Ramp's first production-ready AI Agent for Financial Modeling 📊🤖; Revolut doubles down on travel ecosystem 🧳💳; Coinbase bets on prediction markets to break free from crypto volatility 📈📊

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

The Ultimate LLM Toolkit for Unleashing AI Innovation 🤖📚 [100+ battle‑tested tools and frameworks to accelerate your AI projects and stay ahead in the LLM race]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

Purple Reign, or how Nubank built an AI moat competitors can’t touch 🤖💜🏦 [deep dive into NU’s 3Q 2025, breaking down the most important facts & figures, understanding what they mean, and why you should be bullish on NU]

Ramp’s $32 billion valuation, or the dawn of autonomous finance 🤖💸 [latest numbers, why they matter, and what’s the big picture here + bonus dives into Ramp’s biggest competitor Brex and more resources on Agentic Finance inside]

Block’s 3Q 2025 & Investor Day position it as an AI-driven FinTech juggernaut approaching an inflection point 🤖📈 [breaking down their most important financials & product focus to see whether this FinTech giant is worth your time and money + bonus deep dive into PayPal inside]

Circle’s 3Q 2025: minting dollars while printing questions 🤔💸 [deep dive into Circle’s 3Q 2025, breaking down the most financial facts & figures, and whether it’s worth your time and money in 2025 & beyond]

Latin America’s e-commerce crown jewel’s 3Q 2025, or the MercadoLibre investment case Wall Street’s short-term thinking completely missed 🛍️🇺🇾 [deep dive into MELI 0.00%↑ latest 3Q 2025 financials, breaking down the most important facts & figures, understanding what they mean & why MercadoLibre is worth your time and money in 2025 and beyond]

Aave’s consumer app signals DeFi’s direct challenge to traditional banking 😳🏦 [what’s the USP here & why it’s compelling + what to expect next]

Due diligence checklist for VCs and startup investors 📋💸 [Everyone’s funding AI. Almost no one is doing the DD properly]

The $400 billion problem nobody talks about: inside AI startup’s pitch to fix the internet 🤖🌐 [How Vibranium Labs is building the AI that prevents your 3 am wake-up calls 💤]

The 75% Problem, or How This AI Startup Raised $13M in One Week 💸🤖 [How ex-Monzo founders are automating the complex customer operations work financial services companies thought impossible 📈]

This AI startup simulated human behavior better than Claude and ChatGPT, then raised $5.35 million 🤖🧠 [inside Artificial Societies’ masterclass in conviction-driven fundraising & how to sell an impossible future]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Ramp launches the first production-ready AI Agent for Financial Modeling 📊🤖

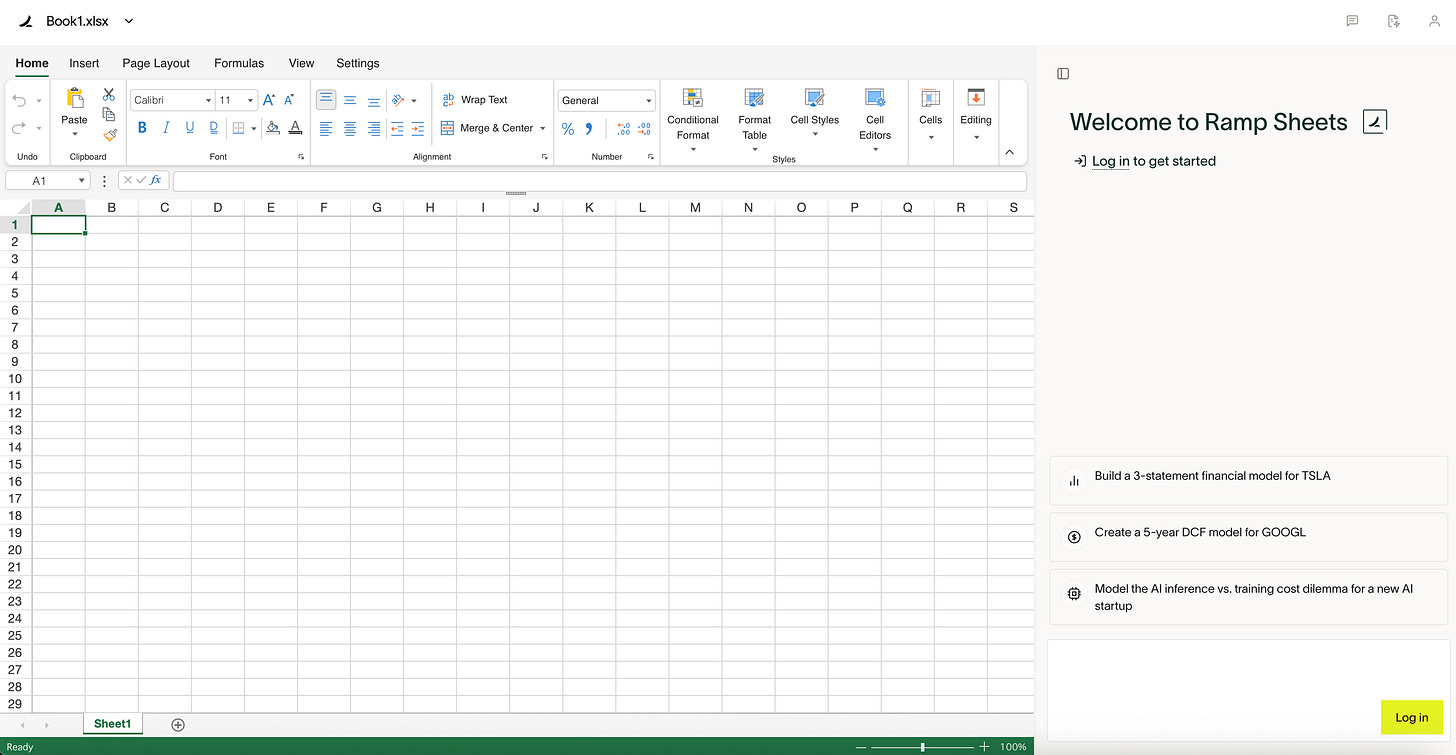

The news 🗞️ FinTech giant Ramp has just introduced Ramp Sheets, an autonomous AI spreadsheet editor that represents a fundamental shift in how financial professionals approach modeling and analysis.

Just 3 days after launch, the product is already generating significant attention from venture capital and finance operators for its ability to produce complete, production-grade financial models from single natural language prompts.

Let’s take a quick look at this.

More on this 👉 Unlike previous AI-assisted spreadsheet tools that primarily suggest formulas or automate individual tasks, Ramp Sheets employs an agentic approach that plans workflows, conducts web research for current financial data, executes multi-step modeling tasks, and formats outputs to professional standards. The system maintains full Excel compatibility, allowing users to upload existing files, make manual edits, and export standard spreadsheet formats without platform lock-in.

Early demonstrations show the tool successfully building three-statement models, discounted cash flow valuations, cohort analyses, and competitive benchmarking studies. The integrated web search capability enables the agent to pull current financial metrics from SEC filings and market data sources, then incorporate those assumptions directly into model construction.

Users report that tasks requiring hours of manual work are completed in minutes while maintaining the accuracy standards required for investor presentations and board reporting.

THE TAKEAWAY ✈️

What’s next? 🤔 At the core, Ramp Sheets signals an inflection point where AI moves from augmentation to genuine automation of high-value financial work. The immediate impact will reshape analyst workflows, shifting junior roles from mechanical model construction to prompt engineering, assumption validation, and strategic interpretation. Organizations will likely achieve substantial productivity gains, with finance teams producing 5 to 10 times their current analytical output. Looking ahead, it’s clear that the broader competitive landscape will evolve rapidly. Microsoft and Google possess distribution advantages through their established spreadsheet platforms, but Ramp holds a critical edge: proprietary access to spending data from over 50,000 companies. If Ramp connects this financial intelligence layer to Sheets, even in aggregated benchmark form, it creates a defensible moat that generic AI spreadsheet tools cannot replicate. So the next 12 to 18 months will determine whether Ramp can extend its first-mover advantage before incumbents close the capability gap.

ICYMI: Ramp’s $32 billion valuation, or the dawn of autonomous finance 🤖💸 [latest numbers, why they matter, and what’s the big picture here + bonus dives into Ramp’s biggest competitor Brex and more resources on Agentic Finance inside]

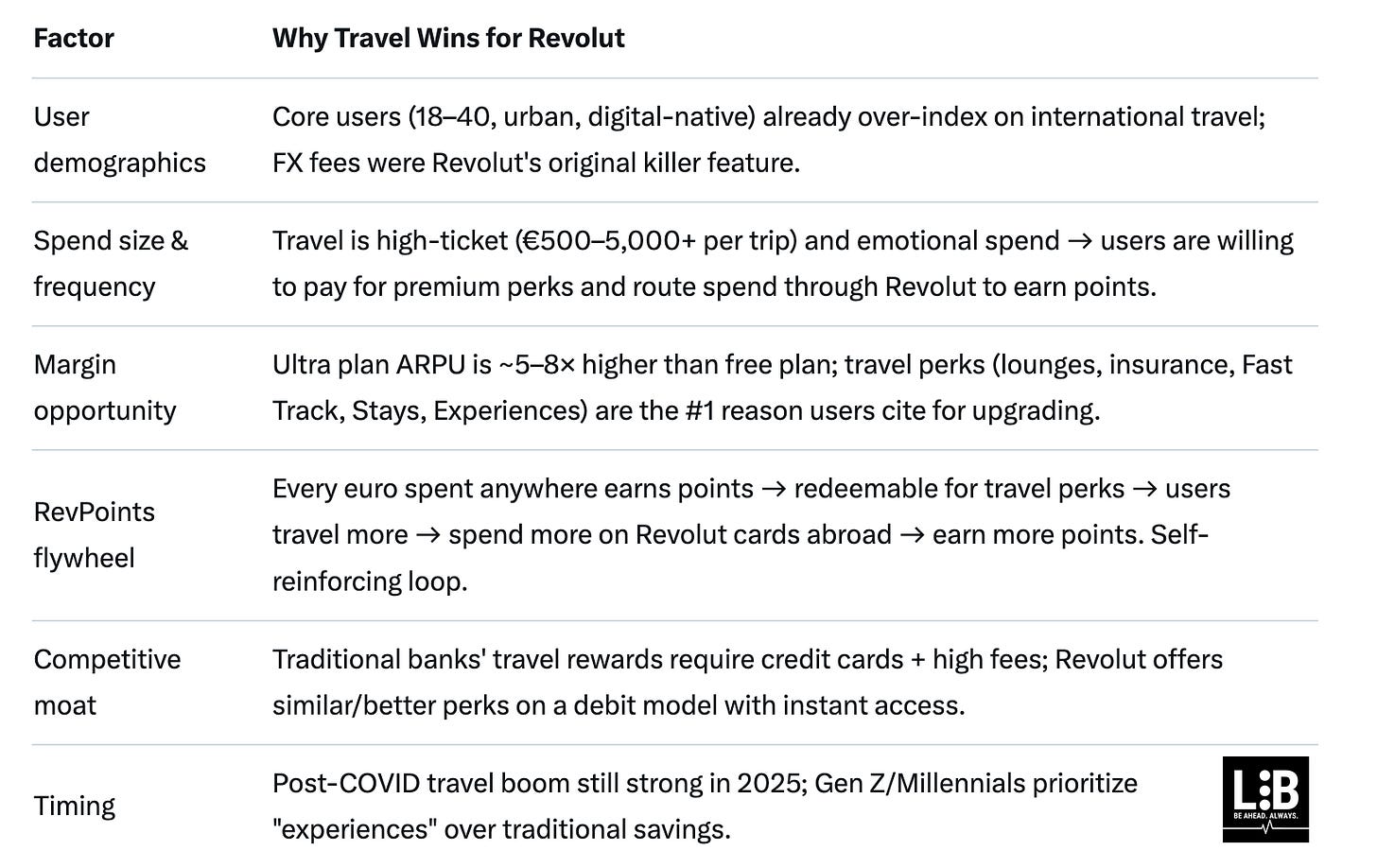

Revolut doubles down on travel ecosystem 🧳💳

The news 🗞️ Europe’s most valuable FinTech startup Revolut has just unveiled two significant travel initiatives that signal its commitment to becoming the primary financial platform for international travelers.

The FinTech giant launched Airport Fast Track (aka Revolut Fast Track) access across more than 80 major airports worldwide while simultaneously partnering with Booking.com to integrate its one-click payment solution, Revolut Pay, into the world’s largest online travel agency.

Let’s take a look at this, understand why it matters, and what’s next for Revolut.

More on this 👉 First and foremost, we must note that these developments represent strategic execution rather than opportunistic feature additions. With Revolut customers spending over £20 billion on travel in 2024 alone, the company has identified travel as a critical avenue for deepening customer relationships and driving subscription upgrades.

The Booking.com partnership proves particularly strategic given that 9 million Revolut users had already made purchases on the platform before this integration, indicating substantial existing demand for streamlined payment experiences.

The Airport Fast Track service complements existing travel benefits available to premium subscribers, including airport lounge access and global data plans. By bundling these services into higher-tier subscriptions such as the Ultra plan, Revolut creates compelling value propositions that compete directly with traditional premium travel cards from American Express and Chase, but at significantly lower price points and without credit requirements.

Zoom out 🔎 The integration of Revolut Pay on Booking.com demonstrates the company’s broader embedded finance strategy, positioning its payment infrastructure within high-value transaction flows rather than attempting to compete as a standalone travel booking platform.

Combined with the recent acquisition of Swifty, an artificial intelligence-powered travel agent developed within Lufthansa Innovation Hub, these moves suggest Revolut is building toward a comprehensive travel orchestration platform where financial services, booking capabilities, and personalized recommendations converge within a single application.

THE TAKEAWAY

What’s next? 🤔 At the core, Revolut is effectively creating a closed-loop travel ecosystem where customers earn loyalty points through everyday spending, redeem those points for travel benefits, and complete purchases through integrated payment rails that generate additional revenue for Revolut. This flywheel effect, once established, creates formidable barriers to customer switching (& is something other neobanks can’t match). Looking at the bigger picture, these moves are also interesting as they serve as a test of whether Super App strategies can succeed in Western markets. Traditional banks also face mounting pressure as Revolut demonstrates that deposit relationships alone no longer guarantee customer loyalty when competitors offer superior travel experiences and reward economics. When it comes to the travel industry, these developments also signal a fundamental shift in power dynamics. Online travel agencies have historically controlled customer relationships, but embedded payment platforms like Revolut now sit inside the transaction flow with direct access to customer data and spending patterns. If Revolut’s artificial intelligence capabilities enable it to anticipate travel needs and proactively suggest bookings, the platform could eventually control discovery and booking intent even while routing through partner inventory systems. And that would be huge.

ICYMI:

Coinbase bets on prediction markets to break free from crypto volatility 📈📊

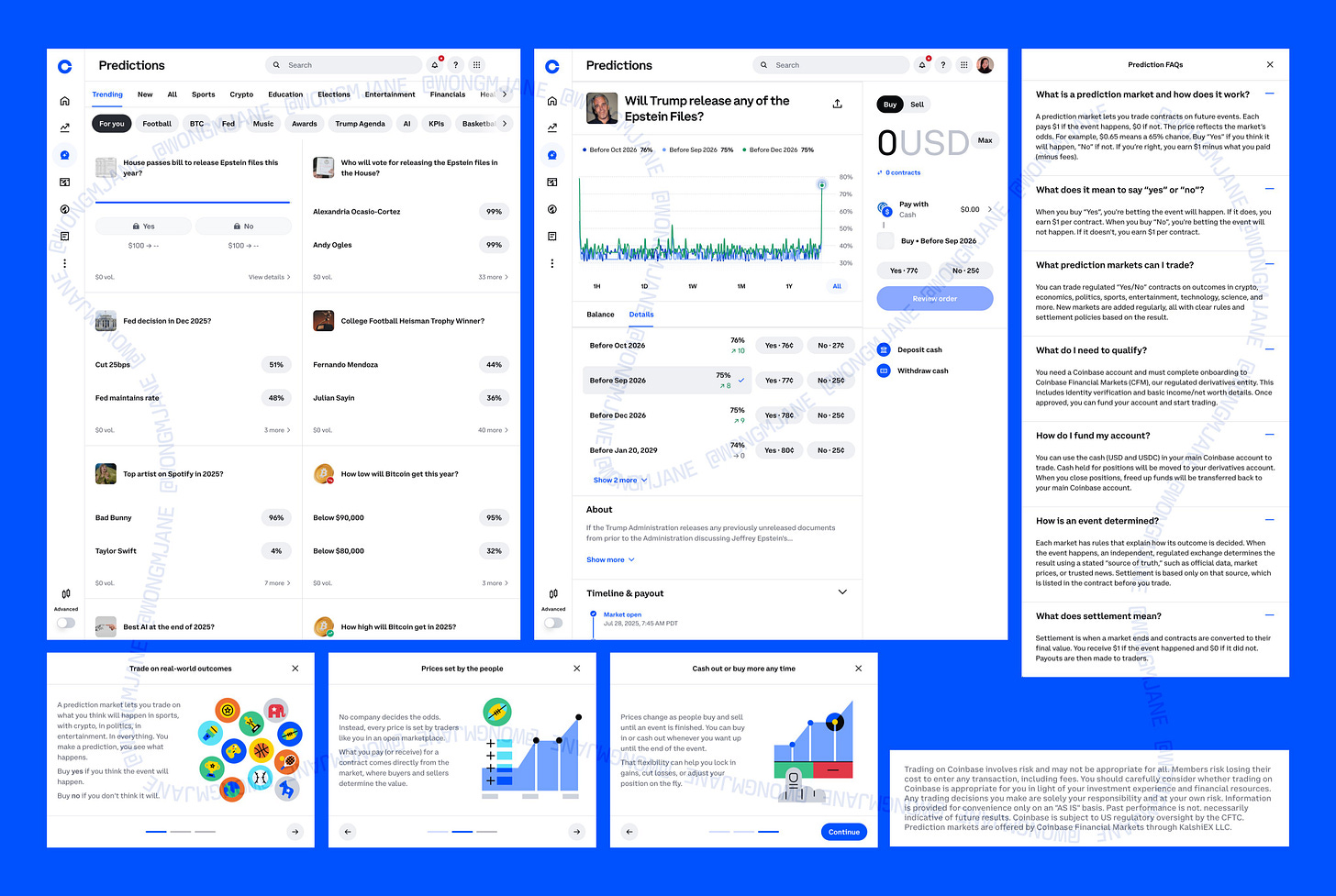

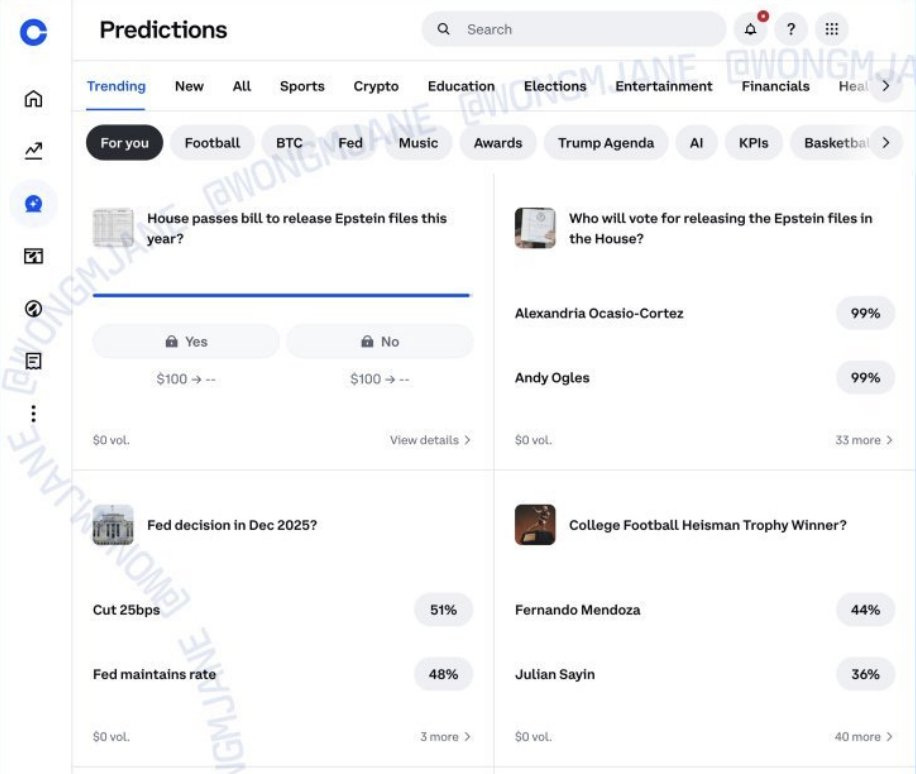

The news 🗞️ Digital asset pioneer Coinbase COIN 0.00%↑ is preparing to launch a regulated prediction markets platform in partnership with Kalshi, marking another expansion beyond its core cryptocurrency trading business.

The move, expected to be formally announced at a December 17 livestream event, represents yet another step in CEO Brian Armstrong’s vision to transform Coinbase into an Everything Exchange for digital and traditional assets.

Let’s take a look at this, understand why it matters, and what to expect next.

More on this 👉 The platform will enable users to trade on real-world event outcomes spanning politics, sports, economic indicators, and technology developments. By partnering with Kalshi, the only CFTC-regulated prediction market operator with Designated Contract Market status in the United States, Coinbase gains federal regulatory coverage that crypto-native competitors like Polymarket cannot match.

At least yet.

The integration will accept both USDC stablecoins and US dollars, settling contracts directly through users’ existing Coinbase accounts.

Zoom out 🔎 This strategic shift addresses a fundamental vulnerability in Coinbase’s business model. The company currently derives a substantial portion of revenue from transaction fees that evaporate during cryptocurrency bear markets. Prediction markets offer a counter-cyclical revenue stream that thrives on uncertainty and major events regardless of Bitcoin’s price trajectory. The sector generated over $27 billion in trading volume through October 2025, with projections reaching $95 billion by 2035.

The launch places Coinbase in direct competition with Robinhood HOOD 0.00%↑, which has already achieved significant traction with its own Kalshi-powered prediction markets.

ICYMI: Robinhood’s epic transformation: from millennial trading app to diversified financial powerhouse 😳📊 [deep dive into their 3Q 2025 financials, breaking down the most important numbers, what they mean, and what’s next for RH]

Robinhood’s event contracts business reached $100M in annualized revenue faster than any other product line in the company’s history. However, Coinbase brings advantages that Robinhood cannot easily replicate: deep institutional custody relationships, a dominant position in stablecoin infrastructure through USDC, and the Base blockchain ecosystem.

THE TAKEAWAY ✈️

What’s next? 🤔 At the core, this move clearly signals Coinbase’s determination to own the complete retail investment stack and de-risk its dependency on crypto market cycles. Three developments will likely unfold over the next 12-18 months. First, expect fierce competition for market share between Coinbase and Robinhood, with both platforms leveraging their respective strengths. Robinhood’s mobile-first interface and zero-commission ethos will compete against Coinbase’s superior liquidity, institutional credibility, and stablecoin economics. This battle will only intensify as both companies pursue the same demographic of young retail traders seeking entertainment value alongside investment returns. Second, the broader financial services industry will need to respond. Traditional brokers like Charles Schwab and Interactive Brokers face mounting pressure to offer comparable features or risk losing customers to platforms that provide a more comprehensive trading experience. We may see a new wave of partnerships or potential acquisitions. Third, regulatory tensions will probably escalate. Multiple state attorneys general have already challenged Kalshi’s operations, arguing that event contracts constitute illegal sports betting under state law. As Coinbase scales prediction markets to millions of users, these legal battles will only intensify. But the ultimate significance extends way beyond Coinbase itself. If prediction markets achieve widespread adoption through trusted platforms, they could fundamentally reshape how information flows through financial markets. Real-time, incentive-aligned forecasting on everything from corporate earnings to geopolitical events creates a new asset class that traditional polling, expert analysis, and futures markets cannot fully replicate.

ICYMI: ICOs 2.0, or Coinbase’s another step towards The Everything Exchange 🏦📈 [what their digital token offerings platform is all about, why it could be huge & what it means for the future of FinTech + bonus deep dive into Coinbase’s 3Q 2025 financials]

🔎 What else I’m watching

Deutsche Börse Integrates SocGen Stablecoins 🏦 Deutsche Börse is integrating EUR and USD CoinVertible stablecoins from Societe Generale’s SG-Forge into its infrastructure to enhance collateral management and securities processes. This initiative aims to improve liquidity and explore further integration across Deutsche Börse’s services, supporting the connection between traditional capital markets and the crypto ecosystem. ICYMI:

JPMorgan Closes Mobility Payments Business 🚗 JPMorgan is shutting down its Mobility Payments business, acquired from Volkswagen in 2021, due to unmet profitability expectations. The closure affects 33 jobs in Luxembourg and marks the end of JPMorgan’s venture into the in-car payments sector. ICYMI: JPMorgan bridges Wall Street and blockchain with deposit token launch on Base 🏦⛓️ [what it’s all about, why it matters & what it means for the future of FinTech + bonus deep dives into Coinbase & JPMorgan, and their latest financials]

Basware Launches InvoiceAI to Streamline Finance Operations 📄 Basware has introduced InvoiceAI, a suite of AI enhancements designed to autonomously process invoices and save finance teams over 200 hours annually. Using agentic AI, InvoiceAI addresses the challenge of non-PO invoices, which account for 40% of invoices and create a $549 billion blind spot in unmanaged spend. The solution includes features like SmartCoding, SmartWorkflow, and SmartPDF to optimize invoice management and reduce manual intervention. ICYMI:

💸 Following the Money

Tether has invested in Ledn as demand for bitcoin-backed credit accelerates across retail and institutional markets. Ledn has originated more than $1B in loans in 2025, pushing annual recurring revenue above $100M.

Sencillo, the FinTech start-up focused on modernising education financing for families, has raised over £350,000 in a pre-seed funding round.

Barker, a pioneering FinTech firm that transforms illiquid asset valuations into insurance-backed instruments, secured $3.5M in funding led by Walkabout VC.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Fabulous read - thank you for sharing this here.