PayPal to become PayPal Bank 📱👉🏦; Crypto just got the keys to the US banking system: 5 digital asset firms secure historic federal charters 🪙🏦; Europe’s latest decacorn 🇪🇺🦄

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

P.S. 🔒 This is the last weekly issue before the holiday break. We’re back next year, and the price goes up. If this has been useful, now’s a good moment to lock in the current rate ⏳

If you’re not a subscriber, here’s what you missed this week:

Top 25 Most Interesting AI Startups of 2025 (& Their Pitch Decks) 🤖🔥 [These startups are turning AI into revenue, leverage, & operational power, and they’re hiding in plain sight. Find who’s backing them, unlock their exclusive pitch decks & learn from the best]

The Ultimate List of Resources about Stablecoins 🪙 [your one-stop resource list for understanding the most disruptive force in global finance]

Agents 20: Top AI Agent Startups of 2025 🤖💸 [these AI Agent startups are defining 2025. Find who’s backing them, unlock their exclusive pitch decks, and learn from the best]

OpenAI’s App Store just launched, and it could be the Apple App Store moment for AI 🤖🛍️ [what it’s all about & why it could be huge + bonus deep dives into ACP & OpenAI’s quest to become the Super App of the West inside]

Inside Coinbase’s blueprint to become the Operating System for Global Finance ⚙️💸 [unpacking their System Update 2025 event, key new products/features and why they matter + bonus deep dive into Coinbase’s latest financials & their pitch deck teardown that started it all inside]

Klarna bets big on becoming the data backbone of AI-powered shopping 📊🛍️🤖 [what their Agentic Product Protocol is all about, how it stacks into the AI-powered tech stack, what to expect next + bonus deep dive into Klarna, Stripe and their ambition to own the full AI payments stack & 25 most interesting AI startups from 2025 and their pitch decks inside]

Visa bets big on stablecoins with launch of dedicated advisory practice 🧠💳 [what’s the USP here & why it’s brilliant + bonus deep dive into Visa & Mastercard & the ultimate list of stables resources inside]

SoFi becomes first US bank to issue public blockchain stablecoin 😳🪙 [what’s the USP here and what value will it unlock + bonus deep dive into SoFi’s latest financials & the ultimate list of stables resources inside]

Monzo’s biggest week overshadowed by boardroom battle over leadership and IPO strategy 🏦⚔️ [what’s happening, why it matters and what to expect next + bonus deep dive into Monzo’s biggest competitor Revolut inside]

The Ultimate List of 790+ Seed Funds 💰 [a curated, data-rich directory built to save you weeks of research and help founders get in front of the right investors, faster]

Inside Asseta AI’s pitch deck: how AI-powered family office startup is targeting the $4B market gap 💰📈 [Family offices control more wealth than Meta and Tesla combined. Most still manage it with Excel and fax machines, so Asseta AI just raised $4.2M to change that]

As for today, here are the 3 incredible FinTech stories that are transforming the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

PayPal to become PayPal Bank 📱👉🏦

The news 🗞️ FinTech pioneer PayPal PYPL 0.00%↑ has just filed applications with the Federal Deposit Insurance Corporation and the Utah Department of Financial Institutions to establish PayPal Bank, a Utah-chartered Industrial Loan Company.

At the core, this move marks a decisive pivot away from the payments giant’s long-standing asset-light strategy and positions the company to compete more directly with traditional financial institutions.

Let’s take a look at this, see why it could be huge, and what’s next for PayPal.

More on this 👉 The proposed bank will focus primarily on small business lending and interest-bearing savings accounts, building on PayPal’s existing track record of providing over $30 billion in loans and working capital to more than 420,000 businesses worldwide since 2013. Nice!

Mara McNeill, former CEO of Toyota Financial Savings Bank, has been appointed to lead the new entity as president.

Zoom out 🔎 The strategic rationale here centers on three imperatives.

First, PayPal currently relies on partner banks such as WebBank to originate loans, requiring the company to share revenue. An in-house bank would allow PayPal to capture the full net interest margin on its lending portfolio.

Second, access to FDIC-insured deposits provides a significantly cheaper source of funding compared to capital markets. Win-win.

Third, the timing aligns with a more favorable regulatory environment, as evidenced by recent preliminary approvals granted to cryptocurrency firms, including Circle and Ripple. ICYMI: Crypto just got the keys to the US banking system: five digital asset firms secure historic federal charters 🪙🏦 [why Circle, Ripple, BitGo, Paxos, etc. wanted to become national trust banks, what it unlocks & what’s next + bonus deep dive into Circle’s latest financials inside]

Notably, PayPal appears to be structuring the bank to avoid triggering the Durbin Amendment, which caps debit card interchange fees for institutions exceeding $10 billion in assets (this is basically how Chime is operating).

By limiting the bank’s scope to SMB lending and savings products while maintaining its consumer debit programs through external partners, PayPal can preserve its existing interchange revenue streams.

THE TAKEAWAY ✈️

What’s next? 🤔 First and foremost, this application reflects a broader trend of FinTech companies seeking banking capabilities to reduce dependency on third-party partners and unlock higher-margin revenue. If approved following an anticipated review period of 12 to 18 months, PayPal Bank could serve as a template for other payments and FinTech firms contemplating similar transitions. Looking ahead, the competitive landscape will likely only intensify as companies recognize that owning the banking infrastructure offers substantial economic advantages. However, regulatory scrutiny remains a meaningful hurdle, as organizations such as the Independent Community Bankers of America have historically opposed ILC charters for commercial entities. But if PayPal succeeds, we can expect accelerated consolidation between FinTech and traditional banking functions, thus fundamentally reshaping how financial services are delivered to consumers and businesses alike. Yet another reason to revisit PayPal stock… 👀

ICYMI: PayPal’s Q3 2025: margin excellence is masking strategic vulnerability 🤔📊 [breaking down the key numbers, what they mean & whether PayPal is worth your time & money in 2025 and beyond]

Crypto just got the keys to the US banking system: 5 digital asset firms secure historic federal charters 🪙🏦

The BIG News 🗞️ The U.S. Office of the Comptroller of the Currency late last week announced conditional approval for five cryptocurrency firms to operate as national trust banks, thus marking a pivotal moment in the integration of digital assets into America’s financial infrastructure.

Stablecoin giants Circle & Ripple, BitGo, Fidelity Digital Assets, and Paxos all received the approvals, with Circle and Ripple establishing new institutions - First National Digital Currency Bank and Ripple National Trust Bank, respectively - while the remaining three will convert existing state charters to federal ones.

Let’s take a look at this, understand why it matters, and what’s next.

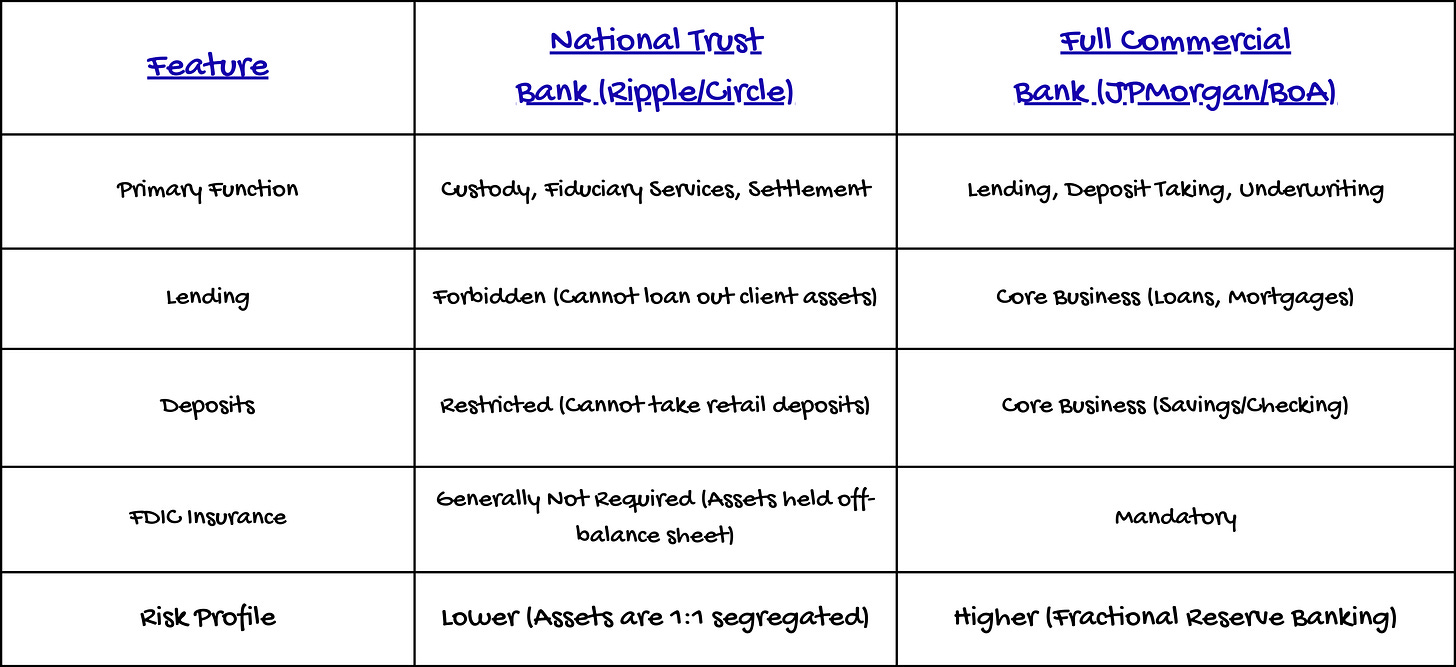

More on this 👉 These limited-purpose trust bank charters permit the firms to provide custody services, manage stablecoin reserves, and facilitate settlement, though they prohibit deposit-taking and lending activities.

The approvals follow the GENIUS Act, signed into law in July 2025, which created the first federal regulatory framework for payment stablecoins and expanded OCC authority over non-bank stablecoin issuers.

Comptroller Jonathan Gould emphasized that new entrants strengthen the banking sector by enhancing competition and expanding consumer access to innovative services.

The regulatory shift stands in stark contrast to the Biden administration’s approach, which prioritized enforcement following the FTX collapse.

Zoom out 🔎 The move carries significant implications for traditional financial institutions. Policy analysts noted that the “light-touch regulatory construct” signals increased competition for established lenders, who may soon contend with nimble, federally chartered crypto firms operating under different rules.

Several additional applications from Coinbase, Bridge Network, and Crypto.com remain pending.

THE TAKEAWAY ✈️

What’s next? 🤔 First and foremost, the conditional approvals position Circle and Ripple to further consolidate their dominance in the stablecoin market, where USDC and RLUSD already command substantial market share. Federal charters eliminate the friction of navigating fifty state regulatory regimes, enabling faster nationwide product deployment and potentially paving the way toward Federal Reserve master accounts - a development that would allow direct settlement with the central bank. Looking at the bigger picture, this integration also suggests a bifurcating stablecoin market: federally regulated coins will likely capture institutional and banking use cases, while offshore alternatives (think USDT here) may be marginalized within U.S. markets. That said, traditional banks now face a strategic choice between building competing infrastructure, acquiring newly chartered entities, or partnering with compliant issuers. The coming years will obviously reveal whether this regulatory acceptance accelerates stablecoin adoption or triggers consolidation that reshapes digital payments entirely. Watch out for this space!

ICYMI: Circle’s 3Q 2025: minting dollars while printing questions 🤔💸 [deep dive into Circle’s 3Q 2025, breaking down the most financial facts & figures, and whether it’s worth your time and money in 2025 & beyond]

Europe’s latest decacorn 🇪🇺🦄

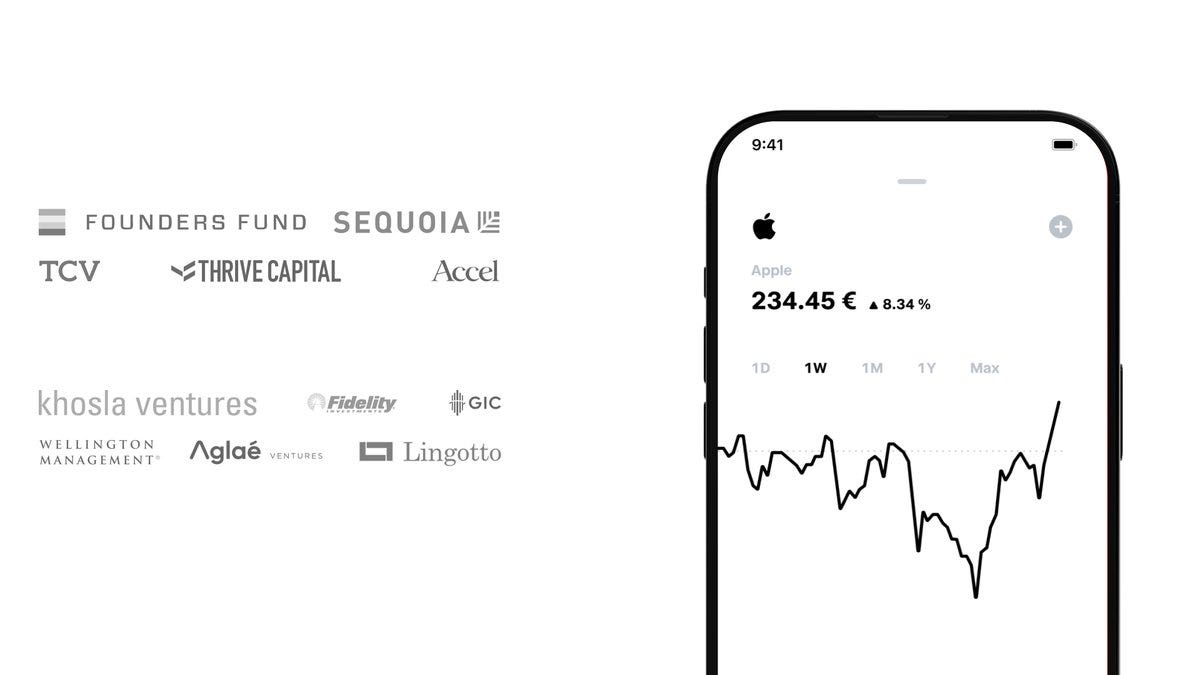

The news 🗞️ Berlin-based neobroker Trade Republic cemented its position as one of Europe’s most valuable private fintech startup following a €1.2 billion secondary share transaction that pushed its valuation to €12.5 billion.

The deal, which more than doubled the company’s 2022 valuation of €5 billion, attracted institutional heavyweights including Fidelity, Singapore’s sovereign wealth fund GIC, and Wellington Management, with Peter Thiel’s Founders Fund leading the round by increasing its existing stake.

Let’s take a quick look at this.

More on this 👉 The transaction’s structure reveals a company operating from a position of strength. Unlike traditional funding rounds that inject fresh capital, this secondary deal allowed early investors and employees to achieve liquidity without diluting company ownership. Trade Republic has remained profitable for 3 consecutive years, generating approximately €340 million in revenue through September 2024, which eliminated any operational need for new capital. Nice!

The company’s growth metrics underscore why institutional investors are betting heavily on its future.

→ Trade Republic now serves more than 10 million customers across 17 European countries and manages €150 billion in assets.

→ Remarkably, approximately 70% of these users are first-time investors, reflecting a broader cultural shift in European attitudes toward personal wealth building.

Zoom out 🔎 Chief Executive Christian Hecker has strategically positioned Trade Republic not as a speculative trading platform but as a solution to Europe’s looming pension crisis. By offering commission-free savings plans, fractional share investing, and competitive interest rates on cash deposits enabled by its full ECB banking license, the company appeals to long-term savers rather than day traders.

This differentiation has proven critical in building sustainable, sticky revenue streams.

THE TAKEAWAY ✈️

What’s next? 🤔 The shareholder restructuring suggests Trade Republic is likely preparing for a public market debut, likely within 18 to 24 months on either the Frankfurt or New York exchange. However, the company faces a significant challenge: the European Union’s impending ban on payment for order flow in 2026, which historically contributed roughly one-third of revenue. Management is already pivoting toward interest income, card fees, and potential subscription models to offset this impact. Looking at the bigger picture, Trade Republic’s success validates the thesis that mobile-first, low-cost investing platforms can achieve profitability at scale in highly regulated European markets. This milestone may accelerate consolidation in the neobroker sector while pressuring traditional banks to modernize their retail offerings, fundamentally reshaping how millions of Europeans build long-term wealth.

ICYMI: FinTech giants Robinhood & Trade Republic are breaking down private market barriers 📈💸 [key details on their recent initiatives, why they matter & why it could change the FinTech game + bonus deep dive into Robinhood, changes in capital markets & the ultimate PE toolkit inside]

🔎 What else I’m watching

Ani Tech Launches AI Command Center for Financial Advisors 🤖 Ani Tech has launched Ani Pulse, an AI-powered command center that autonomously manages daily operations for financial advisors. The platform prioritizes actions, provides real-time health checks, and reduces manual effort by over 75%. It is integrated with Plannr CRM and is available immediately for financial advice firms. ICYMI:

Coinbase Sues States Over Prediction Market Regulation ⚖️ Coinbase has sued Michigan, Illinois, and Connecticut to establish that prediction markets are regulated by the CFTC, not state authorities. The lawsuits follow Coinbase’s partnership with Kalshi and aim to prevent state intervention that could harm their operations. ICYMI: Inside Coinbase’s blueprint to become the Operating System for Global Finance ⚙️💸 [unpacking their System Update 2025 event, key new products/features and why they matter + bonus deep dive into Coinbase’s latest financials & their pitch deck teardown that started it all inside]

Visa Launches Stablecoin Settlement in the US 💳 Visa has launched stablecoin settlement in the US using USDC, enabling faster and more resilient transactions for issuers and acquirers. Initial participants include Cross River Bank and Lead Bank, with broader availability planned for 2026. Visa is also collaborating on Arc, a new blockchain by Circle, to enhance global commercial activity. ICYMI: Visa bets big on stablecoins with launch of dedicated advisory practice 🧠💳 [what’s the USP here & why it’s brilliant + bonus deep dive into Visa & Mastercard & the ultimate list of stables resources inside]

AI Agents Transform Christmas Shopping 🎄 Checkout.com’s research reveals that 47% of consumers plan to use AI agents for Christmas shopping in 2025, with younger demographics leading the trend. Consumers use AI to save money, avoid overspending, and save time, particularly for gift-related shopping. The data suggests that AI agents will become mainstream for routine purchases in 2026, though concerns about control and transparency persist. ICYMI: Stripe’s Agentic Commerce Suite signals a new era in AI-powered payments 🤖💳 [what it’s all about & why it’s huge, why FinTech giant’s strategy here is brilliant & what to expect next + bonus dive into Stripe’s quest to become the financial backbone of the AI economy & 100+ battle‑tested tools and frameworks to accelerate your AI projects inside]

💸 Following the Money

Stablecoin platform RedotPay has raised $107M in Series B funding, bringing the total capital raised in 2025 to $194M. ICYMI:

OnCorps AI, an agentic AI platform for fund operations, has secured $55M in growth capital from Long Ridge Equity Partners. ICYMI:

Tether is considering tokenizing its equity following a planned share sale that could raise up to $20 billion, Bloomberg reported.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

This is great, thank you! So much to unpack...