Citi & Coinbase want to transform institutional payments 🏦🪙; PayPal teams up with OpenAI in AI-powered Agentic Commerce push 🤖🛍️; Revolut launches zero-fee stables conversions for 65M users 😳🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

280+ AI Tools You Should Know 📚🤖 [from automation to creativity - this is your toolkit for working smarter, not harder]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

Anthropic strengthens Claude for Financial Services: here’s how AI could reshape finance as we know it 🤖📈 [what it’s all about, why it’s huge & what’s next for Finance & AI + the ultimate AI Agents & MCPs starter pack, AI agent guide, top AI agent startups of 2025 & their pitch decks inside]

Western Union to launch USDPT stablecoin 🤯🪙 [what’s the USP here & why it matters for WU & their future + bonus reads on Citi & Coinbase stablecoin partnership and the ultimate list of stables resources inside]

Fiserv’s reckoning: a severe 3Q 2025 reset reveals both peril and potential at distressed valuation 🤔📊 [breaking down the key numbers, what they mean and whether Fiserv is worth your time and money in 2025 & beyond]

OpenAI and Nubank team up to democratize AI access in Brazil 🇧🇷🤖 [what’s the USP here & why it could be huge + bonus dives into how PayPal & OpenAI are reinventing commerce and NU’s war against US neobanks]

PayPal’s Q3 2025: margin excellence is masking strategic vulnerability 🤔📊 [breaking down the key numbers, what they mean & whether PayPal is worth your time & money in 2025 and beyond]

What’s really happening at Monzo? 🤔🇬🇧 [why CEO TS Anil actually stepped down, what does it tell us and what can we expect next]

The 75% Problem, or How This AI Startup Raised $13M in One Week 💸🤖 [How ex-Monzo founders are automating the complex customer operations work financial services companies thought impossible 📈]

This AI startup simulated human behavior better than Claude and ChatGPT, then raised $5.35 million 🤖🧠 [inside Artificial Societies’ masterclass in conviction-driven fundraising & how to sell an impossible future]

The Pitch Deck That Won $16M in the AI Agent Gold Rush 🤖💸 [how StackAI positioned itself as the bridge between cutting-edge AI and non-technical enterprises]

3 Essential Templates Every AI Startup Needs 🚀🤖 [raise smarter, scale faster: the essential toolkit for today’s leading tech startups]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another insane week in the financial technology space, so make sure to check all the above stories.

Citi and Coinbase unite to transform institutional payments 😳🪙

The news 🗞️ Banking giant Citigroup C 0.00%↑ and crypto titan Coinbase C 0.00%↑ just announced a strategic partnership that marks a significant milestone in the convergence of traditional banking and digital assets.

The collaboration aims to enhance payment capabilities for Citi’s institutional clients by leveraging blockchain infrastructure and stablecoin technology.

Let’s take a closer look at this.

More on this 👉 The partnership initially focuses on streamlining the conversion process between traditional currencies and digital assets, addressing a longstanding friction point for institutional crypto adoption. By connecting Coinbase’s specialized blockchain infrastructure with Citi’s extensive global payments network spanning 94 markets and over 300 clearing systems, the firms seek to enable faster, more efficient cross-border transactions that operate around the clock.

A central element of this collaboration involves exploring stablecoin-based payment solutions. Citi’s leadership has indicated that clients are seeking programmable payment features, conditional transactions, and improved cost efficiencies beyond what traditional payment rails can offer. The bank plans to launch on-chain stablecoin payment capabilities in the coming months, responding to growing institutional demand for digital payment alternatives.

Zoom out 🔎 This partnership represents more than a technological upgrade. It signals a fundamental shift in how major financial institutions view blockchain technology, moving from skepticism to active integration.

With Citi also preparing to launch crypto custody services in 2026, the bank is clearly positioning itself at the forefront of institutional digital asset adoption.

✈️ THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that this partnership likely represents the beginning of a broader transformation across the financial services sector. As one of the world’s largest banks validates blockchain-based payment solutions, competitive pressure will intensify for other major institutions to develop similar capabilities or risk losing ground in serving institutional clients who increasingly demand digital asset services. But what’s really interesting for me is the stablecoin component. Industry projections suggest the stablecoin market could expand from approximately $300 billion today to over $1 trillion within five years. As Citi and Coinbase refine their stablecoin payment infrastructure, they may establish industry standards that other institutions will follow, potentially accelerating regulatory clarity and widespread adoption. Speaking of Coinbase, this partnership provides crucial validation and access to Citi’s institutional client base, diversifying revenue streams beyond traditional exchange services. As competition from traditional financial firms entering the crypto space intensifies, such strategic alliances may become essential for maintaining market position. Zooming out, we may soon witness accelerated pressure on systems like SWIFT to modernize or face obsolescence. Additionally, success in this partnership could catalyze increased tokenization of real-world assets, as seamless fiat-to-digital conversion becomes standard infrastructure rather than a technical hurdle. Onchain is the future ⛓️

ICYMI: Citi believes bank tokens will beat stablecoins by 2030 despite $4 trillion crypto surge 😳🏦 [key takeaways from Citi’s new research, unpacking the key details & future implications + the ultimate list of stablecoin resources inside]

Citi’s Q3 2025: why the banking giant at $100 is a value trap, not a value play 📊🏦 [breaking down the latest numbers, what they mean & why the banking giant at $100 is a value trap, not a value play + a bonus deep dive into JPMorgan’s Q3 2025 inside]

PayPal partnered with OpenAI in an AI-powered Agentic Commerce push 🤖🛍️

The news 🗞️ PayPal PYPL 0.00%↑ and OpenAI have established a strategic partnership that fundamentally reimagines how consumers interact with commerce platforms. At the core of this collaboration, PayPal has become the first payments wallet integrated directly into ChatGPT, enabling users to complete purchases within conversational AI experiences without leaving the platform.

This integration extends beyond simple payment processing, as PayPal has launched comprehensive agentic commerce services that allow merchants to synchronize their product catalogs across multiple AI channels, making inventory discoverable and purchasable through platforms including ChatGPT and Perplexity.

Let’s take a quick look at this, understand why it could be huge & what’s next.

More on this 👉 At the core, this partnership represents a decisive shift from traditional search-and-browse shopping to intent-driven commerce, where AI agents interpret user needs, discover appropriate products, and execute multi-step transactions autonomously. PayPal’s established infrastructure provides the critical trust layer for these interactions, offering identity verification, fraud protection, and buyer safeguards while merchants maintain their direct customer relationships.

We can remember that PayPal participated in OpenAI’s October 2024 funding round, which valued the AI company at $157 billion, thus underscoring the strategic commitment underlying this collaboration.

Zoom out 🔎 Despite all the excitement, the emergence of agentic commerce introduces unprecedented security challenges that traditional rule-based systems cannot address. As AI agents gain autonomy in financial decision-making, specialized platforms focused on adaptive risk management (i.e. Oscilar*) become essential infrastructure.

These systems must combat increasingly sophisticated AI-enabled fraud, provide explainable decision-making for regulatory compliance, and balance security requirements against the frictionless user experience that defines successful agentic commerce.

THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that the PayPal-OpenAI partnership signals the beginning of a fundamental restructuring of financial services and commerce. Within the next 3 to 5 years, agentic systems will likely progress from executing discrete transactions to managing comprehensive financial workflows, including autonomous budget optimization, investment rebalancing, and dynamic debt management. This evolution will challenge traditional banking models as consumers gain access to sophisticated financial capabilities previously available only to institutional players. Zooming out, the broader FinTech landscape will increasingly bifurcate between platforms that serve as execution layers for agentic transactions and specialized service providers that enable secure, compliant operation of these autonomous systems. Companies that successfully establish themselves as trusted payment rails for multi-agent ecosystems will capture disproportionate value, while those that fail to adapt to agent-driven interfaces risk disintermediation. The most critical competitive differentiator will be the ability to provide seamless security that operates invisibly within autonomous workflows. And this will require substantial investment in adaptive fraud detection and real-time risk assessment capabilities that can keep pace with the sophistication of both legitimate and malicious AI agents. Because trust is the ultimate currency in the age of AI.

ICYMI: PayPal’s Q3 2025: margin excellence is masking strategic vulnerability 🤔📊 [breaking down the key numbers, what they mean & whether PayPal is worth your time & money in 2025 and beyond]

*Disclaimer: I’m part of Oscilar.

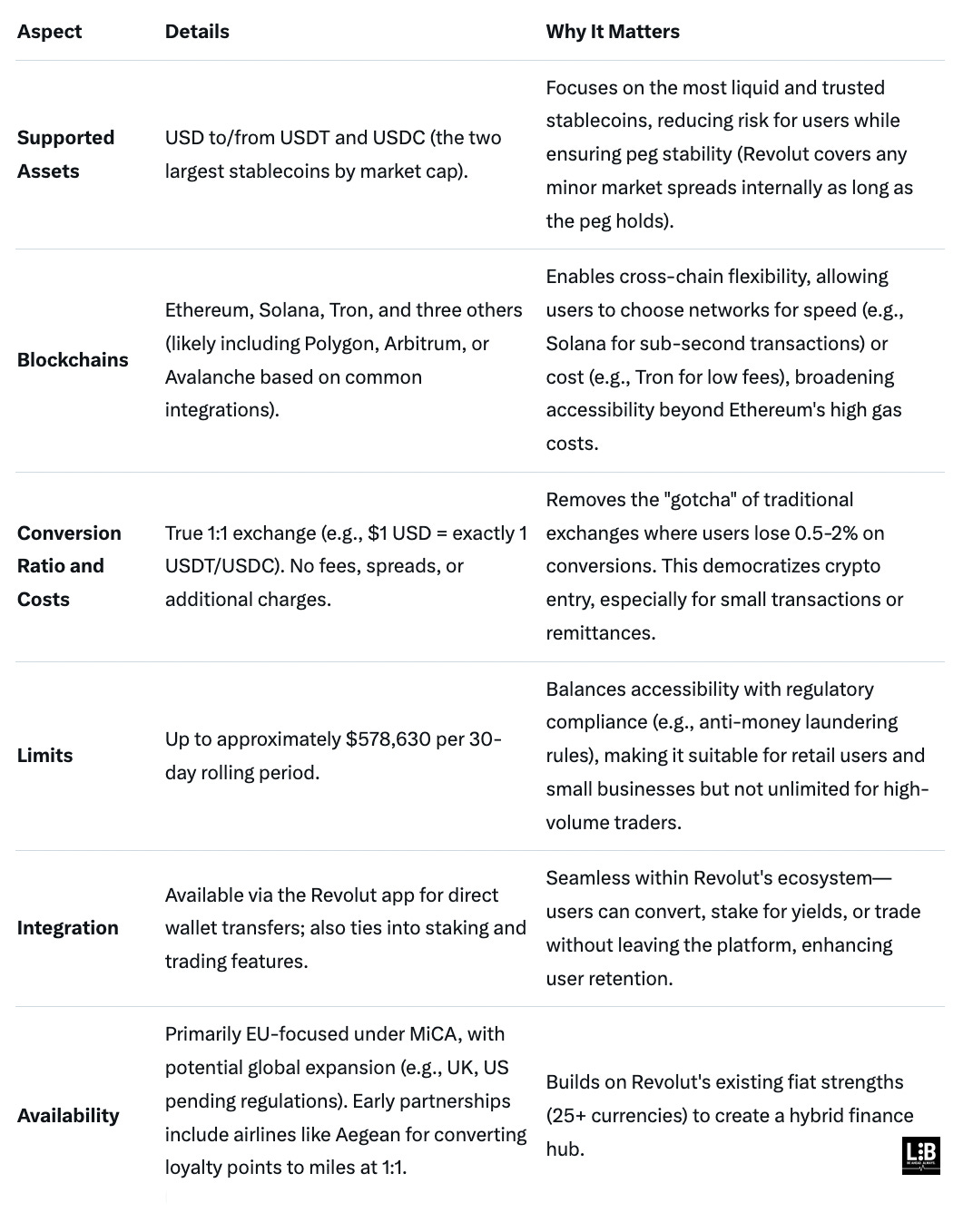

Revolut launches zero-fee stablecoin conversions for 65 million users 😳🪙

The news 🗞️ Revolut, the UK-based FinTech giant serving over 65 million users globally, has just enabled seamless conversion between US dollars and major stablecoins at a true one-to-one ratio without any fees or spreads.

The feature currently supports Circle’s USDC and Tether’s USDT across multiple blockchain networks, including Ethereum, Solana, and Tron.

Let’s take a look at this, understand why it matters, and what this means for the future.

More on this 👉 The service allows users to convert up to approximately $578,630 every 30 rolling days, with Revolut absorbing any market spreads internally to guarantee the exact one-to-one exchange rate as long as the stablecoins maintain their pegs. Nice!

This development follows Revolut’s recent acquisition of a Markets in Crypto-Assets license from the Cyprus Securities and Exchange Commission, enabling the company to offer regulated cryptocurrency services across 30 European Economic Area countries.

Zoom out 🔎 According to Leonid Bashlykov, Revolut’s head of product in crypto, the initiative aims to “completely eliminate the pain of going on and offchain” rather than simply offering better rates. The impact extends particularly to small and medium-sized businesses in economies facing currency volatility, where traditional conversion processes compound losses through foreign exchange spreads and international transfer fees.

We must also note that Revolut’s move reflects a broader industry trend, with Western Union, Zelle, and MoneyGram all announcing stablecoin integration plans. Even SWIFT, the global interbank payment network, is developing blockchain-based infrastructure for stablecoin settlements.

ICYMI: Western Union to launch USDPT stablecoin 🤯🪙 [what’s the USP here & why it matters for WU & their future + bonus reads on Citi & Coinbase stablecoin partnership and the ultimate list of stables resources inside]

THE TAKEAWAY

What’s next? 🤔 First and foremost, this development yet again signals a fundamental shift in how mainstream financial institutions view stablecoins - no longer as speculative crypto assets but as essential infrastructure for global payment systems. Revolut’s integration brilliantly demonstrates that regulatory clarity, particularly through frameworks like MiCA, enables established financial players to confidently bridge traditional finance and digital assets. Looking ahead, it’s clear that the competitive landscape here will only intensify as more and more fintech platforms race to offer similar services, potentially triggering a consolidation phase (we’re seeing this already - more here) where only the most compliant and well-backed stablecoin offerings survive. As for Revolut, this well positions the company to capture significant transaction volume as stablecoins increasingly replace legacy payment rails, particularly in cross-border transactions and emerging markets (which is becoming a bigger focus for the FinTech giant). Of course, the true test will be whether this model can scale globally beyond Europe, especially in major markets like the United States and the United Kingdom, where regulatory frameworks remain under development. But if all goes well, this could accelerate the projected growth toward a $100 trillion on-chain economy by 2030, thus fundamentally reshaping how money moves across borders. Onchain is the future ⛓️

ICYMI: Revolut navigates regulatory roadblocks while betting big on AI travel integration ✈️🏦 [recap of the latest UK bank licencing challenges & why the M&A of AI travel agent startup is a brilliant play + bonus dives into Revolut’s other strategic moves & the list of top AI agent startups of 2025 and their pitch decks inside]

Stablecoin infrastructure consolidation signals new era for digital finance 💸📈 [quick look at the most interesting M&As that just happened, what they tell us & what to expect next + bonus list of the ultimate stables resources inside & M&A templates that could save you a lot of $$$]

🔎 What else I’m watching

Starling’s AI Scam Tool 🤖 Starling Bank has launched Scam Intelligence, an AI tool designed to spot purchase scams. Users can upload images and ads from online marketplaces for fraud assessment. Developed with Google Cloud, the tool provides personalized guidance. Financial scams cost UK consumers over £1.17B in 2024. This is Starling’s second AI tool, following Spending Intelligence. ICYMI:

Klarna Launches Membership Program 💳 Klarna KLAR 0.00%↑ has launched a global membership program with two tiers: Premium (€17.99/month) and Max (€44.99/month). Benefits include airport lounge access, travel insurance, ClassPass membership, and subscriptions to various publications. Members can also convert cashback to travel and hospitality partners. ICYMI: Klarna’s $15B IPO, or a 26x oversubscribed feeding frenzy on Wall St. for Europe’s biggest FinTech comeback 👏🤑 [what it’s all about, why it matters & what to expect next + bonus deep dive into Klarna’s IPO filing & why you should be bullish on them]

JPMorgan Uses AI for Performance Reviews 🤖🏦 JPMorgan Chase is allowing employees to use its in-house AI system, LLM Suite, to help write year-end performance reviews. The AI generates reviews based on prompts but employees are responsible for the final content. With over 300,000 employees, the bank aims to reduce the time spent on reviews. JPMorgan invests $2 billion annually in AI, saving about the same amount. ICYMI:

💸 Following the Money

Natural raises $9.8M to build agentic payments infrastructure.

A secondary share sale has seen the valuation of MENA-based financial app Tabby rise to more than $4.5B.

Canada’s Wealthsimple has raised C$750M at a post-money valuation of C$10B in a funding round led by Dragoneer Investment Group and GIC.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

JPMorgan's LLM Suite deployment for performance reviews signals a broader shift in how large enterprises will automate administrative workflows at scale. The $2 billion AI investment returning equivalent savings demonstrates the compelling unit economics that will drive rapid adoption across financial services. However, using AI to evaluate human performance introduces significant fairness concerns if the models inherit biases from historical review data or struggle to assess nuanced contributions that don't fit neat categorizations. The real test will be whether employees trust AI-generated assessments or if this creates a new layer of bureaucracy where people spend time editng AI output instead of writing from scratch.

What an issue! So many things to digest...