Grifters keep on grifting, or the insane “comeback” of Bolt 🤯🤯; FinTech giant Adyen expands into India 💸🇮🇳; Mercado Libre unveils its own stablecoin - Meli Dollar 😳🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Startup Growth Toolkit: Top 5 Resources to Scale Your Business to New Heights 🚀 [unlock the secrets to startup success with these essential resources]

Top resources for building and scaling billion-dollar startups 🦄 [600+ pages of knowledge and advice to launch & scale your next unicorn in 2024]

PayPal and Adyen join forces for the first time to change the game in payments 🤝💳 [what it’s all about & why it’s huge + bonus deep dives both into Adyen & PayPal and an extra one into Shopify]

Bill.com's Q4 2024: a high-growth FinTech juggernaut with an expanding moat, but valuation remains a concern 🤔📈 [breaking down the key Q4 2024 numbers, strategic outlook & what’s next for BILL + a collection of bonus deep dives into FinTech stocks you can’t afford to ignore]

AI Agents in FinTech: from customer service to autonomous spending 🤖💳 [why it matters & what’s next]

Klarna’s strategic M&A to reshape the BNPL landscape in New Zealand 🤝🇳🇿 [what it’s all about & why it makes sense + a bonus dive into Klarna]

HSBC considers SA exit to focus on Asia 👋🇿🇦 [why it’s a logical move + a bonus deep dive into HSBC’s latest financials & LOTS of extra deep dives into other banking behemoths]

Starling Bank gears up for potential IPO 📈🔔 [what’s happening & why now + a bonus deep dive into Starling & their latest financials]

Mastercard to cut 1,000 employees 👀✂️ [why now, what’s next + a bonus deep dive into Mastercard & their latest financials]

Brazilian instant payment giant Pix makes European debut 🇧🇷🇪🇺 [what’s happening & why now + a bonus deep dive into Starling & their latest financials]

Klarna expands into banking 😳🏦 [what it’s all about & what it has to do with their upcoming IPO + a bonus read on Klarna]

BNPL adoption grows during major sales events but still lags overall usage 📈💸 [what it means & what can we expect next]

As for today, here are the 3 captivating FinTech stories that were transforming the world of financial technology as we know it. This was one of the most intense and thrilling weeks in the whole of 2024 so far, so make sure to check all the above stories.

Grifters keep on grifting, or the insane “comeback” of Bolt 🤯🤯

The BIG news 🗞️ Bolt, the once-celebrated (mainly by VCs) one-click checkout startup, is making waves in the FinTech world again with a series of unexpected moves.

Founder Ryan Breslow is set to return as CEO, barely two years after stepping down amid controversy. Crazily enough, the company is also reportedly seeking to raise a whopping $450 million at a staggering $14 billion valuation, a figure that's raising everyone’s eyebrows given Bolt's recent almost defunct performance.

But that’s just the tip of the iceberg, and all the devilish things lie in the details.

Let’s take a quick look at Bolt’s insane comeback so you can see why it doesn’t make any sense.

More on this 👉 First and foremost (once initially reported by The Information), this valuation represents a dramatic turnaround from earlier this year when Bolt offered a share buyback program valuing the company at just $300 million (-97% discount). This means that in less than a year, the valuation would go up by nearly 47x 😳

Let that sink in…

On top of that, the proposed fundraising structure is particularly contentious, requiring existing investors to double their stake to maintain their liquidation preference. Those who don't comply risk having their shares bought back for pennies. Makes sense, right? 🤷♂️

If that wouldn’t be enough, the funding round itself appears complex (to say the least), with less than half expected to be equity. A significant portion - $250 million - is slated to come as "marketing credits" from The London Fund, a UK investment firm nobody heard about. Additional investment is reportedly planned from UAE-based sources that also seem questionable, to say the least.

But assuming all of this is true, the cherry on top is still Bolt's financial situation. Which, to say it mildly remains precarious.

The company reportedly lost $100 million last year, though it still has $250 million in reserves. Its revenue for the first nine months of 2023 was a modest $19 million, contrasting sharply with its ambitious valuation.

Just to make it clear - the $14 billion valuation on these revenue figures is a revenue multiple of 560x 👀

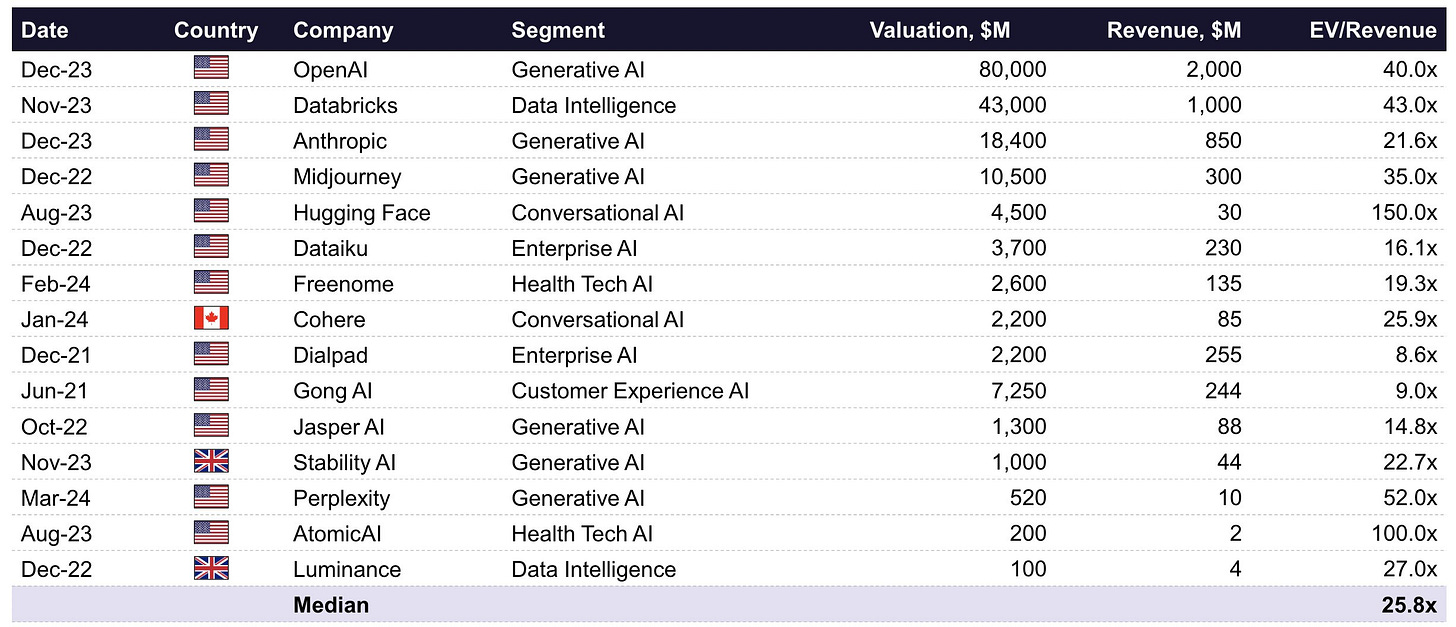

To put this into perspective, even private AI companies - the hottest field in tech right now - have a median revenue multiple of 25.8x.

Finally, adding to the intrigue, Breslow's return comes with substantial personal benefits, including a $2 million bonus, back pay, and a generous monthly travel budget of circa $80k.

The deal also involves Bolt investing in Breslow's other ventures, including an eco-friendly marketplace called Love, under remarkably favorable terms:

Bolt to invest $15B in Love at a $1T valuation if Love convinces 1M merchants to use Bolt’s “checkout everywhere” product and Bolt would invest $15M in The London Fund, a fund that invested in Love and Breslow is a director of 🫠

✈️ THE TAKEAWAY

What’s next? 🤔 This one is hard. Usually, astronomical valuation in the face of modest revenues and recent setbacks would signal a return to the exuberant valuations of the early 2020s, and we could say FinTech is Back! But this doesn’t feel like that at all. What it does look like is more like Breslow's poor attempt to seek attention and free PR (which I’m not gonna lie they received). More importantly, this is increasingly looking like Breslow trying to fleece investors again. On the other hand, what else can you expect from a proud member of Forbes 30 under 30… 🤷♂️

ICYMI: Peak ZIRP: how Bolt went from $11 billion valuation to being worth just $300 million 😳 [it’s the best illustration of peak ZIRP in FinTech + more reads & some valuable lessons from one other once famous one-click checkout startup]

FinTech giant Adyen expands into India 💸🇮🇳

The news 🗞️ Adyen, a leading global payments platform, has announced its expansion into India's rapidly growing digital payments sector.

This move follows authorization from the Reserve Bank of India for Adyen to operate as an Online Payment Aggregator for both domestic and cross-border transactions.

Let’s take a quick look at this and see why it matters.

More on this 👉 As part of the expansion Adyen will:

Establish a technology hub in Bengaluru (Bangalore)

Introduce local payment processing capabilities

Integrate with major card schemes and local payment methods

The new tech hub aims to leverage India's strong talent pool to develop and support payment products for both local and global markets. By bringing technical resources closer to merchants, Adyen seeks to enhance its ability to serve the unique needs of the Indian market.

Adyen's all-in-one payment platform will now offer local payment processing in India, allowing merchants to optimize transactions and streamline their payment operations. This integration includes support for major card schemes like Visa, Mastercard, and Rupay, as well as popular local payment methods such as UPI.

We can remember that just last week, another FinTech heavyweight Wise also announced their plans to double down on India 👀

ICYMI: Wise gears up to tap India's $32 billion remittance market 🇮🇳😤 [why it matters & makes sense + a bonus dive into Wise & why it’s worth your attention in 2024]

✈️ THE TAKEAWAY

What’s next? 🤔 It’s clear that India has been getting some attention as of late. This isn’t that surprising as for Adyen, this move provides access to one of the world's largest and fastest-growing digital payments markets. More importantly, success in India could substantially boost the company's transaction volume and revenue. Separately, the experience gained in navigating India's complex regulatory environment and diverse payment landscape could prove valuable for future expansions into other emerging markets. Looking at the big picture, Adyen's entry is likely to intensify competition among payment processors in India. This could effectively lead to increased innovation and potentially lower costs for merchants, ultimately benefiting consumers. Win-win for everyone 👏

ICYMI: PayPal and Adyen join forces for the first time to change the game in payments 🤝💳 [what it’s all about & why it’s huge + bonus deep dives both into Adyen & PayPal and an extra one into Shopify]

Mercado Libre unveils its own stablecoin - Meli Dollar 😳🪙

The news 🗞️ Latin American e-commerce giant Mercado Libre MELI 0.00%↑ has just launched a new US dollar-pegged stablecoin called Meli Dollar in Brazil through its financial arm, Mercado Pago.

This move is a significant step in the company's ongoing efforts to expand its cryptocurrency offerings and provide innovative financial solutions to its users.

Let’s take a quick look at this.

More on this 👉 The Meli Dollar stablecoin aims to offer Brazilians a stable financial instrument in the face of economic volatility. Users can purchase and sell Meli Dollars through the Mercado Pago app using their Brazilian real balances without incurring any transaction fees during the initial phase.

This fee-free structure is exactly what makes it an attractive option for those looking to protect their purchasing power from currency fluctuations. Well played! 👏

To ensure the stability and security of the Meli Dollar, Mercado Libre has partnered with Ripio, a leading cryptocurrency platform in Latin America. Ripio will act as the market maker and handle exchange operations for the stablecoin. The Meli Dollar is issued by Meli Uruguay SRL, a subsidiary of Mercado Libre, which guarantees its constant value and link to the US dollar.

This launch is part of Mercado Libre's broader strategy to integrate cryptocurrency solutions into its ecosystem. The company has previously introduced Mercado Coin, a cryptocurrency used for purchases and cashback on its platform, and has integrated Bitcoin, Ether, and the Pax Dollar (USDP) stablecoin for payments in Brazil.

✈️ THE TAKEAWAY

What’s next? 🤔 This is a very positive and solid development development for both Mercado Libre and the broader FinTech and Finance space in Latin America. First and foremost, by providing a stable, accessible digital currency, Mercado Libre may help bring more Brazilians into the formal financial system, especially those who have been underserved by traditional banks. On top of that, the Meli Dollar could serve as a gateway for many users to enter the world of cryptocurrencies, potentially accelerating the adoption of digital assets in Brazil and beyond. Lastly, the stablecoin could facilitate smoother transactions within Mercado Libre's platform, potentially increasing user engagement and transaction volumes. Win-win! Looking ahead, we may see Mercado Libre expand the Meli Dollar to other countries in Latin America where it operates so it could both increase usage and adoption. I also wouldn’t be surprised if the FinTech giant also develops additional financial products built around the stablecoin, such as savings accounts or lending services thus challenging traditional financial incumbents. Fascinating times for MELI 0.00%↑ 🚀

ICYMI: Latin America's e-commerce giant MercadoLibre is uniquely poised for continued dominance 😤🚀 [breaking down their key numbers, understanding what they mean so you can see why you just can’t ignore this FinTech giant in 2024]

🔎 What else I’m watching

BBVA Doubles AI Staff, Opens New AI Factories 🤖 BBVA has doubled its AI staff to over 400 by opening new AI Factories in Mexico and Turkey, joining an existing center in Spain. The bank hired 230 new professionals, including data scientists and machine learning engineers, as part of a global technology talent recruitment strategy. BBVA plans to add 2,700 more tech hires in 2024, with 1,225 in Spain. The AI Factories are working on projects like conversational virtual assistants and 'copilot' tools to enhance user experience and efficiency. This expansion follows BBVA's alliance with OpenAI to deploy ChatGPT Enterprise licenses for increased productivity. ICYMI: AI Agents in FinTech: from customer service to autonomous spending 🤖💳 [from CS to autonomous spending - why it matters & what’s next]

Molten Ventures Benefits from Revolut's $45B Valuation 💰 Fintech VC Molten Ventures has seen its initial £7M stake in Revolut surge to £160M following a recent share sale that valued the SuperApp at $45 billion. Despite a previous 40% write-down amid market concerns, Revolut's strong performance, including a $545M pre-tax profit in 2023 and securing a UK banking license, has reversed the trend. Molten's chief executive, Martin Davis, highlighted the significant upside for investors and the prudent approach to managing the firm's net asset value (NAV). ICYMI: OFFICIAL: Revolut soars to $45 billion valuation, making it the most valuable startup in Europe 😳🚀 [what happened, why it matters & what’s next + tons of bonus deep dives inside]

Adyen and InvoiceASAP Partner for Instant Deposits 💸 Adyen and InvoiceASAP have launched a partnership focused on instant payments for small businesses. The collaboration provides users with immediate access to deposited funds using Adyen's Adyen for Platforms solution. InvoiceASAP CEO Paul Hoeper highlighted the partnership's ability to offer the fastest velocity of bank deposits for over 23,000 merchants. Adyen, certified by the Federal Reserve to use the FedNow Service, helps companies move money faster and more efficiently. The FedNow Service, while showing modest volumes, is expected to become a routine part of everyday commerce in the long run. ICYMI: PayPal and Adyen join forces for the first time to change the game in payments 🤝💳 [what it’s all about & why it’s huge + bonus deep dives both into Adyen & PayPal and an extra one into Shopify]

💸 Following the Money

Pakistan-based FinTech PostEx has secured $7.3M in pre-Series A funding to facilitate its expansion in the GCC.

MUFG Bank is investing another $333M in Indian digital lender DMI Finance at a valuation of around $3B.

Holonym Foundation, the developer of the privacy-preserving identity protocolZeronym, has secured $5.5M in seed funding led by Finality Capital and Paper Ventures, with backing from Draper Dragon and Arrington Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Great read as always! Thank you.

Every time I read about another USD linked stable coin, it always comes back to transparent auditing- has the "guatantor" actually got real USD backing the stable coin?

Cos if not, the "guarantee" isn't worth the "digital " paper its written on

Can't remember the name but the last collapse of a "stable coin" was because it WASN'T backed by real dollars but an algorithm

And "surprise surprise" when the algorithm read the market wrong, lo and behold, the coins backing suddenly went south. As did the coin and the coin holders assets