Apple should go into stock trading in 2025 👀💸; Revolut’s Swift “challenger” RevTag will probably fail 🫤; It’s all about that Base 'bout that Base🎵

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Inside Spotify's IPO: the valuation symphony every startup should listen to 🎵 [priceless resource for tech startups & unicorns trotting the IPO path 🔔]

Wise & Swift join forces. It will change the game for banks 🏦🌐

Monzo is on track to be the most downloaded UK banking app in 2024 🇬🇧🚀

UK banking licence unlikely? Revolut's latest 2022 accounts delayed 🤷♂️

Revolut is yet to file a formal US banking license application 😬🇺🇸

Most active VC investors in August 🤑 [+ startup resources]

As for today, here are the 3 captivating FinTech stories that were changing the world of finance as we know it. This week was just absurd in the financial technology space, so make sure to check all the above stories.

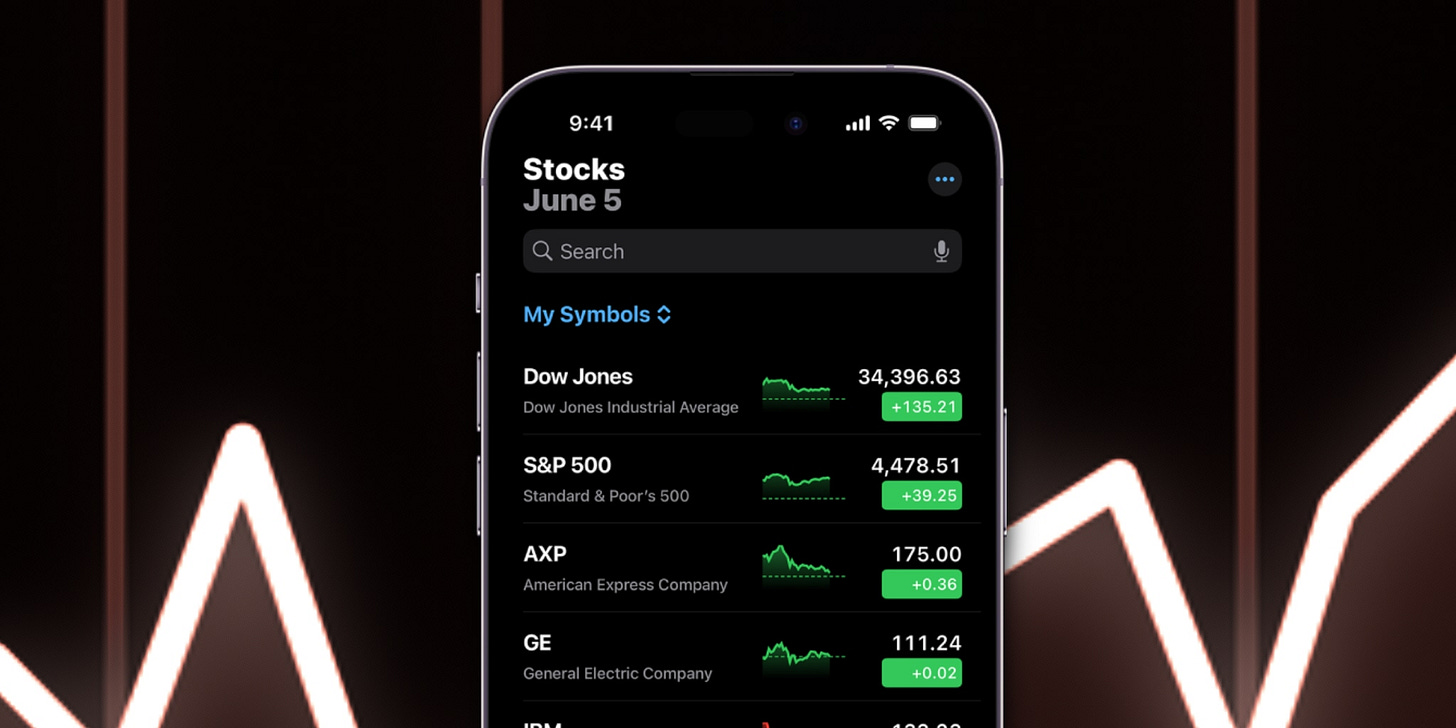

Apple should go into stock trading in 2025 👀💸

HOT news🔥 Apple AAPL 0.00%↑ was exploring the launch of an iPhone feature that would let users buy and sell stocks, according to three sources familiar with the plans, CNBC reported.

This is a potentially massive development that could completely redefine the FinTech market.

Let’s unpack it.

More on this 👉 As equities soared in 2020 and consumers flocked to trading apps like Robinhood HOOD 0.00%↑, Apple and Goldman Sachs GS 0.00%↑ were reportedly working on an investing feature that would let consumers buy and sell stocks directly within the iPhone interface.

The development effort began during that hype cycle in 2020, and the companies planned to launch the trading app in 2022 but decided to shelve the plans as the stock market declined in 2022 amid higher interest rates and inflation.

Apple feared a potential backlash from users losing money in the volatile market if they launched a trading app under current conditions.

Gold(ma)n Apple 🍎 The effort, which has been reported for the first time ever, would have added to Apple’s suite of financial products powered by Goldman.

We can remember that Apple first teamed up with the Wall Street giant to offer a credit card in 2019, and then added Buy Now, Pay Later (BNPL) loans and a high-yield savings account. Just recently, the Apple Savings account offering had climbed past $10 billion in user deposits making it one of the biggest challenger banks in the world…

ICYMI: Apple now runs one of the largest neobanks in the world 🤯

And it might not stop there as the trading app infrastructure is largely built and could potentially be launched in the future if conditions improve and Apple decides to move forward. Because it should.

✈️ THE TAKEAWAY

Not IF but WHEN 👀 I’d argue that Apple going into stock trading is only a matter of when not if. Sure, it would face stiff competition in the market from the likes of Robinhood, SoFi, or Square (Cash App). But the rewards easily outweigh the cost here as Apple is ultimately an ecosystem play while most of its to be competitors are basically standalone apps. Just think about it for a second. Apple has an enormous iPhone user base who could start trading stocks seamlessly through their devices (better UI and seamless UX alone would be good enough for switching & ditching their current apps). Or even better - imagine that every $1 you spend via Apple Pay is rounded up and invested into your favorite stock, ETF, or digital assets? Some FinTech companies are already doing that, but Apple’s size and scale would change the game entirely. As an effect, it would further expand Apple's financial services offerings beyond just payments, credit, loans (BNPL), and savings accounts. Given that investing apps are engagement drivers, this would also help retain users within the Apple Ecosystem and drive more revenue while at the same time putting Apple in a perfect position to disrupt traditional brokerages.

But why 2025, Linas? Well, Apple is known for its strategic and methodist approach when it comes to launching new products and services. That said, I believe they will sit quietly throughout 2024, and if markets are back in the green or at least trending towards that, Apple will make sure it rides on the next bull run.

Bonus: Apple should have bought Goldman Sachs’ PFM unit. Here’s why 🍎 [where’s the value at + lots of deeper dives]

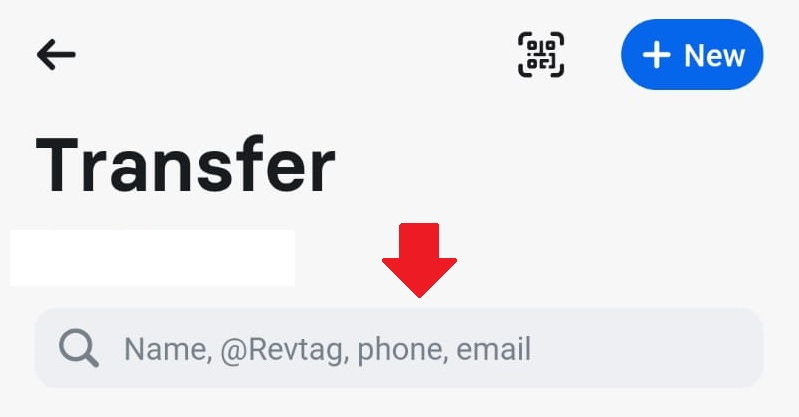

Revolut’s Swift “challenger” RevTag will probably fail 🫤

The news 🗞️ London-based FinTech heavyweight Revolut just announced the launch of RevTags, a new payments feature aimed at facilitating fast and free cross-border transactions for business customers.

The new feature aims to challenge Swift in cross-border payments.

I believe it will fail to achieve anything even close to meaningful, so let’s take a look.

More on this 👉 With RevTags, Revolut users can make international payments by entering a unique RevTag identifier instead of account details like IBANs.

The feature is free and provides businesses with the ability to pay employees and contractors in over 150 countries and regions around the world. It will be immediately available to Revolut Business customers worldwide.

Revolut reports customers will be able to send and receive instant zero-fee cross-border payments in over 29 currencies within the Revolut network, which includes more than 30 million retail users and thousands of businesses around the world.

Zoom out 🔎 In other words, Revolut just opened up its ecosystem beyond P2P use and now calls it a Swift disruptor.

I get the marketing and PR angle here but beyond quick clicks, this is kinda laughable… Here’s why:

✈️ THE TAKEAWAY

What this maens? 🤔 Revolut can frame RevTags as a challenger to the dominant cross-border network SWIFT, but it’s highly unlikely it will make any difference in the global payments infrastructure. SWIFT remains the primary network connecting over 11,000 financial institutions across 200 countries. This probably equals a ~billion(s) customers and enormous amounts of businesses. In contrast, Revolut's network consists mainly of its 30 million retail users and still lacks major institutional adoption. Also, as per Revolut's own survey, high costs and slow processing times are pain points for businesses making international transfers. However, SWIFT already offers various fast payment solutions and plans to expand instant cross-border transfers more broadly (remember: it has just partnered with Wise. And that’s what will really change the game). Hence, Revolut matching SWIFT's speed is therefore not a key competitive advantage. Additionally, Revolut's zero-fee structure for RevTags payments may not be sustainable long-term if transaction volumes increase substantially. The neobank aka Super App would likely have to introduce fees to cover compliance, FX, and other costs at scale. SWIFT's volume-based pricing could ultimately prove more viable. All in all, Revolut has a long way to go before truly challenging the dominance of SWIFT for global business payments. The network effects and entrenched partnerships powering SWIFT are nearly impossible for challengers like Revolut to overcome without major banking relationships. So, if I were Revolut, I would leave SWIFT to control the cross-border infrastructure underpinning global finance while I would focus on how to get my house in order.

ICYMI: Revolut is yet to file a formal US banking license application 😬🇺🇸 [the bad & the ugly + more bonus reads]

It’s all about that Base 'bout that Base🎵

Following the data 📈 Crypto giant Coinbase’s COIN 0.00%↑ new optimistic rollup, Base is still getting people excited.

At least that’s what the data is telling us about the new competitor in the scaling solutions sphere.

Let’s take a look at this and see why it matters.

More on this 👉 We can remember that Base did a public launch just over a month ago on August 9th, but even before then, it was garnering traction as people bridged over using a proxy portal contract or other third-party sources.

According to The Block’s data, Base has seen a recent sustained uptick in new addresses on the network. Since August 26th, the layer 2 has been gaining over 720,000 new addresses a day, putting its total number of unique addresses over 15 million.

On the other hand, the 7-day moving average of transactions on the network has been dipping. It peaked at just under 900,000 at the end of August and has now sunk to circa 367,000. That being said, Base still remains comparable to Arbitrum and Optimism in terms of transactions.

Yet, the number of new addresses on the network seems to be staying consistently high. This could hence be a sign of a steady flow of new users interested in using Base.

As an Ethereum scaling solution, it offers faster and cheaper transactions as opposed to mainnet, which in itself looks attractive. It’s also built by Coinbase on the OP Stack, two familiar names that help it gain traction.

✈️ THE TAKEAWAY

Looking ahead 👀 Launching Base Blockchain was a huge milestone for a public company on its own. The fact that it’s both gaining and adoption is a very good and positive indication that Coinbase made the right choice. Bullish.

ICYMI: Coinbase becomes the first publicly traded company to launch its own decentralized blockchain 😳 [why it’s a game-changer and a critical part of their "Master Plan" + a deeper dive into Coinbase]

🔎 What else I’m watching

Gen AI + Banks 🇯🇵 Japanese technology giant Fujitsu is to conduct trials into the use of generative AI (gen-AI) for banking operations. The tech vendor has partnered with Japan-based Hokuhoku Financial Group for the experiments. Fujitsu's AI platform, Fujitsu Kozuchi, will be applied to the banking operations of Hokuriko Bank and Hokkaido Bank, two Hokuhoku subsidiaries. More specifically, the gen-AI module on the platform will be used to respond to internal inquiries, generate and verify business documents, and create programs. The objective is to identify promising use cases for the technology, according to Fujitsu. It is not the first time that Fujitsu has sought to trial the use of gen-AI with a Japanese bank. In June it announced such a plan with Mizuho.

Spot bitcoin ETF race heats up🔥 Franklin Templeton has recently become the latest asset manager to file with the Securities and Exchange Commission for a spot bitcoin ETF. The proposed ETF's primary assets will be bitcoin, held in custody by Coinbase Custody Trust Company, with shares to be listed on the Cboe BZX Exchange if approved. Meanwhile, SEC Chair Gary Gensler told the Senate Banking Committee that the agency is still reviewing a court’s ruling in the ongoing Grayscale case, as well as “multiple filings around bitcoin exchange-traded products.”

Brex + AI 🤖 FinTech startup Brex is rolling out a new artificial intelligence tool designed to boost its employee expense management suite. The tool, known as Brex Assistant, can flag expenses that don’t fall under corporate policies, among other capabilities, said Michael Tannenbaum, Brex’s chief operating officer. “This really helps increase compliance with expense policies overall and also makes the job of CFOs and finance teams much easier,” Tannenbaum said in an interview.

💸 Following the Money

Range Protocol, an on-chain asset management platform, has closed a $3.75M seed funding round.

Curve has secured an additional £58M in its series C round, taking the round’s total funding to over £133M. The app that brings users' debit and credit cards into one app, has also stated it aims to reach profitability in early 2024. Curve recently released a new app featuring a marketplace of financial ‘applets’, which is likely to benefit from the extra funding, along with the company’s Flex offerings.

Brazilian neobank Nomad has secured $61M in its Series B funding round, to bring in the largest investment for a LatAm financial startup this year.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: