was acquired by travel industry tech player Sabre earlier this year - connects issuers to more than 700 travel management companies, all the major global distribution systems, and more than 100 online booking tools.

Web3 gaming and software giant Animoca Brands will debut a fund of up to $2B to invest in metaverse companies.

Crypto payments company Ripple led a $72M Series B funding round into digital asset market maker Keyrock.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

I'm curious is to how liquid Binance actually is at this point. And I mean liquid in the old-fashioned sense with real money guaranteed by governments and central banks, not the crypto Monopoly money.