The West’s WeChat Moment, or OpenAI’s evolution from AI chatbot to the ultimate Everything App 😳📲; SoFi launches crypto trading 🤑📈; Coinbase walks away from $2B stablecoin M&A 😳🪙

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

The Ultimate LLM Toolkit for Unleashing AI Innovation 🤖📚 [100+ battle‑tested tools and frameworks to accelerate your AI projects and stay ahead in the LLM race]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

Visa’s payment processing throne is a masterclass in network economics 👏😤 [deep dive into their 4Q 2025 earnings, breaking down the most important facts & figures, and what’s next for the payments heavyweight + bonus dives into Visa’s Trusted Agent Protocol & more reads on agentic finance inside]

ICOs 2.0, or Coinbase’s another step towards The Everything Exchange 🏦📈 [what their digital token offerings platform is all about, why it could be huge & what it means for the future of FinTech + bonus deep dive into Coinbase’s 3Q 2025 financials]

Mastercard’s wide moat justifies premium valuation 📈💳 [breaking down the most important facts & figures from their 3Q 2025 earnings, understanding what they mean and whether Mastercard is worth your time and money in 2025 & beyond]

LendingClub went from FinTech disruptor to digital banking powerhouse 😤🏦 [deep dive into their 3Q 2025 earnings, breaking down the most important numbers, what they mean and whether LendingClub is worth your time & money in 2025 & beyond + a bonus deep dive into SoFi inside]

JPMorgan bridges Wall Street and blockchain with deposit token launch on Base 🏦⛓️ [what it’s all about, why it matters & what it means for the future of FinTech + bonus deep dives into Coinbase & JPMorgan, and their latest financials]

Robinhood crashes Private AI Market Party: retail investors to get access to top AI startups 🤖💰 [what’s the value proposition here & why it’s interesting + bonus deep dive into Robinhood’s latest earnings]

The $400 billion problem nobody talks about: inside AI startup’s pitch to fix the internet 🤖🌐 [How Vibranium Labs is building the AI that prevents your 3 am wake-up calls 💤]

The 75% Problem, or How This AI Startup Raised $13M in One Week 💸🤖 [How ex-Monzo founders are automating the complex customer operations work financial services companies thought impossible 📈]

This AI startup simulated human behavior better than Claude and ChatGPT, then raised $5.35 million 🤖🧠 [inside Artificial Societies’ masterclass in conviction-driven fundraising & how to sell an impossible future]

As for today, here are the 3 fascinating FinTech stories that are changing the world of financial technology as we know it. This was yet another solid week in the financial technology space, so make sure to check all the above stories.

The West’s WeChat Moment, or OpenAI’s evolution from AI chatbot to the ultimate Everything App 😳📲

The BIG news 🗞️ $500 billion AI giant OpenAI just quietly launched group chats. At the core, this functionality within ChatGPT represents far more than just a collaborative feature - it marks a strategic inflection point in the company’s pursuit of becoming the Western world’s first true Everything App.

The capability allows up to 20 users to plan, brainstorm, and collaborate with AI assistance, initially rolling out in Japan, New Zealand, South Korea, and Taiwan.

Let’s take a closer look at this, understand why it could be huge, and what this means for the future of OpenAI.

More on this 👉 This release sits within a comprehensive ecosystem strategy that mirrors WeChat’s dominance in China.

OpenAI has systematically assembled the infrastructure for platform control:

An Apps SDK enabling native third-party applications within ChatGPT

The Atlas browser provides conversational web navigation

Sora’s video-generation social network and

Integrated commerce capabilities with Stripe aka Agentic Commerce Protocol (ACP).

Each component strengthens network effects and raises switching costs for the platform’s 800 million weekly users.

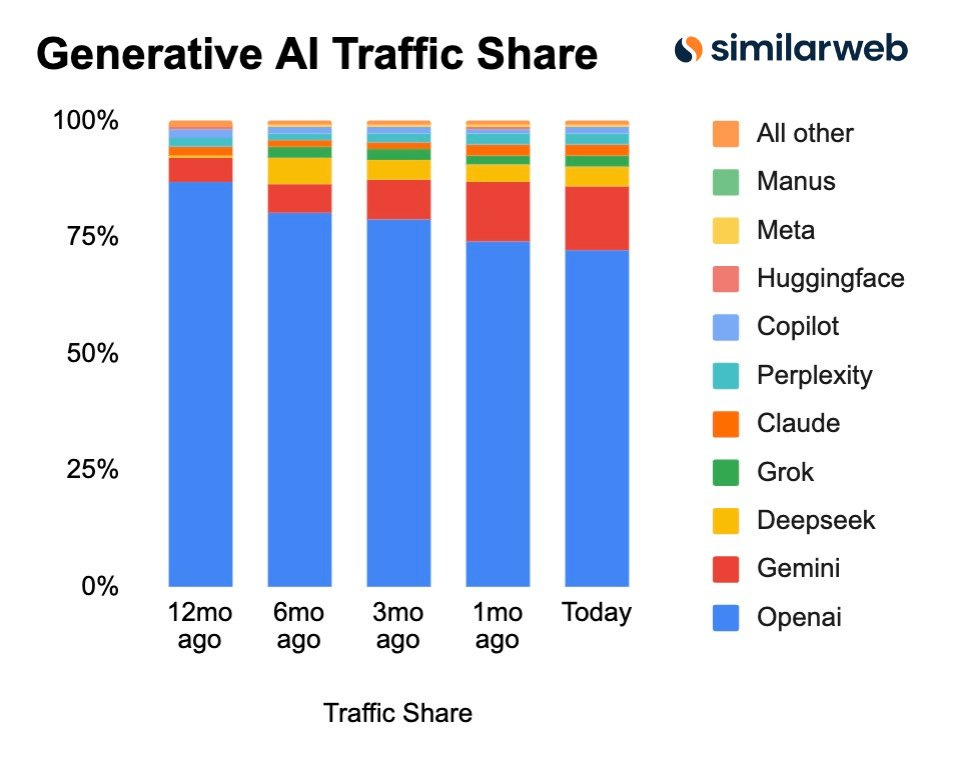

At the core, the strategic logic here centers on distribution rather than model superiority alone. While ChatGPT commands ~70% market share, competitors like Anthropic’s Claude and Google’s Gemini are narrowing performance gaps.

OpenAI’s defensibility thus increasingly derives from behavioral lock-in: stored memories, integrated workflows, custom applications, and now social coordination. All embedded in a single interface.

The company projects $20 billion in annual recurring revenue by year-end, though it faces $9B in losses for 2025.

Zoom out 🔎 This was about software. Now comes hardware.

OpenAI’s $6.5B acquisition of Jony Ive’s hardware venture brilliantly extends this vision to physical devices, hence positioning the company to own the complete stack from silicon to social interaction.

Of course, technical challenges remain, particularly around always-on AI behavior and profitability timelines, yet the velocity of execution - from browser to social network to collaborative tools - demonstrates systematic platform construction at unprecedented scale.

THE TAKEAWAY

What’s next? 🤔 First and foremost, we must note that OpenAI’s current trajectory presents quite a bit of food for thought (if we could call it like that 👀) for financial technology and the super app paradigms. Because ultimately, the integration of commerce protocols and payment infrastructure positions ChatGPT as a potential disintermediation layer for traditional financial services. When users can discover, compare, and purchase financial products through conversational interfaces - with AI agents handling transactions autonomously - conventional banking apps and FinTech platforms face existential pressure to justify a standalone existence. Zooming out, the Super App model’s migration to Western markets through AI-native interfaces fundamentally differs from what we’ve seen in Asia. Rather than building outward from messaging to services, OpenAI constructs inward from intelligence to transactions. Financial institutions must therefore decide whether to become ChatGPT-integrated services or maintain independent customer relationships at significantly higher acquisition costs. The company’s network effects compound rapidly: as more financial providers integrate, user dependency deepens, creating winner-take-most dynamics reminiscent of iOS and Android platform dominance. Of course, it’s also clear that the regulatory scrutiny will only intensify as OpenAI approaches payment rails and financial advice at scale. The growing convergence of AI reasoning, commerce infrastructure, and user data will raise more and more questions about fiduciary responsibility, algorithmic accountability, and competition policy that existing frameworks inadequately address. Most importantly, financial regulators will likely require more transparency into AI decision-making for transactions and recommendations, potentially fragmenting OpenAI’s unified experience across jurisdictions. And that’s exactly why companies like Oscilar* will become critical. They’re already building the invisible safety net - real-time fraud detection, agent verification, and contextual risk intelligence for the agentic era. Looking ahead, we can expect direct banking partnerships, embedded financial products within conversational flows, and AI agents autonomously managing portfolios and payments. This means that traditional financial institutions that fail to integrate will find themselves potentially & progressively marginalized as ChatGPT becomes the default interface for an entire generation’s financial decision-making. That said, the question now is no longer whether AI disrupts finance, but whether OpenAI specifically becomes the platform through which that disruption occurs.

*Disclaimer: I’m part of Oscilar.

ICYMI:

OpenAI’s integrated AI ecosystem: Browser, Payments, and Finance all converge in Agentic Commerce push 🤖🛍️ [how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside]

SoFi becomes the first nationally chartered bank to launch crypto trading 🤑📈

The news 🗞️ SoFi just became the first nationally chartered bank in the United States to offer direct cryptocurrency trading to consumers. SoFi Crypto represents a fundamental shift in how traditional banking institutions engage with digital assets, following regulatory clarity provided by the Office of the Comptroller of the Currency earlier this year.

Let’s take a look at this.

More on this 👉 The platform allows SoFi’s 12.6 million members to buy, sell, and hold dozens of cryptocurrencies, including Bitcoin, Ethereum, and Solana, directly within their existing banking app. Users can instantly fund crypto purchases from their FDIC-insured checking or savings accounts without transferring money to external exchanges, while uninvested cash continues earning interest in bank accounts.

This seamless integration addresses a key friction point that has historically separated traditional banking from crypto trading.

Zoom out 🔎 SoFi’s entry into this market comes at a pivotal moment. The company’s internal research reveals that 60% of its crypto-owning members would prefer transacting through a licensed bank over standalone exchanges, reflecting heightened consumer demand for institutional-grade security and regulatory oversight in the wake of industry volatility and high-profile exchange failures.

As a nationally chartered bank regulated by the OCC, SoFi can offer compliance standards and consumer protections that differentiate it from crypto-native platforms.

THE TAKEAWAY

What’s next? 🤔 At the core, this launch is all about the broader convergence between traditional finance and digital assets that will reshape the competitive landscape. For SoFi, crypto trading represents phase one of an ambitious blockchain strategy that includes launching a dollar-pegged stablecoin in early 2026, implementing Lightning Network-powered international remittances, and integrating digital assets into lending services. The company views blockchain as a transformational infrastructure layer that will make money movement faster, cheaper, and more accessible across its entire product ecosystem. Looking at the bigger picture, SoFi’s first-mover advantage creates competitive pressure on both traditional banks and crypto-native platforms. Major institutions, including Charles Schwab, Morgan Stanley, and PNC Financial, have also announced plans to launch similar offerings in the coming months, validating the strategic importance of integrated crypto services. However, SoFi’s digital-first architecture and vertical integration through its Galileo technology platform position it to maintain differentiation as competition intensifies. Looking ahead, as other financial institutions seek to enter this market, SoFi’s Galileo subsidiary can monetize its crypto infrastructure by providing payment processing, custody, and compliance capabilities to enterprise clients. This hence creates a dual revenue opportunity where SoFi benefits from both direct consumer adoption and business-to-business technology licensing. Expect accelerated mainstream adoption of crypto services within traditional banking over the next 12 to 18 months, driven by improving regulatory clarity and demonstrated consumer demand.

ICYMI: SoFi’s 3Q 2025: a FinTech unicorn executing on all cylinders, but valuation leaves no room for error 🦄📊 [breaking down their key 3Q 2025 numbers, understanding what they mean, what’s next & whether SoFi is worth your time and money in 2025 and beyond]

LendingClub went from FinTech disruptor to digital banking powerhouse 😤🏦 [deep dive into their 3Q 2025 earnings, breaking down the most important numbers, what they mean, and whether LendingClub is worth your time & money in 2025 & beyond + a bonus deep dive into SoFi inside]

Coinbase walks away from $2 billion stablecoin M&A 😳🪙

The (surprising) news 🗞️ Digital assets giant Coinbase has officially terminated its proposed $2 billion acquisition of BVNK, a London-based stablecoin infrastructure provider, marking a significant shift in the cryptocurrency exchange’s expansion strategy.

The deal, which reached advanced stages including exclusivity agreements and due diligence, was mutually abandoned this week, with both parties declining to disclose specific reasons for the decision.

Let’s take a look at this.

More on this 👉 BVNK, valued at $750 million following its December 2024 Series B funding round, processes over $20 billion in annual payments and serves enterprise clients including Worldpay and Deel. The proposed acquisition would have represented Coinbase’s second-largest deal after its $2.9 billion Deribit purchase completed earlier in 2025.

However, multiple factors appear to have contributed to the collapse, including potential due diligence discoveries, regulatory complexities across jurisdictions, and concerns about the substantial valuation premium.

Zoom out 🔎 The market responded negatively to the news, with Coinbase shares declining 4.1% to approximately $305, though the company maintains a market capitalization near $78 billion.

Meanwhile, BVNK remains free to pursue alternative strategic options, with Mastercard having previously expressed acquisition interest before pivoting toward competitor Zerohash.

THE TAKEAWAY

What’s next? 🤔 This development is all about the maturation of the stablecoin mergers and acquisitions landscape, where rigorous due diligence and regulatory scrutiny are tempering the aggressive deal-making that characterized 2024 and early 2025. The collapse suggests that buyers are prioritizing integration feasibility and sustainable valuations over rapid consolidation at any cost. For Coinbase, the decision preserves capital for organic development through its existing Circle partnership and Base blockchain infrastructure, potentially positioning the company for more targeted acquisitions with clearer synergies. Zooming out, the broader industry can expect traditional financial institutions like Mastercard and Visa to intensify their stablecoin infrastructure investments, thus creating increased competition for crypto-native firms while driving professionalization across the sector.

ICYMI:

ICOs 2.0, or Coinbase’s another step towards The Everything Exchange 🏦📈 [what their digital token offerings platform is all about, why it could be huge & what it means for the future of FinTech + bonus deep dive into Coinbase’s 3Q 2025 financials]

🔎 What else I’m watching

MoneyGram Partners with Oscilar for AI Risk Management 🔒 MoneyGram has partnered with Oscilar* to enhance its risk management infrastructure with real-time AI-driven intelligence. This collaboration aims to improve efficiency, agility, and performance across MoneyGram’s global network. Oscilar’s platform unifies fraud, AML, and compliance operations, enabling automated decision-making, real-time risk assessment, and enhanced customer experiences while reducing operational costs and complexity. *Disclaimer: I’m part of Oscilar. ICYMI:

PayPal Launches BNPL in Canada 🛍️ PayPal has introduced PayPal Pay in 4, an interest-free, no-fee buy now, pay later solution for Canadian shoppers. This service allows consumers to split purchases from $30 to $1,500 into four equal payments over six weeks, with no late fees or hidden costs. The launch is timed for the holiday season, aiming to provide flexible payment options and boost sales for businesses. Survey data shows strong consumer interest in BNPL options. ICYMI: PayPal’s Q3 2025: margin excellence is masking strategic vulnerability 🤔📊 [breaking down the key numbers, what they mean & whether PayPal is worth your time & money in 2025 and beyond]

JPMorgan and DBS Collaborate on Tokenized Deposits 🔗 JPMorgan’s blockchain unit, Kinexys, is partnering with DBS to create an interoperability framework for tokenized deposit transfers across different blockchain networks. This initiative, involving JPM Coin on Coinbase’s Base blockchain, aims to facilitate seamless cross-bank transactions and enhance the utility of tokenized deposits for institutional clients. ICYMI: JPMorgan’s Q3 2025: premium quality at premium prices demands patience 📊🏦 [breaking down their latest numbers, what they mean & whether JPM is worth your time & money + bonus reads on the banking titan inside]

💸 Following the Money

Charles Schwab has entered into a definitive agreement to acquire Forge Global in a transaction valued at approximately $660M.

Stripe-backed Tempo makes first venture bet with $25M investment in open-source dev team Commonware.

Seismic adds $10M from a16z crypto to expand fintech privacy network.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Couldn't agree more. This totally connects to your Agents 20 piece, seeing the 'everything app' future becoming so real. Your grasp on AI and FinTech is just brilliant Linas.

OpenAI's strategy to build inward from inteligence to transactions is fascinatng. The behavioral lock-in you mentioned through stored memories and integrated workflows creates switching costs that go beyond just model performance. When SoFi launches crypto trading at the same time OpenAI is integrating commerce, we're seeing the convergence you described play out in real time. The question of whether ChatGPT becomes the default interface for financial decision-making isn't hypothetical anymore.