Revolut’s financial engineering masterclass, and why every FinTech should be taking notes 💸🏦; Klarna expands debit-first card to Europe 💳🇪🇺; Wise explores a UK banking license 🇬🇧🏦

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who's backing them, unlock their exclusive pitch decks, and learn from the best]

The Ultimate Financial Plan for SaaS & AI Startups 🤖🚀 [In 2025, every company is a SaaS company, and every SaaS company is becoming an AI company]

Klarna's IPO filing 2.0: an incredible FinTech transformation story at the intersection of growth and profitability 📈💸 [deep dive into Klarna’s 451-page F-1 filing, uncovering the key financial facts and figures, understanding why they matter, and why you should be bullish on one of the most significant FinTech public debuts in recent years + a bonus deep dive into Klarna’s biggest competitor Affirm]

Stripe's killing SWIFT? Their new L1 blockchain Tempo unites OpenAI, Visa, Shopify, and Deutsche Bank to make stablecoins the default global payment rail 😳⛓ [key details we know so far, why it matters, could it kill SWIFT + the ultimate list of stables resources, deep dive into Circle’s latest earnings & more inside!]

Affirm's remarkable transformation: from growth story to profitable FinTech powerhouse 🤑📈 [deep dive into their latest Q4 2025 earnings, unpacking the most important facts & figures, what they mean & why you should be bullish on AFRM 0.00%↑ + bonus deep dive into their biggest competitor Klarna]

Revolut hits $75 billion valuation 🤯🏦 [what it’s all about, why it matters & what’s next + bonus dives into Revolut, Nubank and Coinbase inside]

Trump family's crypto venture faces market reality 🤷♂️📉 [what happened here and what does this mean for the future of FinTech]

The AI Code has been cracked: welcome to new, AI-first reality 🤖 [AI's experimental phase just ended. This new report reveals the hard data behind a new economic reality, and why most are already playing catch-up]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Revolut’s financial engineering masterclass, and why every FinTech should be taking notes 💸🏦

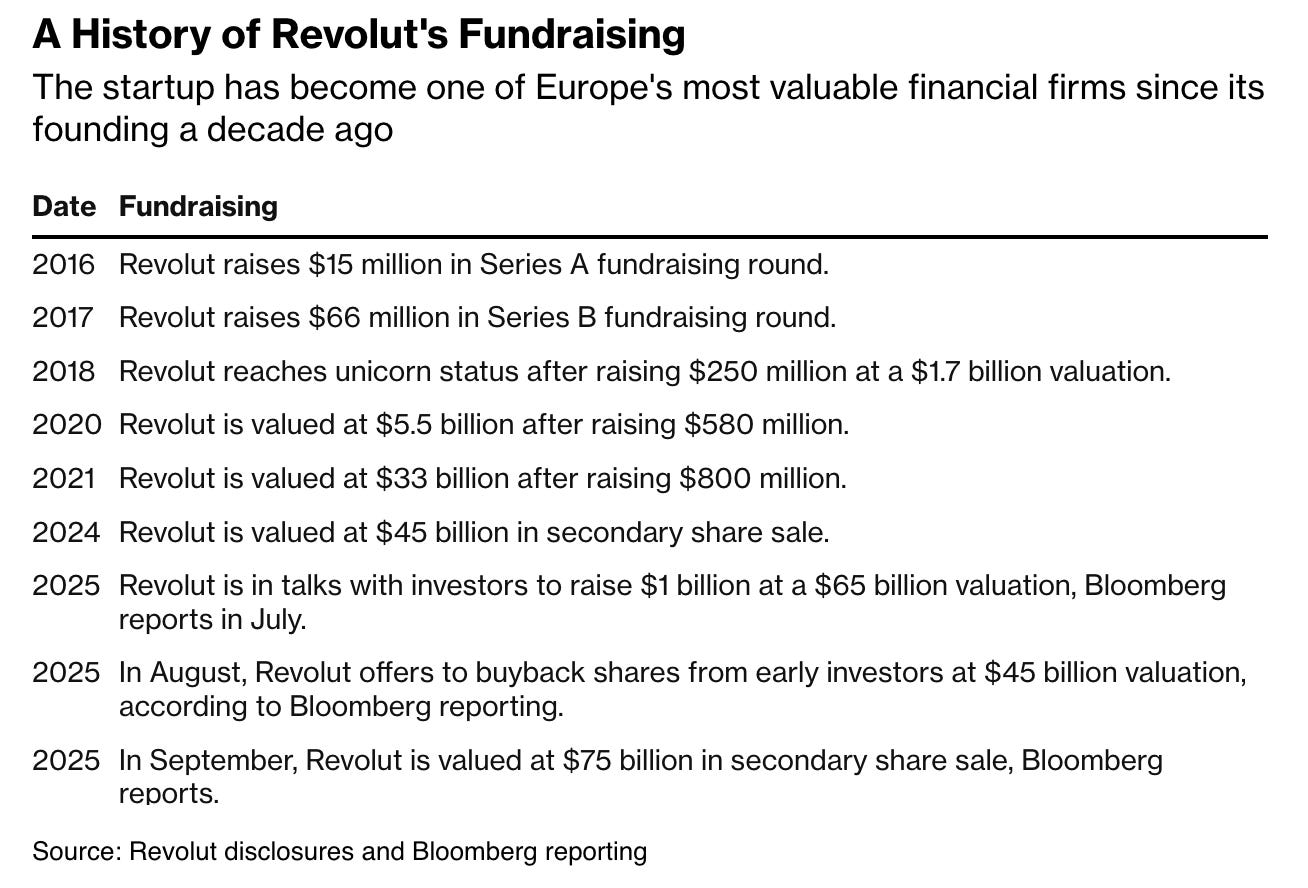

The news 🗞️ FinTech giant Revolut has orchestrated a sophisticated financial maneuver that demonstrates how late-stage technology companies can maintain private status while satisfying diverse stakeholder needs.

The London-based FinTech heavyweight is simultaneously executing two transactions at dramatically different valuations: a share buyback program at $45 billion, allowing early investors to exit, and an employee secondary sale valued at $75 billion, providing staff liquidity at a premium price point.

Let’s take a quick look at this.

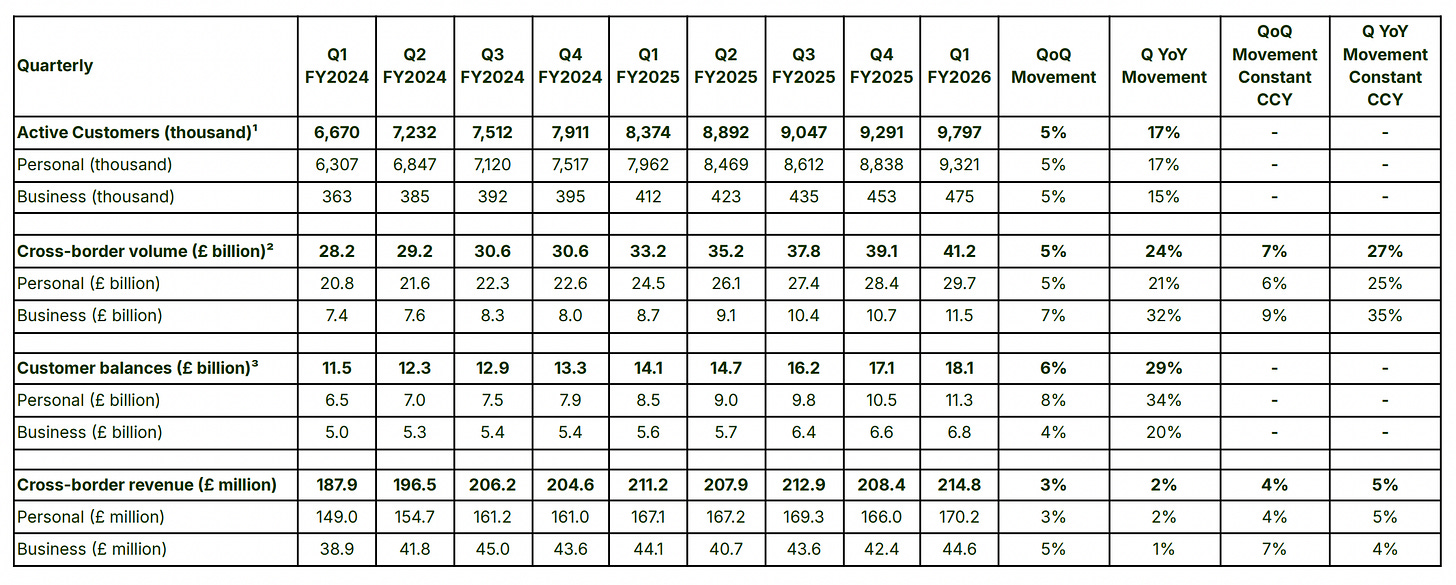

More on this 👉 This strategic approach serves multiple objectives. The company, which now serves over 60 million customers globally and generated $4 billion in revenue with 72% year-over-year growth, can selectively manage its shareholder composition while rewarding employees without diluting founder control.

CEO Nikolay Storonsky, whose net worth has nearly doubled to $14 billion through these transactions, maintains significant voting power while the company pursues aggressive expansion plans, including potential acquisitions in the United States market.

The dual-valuation structure hence represents sophisticated financial engineering that provides liquidity comparable to public markets without the regulatory burden and quarterly scrutiny of an initial public offering.

By offering different prices to different stakeholder groups, Revolut perfectly demonstrates that valuation has become less about singular market consensus and more about strategic allocation of ownership and rewards.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, this approach signals a fundamental shift in how mature technology companies view public markets. As Revolut, Stripe, and OpenAI demonstrate, remaining private no longer constrains growth or liquidity. This means that the investment banks may need to reimagine IPO advisory services, while public market investors could face reduced access to high-growth technology companies during their most dynamic phases. Sure, the sustainability of this model depends on continued private capital availability and regulatory tolerance. Yet, as companies accumulate thousands of shareholders through secondary transactions, pressure may mount for enhanced disclosure and governance standards that blur the distinction between public and private markets. Looking ahead, Revolut's next moves will likely focus on leveraging its controlled shareholder base to execute ambitious expansion plans, particularly in the United States, where acquiring an existing banking license could accelerate market penetration. The success here could therefore establish a new template for how global financial technology companies scale without surrendering strategic flexibility to public market demands. Well played Revolut, well played 👏

ICYMI: Revolut hits $75 billion valuation 🤯🏦 [what it’s all about, why it matters & what’s next + bonus dives into Revolut, Nubank and Coinbase inside]

Klarna expands debit-first card to Europe 💳🇪🇺

The news 🗞️ Swedish FinTech giant Klarna has just announced the expansion of its debit-first card across the European Union, marking another step in its evolution from a Buy Now, Pay Later (BNPL) specialist to a comprehensive digital banking provider.

The move follows a successful United States launch that attracted 685,000 customers since July 2025.

Let’s take a look at this.

More on this 👉 The Klarna Card, supported by Visa Flexible Credential technology, operates as a debit card by default while offering consumers the flexibility to switch between payment methods within the Klarna application. Users can choose immediate payment with their own funds, split purchases into three installments, defer payment, or access longer-term financing for larger purchases, subject to approval. The card functions at over 150 million Visa merchant locations worldwide, both online and in-store.

The European rollout initially targets ten markets, including France, Spain, Italy, Sweden, Austria, Belgium, Finland, Ireland, the Netherlands, and Portugal. Klarna plans subsequent expansion into Denmark, Germany, Norway, Poland, and the United Kingdom.

This strategic expansion coincides with the company's renewed pursuit of an initial public offering in New York, targeting a valuation between $12.5 billion and $14 billion (deep dive on this - at the end).

Card-based products currently represent 10% of Klarna's global payment volume, reflecting the company's successful diversification beyond its traditional BNPL offerings.

✈️ THE TAKEAWAY

What’s next? 🤔 At the core, Klarna's debit-first card launch represents a calculated disruption of traditional banking models and signals intensifying competition in the European payments landscape. The company's hybrid approach - combining immediate payment functionality with flexible credit options - positions it to capture market share from both conventional banks and emerging fintech competitors. Additionally, the timing appears strategic now, coinciding with heightened consumer demand for financial flexibility amid economic uncertainty. Looking at the bigger picture, the upcoming IPO will provide Klarna with significant capital to fuel further expansion and product development. Success in Europe could thus accelerate the company's banking license applications in various jurisdictions and enable it to offer additional financial services such as savings accounts and personal loans. Furthermore, the integration of artificial intelligence and machine learning capabilities could enhance credit decisioning and risk management, allowing Klarna to serve a broader customer base while maintaining prudent lending standards.

ICYMI:

Wise explores a UK banking license 🇬🇧🏦

The news 🗞️ International money transfer company Wise is considering applying for a UK banking license, marking an interesting (yet logical) evolution for the FinTech that recently moved its primary stock listing from London to New York.

According to reports, the company has initiated early-stage discussions with financial services executives over the past two months regarding roles needed to establish banking operations in the UK, though no formal regulatory application has been submitted.

Let’s take a look at this and see why it’s actually a brilliant move.

More on this 👉 The potential move represents a strategic expansion beyond Wise's core payments business. Currently operating under an electronic money institution license, Wise already holds direct access to UK payment infrastructure as an RTGS clearing member of the CHAPS high-value payment network.

A full banking license would enable the company to offer interest directly on customer deposits, expand into lending products, and reduce its dependence on third-party banking relationships.

This UK initiative parallels Wise's June 2025 application for non-depository trust bank status in the United States, demonstrating a coordinated global strategy to deepen its financial services capabilities.

The company, which reported pre-tax profits of £565 million in 2025 and serves 15.4 million customers worldwide, has seen customer balances grow 29% YoY, suggesting increasing consumer trust in FinTech platforms for holding funds. And the banking licence would only strengthen this trust further.

Zoom out 🔎 The move is both a diversification strategy and a vote of confidence in UK financial regulation, despite Wise's earlier decision to shift its primary listing to New York for greater liquidity.

On top of that, the development also reflects broader industry trends as the distinction between traditional banks and FinTech companies continues to blur.

Competitors like Revolut are pursuing similar banking licenses, while others, such as Tide, have opted for partnership models with established banks to expand their product offerings.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, Wise's banking license pursuit signals a fundamental shift in how global payment infrastructure companies position themselves for the future. The FinTech champion appears to be building toward becoming a comprehensive financial services provider that combines the efficiency of modern payment rails with traditional banking capabilities. This infrastructure-first approach could enable Wise to capture higher-margin revenue streams through lending and deposit products while maintaining its competitive advantage in low-cost international transfers. And that’s a solid moat to have. More importantly, the timing suggests Wise is also positioning itself for emerging opportunities in digital finance, particularly as regulatory frameworks for stablecoins and tokenized assets mature in the UK and globally. Direct banking capabilities would allow Wise to serve as a critical bridge between traditional fiat systems and emerging digital payment networks, potentially becoming a key infrastructure provider as cross-border payments increasingly incorporate blockchain-based solutions (hint: see what JPM is doing). Looking at the bigger picture, Wise's evolution yet again shows how successful FinTech companies are transitioning from single-product disruptors to full-service competitors to traditional banks. This convergence will likely only accelerate competitive pressure on incumbent financial institutions while driving innovation in product offerings and customer experience. We should therefore expect to see increased M&A activity as traditional banks seek FinTech capabilities while FinTechs pursue banking licenses or partnerships to expand their service portfolios. Bullish.

ICYMI:

🔎 What else I’m watching

0TO9’s moonshot: 1,000 fintechs by 2045 🚀 Pan-European venture builder 0TO9 has exited stealth with a radical mission: launch and scale 1,000 profitable FinTechs in 20 years by slashing the years-long regulatory and funding hurdles that kill 75% of startups early. Backed by serial founders like Oliver Hildebrandt and ex-bank CEO Tord Topsholm, the Stockholm-Berlin team offers turnkey compliance, deposit funding, tech stacks, and go-to-market playbooks - letting founders focus on growth, not paperwork. Early portfolio wins include SME lender Flow & Partners and AI savings tool Hugo. Their fix for fintech’s "valley of death"? Longer runways, embedded expertise, and a bet that Europe’s fragmented rules can become a competitive edge - not a graveyard. ICYMI:

Ant’s AI agents now handle payments 🤖💳 Ant International’s Antom unit has unveiled agentic AI that autonomously processes payments - both via Mastercard/Visa and alternative methods like digital wallets - through conversational flows. The tech handles everything from direct purchases to conditional transactions (e.g., pre-approved spending limits or flash-sale snipes), blending intent recognition with fraud safeguards. Piloted with card networks, it’s designed to embed seamlessly into commerce to "rethink payment systems" for an AI-first era. Next step: industry-wide protocols to standardize agent-driven transactions. ICYMI:

24/7 blockchain FX settlements in Asia ⚡ Ant International and JPMorgan’s Kinexys have executed one of Asia’s first near-instant USD-to-EUR blockchain-based FX settlements, breaking free from traditional market hours and cutoff limits. Integrated into Ant’s Whale platform, the solution gives businesses -especially in travel, trade, and commerce - real-time access to USD, EUR, and GBP liquidity, even outside banking hours. ICYMI: JPMorgan claims its first major Open Banking victim: payments giant Visa 😳🏦 [what it’s all about, what it means for Visa & what to expect next + bonus deep dive into Visa’s latest Q3 2025 financials & more reads inside]

💸 Following the Money

Hong Kong-based stablecoin-powered cross-border payments infrastructure provider Obita has raised over $10M in an angel funding round.

Pave Finance, a provider of AI-powered, institutional-grade, personalised wealth management software, has raised $14M in seed funding.

Digital assets operations platform Utila has closed a $22M Series A extension round, tripling its valuation in just six months as the stablecoin boom continues. ICYMI:

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Wow, this is sooo good. One of my favourite issues this year! Thanks for this.