This is the End: Apple is shutting down its credit card partnership with Goldman Sachs 😳; Orange bets on Africa with new Super App 🟠📲; Will Open Banking eat Visa’s and Mastercard’s lunch? 🤔

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Cashflow Forecast Model Template 📊 [leverage this to do a proper cashflow forecast]

Mastercard's new AI Shopping Assistant aims to revolutionize online shopping 🛍️💳 [how it aims to revolutionize online shopping & why Mastercard is entering Klarna’s territory + more deep dives into Mastercard, and AI + Finance]

Khosla Ventures bucks VC slowdown trend 📈 [what they are up to & what’s next + resources to help you raise money - family offices list, no intro VCs, angel investors, etc.]

As for today, here are the 3 wild FinTech stories that were transforming the world of finance as we know it. This week was very intense in the financial technology space, so make sure to check all the above stories.

This is the End: Apple is shutting down its credit card partnership with Goldman Sachs 😳

It was fun while it lasted… 🤷♂️ It’s over. Apple AAPL 0.00%↑ has decided to terminate its credit card partnership with Goldman Sachs GS 0.00%↑, delivering the final blow to the investment bank's ambitions in consumer lending, according to WSJ.

Let’s take a look at what happened, what this means, and what’s next.

More on this 👉 The tech giant proposed exiting the contract that covers their joint credit card and savings account in the next 12-15 months.

Launched in 2019, the Apple Card was intended to be a pillar of Goldman's shift towards consumer banking 💳

However, Goldman lost billions on its consumer business (a whopping $1.2 billion in 2022 alone 🤯) and indicated to Apple earlier this year that it aimed to sell the partnership.

Goldman has had talks with American Express AXP 0.00%↑ about taking over the card program, but AmEx expressed concerns over aspects like loss rates. Synchrony Financial SYF 0.00%↑, the largest US store card issuer, has also explored acquiring the portfolio.

✈️ THE TAKEAWAY

Looking ahead 👀 The unraveling signifies the end of Goldman's short-lived and unsuccessful foray into consumer lending after deciding to refocus on traditional corporate and high-net-worth clients. For Apple, this setback dents its services business, a growing focus as iPhone sales are slowing down. But the impact will be minimal here as the GS deal likely represented a small portion of services revenue. So Apple will be fine, they’re going to keep offering the Apple Card, but just with a new issuing partner. Hence, the most interesting question now is to see who will step in. Or maybe Apple will bring this in-house? 🤔 Zooming out, this divorce proves the importance of alignment of commercials between the Embedded and the Embedder, as many are discovering in real-time. More importantly, this serves as a perfect reminder that FinTech is hard but consumer FinTech is 10X harder.

ICYMI: Goldman Sachs regrets Apple Card, calls it a “mistake” and is trying to escape the deal ASAP 😳 [a closer look at the deal that was brilliant for Apple but not for GS + lots of bonus reads and deep dives ]

Orange bets on Africa with new Super App "Max It" 🟠📲

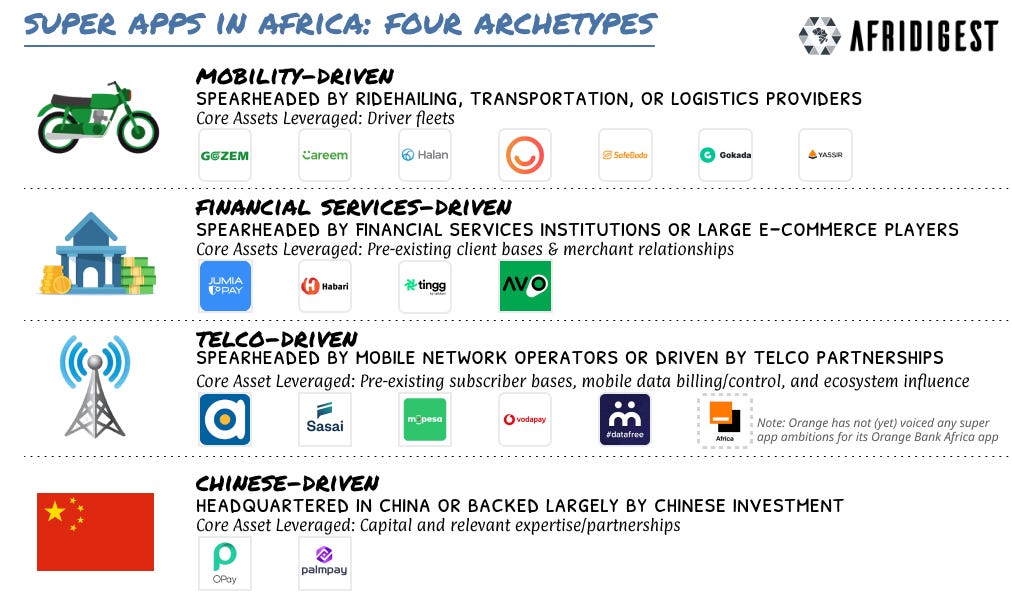

The launch 🚀 French telecom giant Orange is making a bold bet on Africa and the Middle East with the launch of its new super app Max It, which brings together telecom, financial, and e-commerce services in one platform. Classical super app with a rather odd name…

The company aims to sign up 45 million active users by 2025 - more than double its current 22 million daily app users. That’s pretty ambitious…

Let’s take a look at this and see why it could be BIH.

More on this 👉 Unveiled this month, Max It consolidates Orange's previous My Orange and Orange Money apps into a single interface. Users can manage their mobile accounts, send money locally and abroad via Orange Money, and access digital content ranging from online games to news and videos.

It also offers e-ticketing for concerts and transportation.

The roll-out 📱 The app launches first in Cameroon, Senegal, Mali, Burkina Faso, and Botswana before rolling out across Orange's entire African and Middle Eastern footprint. Localized versions will cater to country-specific needs and preferences.

Driving adoption is the rising smartphone and mobile internet penetration in the region. With over 60% of subscribers expected to use smartphones by 2025, Orange is leveraging its strong existing customer base and brand recognition.

An open platform strategy also allows the integration of third-party local and global services over time.

✈️ THE TAKEAWAY

What’s next? 🤔 If successful, Max It could increase consumer spend and loyalty for Orange while reinforcing its image as a digital innovator. This in turn should drive revenues and further strengthen Orange’s already solid numbers in the Middle East & Africa:

Different than in the US or Europe, the super app model - already popularized by WeChat in China - appears to be well suited to the mobile-first population of Africa and the Middle East.

More importantly, seamless mobile financial services within Max It could boost financial inclusion and cashless transactions for the large unbanked and underbanked population across emerging markets (especially in Africa). This thus represents a significant revenue opportunity in payments and transfers alone and probably explains why Orange took this move in the first place. Looking at the big picture, Max It might even evolve into a marketplace for Orange and partners to sell all kinds of digital services and products across MEA. Given how massive the TAM is, it might end up as a pretty big deal.. But for now, hitting the ambitious user target could cement Orange's pole position in Africa's rapidly growing digital economy.

ICYMI: Africa rising: Mastercard buys minority stake in MTN’s FinTech biz 💸

Visa knows that Africa is the world's next superpower. You should pay attention too💡 [+ more bonus reads]

Will Open Banking eat Visa’s and Mastercard’s lunch? 🤔

Zooming out 🔎 If you’re following the space actively, you know that financial technology companies have succeeded in reducing payment costs for merchants by providing cheaper and easier ways to accept payments.

However, their ability to truly disrupt the dominance of card network giants like Visa V 0.00%↑ and Mastercard MA 0.00%↑ in payment processing looks small. At least for now.

Let’s take a quick look and see what’s the status quo right now.

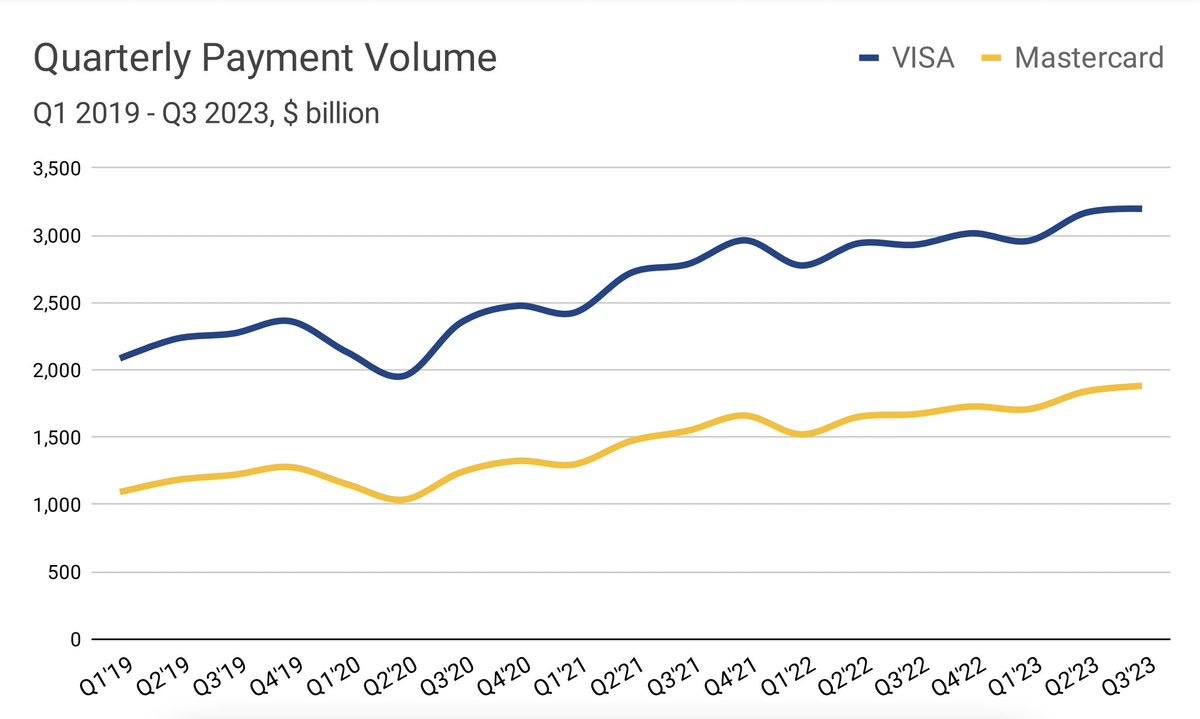

More on this 👉 Love it or hate it, the card networks still control the vast majority of the plumbing that connects banks and enables card payments. Together, Visa and Mastercard handle a whopping ~$20 trillion in payment volumes annually.

In contrast, one of the leading European FinTechs TrueLayer processed just $35 billion in open banking payments last year. Hence, it’s not surprising that card payments are still expected to account for close to half of total payments in major markets over the next few years.

Lucrative industry 💸 The card networks generate very high margins (and by very high - I mean really high!), with minimal marginal costs, on payment transaction fees. So rich rewards are awaiting any company that can divert a significant share of volumes away from cards to direct bank transfers aka account-to-account (A2A) payments.

FinTechs thus aim to do this by enabling mobile and digital payments through technologies like QR codes, biometrics, and/or open banking.

While in the long run, this could reduce reliance on physical cards, for now, though, cards still dominate both in-store and online payments.

✈️ THE TAKEAWAY

Looking ahead 👀 It’s clear that changes driven by the FinTech revolution are reshaping the global payments landscape. But card networks are not stupid - they understand and monitor these global shifts and more importantly, are also adapting by building their own real-time payment capabilities. In fact, due to their scale, resources, and network effects, they might end up being the ones that will end up setting the new standards for open banking. Hence, the death of Visa & Mastercard due to OB might have been greatly exaggerated…

ICYMI: Open Banking now is more important than ever before 🚀

The Finance Giants: Visa vs. Mastercard 💳 [breakdown + numbers + solid deep dives]

Prospering amid economic weakness: Visa acquires Brazil's Pismo in one of the largest FinTech M&A deals in LatAm 🤝💰 [how Visa is prospering amid economic weakness + why it’s a solid long-term investment]

Mastercard is getting aggressive with Open Banking 😎

🔎 What else I’m watching

SBF’s fish 🐟 Jailed FTX founder Sam Bankman-Fried has adapted to prison economics, using fish as currency for a haircut, reports the WSJ. With cigarettes banned, mackerel is the common "mack" tender in federal prisons amid inflationary pressures. Consultants say macks offer more stability than crypto. Though his trading days are over, SBF still offers guards crypto tips. The bizarre yet pragmatic shift for someone who recently lived a $30 million penthouse crypto billionaire lifestyle signals how tangible assets retain tangible value in prison. As he awaits sentencing on fraud charges and appeals to overturn convictions, SBF sports a fresh haircut likely paid in fish rather than the digital assets now beyond his reach. ICYMI: Guilty: SBF convicted in historic crypto fraud trial 👨🏻⚖️

CR7 in trouble 🤕 Cristiano Ronaldo faces a $1+ billion class action lawsuit over promoting the CR7 NFT collection with crypto exchange Binance, which allegedly led investors to lose money. The suit claims Ronaldo's endorsement brought buyers into unregistered securities like Binance's BNB token. It alleges Ronaldo coordinated with Binance on offering and selling unregistered crypto securities and should have known better given his resources. The lawsuit also notes SEC guidance saying celebrities should disclose payments for crypto promotions. Meanwhile, Ronaldo hinted at further collaboration with Binance this week, despite the legal action over their past NFT partnership's impacts. ICYMI: BREAKING: Binance. CZ to step down & Binance to pay $4.3 billion in fines 🤯 [a closer look at this craziness with the details, data + what it means for the industry & what’s next]

Problema italiano 🇮🇹 Italy's competition authority ordered Intesa Sanpaolo to halt migrating 2.4M customers to its new app-only Isybank without express consent. Intesa moved 300,000 users in October, sparking 5000 complaints about messaging and worse conditions. The AGCM says switch notices were sent to archives without alerts during holidays. Customers protested lost services like virtual cards too. With users unhappy about forced changes absent transparency and input, Intesa cannot continue transfers. The action safeguards choice and rights, ensuring people can retain accounts under existing terms. After an insensitive rollout, Intesa must slow its digital shift and earn customer buy-in rather than take it for granted.

💸 Following the Money

Mozaic.io, a payments platform revolutionizing the way creative professionals handle revenue and royalty splits, has secured a $20M.

Nucleus Commercial Finance (NCF) has announced up to GBP 200M in new funding from NatWest to strengthen its SME loans business.

French startup Indy has recently closed a new funding round of $44M (€40M), with BlackFin Capital Partners leading the round, as per TechCrunch. Indy started as an automated accounting platform for freelancers and other self-employed people. But the company has been slowly iterating on its product to become an all-in-one platform for freelancers, from accounting to company creation, tax preparation, invoicing, and (soon) business banking. It’s an interesting example of the positive effects of bundling in a software-as-a-service company.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Goldman Should Have Toughed It Out. It Takes Time To Engage A New Consumer Market. You Can’t Get The Type Of Visibility You Could Have Running After Only 3 Years. Where Was Their Plan For Engagement?? Did They Think The Partnership Was Just Set It And Forget It?

will be interesting to see who will take over from GS