More Finance Giants follow BlackRock in filing for a BTC ETF 👀; Wise is one of the most underrated FinTech powerhouses now 😳; Grab’s slowing growth & brutal layoffs reflect Super App realities 📉🔥

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Investor list that don't need warm intro 💸 [read this if you want to grow your startup 🚀]

Prospering amid economic weakness: Visa acquires Brazil's Pismo in one of the largest FinTech M&A deals in LatAm 🤝💰 [deep dive into Visa & my investment thesis]

As for today, here are the 3 mesmerizing FinTech stories that were changing the world of finance as we know it. This week was one of the most intense ones in the financial technology space this year thus far, so make sure to check all the above stories.

More Finance Giants follow BlackRock in filing for a Bitcoin ETF 👀

The BIG news 🗞 WisdomTree and Invesco have filed applications for spot Bitcoin exchange-traded funds (ETFs) in the US, following BlackRock's BLK 0.47%↑ massive move a week ago.

ICYMI: BlackRock’s Bitcoin ETF: a game-changer or just hype? 🤔

More on this 👉 New York-based asset management firm WisdomTree has applied for a 3rd time, requesting that the SEC allows WisdomTree to list its “WisdomTree Bitcoin Trust” on the Cboe BZX Exchange under the ticker “BTCW.” The SEC previously rejected its application in December 2021, and again in October 2022, claiming concerns of fraud and market manipulation.

Meanwhile, Invesco has "reactivated" its application for its “Invesco Galaxy Bitcoin ETF.” According to the filing, the spot Bitcoin ETF will make use of "professional custodians and other service providers."

WisdomTree had $90.7 billion in assets under management as of April while Invesco, one of the largest ETF issuers in the world, had $1.4 trillion in assets under management as of April. That’s a lot of money 👀

✈️ THE TAKEAWAY

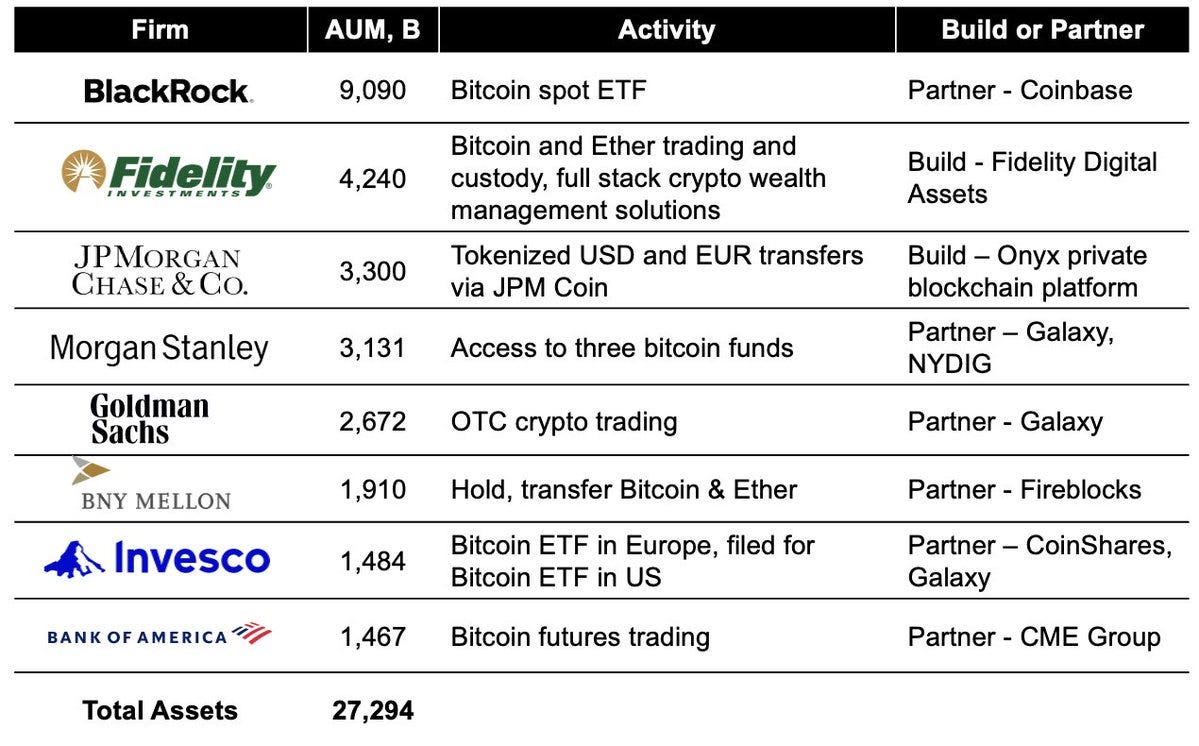

Zoom out 🔎 The two firms now join BlackRock, which surprised the market with its filing for a spot Bitcoin ETF filing about a week ago. We must note that thus far, the SEC has only approved bitcoin ETFs that are tied to U.S.-traded futures and has cited the lack of proper cross-exchange market surveillance as one reason why it won't approve a bitcoin spot ETF. Yet, once you zoom out, it's clear that this is just the beginning of a bigger wave we have started seeing as many of the largest financial institutions in the US (and globally) are actively working to provide access to Bitcoin. So far, $27 trillion of client assets are here, and that might not be the end of it.

Wise is one of the most underrated FinTech powerhouses 😳

The news 🗞 Shares in British FinTech star Wise soared by more than 18% this week following the news that the money transfer app saw its full-year pre-tax profits triple, boosted by rising interest rates.

Let’s take a brief look at why Wise is one of the most underrated FinTechs.

More on this 👉 Here are the latest full-year key numbers from Wise:

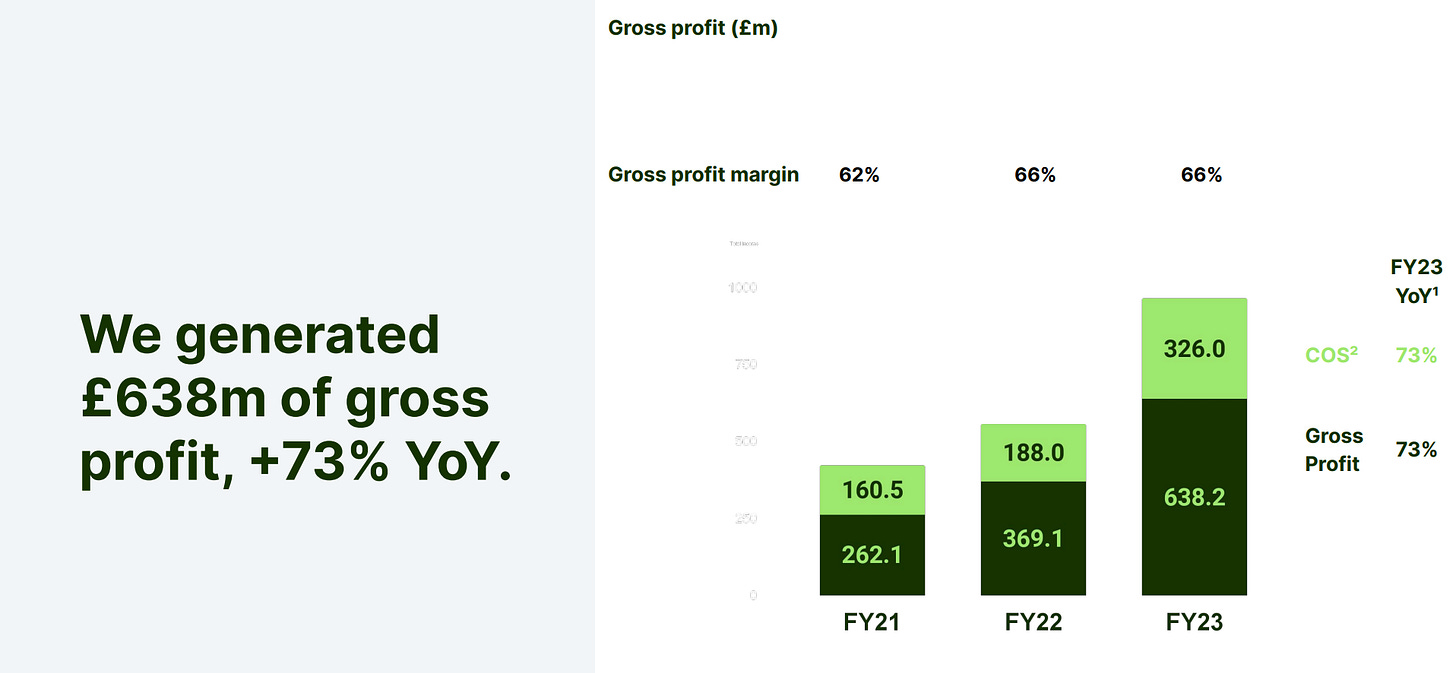

The UK-based firm posted pre-tax profits of £146.5 million for the year, up from £43.9 million (more than 3X!) the year before. Revenue was up 51% to £846.1 million. This is nuts 🤯

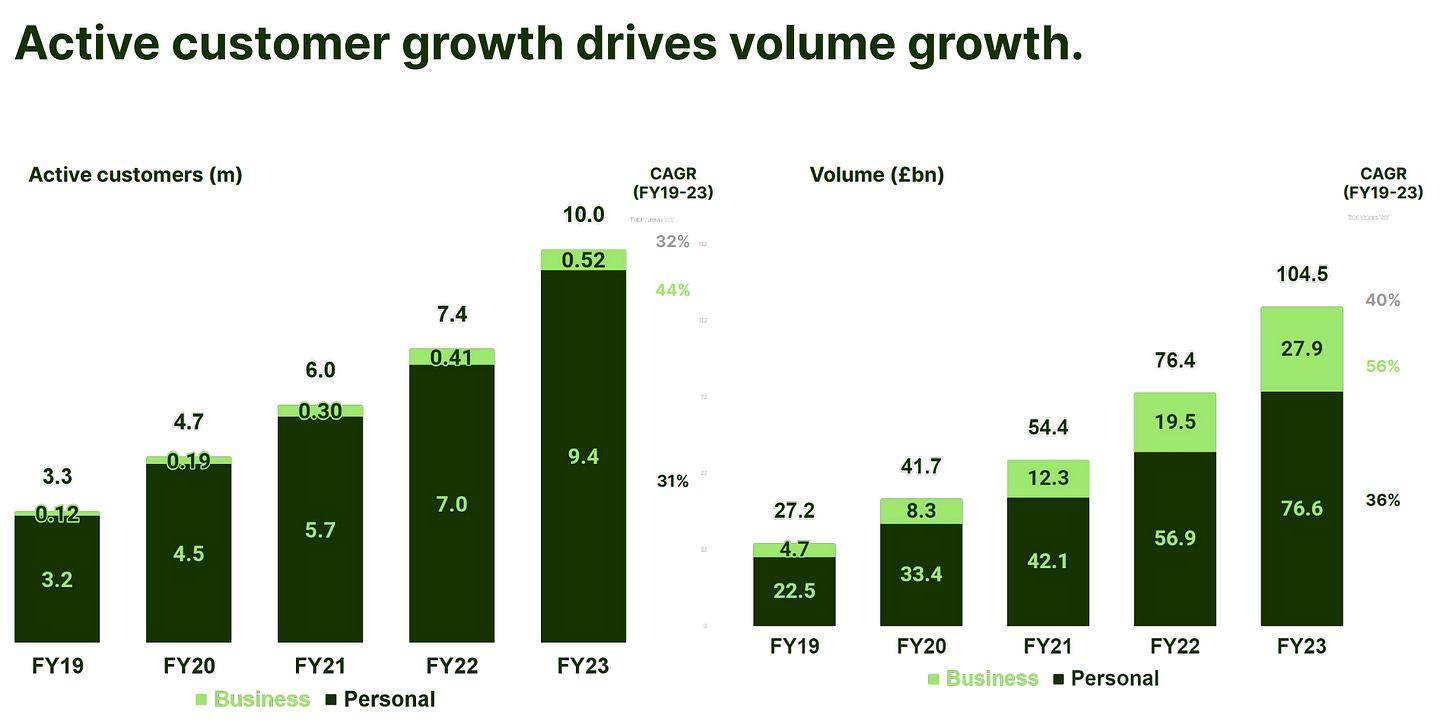

The company also hit 10 million active customers, a 34% year-on-year rise, with volumes of £104.5 billion.

Soaring interest rates mean that Wise is also expecting income to grow by between 28% and 33% in full-year 2024.

Following great results, Wise shares hit £6.20 on Tuesday afternoon, up about 18% but still below its 2021 IPO price.

✈️ THE TAKEAWAY

Undervalued 👀 Wise continues being among very few profitable and very healthy growing FinTechs. That said, it’s pretty surprising to see they have lost around 35% in market capitalization since going public. Given that they have a very active and loyal customer base that loves their product (66% of customers join by word of mouth), a pretty diverse business (Wise Account, Wise Business, and Wise Platform), strong global presence (hold 69 licenses across 45 countries) and expect their profits to grow by between 28% and 33% in the next year, this seems like a very undervalued stock and a solid business to back right now. I’m bullish.

Disclaimer: I’m a shareholder of Wise.

Dive deeper: Wise is now about all things money 💸 [+4 more reads]

Grab’s slowing growth and brutal layoffs reflect Super App realities 📉🔥

The news 🗞 Asian Super App Grab GRAB 0.59%↑, known for its ride-hailing and food delivery services, has announced significant layoffs, affecting about 11% of its workforce.

This is the group’s largest round of layoffs since 2020 when it cut 360 jobs in response to Covid-19 pandemic challenges.

More on this 👉 The move comes after the company reported slowing user growth, decreased user spending, and ongoing net losses.

Grab's CEO Anthony Tan framed the layoffs as a response to changes in technology, capital markets, and increased competition. The company reportedly aims to adapt to the evolving environment and achieve profitability, committing to being "Group Adjusted EBITDA breakeven" by the end of the financial year. That’s ambitious.

We must note that Grab had previously refrained from major layoffs, unlike its regional competitors Sea and GoTo, but the current market conditions and challenges have led to this strategic reorganization. Tan hinted at potential further measures such as divestments or service sunsetting to align with long-term strategies.

For context, it must also be noted that Grab was hiring quite aggressively last year:

The USP 🥊 As a refresher, we can remember that founded in 2012 as a regional ride-hailing app in Malaysia, Grab has since added food and grocery delivery, mobile banking, and payments and now operates a Super App across Southeast Asia.

Grab did the largest SPAC deal ever back in December 2021. Shares Grab opened the trading day of the debut at $13.06 apiece which valued the company at nearly $40B.

Since then the company lost more than 70% of its value. That’s brutal…

✈️ THE TAKEAWAY

What this means? 🤔 First, we must note that Grab operates in a market with a large market opportunity and low penetration across their verticals (especially food delivery and rides), which effectively means a huge potential upside. Second, all-in-one platforms aka Super Apps are super convenient for users, but that comes at a cost - you need heavy investments towards growth and only massive scale could justify your business economics. Grab’s latest results once again prove that profitability remains a key challenge for the Super App operator as it faces strong competition. To combat that, Grab has offered generous driver incentives and consumer discounts since early 2022, looking to make rival GoTo's mobility business irrelevant in Singapore. But that obviously hurt and will continue to hurt Grab’s margins, not to mention that the FinTech Super App is losing delivery market share in Indonesia to regional tech rival Sea. Therefore, it’s yet another proof that FinTech is hard, but Super Apps are even harder. That said, being a publicly-traded stock, Grab must convince investors that it has a clear plan for profitability. Otherwise, the public markets can be even more brutal, and bigger selling pressure will inevitably arise. Zooming out, we must note that this also brings some food for thought when it comes to Super Apps per se. First, it’s all about the cost, which primarily has to do with bigger privacy and regulatory concerns. As antitrust scrutiny heats up, becoming a super app could get increasingly harder for US tech titans, not to mention their European counterparts (think Square, Revolut, PayPal, and Klarna, among others). Second, growing competition will inevitably lead to lower margins and growing customer acquisition costs, as well as increased focus on differentiation.

On the other hand, this might be a massive opportunity for the BIG Guys. And the biggest of them all is obviously Apple AAPL 1.57%↑.

ICYMI: Apple might become the First Super App of the West 🍎

🔎 What else I’m watching

Getting paid BIG Time 🤑 The closure of FTX, a cryptocurrency exchange, is projected to be very costly due to significant professional fees that have already exceeded $200 million, with lawyers and professionals accumulating thousands of billable hours. The lack of regulation and basic corporate governance in the exchange has been cited as factors contributing to the high costs. Reread: A mindblowing FTX report 😱

SALE 🏷️ SVB Financial Group has entered an agreement to sell its investment banking division, SVB Securities, to a group of some of its own bankers, including Jeffrey Leerink, and backed by funds managed by the Baupost Group, AltFi reported. The bidder group, led by SVB Securities CEO Leerink, will acquire the investment banking business for a combination of cash, repayment of an intercompany note, and a 5% equity instrument. Could this be a very interesting FinTech in the making? Also: The leaked doc shows that regulators saved Big VCs & Big Tech from billions of losses in uninsured SVB deposits 😳

Revolut’s robo advisor 🤖 Revolut has launched a robo-advisor in the US, offering customers the option to have their investment portfolios automated. Based on responses from customers, the robo-advisor will provide users the opportunity to invest in one of five diversified portfolios based on their risk tolerance. Once a customer deposits money into their portfolio, the advisor automatically invests it in the market and then monitors and manages it. The robo-advisor rebalances the portfolio automatically to stay in sync with the customer’s risk tolerance. This is so much better than the Ultra plan… ICYMI: Revolut launches new premium plan ‘Ultra’: could initial disappointment become a hit? 🤔

💸 Following the Money

UK high street bank Lloyds has invested £2M in an AI-based corporate banking platform for financial institutions and corporates, Fennech. Fennech uses AI, machine learning, and business rules with cloud-based technology, to automate businesses’ finance, treasury, and payments processes in real-time.

Hong Kong-based OneDegree, a leader in digital asset insurance and generative AI-enabled InsurTech solutions, has successfully garnered a significant amount of funding in its recent investment round. The FinTech firm has concluded its Series B round, amassing a substantial $55M in investments.

Capital markets fintech TreasurySpring raises £15M. The London-based startup's Series B was led by Balderton and existing investors ETFS Capital, Anthemis, and MMC Ventures.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: