Robinhood is challenging Apple 😮; Tell me Revolut is in trouble without telling me Revolut is in trouble 😨; The US banking system isn’t “sound and resilient” 😬

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Cash App is at the center of the financial services revolution 😎 [& why it’s a FinTech beast we’ve never seen before]

PayPal’s focus on efficiency is starting to pay off 💸 [how + a deeper dive on why PayPal is one of the strongest companies in the digital money space]

Stripe’s expanded fiat-to-crypto on-ramp is a killer to a dozen Web3 startups 🤯

Mastercard just redefined digital account opening with open banking 👀

As for today, here are the 3 FinTech stories that were changing the world of finance as we know it. This week was super hot in the financial technology space, so make sure to check all the above stories.

Robinhood is challenging Apple 😮

The news 🗞 Once stock-trading darling Robinhood HOOD -9.63%↓ has introduced a new instant access saving account paying an interest rate of 4.65%, as per Alfi.

The move seems to be a direct response to Apple’s AAPL -0.62%↓ recent move into Savings.

Let’s take a quick look.

More on this 👉 The move comes just a day after the latest Fed interest rate hike, and it will be for Robinhood’s Gold Members, who pay $5 per month for membership.

More importantly, it is also 3 weeks since Apple launched its own highly competitive savings account offering 4.15%. It brought in $1 billion in its first 5 days.

ICYMI: Apple Savings account takes the industry by storm 🤑

The economics 💸 Robinhood says the rate is 19x more interest when compared to the national average savings rate.

All eligible customers who opt into brokerage cash sweep have their uninvested brokerage account cash automatically moved to deposit accounts at a network of program banks. The cash deposited to these banks is covered by FDIC insurance up to $1.5M (up to $250,000 per program bank, inclusive of deposits customers may already hold at the bank in the same ownership capacity). On June 1st, this maximum will increase to up to $2M.

Non-subscriber Robinhood accounts earn 1.5% interest for all uninvested brokerage cash. Subscription seems like a no-brainer then… 🤷♂️

✈️ THE TAKEAWAY

Taking on Apple, huh? 🤔 First and foremost, this move was rather inevitable given the current macro situation and rising interest rates. Also, following the collapse of SVB, Signature, First Republic, etc., the fight for customer deposits has never been so intense (unless you’re JPMorgan JPM -1.95%↓, of course). But more importantly, this is about customer engagement and retention - despite the recent growth, Robinhood has been losing both users and their assets YoY:

Hence, offering 4.65% APY is attractive enough to try to make users come back to the platform. So far, this seems to be working, and a $0.9B increase in deposits in a single month is not bad at all:

Looking at the big picture, this data from Robinhood actually makes me even more bullish on Apple. With a somewhat similar APY (that could be easily increased) yet a 10-50x bigger user base (just in the US), the tech giant can take everyone out by storm. In fact, Apple’s mastery of user data coupled with its size and customer reach is already triggering a rapid change in the financial services industry that will soon leave established banks behind and at a competitive disadvantage.

ICYMI: Apple is building JPMorgan 2.0 😳 [deeper dive + lots of bonus reads]

Tell me Revolut is in trouble without telling me Revolut is in trouble 😨

The BREAKING news🔥 British FinTech giant Revolut has lost another senior executive. This time, group CFO Mikko Salovaara is leaving the FinTech heavyweight for "personal reasons". Sure he is!

Just yesterday I wrote about Revolut fighting its own banking crisis, and now we have this. Wow 😮

ICYMI: Revolut is fighting its own banking crisis 😳

More on this 👉 Salovaara leaves Revolut as the neobank’s 2-year quest to secure a UK banking license appears in trouble. The Financial Times reported that the process has "nearly halted" 👀

One must remember that at the beginning of March, Salovaara - who joined Revolut in 2021 - had signaled that the unusually-long process to secure a license was coming to a close, promising that it would arrive "any day now".

In a resignation statement, he now said:

I am grateful for the opportunity to serve as Group CFO at Revolut and remain confident in the firm’s future success.

Of course, you are 🙃

Zoom out 🔎 In business, the resignation of your Chief Financial Officer usually makes one question whether there are any financial issues that the company is facing. It can also cause concerns among investors, lenders, and other stakeholders who may view the departure of a CFO as a red flag for the company's financial health.

What does it tell you if this becomes a trend? Probably a lot…

2023 May 11: group CFO Mikko Salovaara is leaving Revolut for “personal reasons”.

2020 March 16: David Maclean is stepping down after less than 6 months at the company. Maclean, who was previously a finance director at Metro Bank, has cited personal reasons as the reason for his sudden exit.

2019 January: Peter O’Higgins, the chief financial officer of unicorn FinTech start-up Revolut, resigned as questions were raised over the firm’s ability to screen suspicious transactions.

✈️ THE TAKEAWAY

It’s bad out there 😬 One CFO resigning might be an outlier and an unfortunate event. Because things happen, views might not align, or some bigger opportunities might come across. But losing your CFOs consistently is already a trend that’s deeply worrying. Not only because it might mean that Revolut is not going to get a UK banking license altogether. But more importantly, it might signal that they could be having some serious issues with their financial health.

Worth revisiting: Revolut revenue drama 🎭

The US banking system isn’t “sound and resilient” 😬

The news 🗞 The US Federal Reserve has stated that the country's banking system remains "sound and resilient" despite warnings of potential credit squeezes and slower economic activity.

Let’s take a look.

More on this 👉 According to the Fed's Financial Stability Report, persistent inflation, tighter monetary policy, banking-sector stress, and real estate pressures are the biggest risks to financial stability.

The central bank also found that lenders plan to tighten lending standards over the rest of 2023, citing concerns about bank funding costs, liquidity, and deposit outflows. Smaller banks are most at risk, listing liquidity and funding costs as reasons for cutting lending, indicating concerns about regional bank failures.

The Fed remains confident in the system, which has held up relatively well compared to 2008, with ample liquidity and limited reliance on short-term wholesale funding. The banking sector turmoil could spread, and the Fed has singled out sectors with "structural vulnerabilities" that could be hit by economic problems.

✈️ THE TAKEAWAY

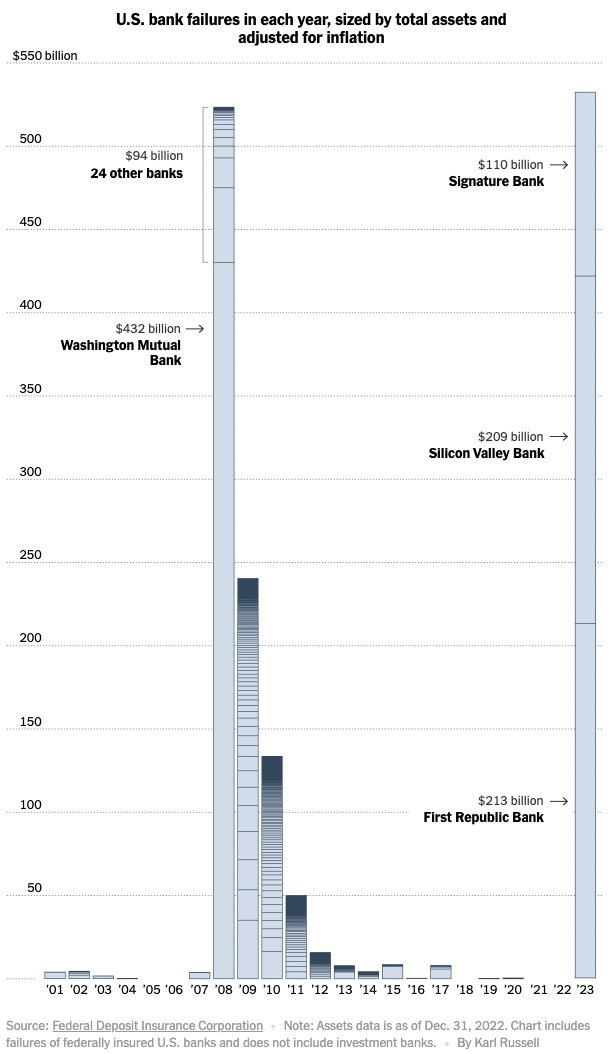

Are you sure? 🤔 “Banking system is sound and resilient". Meanwhile, the system goes Bingo:

Also, this (probably nothing):

And this:

So no, the system is definitely not sound and resilient 🙃 On a more serious note, tighter oversight and new legislation may protect regional banks in the future, although this could intensify the lending squeeze. Furthermore, the Fed's recent rate hike and hints that a series of increases could be coming to an end may offer banks breathing room and help prevent further deposit flights. So watch this out very closely.

ICYMI: The banking crisis is far from being over 🏦

🔎 What else I’m watching

It’s over… 😢 Crypto exchange Bittrex has filed for bankruptcy in the US, weeks after being hit with charges by the SEC and months after saying that it would leave the country. In March Bittrex said that it would shut up shop in the US by the end of April, citing the "current US regulatory and economic environment". Despite this, last month the SEC charged the firm, and co-founder and former CEO William Shihara, for operating an unregistered securities exchange, broker, and clearing agency. Now the company has filed Chapter 11 bankruptcy in federal court in Delaware, saying it believes it has more than 100,000 creditors, with estimated liabilities and assets both within the $500 million to $1 billion range.

What the FinTech? 🤯 JPMorgan Chase has been ordered by a judge to pay Frank founder Charlie Javice’s defense costs in the bank's suit accusing her of defrauding it in its $175M acquisition of her college financial planning site. We can remember that the bank agreed to buy Frank - which provided an online portal that lets users apply for financial aid in minutes and enroll in a catalog of online college courses - in late 2021. But, late last year JPMorgan sued Javice, for creating a list of millions of fake users to get the deal completed. Javice filed her suit against JPMorgan to force the bank to cover her legal fees. Delaware Chancery Court Judge Kathaleen McCormick has now rejected JPMorgan's argument that Javice's alleged fraud fell outside of the merger agreement and ruled that the bank is legally obligated to cover her legal bills.

Regulated DeFi Bank? 🤔 Berlin-based crypto startup Unstoppable Finance is preparing to build Europe's "first fully regulated DeFi-native bank" alongside a fiat-backed Euro stablecoin. Unstoppable Finance is founded by Peter Grosskopf, Maximillian von Wallenberg-Pachaly, and Omid Aladin who worked on the launch of Börse Stuttgart Digital Exchange (BSDEX), Germany's first regulated crypto exchange in Germany. The first product out of the Unstoppable Finance stable was the crypto self-custodial wallet 'Ultimate', launched in 2022 on the back of a €12.2M funding round. This one will be an interesting watch.

💸 Following the Money

HV Capital closes €710M fund amidst the wider European and global funding downturn.

Slash, a US banking startup that bridges the gap between personal and business banking for entrepreneurs, has emerged from stealth on the back of a $19M funding round led by NEA. The seed and Series A rounds included additional participation from Menlo Ventures, Connect Ventures, Y Combinator, Soma Capital, Global Founders Capital, and angel investors William Hockey, the founder of Plaid, and Justin Mateen, co-founder and former CMO of Tinder.

Netherlands-based fraud prevention company ThreatFabric has raised EUR 11.5M in a seed round to expand its technical capabilities and support growth.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: