European banking giants unite to challenge US stablecoin supremacy 🪙🇪🇺; Nubank just declared war on US neobanks 🏦🇺🇸; Revolut weighs dual London-New York listing 🇬🇧🔔🇺🇸

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

The Pitch Deck That Won $16M in the AI Agent Gold Rush 🤖💸 [how StackAI positioned itself as the bridge between cutting-edge AI and non-technical enterprises]

Wealthfront’s IPO filing: a profitable FinTech built on borrowed time 📊🏦 [breaking down the 324-page S-1 filing, uncovering the key financial facts and figures, why they matter, and what’s next for Wealthfront + lots of bonus dives inside]

The browser died today: OpenAI and Stripe launch Instant Checkout & the Agentic Commerce Protocol 🤖💳🤖 [why it’s a game-changer that just killed the browser, what’s next & how FinTechs and other finance firms must adapt + bonus deep dives into Shopify, Google’s & Coinbase’s agentic payments protocols, top AI agent startups and more inside!]

Brex launches instant stablecoin payments for corporate cards 🪙💳 [what’s the USP here & why it matters for stables & FinTech industry per se + bonus dive into Brex’s biggest competitor Ramp & the ultimate list of stablecoin resources inside]

Stripe launches comprehensive stablecoin suite, positioning itself as a full-stack digital asset infrastructure provider 💳 🪙 [what it’s all about & why it could be huge + bonus dives into Agentic Commerce Protocol launched with OpenAI, recap of their L1 Tempo & the ultimate list of stablecoin resources inside]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

The Ultimate B2B Growth Playbook for 2025 🚀 [nail your targeting, supercharge your outbound strategy, and close deals with confidence]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

European banking giants unite to challenge US stablecoin supremacy 🪙🇪🇺

The news 🗞️ A coalition of nine leading European banks has announced the formation of a new Amsterdam-based company to issue a euro-denominated stablecoin, marking the most significant coordinated effort yet by European financial institutions to reclaim ground in the rapidly expanding digital currency market.

The consortium, which includes major players such as ING, UniCredit, Banca Sella, KBC, Danske Bank, DekaBank, SEB, CaixaBank, and Raiffeisen Bank International, plans to launch the stablecoin in the second half of 2026, pending regulatory approval.

Let’s take a look at this, understand why it matters, and what’s next.

More on this 👉 The initiative addresses a striking imbalance in the global stablecoin landscape. While the total stablecoin market has surged to nearly $300 billion in value, euro-denominated stablecoins represent a mere $620 million of that total, accounting for less than 0.2% of the market. In stark contrast, dollar-pegged tokens such as Tether’s USDT and Circle’s USDC command approximately 88.5% of the market, with market capitalizations of $173 billion and $74 billion, respectively. This disparity has raised concerns about Europe’s strategic autonomy in digital payments and its capacity to compete in an increasingly tokenized financial ecosystem.

The new stablecoin will operate as a fully reserved digital asset, backed one-to-one by euros held in segregated accounts and regulated under the European Union’s Markets in Crypto-Assets Regulation, known as MiCA. The entity will function as an electronic money institution supervised by the Dutch Central Bank, with each participating bank developing customer-facing services, including wallets and custody solutions. The consortium has indicated that additional banks may join the initiative over time, and a chief executive for the new company will be appointed shortly.

Zoom out 🗞️ The banks have explicitly framed this venture as a response to US dominance in the stablecoin market, particularly following President Donald Trump’s signing of legislation establishing regulatory frameworks for stablecoins that could further entrench American hegemony. The European institutions argue that their initiative will provide a genuine European alternative, contributing to the continent’s strategic autonomy in payments and digital finance. The stablecoin is designed to enable near-instant settlements, programmable payments, supply chain efficiencies, and digital asset transactions, addressing longstanding inefficiencies in traditional cross-border payments that typically involve high costs and significant delays.

This development comes at a time when the European Central Bank has expressed considerable skepticism about privately issued stablecoins. ECB President Christine Lagarde has warned that such instruments pose risks to monetary policy and financial stability, urging European lawmakers instead to support the introduction of a digital euro, a central bank digital currency that would be guaranteed by the ECB. However, commercial banks have resisted the digital euro concept, fearing that customers would transfer funds from bank deposits into ECB-guaranteed wallets, effectively disintermediating the banking sector and draining their capital reserves.

The tension between private stablecoins and central bank digital currencies reflects broader debates about the future of money and monetary sovereignty. The bank-issued stablecoin could serve as a wholesale tool for institutional transactions while a digital euro might target retail users, allowing both to coexist. However, if the private stablecoin gains significant retail traction, it could complicate or delay the ECB’s CBDC rollout, particularly as banks advocate for solutions that preserve their role in the financial system.

✈️ THE TAKEAWAY

What’s next? 🤔 If the consortium achieves widespread adoption, it could catalyze a fundamental shift in the stablecoin landscape, potentially growing the euro stablecoin market from hundreds of millions to billions of euros within just a few years. MiCA’s restrictions on non-compliant stablecoins, including volume caps and possible delistings, will create regulatory pressure that funnels demand toward compliant euro alternatives, providing a significant structural advantage to this bank-backed offering. However, the initiative faces substantial challenges. Previous euro stablecoin efforts, such as Société Générale’s EUR CoinVertible, launched in 2023, have struggled to gain traction, with only modest circulation figures. The success of this consortium will depend on whether it can overcome the network effects that currently favor dollar-denominated stablecoins, which benefit from deep liquidity, extensive exchange listings, and established use cases in decentralized finance protocols and cross-border remittances. Looking ahead, we can first expect the competition in the regulated stablecoin space to intensify significantly. US financial institutions, including Bank of America and Citigroup, are preparing their own stablecoin offerings following the passage of US stablecoin legislation. This could lead to a bifurcated market where European users primarily transact in euro stablecoins while global markets continue to favor dollar-denominated instruments, potentially fragmenting liquidity and complicating cross-currency transactions. Second, the relationship between private stablecoins and central bank digital currencies will become increasingly complex. If the bank consortium’s stablecoin proves successful, it may demonstrate that private sector solutions can effectively serve public interest goals without requiring direct central bank intervention. This could influence the ECB’s approach to the digital euro, potentially leading to a hybrid model that leverages both private innovation and public oversight. Alternatively, competition between the two could lead to regulatory friction as policymakers navigate the delicate balance between fostering innovation and maintaining monetary sovereignty. Third, this initiative signals a broader trend toward the institutionalization of digital assets. Bank-backed stablecoins offer the transparency and regulatory compliance that institutional investors and risk-averse users demand, potentially bridging the gap between traditional finance and decentralized finance. As programmable money becomes more prevalent, entire industries such as trade finance, supply chain management, and real estate could be transformed through tokenization, creating substantial economic efficiencies and new business models. Finally, it’s clear that geopolitical considerations will shape the stablecoin landscape in the coming years. In an era of increasing economic fragmentation and strategic competition, control over digital payment rails represents a form of soft power. A successful euro stablecoin could reduce Europe’s dependence on US-controlled financial infrastructure, enhancing its strategic autonomy and potentially inspiring similar initiatives in other regions. This could lead to a multipolar stablecoin ecosystem that mirrors broader geopolitical alignments, with profound implications for cross-border capital flows, reserve currency dynamics, and the future architecture of the global financial system. The European bank consortium’s initiative thus represents not merely a financial innovation but a strategic assertion of digital sovereignty.

ICYMI:

Brazilian FinTech giant Nubank just declared war on US neobanks with a national bank charter application 🏦🇺🇸

The news 🗞️ Brazilian digital banking powerhouse Nubank NU 0.00%↑ has just submitted an application to the Office of the Comptroller of the Currency for a national bank charter in the United States 🏦🇺🇸

This filing represents a strategic inflection point for $77 billion Latin American FinTech, which currently serves nearly 123 million customers across Brazil 🇧🇷, Mexico 🇲🇽, and Colombia 🇨🇴.

Let’s take a deeper dive into this, understand why it’s huge, and what’s next for NU (& its competition).

More on this 👉 At the core, the move signals Nubank’s ambition to transform from a regional disruptor into a global financial services platform. The company has assembled a formidable leadership team for its American operations, with co-founder Cristina Junqueira relocating full-time to serve as chief executive of the US subsidiary. The board brings substantial regulatory expertise too - it’s chaired by Roberto Campos Neto, former president of Brazil’s central bank, and includes Brian Brooks, who previously served as acting comptroller of the currency.

NU plans to invest more than $500 million in its US expansion over the coming years, creating hundreds of jobs while building out a comprehensive product suite. The intended offerings include deposit accounts, credit cards, personal loans, and notably, digital asset custody services. This product mix reflects both Nubank’s technology-forward approach and its understanding of evolving consumer preferences, particularly among younger demographics and underserved communities.

Zoom out 🔎 The application comes at a moment of operational strength for Nubank. Second quarter 2025 revenues reached $3.7B, representing 40% year-over-year growth, while customer activity rates exceeded 83%. We can remember that the company recently secured a banking license in Mexico, demonstrating its capacity to navigate complex regulatory environments and successfully expand beyond its Brazilian home market.

ICYMI: Nubank’s Q2 2025, or why Latin America’s digital banking emperor is the FinTech investment steal of the decade 😤📈 [deep dive into NU’s financials, what they mean, what’s next & why you just can’t be not bullish on NU 0.00%↑]

However, obtaining a national bank charter from the OCC remains notoriously challenging. Only a handful of fintech companies have successfully navigated this process in recent years, including Varo Bank in 2020 and SoFi through its acquisition of Golden Pacific Bank. The approval timeline typically spans 12 to 24 months and requires extensive due diligence on capital adequacy, compliance frameworks, and business plans.

Strategic play 🧠 The strategic rationale for pursuing a national charter centers on several competitive advantages.

Federal preemption would allow Nubank to operate nationwide without navigating fifty different state regulatory regimes, a crucial benefit for a digital-first model.

Direct access to Federal Deposit Insurance Corporation coverage would eliminate dependence on partner banks, while lower-cost deposit funding could significantly improve margins compared to wholesale funding arrangements.

Additionally, federal charter status would enhance institutional credibility and potentially facilitate access to Federal Reserve master account privileges.

Most importantly, the United States represents an enormous addressable market for Nubank, with a particular opportunity among the 65 million Hispanic Americans, many of whom remain underbanked or poorly served by traditional financial institutions. The company’s proven ability to win primary banking relationships in Latin America, where 70% of active users consider Nubank their main financial provider, suggests it possesses differentiated capabilities in customer engagement and retention.

Of course, the American market presents distinct challenges. Competition is intense, with established digital players like Chime, SoFi, and Revolut already serving tech-savvy consumers, alongside traditional banking giants with deep resources and regulatory experience. On top of that, customer acquisition costs run significantly higher in the United States than in LatAm markets, and NU will need to demonstrate it can achieve attractive unit economics in a mature, crowded landscape.

ICYMI: SoFi, the FinTech flywheel that finally achieves escape velocity 😤📈 [deep dive into their Q2 2025 financials, unpacking the most important facts & figures to see why you should be bullish on SoFi for the years to come]

Chime’s new credit card lets you earn cash back while building credit 🤔💳 [what’s the USP here & what it means for Chime + bonus deep dive into Chime’s first earnings as a public company]

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, the successful charter approval could fundamentally reshape Nubank’s growth trajectory and valuation. The United States banking market exceeds $2 trillion annually, offering scale that could dwarf even Nubank’s substantial Latin American operations. With a cloud-native technology architecture and proven ability to rapidly deploy new products, the company could potentially add tens of millions of American customers within several years of receiving approval. Revenue diversification represents another critical benefit. While Nubank has achieved impressive growth in Brazil, that market is maturing, with increasing competition from both traditional banks modernizing their digital offerings and new fintech entrants. Mexico shows strong momentum but remains relatively early in its development. A successful US presence would thus provide a third major growth engine, reducing geographic concentration risk and potentially accelerating the path to sustained global profitability. More importantly, a US charter would validate Nubank’s operational maturity and regulatory sophistication on the world stage, likely attracting increased institutional investor interest and facilitating future capital raising on favorable terms. It could thus enable partnerships with American technology companies and payment networks that might otherwise remain cautious about working with a foreign fintech. The credibility boost could also smooth expansion into other developed markets, potentially including Europe or developed Asian economies. Looking at the bigger picture, Nubank’s application would test whether a fintech company from an emerging market can successfully compete in the world’s most sophisticated and competitive banking environment. Historically, financial services innovation has flowed from developed to developing economies. Nubank’s move therefore, represents a reversal of that pattern, bringing proven capabilities honed in challenging LatAm markets to American shores.

FinTech giant Revolut weighs dual London-New York listing 🇬🇧🔔🇺🇸

The news 🗞️ Revolut, Europe’s most valuable FinTech company, is reportedly exploring a groundbreaking dual initial public offering that would see its shares trade simultaneously on the London Stock Exchange and a major US exchange, according to recent media reports citing senior financial sources.

The move represents a significant shift in strategy for founder and CEO Nik Storonsky, who previously expressed a preference for a US-only listing, and could provide a much-needed boost to London’s struggling capital markets.

Let’s take a look at this.

More on this 👉 The proposed listing would value Revolut at approximately $75 billion, reflecting the valuation established in a recent secondary share sale. If executed, the fintech pioneer would immediately enter the FTSE 100 index as one of London’s fifteen most valuable companies while simultaneously accessing the deep liquidity and premium valuations typically associated with American technology listings.

This dual approach allows Revolut to tap into the substantial capital pools of US institutional investors while maintaining its connection to its UK home market and European customer base of 65 million users across 48 countries.

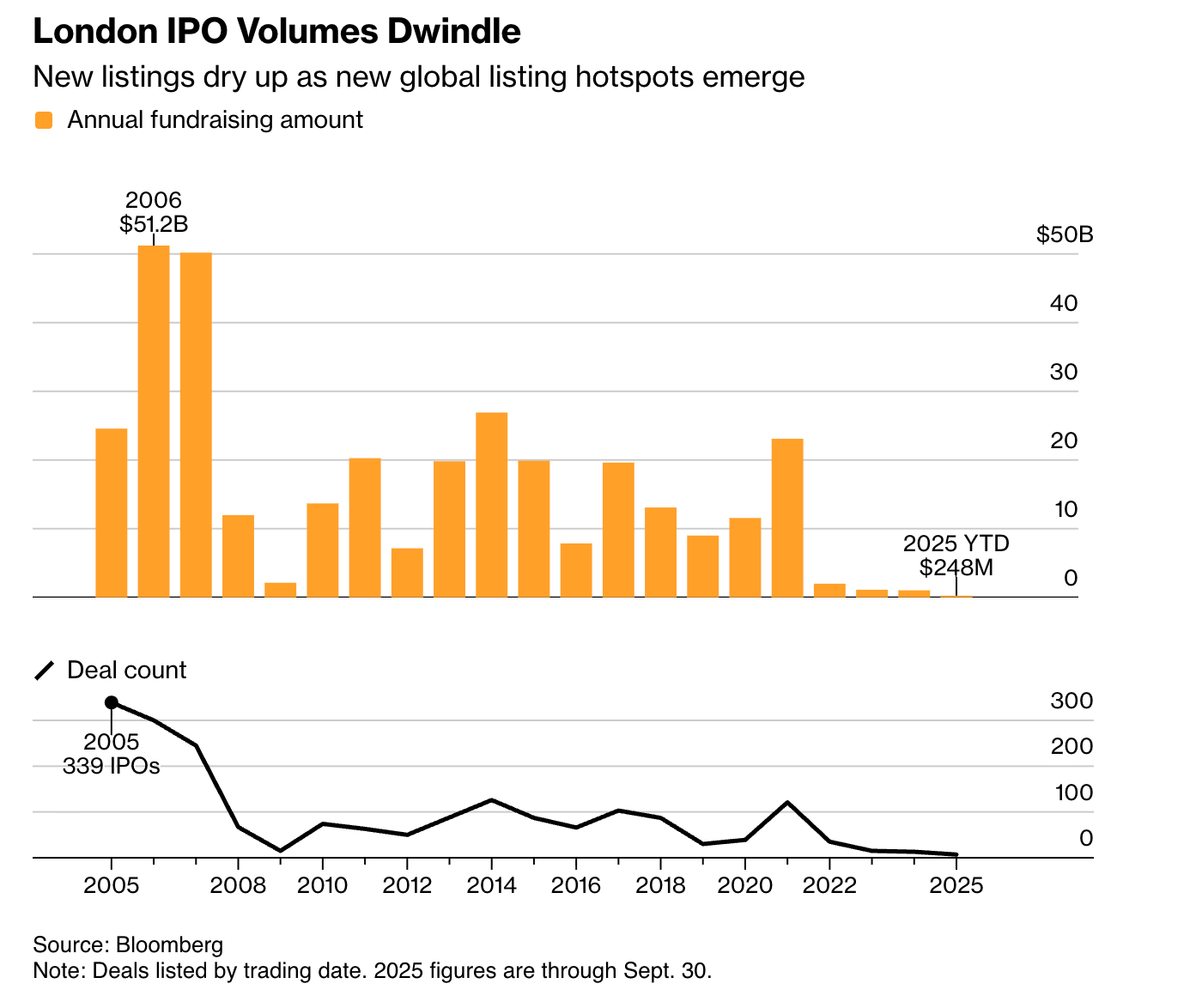

Zoom out 🔎 The timing reflects broader shifts in both markets. London has experienced a precipitous decline in IPO activity, with only 9 listings in the first half of 2025 raising a mere 199 million pounds, the weakest performance since 2000.

Meanwhile, recent UK regulatory reforms, including expedited FTSE 100 inclusion processes, have addressed some of the structural concerns that previously deterred high-growth technology companies from listing in Britain.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, a successful $75B public debut would validate the “super app” business model and demonstrate that digital financial services companies can achieve both scale and profitability. This stands in marked contrast to earlier fintech offerings that struggled post-listing, and could catalyze a new wave of public market activity from mature fintech players (i.e. Stripe, Plaid) who have delayed their own IPO plans. For London specifically, securing even a partial Revolut listing could signal a turning point for UK capital markets. The symbolic value of retaining a homegrown technology champion cannot be overstated, particularly as Britain seeks to rebuild its post-Brexit position as a global financial center. Success here might encourage other European technology companies to consider London listings, potentially reversing the exodus toward New York that has characterized recent years. Yet, execution risks are substantial. Dual listings introduce operational complexity, including duplicative regulatory compliance, potential share price arbitrage between markets, and the challenge of maintaining investor relations across multiple time zones. Revolut’s significant cryptocurrency offerings may also face heightened scrutiny from US regulators, particularly as the Securities and Exchange Commission continues to refine its approach to digital asset oversight. The company’s pending applications for full UK banking operational authority and US banking charter approvals add additional regulatory uncertainty to the timeline. Looking ahead, it’s clear that a successful Revolut IPO could unlock capital for expansion into artificial intelligence-driven personalization, embedded finance solutions, and geographic expansion into markets like the United States and Asia, where Revolut currently maintains smaller footprints.

ICYMI: Revolut’s $75 billion valuation amid 46% revenue surge and aggressive US expansion plans 😳📈 [what does it indicate & what’s next + bonus dives into Revolut inside]

Klarna’s $15B IPO, or a 26x oversubscribed feeding frenzy on Wall St. for Europe’s biggest FinTech comeback 👏🤑 [what it’s all about, why it matters & what to expect next + bonus deep dive into Klarna’s IPO filing & why you should be bullish on them]

🔎 What else I’m watching

JPMorgan Phases Out Nutmeg Brand 💼 JPMorgan Chase is replacing its Nutmeg digital wealth management brand in the UK with JP Morgan Personal Investing. From November, the new service will be available via the Chase UK app and as a standalone offering, providing access to existing Nutmeg products and new features like digital financial planning tools. A DIY investment platform is set to launch in 2026. JPMorgan acquired Nutmeg in 2021 for around £700M. ICYMI: JPMorgan and Plaid strike data-sharing deal 📊🏦 [key details, why it matters & what’s next for the future of open banking + bonus dive into JPM]

Aleo, Paxos Labs Unveil Private Stablecoin 🔒 The Aleo Network Foundation and Paxos Labs have partnered to launch USAD, a privacy-preserving US dollar stablecoin. USAD is the first stablecoin on a layer 1 blockchain, combining smart contracts with enhanced privacy. The partnership leverages Aleo’s zero-knowledge cryptography and Paxos Labs’ issuance framework to deliver a secure and private digital dollar. USAD encrypts transactions end-to-end, addressing the privacy gap in blockchain-based financial infrastructure. The launch comes as stablecoin use surges, with transaction volume reaching $27.6T in 2024. ICYMI:

Bank of America Debuts AI Assistant 🤖 Bank of America has launched an AI assistant called Ask Global Payments Solutions (AskGPS) to help staff handle complex queries from institutional users. AskGPS was built in-house and trained on over 3,200 internal documents, enabling faster responses and better client service. The tool is said to have a transformative impact on team productivity and client service. AskGPS complements existing AI tools like CashPro Chat and Forecasting, and Intelligent Receivables. ICYMI:

💸 Following the Money

Embedded remittance infrastructure provider Remitee has raised $20M to help banks, fintechs, and retailers integrate instant cross-border payments directly into their apps and platforms.

US-based remittance and international money transfer firm Viamericas has raised $113.6M in a funding round led by Old National Bank.

Bite Investments, a technology provider for the alternative investments sector, has secured $25M in funding from NewSpring Growth.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Wow, what a week in FinTech... thank you for another great Sunday!

Really sharp roundup, Linas. The European bank stablecoin push and Revolut's dual listing both highlight how payment infrastructure shifts directly impact corporate cash flow and working capital timing. TCLM explores these exact connections between payment systems, trade credit, and liquidity management. Might be helpful alongside your analysis.

(It’s free)- https://tradecredit.substack.com/