FTX was actually a real estate company 🏡; DeFi, Blockchain, and the future of finance 🔮; This Fintech vertical is recession-proof 💸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Here's how India is disrupting the entire global payments space🇮🇳💳

"Fake it till you make it", or the craziest FinTech fraud since FTX 😳

Silvergate Bank is the mirror of the struggling crypto market 📉

As for today, here are the 3 huge FinTech stories that were making a massive difference this week. It was the most interesting and intense week yet, so definitely check out all the above stories.

FTX was actually a real estate company 🏡

Fresh stuff 🥬 It’s been more than a few months since the fraudulent crypto exchange FTX imploded and yet it still keeps on giving. Recently released court findings reveal some fascinating things you just cannot miss. So let’s take a look.

More on this 👉 According to recent court findings, FTX had $1.6 billion in crypto assets at the time of the bankruptcy petition. However, the total value of all assets recovered by the FTX Debtors was $5.5 billion. That included cash, crypto, and illiquid securities.

Given $5.5B in total assets were recovered with only $1.6 billion linked to FTX.com, it resulted in a shortfall being declared by investigators. In addition, roughly $1.9 billion in crypto was attributed to Alameda between hot wallets and BitGo custody.

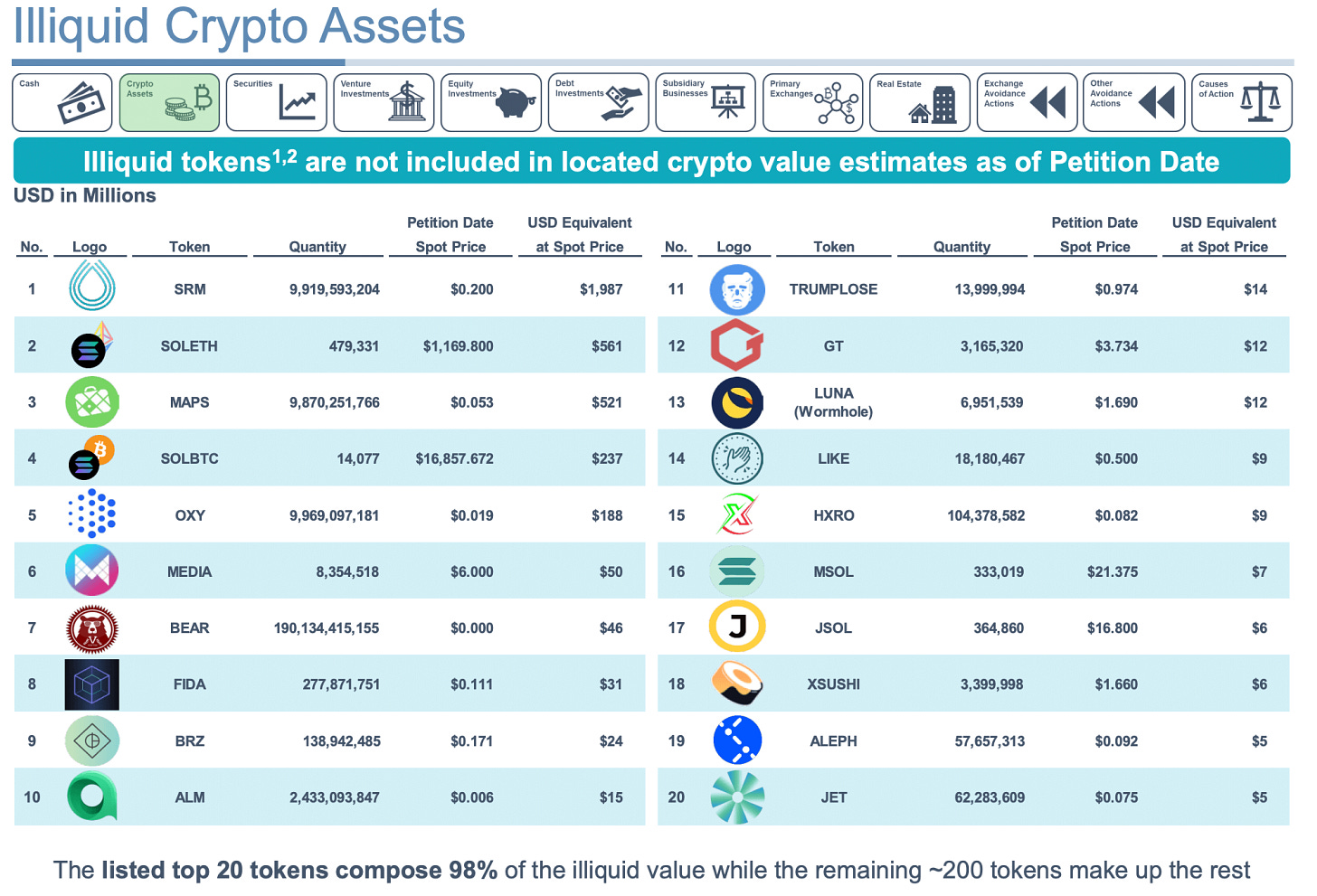

A slide from the deck revealed that FTX held billions of ‘illiquid’ crypto assets, The largest holding of such tokens was Serum (SRM), with a value of $1.9 billion. The next most significant holdings were SOLETH and MAPS at $561 million and $521 million, respectively.

But real estate is where things get really interesting.

As you can see above, FTX had quite some real estate properties out there, including 36 properties in the Bahamas that were acquired for a total of $253 million. These properties ranged from exclusive penthouse accommodation to villas valued at up to $12.9 million and were allegedly used as personal premises.

Moreover, several transactions are currently under review, including $93 million in political donations, a $2.1 billion payment to Binance for FTT tokens, $2 billion in insider loans, $446 million in transfers to Voyager, an investment of $400 million from Modulo Capital, and a large number of Robinhood shares.

What does it mean? 🤔 It’s simple, complicated, and disappointing at the same time. Here’s the takeaway:

✈️ THE TAKEAWAY

No comments 🫣 Let’s start with the good thing first. The only good thing here is that it seems that FTX has $5.5B in liquid assets that can really be sold and ultimately used to repay the creditors and affected customers. That’s basically it. More importantly, these new findings yet again show that FTX was nothing more than a complicated fraud scheme disguised as a cryptocurrency exchange. Remember that FTX only moved its HQ to the Bahamas from Hong Kong in late 2021, which makes it all even crazier. After building out that property portfolio it's hardly surprising people had no time to run the exchange properly. In fact, it’s clear now that FTX was actually a real estate company in disguise 🥸

Go deeper and learn more: The FTX story just keeps getting crazier 😳 (+5 bonus reads)

DeFi, Blockchain, and the future of finance 💸

The news 🗞 As anticipated, decentralized finance aka DeFi and blockchain continues to disrupt the world. Two recent cases in finance got my attention, so let’s take a brief look at them.

DeFi in Finance 💸 The first one is about French multinational investment bank Société Générale which made its foray into the crypto space by taking out a $7 million loan in the form of decentralized stablecoin dai from its issuer, MakerDAO.

The bank was unanimously approved to start a MakerDAO vault last year following a vote by the DAO's community members. Several months later, it has now drawn on that vault facility for the first time, borrowing $7M in dai.

We must note that the vault has a borrowing limit of $30M and is overcollateralized with $40M in home loan bonds put up by the bank.

Blockchain in Finance ⛓ Another one is from The Netherlands where ABN Amro became the first bank in Europe to register a digital bond for a Midcorp client on the public blockchain.

Issued to a select group of investors, the fully digital process raised €450,000 on behalf of aircraft part-out company APOC, one of the bank’s commercial clients. Ownership was recorded on the blockchain in the form of tokens that the investors acquired after they had paid for the bond.

✈️ THE TAKEAWAY

A glimpse at the future 🔮 These two examples are a brilliant illustration of how traditional finance and DeFi can work together and where blockchain really adds value. In the first case, TradFi gets to leverage decentralized finance to create new avenues for borrowing while Maker gets to diversify its balance sheet into real-world assets, reducing its reliance on crypto alone as collateral backing the dai stablecoin. In the second one, larger commercial clients with leveraged financing can now fill a gap between traditional bonds and crowdfunding. Thanks to the blockchain, the process is highly efficient and very client-friendly. Hence, these are perfect illustrations that the future of finance will be built with DeFi and blockchains as integral parts.

Bonus: JPMorgan, DeFi, and the future of finance 💸

This Fintech vertical is recession-proof 💸

Zoom out 🌍 Despite all the uncertainty and macroeconomic challenges in the world, technology continues to disrupt legacy industries. In fact, this FinTech vertical is seemingly not only recession-proof but also is heating up as the next big thing.

More on this 👉 If you were guessing what this could be, I’m almost 100% sure that you didn’t get it right. But it’s pretty simple - it’s Buy Now, Pay Later. But not just another Klarna or Affirm - it’s B2B BNPL. Let’s take a look.

Following the money 💸 If you follow the money, you will end up in Germany where a Berlin-based FinTech startup Mondu has just added $13 million to its Series A round. The investment was led by Valar Ventures, with participation from FinTech Collective bringing the startup’s Series A to a total of $56M. That’s pretty solid given the current funding environment 👏

Mondu’s B2B Buy Now, Pay Later solution for online checkouts lets users offer their customers their preferred payment methods and flexible terms without risk or additional costs.

Follow the growth 📈 If you follow the growth, you will end up in the United Kingdom where a London-based FinTech Divido saw a 50% jump in gross merchandise volume (GMV) for 2022. That’s impressive 👏

Founded in 2015, Divido is a global white-label software platform for retailers, lenders, and payment intermediaries that want to offer point-of-purchase finance to consumers powering the likes of BMW, BNP, and Shopify. The fact that Divido last raised funding only in June 2021 (!) when it closed $30M Series B, perfectly illustrates how solid its performance is.

So, what does this mean? 🤔 In short, BNPL is dead, long live (B2B) BNPL! In other words, B2B BNPL is not only recession-proof but also is heating up as the next big thing. Here’s why (+3 bonus reads on a killer BNPL strategy):

Making sense of B2B BNPL 🧠 First and foremost, B2B BNPL > B2C BNPL.

I talked about this earlier but it has to be repeated again and again - the B2B payments market is huge and much bigger than its B2C counterpart. Given its accelerated transition to digital over the past couple of years as well as considering that the B2B e-commerce market is also larger than B2C, it’s clear what companies like Mondu or Divido are after. Furthermore, B2B BNPL is believed to be a $200B opportunity just in Europe and the US, which is already bigger than the global consumer BNPL market. Given that the market is currently underserved by existing offerings, this could actually be the next big driver in the BNPL market globally. Looking at the big picture, this goes on to show again that BNPL is far from being dead. You can’t build a sustainable business on it alone, but if you don’t have a BNPL strategy as part of your roadmap you are definitely going to miss out.

Bonus: If you don't have a BNPL strategy, you're missing out 🫵

Affirm offers a profitability strategy that other BNPL FinTechs should steal 👏

The real winner of the BNPL Wars is…Mastercard? 🤔

What about the recession? 📉 B2B BNPL can be considered a recession-proof sector for several reasons. First, B2B BNPL as such allows businesses to make purchases without paying for them upfront, which can thus help to preserve cash flow during economic downturns. This can be particularly important for small and medium-sized businesses that may be facing financial constraints. Second, B2B BNPL can also help to stimulate economic activity by making it easier for businesses to invest in equipment, inventory, and (as shown above) launch new features. This can help to keep businesses running smoothly and stay in the game. Looking further, B2B BNPL which is focused on businesses can also provide a flexible financing option for those companies that may not qualify for traditional forms of financing (i.e. bank loans). This can be hence especially helpful for businesses that are just starting out or that have limited credit histories (case in point - online marketplaces). Finally, B2B BNPL typically has low default rates compared to B2C BNPL primarily because they typically target financially stable companies with good credit ratings.

✈️ THE TAKEAWAY

Looking ahead 👀 On a high level, with its innovative solutions and ability to provide businesses with flexible financing options, B2B BNPL is proving to be a recession-proof industry that can help businesses thrive in any economy. Looking further, the growing demand and popularity of this payment method across the board as well as the massive size of B2B payments markets and little to no innovation in this space makes it a perfect growth opportunity for startups. It seems that 2023 FinTech predictions are materializing already. :)

🔎 What else I’m watching

FinTech Cuts ✂️ Australian payments processor Till Payments is shedding 40% of its workforce, joining the long line of FinTechs that have been forced to cut staff in the wake of over-ambitious quick-scale growth strategies. The job cuts, reported by the Australian Financial Review, will hit 120 staff in the UK, North America, and Australia. The firm has pointed to high inflation and tough global economic conditions for the downsizing. More to come…

Hiring ✌️MangoPay, a European payment technology provider for marketplaces and platforms, is to hire 250 people this year in a rare reversal of the current trend for layoffs across the tech industry. The move comes as the firm reports 35% of year-on-year growth and a total 2022 transaction value reaching over €11.3B. The company says it onboarded 243 new customers this year and has already hired 100 new staff across the business, including four C-suite appointments. This is a big one - going to write about it next week, stay tuned!

💸 Following the Money

Crypto market maker CyberX received a $15M investment from the crypto investment firm Foresight Ventures, its only investor.

Netherlands-based Sprinque has raised EUR 6M in a seed round in order to expand its Pay by Invoice solution in Europe.

HashKey Capital has closed its third fund at $500M. Dubbed HashKey Fintech Investment III, the fund targets crypto projects, with a focus on infrastructure and application builders

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: