Robinhood is targeting UK's active traders 🖥️📈; BIG US banks to challenge crypto giants in $246B stables market 🪙🏦; Block transforms Square into Bitcoin payment gateway 😳🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate Beginners Guide to AI 📚🤖 [5,500+ pages of knowledge to transform your understanding from beginner to AI authority]

The Ultimate List of Stablecoin Use Cases 🪙 [discover how stablecoins are quietly revolutionizing finance, business, and daily life across industries]

Starling's Engine roars, but will it be enough? 🤔🏦 [diving deep into Starling’s 2025 annual report, breaking down the most important numbers, what they mean & what’s next + bonus deep dives into its biggest competitors Monzo & Revolut]

Google’s AI might eliminate traditional online checkout 😳🛍️ [what this paradigm shift means for both FinTech & e-commerce firms alike + more bonus reads on agentic commerce, resources on AI agents, the Ultimate Beginners Guide to AI & more!]

Stablecoin giant Circle launches its $5.65 billion IPO 🔔📈 [what it’s all about & why it matters + a bonus deep dive into Circle, its financials, etc. & the ultimate list of 110+ real-world stablecoin use cases]

PayPal secures strategic regulatory victory in India ✅🇮🇳 [what it means & why it matters for the future of PayPal + bonus deep dive into this payment behemoth]

AI-powered lending platform Pagaya enters BNPL market with $300M bond issuance 🤖🛍️ [what it’s all about & why it matters for Klarna + bonus deep dive into Klarna’s S-1]

Global Payments streamlines operations with $1.1B Heartland Payroll sale to Acrisure 😳💸 [what it’s all about & why it matters + bonus reads on Global Payments & some priceless M&A resources]

Unlock Explosive Growth: The Ultimate LTV/CAC Calculation Template 📈 [master the art of profitable customer acquisition with this incredible financial tool]

The Ultimate List of Resources about AI Agents 🤖 [unlock the power of AI Agents: your gateway to the future of autonomous agentic systems]

The Ultimate List of Top Seed Investors of 2025 💸🚀 [discover the top 100 people shaping the future of startups - and how to get their attention]

As for today, here are the 3 fascinating FinTech stories that are transforming the world of financial technology as we know it. This was yet another huge week in the financial technology space, so make sure to check all the above stories.

Robinhood targets UK's active traders with advanced desktop platform launch 🖥️📈

The news 🗞️ US-based FinTech giant Robinhood HOOD 0.00%↑ has officially launched its sophisticated desktop trading platform, Robinhood Legend, in the United Kingdom, further solidifying the expansion of the company's international presence and its commitment to serving active retail investors.

Let’s take a look at this.

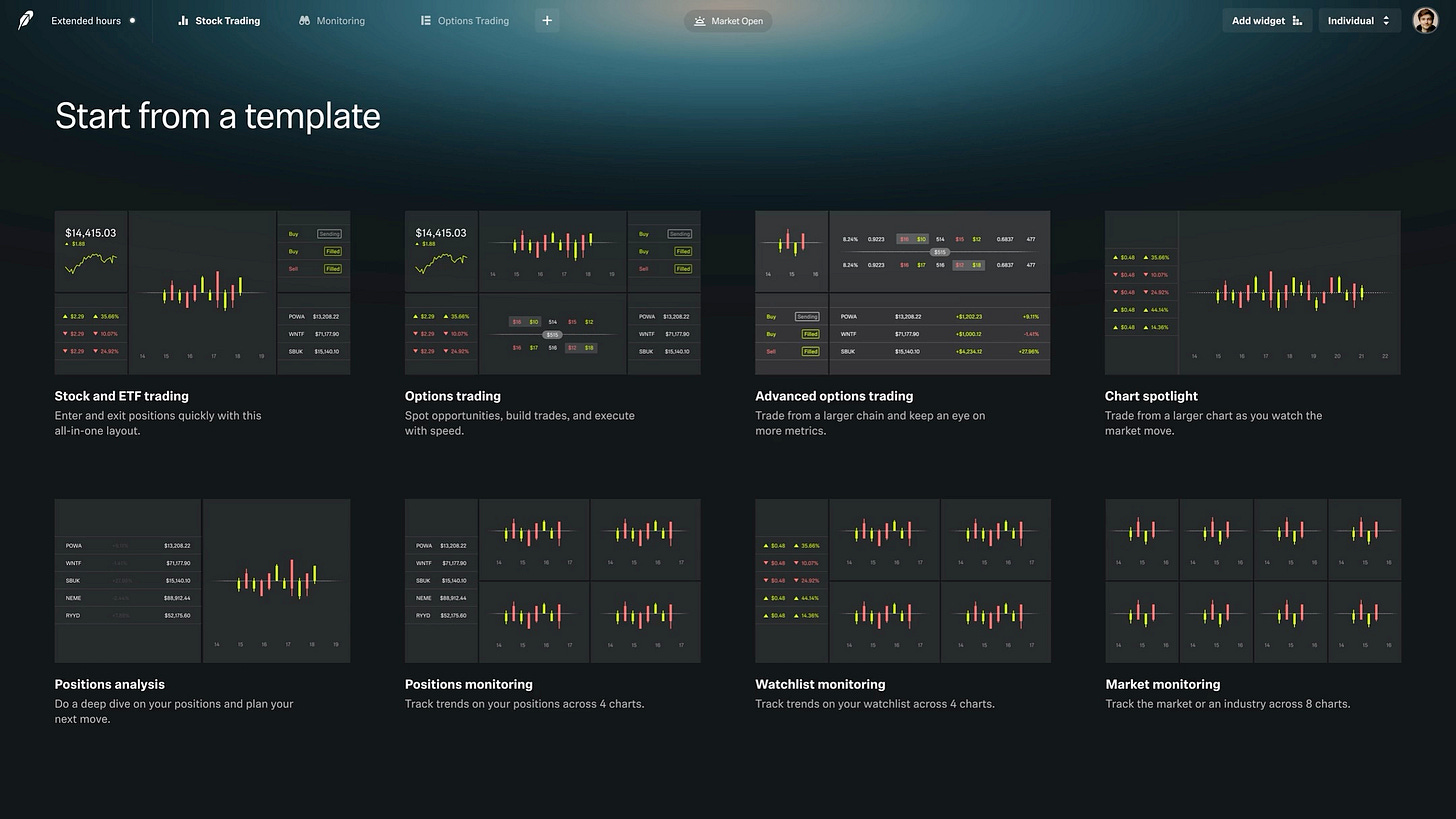

More on this 👉 The browser-based desktop platform represents Robinhood's strategic response to market research revealing substantial dissatisfaction among UK desktop traders. According to the company's data, only 1/3 of desktop traders in the UK are content with their existing trading platforms, citing a lack of customisation and complex navigation as primary pain points. This insight drove Robinhood's decision to introduce Legend to the UK market, following its successful October 2024 launch in the United States.

Robinhood Legend offers UK investors a comprehensive suite of advanced trading tools at no additional cost for existing account holders. The platform enables users to create customised trading environments, access real-time data with sub-second updates, and utilise sophisticated charting capabilities, including ten chart types and over 80 technical indicators such as moving averages, Bollinger Bands, and Ichimoku Cloud.

Multi-chart functionality allows traders to monitor up to eight charts simultaneously within a single window, addressing the screen real estate advantages that desktop platforms provide over mobile applications.

The launch comes as Robinhood continues expanding its UK operations, having accumulated over 150,000 customers across the UK and European Union since entering the British market in March 2024. The company has progressively enhanced its UK offerings, introducing options trading, margin trading, and plans for a fee-free stocks and shares ISA product specifically tailored to the British market.

✈️ THE TAKEAWAY

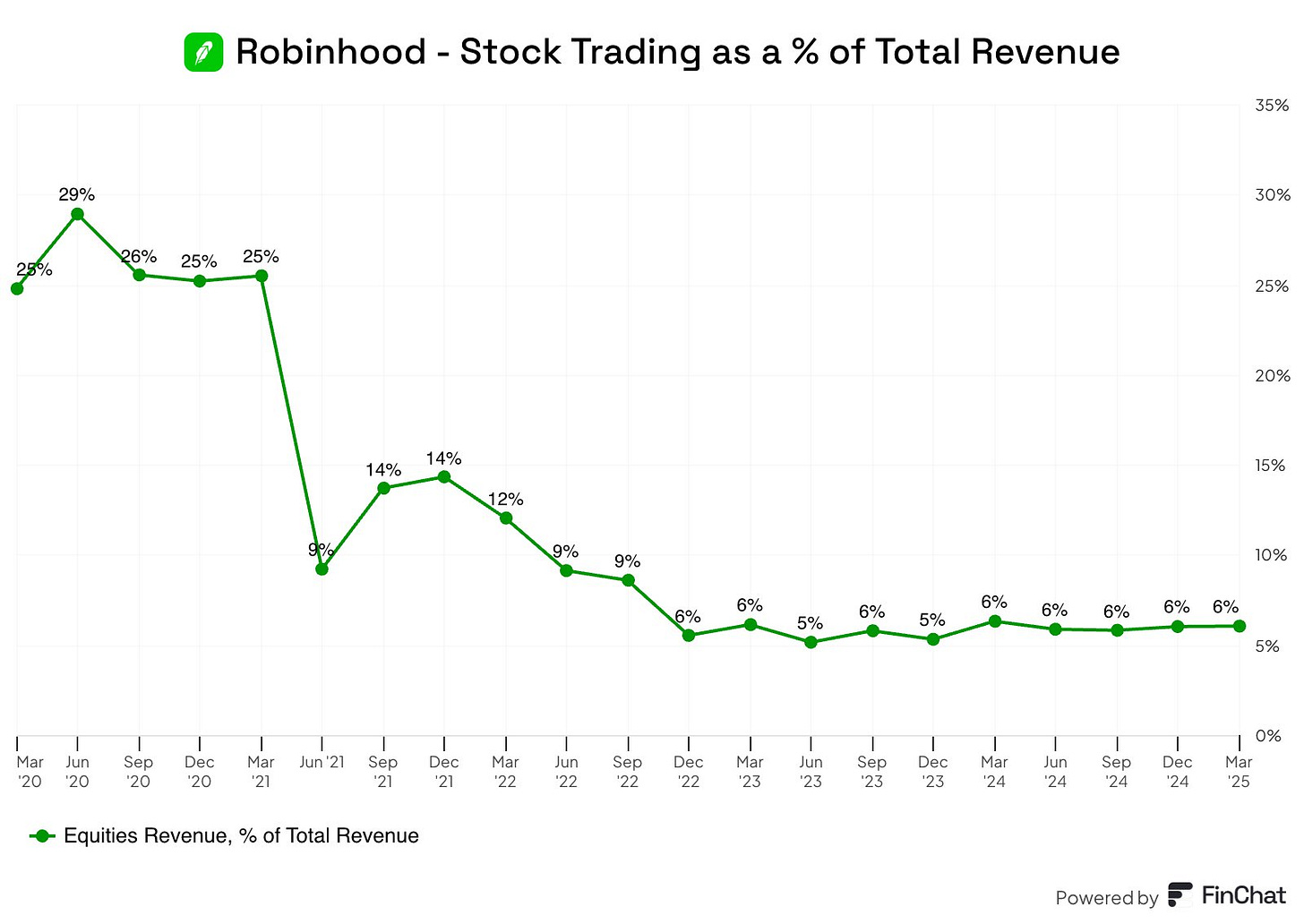

What’s next? 🤔 At the core, this expansion reflects the evolving perception of retail trading from a recreational activity to a legitimate career path and wealth-building strategy, particularly as traditional savings accounts offer minimal returns in the current interest rate environment. For Robinhood specifically, this UK expansion represents a crucial component of the company's diversification strategy, which includes recent ventures into wealth management and private banking services launched in March 2025. By broadening its service portfolio and geographic reach, Robinhood thus aims to reduce its dependence on the inherently cyclical nature of trading revenues, creating more stable income streams across varied market conditions. And it has been doing this quite well, to be honest:

Looking ahead, Robinhood's success in the UK market could serve as a blueprint for further European expansion, potentially disrupting established players across multiple markets (remember: they recently got a brokerage licence out of Lithuania). Also, the broader trend toward retail trading professionalisation suggests that financial services providers will need to develop increasingly sophisticated tools while maintaining accessibility for newer investors. This balance between complexity and usability will likely define the next phase of FinTech evolution. Revolut, you next? 👀

ICYMI: The Renaissance Platform: Robinhood's transformation from meme stock enabler to financial services powerhouse 😤📱[unpacking the most important numbers, what they mean, see how the FinTech giant transformed from meme stock enabler to financial services powerhouse & what’s next for Robinhood]

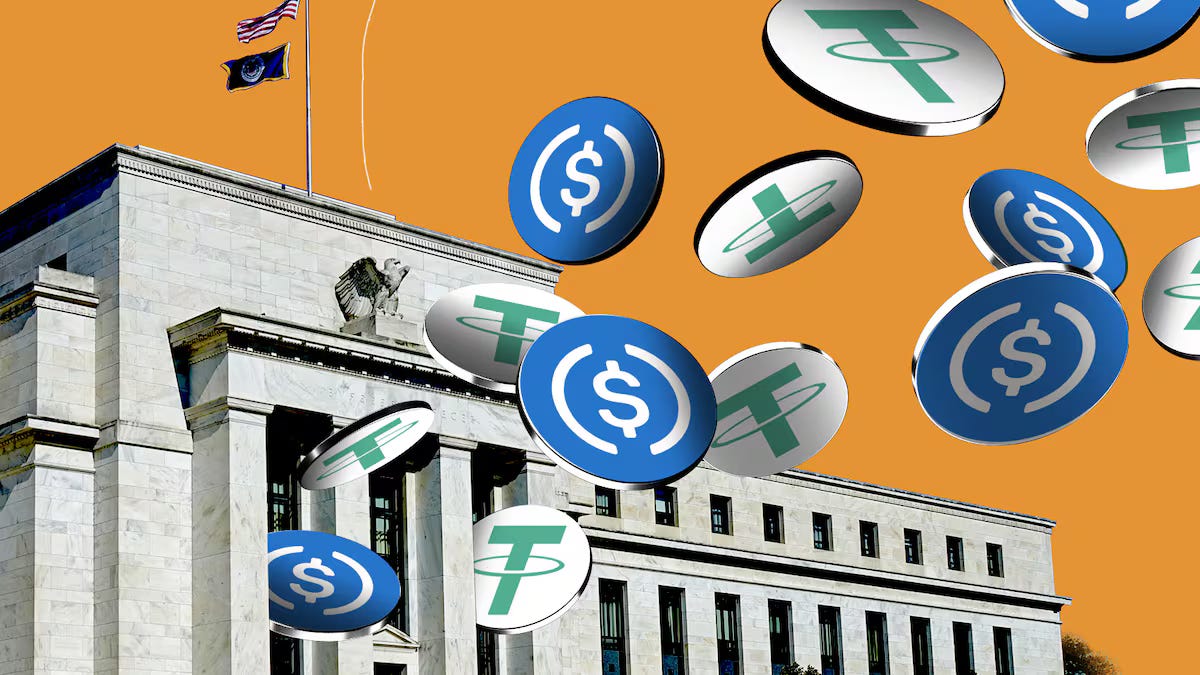

Major US banks unite to challenge crypto giants in $246B stablecoin market 🪙🏦

The news 🗞️ America's largest financial institutions are preparing to enter the digital currency arena through a collaborative approach that could reshape the stablecoin landscape.

According to recent reports, JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo are all engaging in preliminary discussions about jointly issuing a stablecoin through their co-owned payment infrastructure companies, including Early Warning Services and the Clearing House.

Let’s take a closer look at this, understand why it matters, and what’s next.

More on this 👉 First and foremost, we must note that this strategic initiative represents a significant shift for traditional banking, which has largely remained on the sidelines during the explosive growth of digital currencies. The banking consortium's discussions are driven by mounting concerns that existing stablecoin providers could increasingly capture deposit flows and transaction volumes that have traditionally belonged to regulated financial institutions.

The current stablecoin market, valued at approximately $246 billion, still remains dominated by two primary players. Tether maintains the largest market share at over 60% despite ongoing scrutiny regarding reserve transparency, while Circle has positioned its USDC token as a more compliant alternative with regular third-party attestations and closer regulatory engagement.

ICYMI:

Zoom out 🔎 The timing of these banking discussions well coincides with favorable regulatory developments. The Senate recently advanced the GENIUS Act, bipartisan legislation that would establish a comprehensive framework for stablecoin regulation. This potential regulatory clarity thus provides the foundation banks need to confidently enter the digital currency space while maintaining compliance with existing financial regulations.

Banks view stablecoins as particularly valuable for accelerating cross-border payments and international settlements, which currently face multi-day processing times through traditional banking networks. The consortium approach therefore offers several strategic advantages, including shared development costs, distributed regulatory risks, and the collective reputation necessary to build consumer and institutional trust in a bank-issued digital currency.

Additionally, this collaborative model provides crucial protection against reputational risks associated with potential criminal usage of digital currencies. By working together, individual banks can shield themselves from the full brunt of any negative associations while still participating in this growing market segment.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, the entrance of major US banks into the stablecoin market signals yet another fundamental convergence between traditional finance and digital currencies. Here’s what everyone in the financial technology space should be thinking about:

The banking consortium's potential success could trigger a wave of institutional adoption, as corporate treasurers and institutional investors gain access to stablecoins backed by the full regulatory compliance and reserve management capabilities of major financial institutions.

This institutional-grade infrastructure could thus significantly expand stablecoin usage beyond crypto trading into mainstream commercial payments, treasury management, and international trade finance.

Current market leaders Tether and Circle could face an unprecedented competitive challenge. While these crypto-native companies maintain advantages in blockchain expertise and established market relationships, bank-issued stablecoins would likely offer superior regulatory compliance, transparent reserve management, and integration with existing banking infrastructure that could prove attractive to institutional users seeking lower regulatory risk.

The regulatory landscape will likely evolve rapidly as banks enter this space. The GENIUS Act represents just the beginning of comprehensive digital currency regulation, and bank participation will accelerate the development of robust compliance frameworks, reserve requirements, and consumer protection measures that could become the global standard for stablecoin operations.

Looking ahead, successful bank-issued stablecoins could serve as a good foundation for broader central bank digital currency initiatives, providing valuable operational experience and technological infrastructure that regulators can evaluate as they consider sovereign digital currencies (note: I’m not saying these are needed and/or make sense). Regardless of how this goes, it’s clear that we’re now witnessing a new era of hybrid financial services that combines the stability of traditional banking with the efficiency of blockchain technology.

ICYMI:

JPMorgan's fortress capital and diversification excellence position it for outperformance amid mounting economic uncertainty 😤🏦 [deep dive into JPMorgan’s latest Q1 2025 financials, breaking down what they mean & what’s next + bonus reads on how JPM is leading in all things AI & more resources inside]

Citi's transformation bearing fruit: strong Q1 performance signals turnaround progress despite global uncertainty 📈🏦 [deep dive into their Q1 2025 financials unpacking the most important numbers, what they mean & what’s next for Citi + bonus deep dives into JPMorgan, Bank of America & co]

Bank of America Delivers robust Q1 2025 growth amid economic uncertainty 📈🏦 [unpacking the most important numbers, what they mean & what’s next for BoA + bonus deep dive into JPMorgan & their latest financials]

Block transforms Square into Bitcoin payment gateway 😳🪙

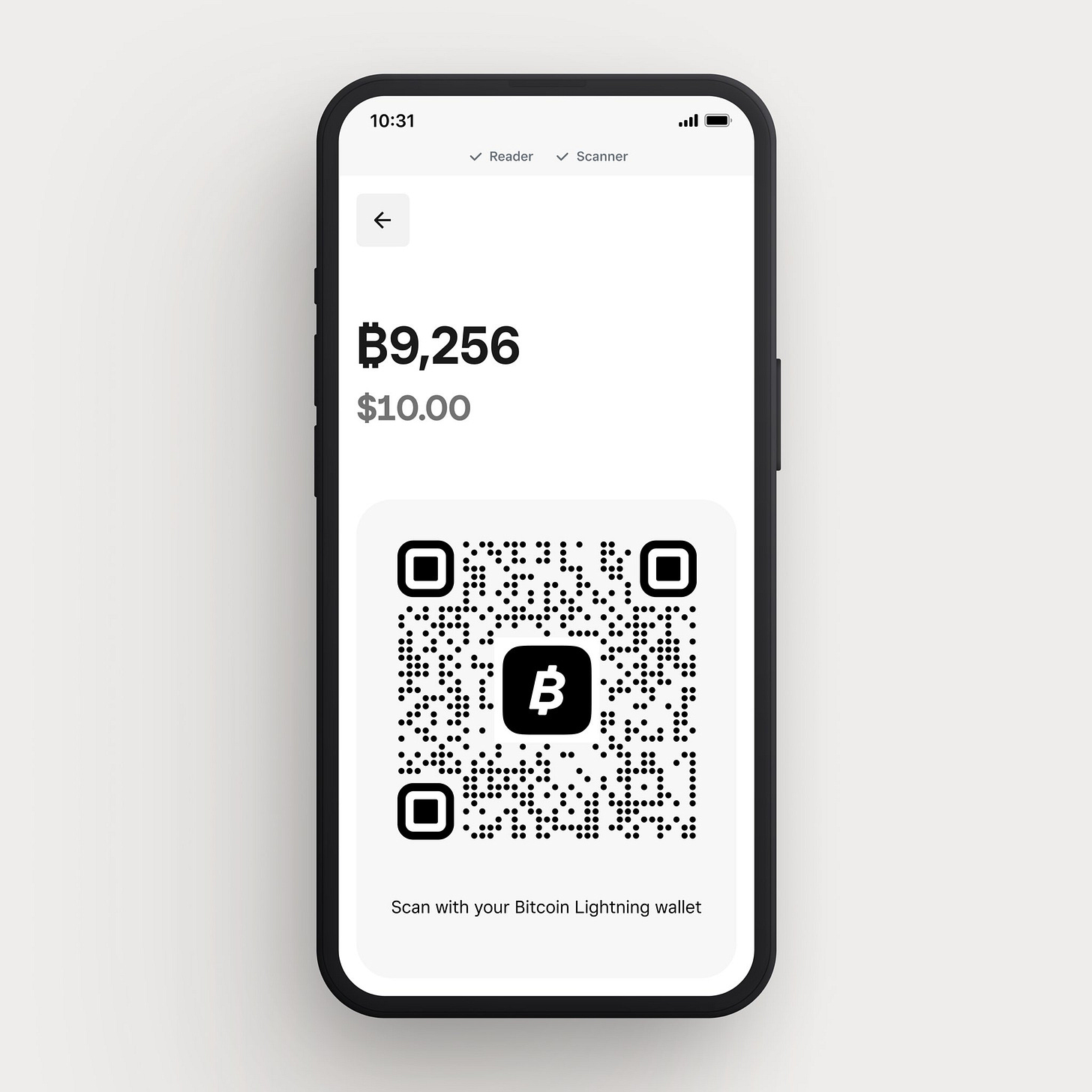

The news 🗞️ Jack Dorsey's Block XYZ 0.00%↑ has just announced a comprehensive Bitcoin payment integration for its Square platform, representing one of the most significant moves to mainstream cryptocurrency adoption in point-of-sale commerce.

The payments giant demonstrated live Bitcoin transactions at the Bitcoin 2025 conference in Las Vegas, where attendees successfully purchased merchandise using the Lightning Network through Square terminals.

Let’s take a quick look at this, see why it matters, and what’s next.

More on this 👉 The integration allows merchants to accept Bitcoin payments through existing Square hardware, with customers simply scanning QR codes to complete transactions. Block has engineered the system to handle technical complexities behind the scenes, including real-time exchange rate calculations and transaction confirmations through the Lightning Network, Bitcoin's faster and more cost-effective layer-2 scaling solution.

Merchants retain full control over their Bitcoin exposure, with options to immediately convert payments to traditional currency or hold the cryptocurrency. This flexibility builds upon Block's existing Bitcoin Conversions feature, which has already enabled over 1,000 merchants to automatically convert portions of daily sales into Bitcoin.

The rollout strategy targets small and medium-sized businesses, with initial deployment scheduled for the second half of 2025 and full availability expected by 2026, pending regulatory approvals. This approach aligns with Block's broader mission to democratize financial services for smaller merchants who traditionally lack access to sophisticated payment technologies.

Zoom out 🔎 Market response has been notably positive, with Block's shares surging 5.3% upon the announcement. The broader financial sector experienced sympathetic gains, including 1.7% increases in both the NYSE Financial Index and Financial Select Sector SPDR Fund, suggesting investor confidence in cryptocurrency's expanding role within traditional finance.

✈️ THE TAKEAWAY

What’s next? 🤔 This initiative positions Block as the first major payment processor to offer comprehensive Bitcoin acceptance at scale, potentially creating significant competitive advantages in merchant acquisition and retention. That said, the strategic implications extend way beyond immediate revenue opportunities. By integrating Bitcoin payments with its existing ecosystem of financial products, including Cash App, Bitkey wallet, and Spiral development initiatives, Block is constructing a comprehensive Bitcoin infrastructure that could become increasingly valuable as cryptocurrency adoption accelerates. This integrated approach thus creates multiple touchpoints for customer engagement and potential revenue streams. Zooming out, Block's move likely signals the beginning of a new competitive dynamic. Traditional payment processors may face pressure to develop similar capabilities or risk losing market share to more cryptocurrency-forward competitors. The success of Block's implementation could thus accelerate industry-wide adoption timelines and influence regulatory frameworks governing digital currency commerce. Looking ahead, the success of this integration will likely influence Block's broader corporate strategy and could catalyze similar initiatives across the FinTech industry. More importantly, the company's comprehensive approach to Bitcoin infrastructure positions it to capitalize on potential regulatory clarity and mainstream adoption trends, while its demonstrated commitment to cryptocurrency innovation may attract both merchants and investors seeking exposure to digital asset growth opportunities. Bullish.

ICYMI: Block's Inflection Point: margin strength vs. growth concerns in a critical transition year 📉📈 [deep dive into their Q1 2025 financials, uncovering the most important numbers, what they mean, and what’s next for Block + bonus deep dive into Robinhood & its latest financials]

🔎 What else I’m watching

SEB Joins AI Factory Consortium 🤖 SEB has partnered with AstraZeneca, Ericsson, Saab, and Wallenberg Investments to build an AI supercomputer in Sweden, leveraging NVIDIA’s technology. This initiative aims to accelerate AI development and adoption across Swedish industries. The AI factory will handle compute-heavy workloads, enhancing processes like AI model training and large-scale inference. ICYMI:

Griffin Develops Agentic Banking Platform 🤖 Griffin, a UK Banking-as-a-Service provider, is pioneering an agentic banking platform using a Model Context Protocol (MCP) server. This technology allows AI agents to autonomously perform financial tasks for customers, such as wealth management and payments. Griffin, which obtained a full banking license in 2023, aims to rewire the financial system to accommodate AI transactions while maintaining safeguards. Currently in beta, the platform enables AI agents to open accounts, make payments, and analyze transactions. Griffin invites customer input to transition the platform from a sandbox to a production environment, highlighting the potential for AI-driven financial services. ICYMI:

FCA Integrates Stablecoins into New Crypto Regime 💷 The UK's Financial Conduct Authority (FCA) has proposed new regulations to ensure financial resilience and stability in the cryptoasset sector, with a focus on stablecoins. The FCA aims to leverage stablecoins' potential to enhance payment and settlement efficiency, particularly for cross-border transactions. Key proposals include maintaining stablecoin value and providing clear information on backing assets. ICYMI:

💸 Following the Money

Foreign exchange infrastructure company OpenFX has emerged from stealth with $23M in funding led by Accel.

Stockholm-based Treyd, which provides flexible financing solutions to trading companies, raised €5M in funding.

British startup Velocity has raised $10M in a pre-seed funding round led by Activant Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is a pure gem. Cannot believe you're doing this for free - thank you!