Stripe’s $140B price tag is IPO replacement, not IPO preview 🤑📈; The CFTC quietly made stables valid collateral for futures 😳🪙; MrBeast bought a bank for pennies on the dollar 🏦🐯

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The One-Person Unicorn 🦄 [I built an AI operating system to run a startup with Claude]

What to Build in 2026 🚀 [The startup ideas every top VC is funding right now, the pitch decks that worked, and how to build them]

AI Just Killed the User Interface 🧠🖥️ [Anthropic AI launched an app layer inside Claude, & it changed the role of SaaS entirely]

The Agentic Singularity 🤖🌀 [Deconstructing OpenAI’s operating system strategy and the eclipse of the application era]

Turn Claude From a Chatbot Into a Thinking Partner 🧠 [Most people prompt Claude like it’s Google. Here’s the framework Anthropic actually recommends]

Software Ate the World. Is AI Eating Software Now? 🤖 [Wall Street is pricing the death of SaaS when it should be pricing the death of the middleman]

The Institutionalization of FinTech 💳🏦 [Capital One bought Brex for $5B. Ramp is worth $32B. What happened? 🤔]

Robinhood: the $4.5 billion revenue dark horse that Wall Street still underestimates 🤷♂️📉 [deep dive into their Q4 & full year 2025 financials, what stands out, and why I’m still really bullish]

The billion-dollar quarter that changes the SoFi thesis 🤑📈 [deep dive into their most important Q4 2025 financial facts & figures, what they mean, what’s next & whether SoFi is worth your time and money in the years to come]

Shopify is the commerce OS that prints cash while building the rails for AI’s shopping revolution 🤖🛍️ [breaking down their latest most important financial facts & figures, understanding what they mean, and why Shopify should continue growing + deep dive into their UCP co-developed with Google & a competing protocol from Stripe & OpenAI]

Google’s Universal Commerce Protocol: the new default for how AI buys things 🤖🛍️ [2,000+ words dive into Universal Commerce Protocol (UCP), why it’s huge, how it changes everything, and how each player needs to adapt to the new AI-first economy + bonus list of top 10 AI startups to watch in 2026 & AI leader playbook inside]

Gemini ditches three continents to save its balance sheet 👋🇪🇺 [what does it tell us and what’s next + bonus deep dive into Gemini’s latest financials & whether it’s worth your time and money]

Top 10 AI Startups to Watch in 2026 🤖🦄 [Strategies, stories, and GTM blueprints from the fastest-growing AI companies that have collectively raised $500M+]

As for today, here are the 3 captivating FinTech stories that are transforming the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Stripe’s $140B price tag is an IPO replacement, not an IPO preview 🤑📈

The news 🗞️ FinTech giant Stripe has figured out how to be public without being public, and the market is pricing that in.

The payments company is arranging a tender offer at a $140 billion valuation, up 31% from its $107 billion mark last fall and well past its 2021 peak of $95 billion. Wow! 😳Bloomberg reported the news today, noting terms could still shift. Stripe declined to comment.

The company hasn’t raised primary capital since its $6.5 billion Series I in 2023, led by Thrive Capital. And honestly, it doesn’t need to. Stripe hit full-year profitability in 2024.

Let’s take a quick look at this.

More on this 👉 First and foremost, what matters here isn’t the number. It’s the mechanism. Since 2024, Stripe has run recurring tender offers as a standing liquidity program for employees and early investors. Co-founder John Collison told Bloomberg in January that Stripe is “still not in any rush” to go public.

At $140 billion, with regular secondary sales and no quarterly earnings calls to manage, the rush is hard to see. The tender offer isn’t a waypoint to an IPO. It’s becoming a substitute for one.

Zoom out 🔎 The valuation also reflects a specific bet on where Stripe is headed. 78% of the Forbes AI 50 run on Stripe. The company launched its Agentic Commerce Suite in 2025, co-developed with OpenAI, to handle payments initiated by autonomous AI agents. Its $1.1 billion acquisition of Bridge brought stablecoin infrastructure in-house.

Stripe is building the payment rails for a world where software buys things from other software, and it’s doing so while processing roughly 1.3% of global GDP through its existing stack.

That’s a completely different game to play.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, here’s what to watch. If Stripe can keep running tenders at rising valuations every six to nine months, it removes the single strongest argument for going public: employee liquidity. That changes the calculus for every late-stage company watching from the sidelines. The second-order effect is a growing class of $50B+ private companies that never IPO at all, with secondary markets becoming the de facto exit for early investors. The obvious losers here are investment banks waiting on IPO fees and public-market investors locked out of the best returns. That said, the question isn’t whether Stripe will IPO. It’s whether the IPO, as a default endpoint, still makes sense for companies that can engineer their own liquidity at will.

ICYMI: Stripe’s Agentic Commerce Suite signals a new era in AI-powered payments 🤖💳 [what it’s all about & why it’s huge, why FinTech giant’s strategy here is brilliant & what to expect next + bonus dive into Stripe’s quest to become the financial backbone of the AI economy & 100+ battle‑tested tools and frameworks to accelerate your AI projects inside]

The CFTC just quietly made stablecoins valid collateral for futures trading 😳🪙

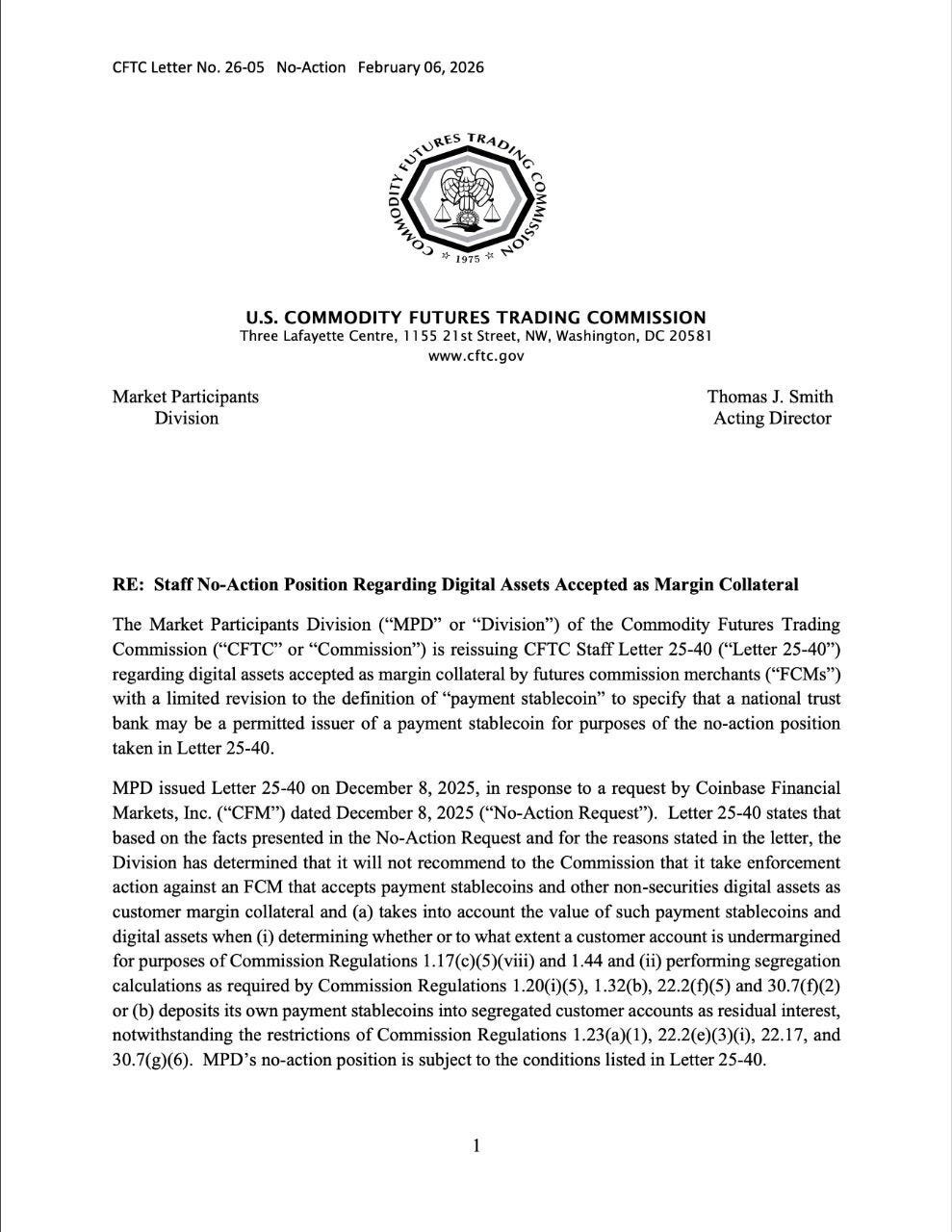

The news 🗞️ Five days ago, the CFTC made a small edit to a no-action letter that most people will overlook and shouldn’t.

Let’s take a look at this.

More on this 👉 On February 6, the agency reissued its December 2025 staff letter - originally numbered 25-40, now 26-05 - with a single targeted change: national trust banks chartered by the OCC now explicitly qualify as permitted issuers of payment stablecoins used as margin collateral in futures trading.

The original letter already lets futures commission merchants accept stablecoins (alongside Bitcoin and Ether) as customer margin without triggering segregation or undermargining violations. But its definition of eligible issuers referenced the GENIUS Act without clarifying whether OCC-chartered trust banks made the cut. Now they do.

Zoom out 🔎 The mechanics matter less than what they reveal about direction. The CFTC isn’t expanding what stablecoins can do in derivatives markets - it’s expanding who gets to play. And the “who” here is telling: national trust banks are OCC-regulated entities that handle custody and asset management without taking deposits. They sit at the intersection of traditional finance credibility and crypto-native operations.

Firms like Paxos and Anchorage, which already hold OCC charters, can now issue stablecoins that plug directly into cleared derivatives as collateral. That’s not a crypto story. That’s a capital markets infrastructure story.

The numbers frame the stakes. Global capital markets run on roughly $600 trillion in bonds, equities, and derivatives, with an estimated $27 trillion parked in idle nostro and settlement accounts. Stablecoins that settle on-chain in seconds, backed 1:1 by Treasuries or insured deposits, are a direct challenge to the SWIFT-and-waiting model that keeps that capital trapped.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, watch three things from here. First, expect a wave of OCC charter applications from fintechs that don’t want to be stuck in a “second-tier” state trust regime. Second, watch whether the FDIC extends any deposit insurance framework to stablecoin subsidiaries of trust banks - that’s the real unlock for institutional comfort. Third, remember this is still no-action relief, not rulemaking. The GENIUS Act’s full regulatory framework is due by July 2026. If permanent rules land close to where this letter sits, stablecoins won’t just be accepted in TradFi. They’ll be expected. Stablecoins are eating the world.

ICYMI:

MrBeast bought a bank for pennies on the dollar. PayPal should be paying attention 🏦🐯

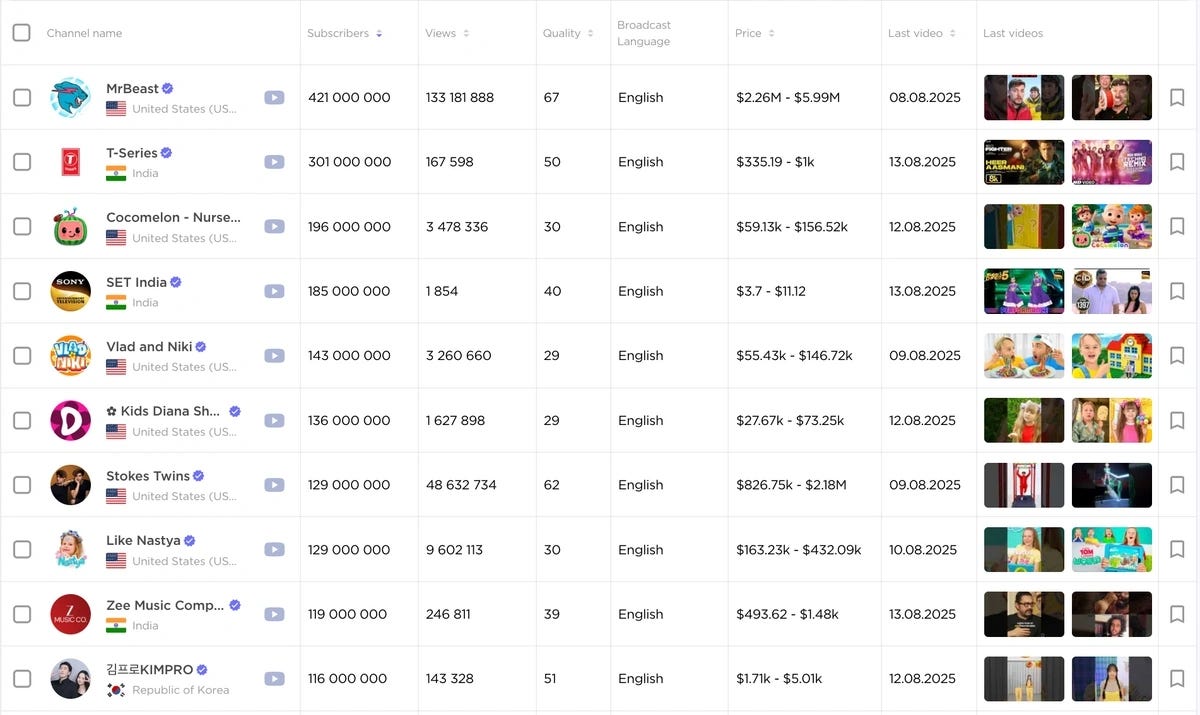

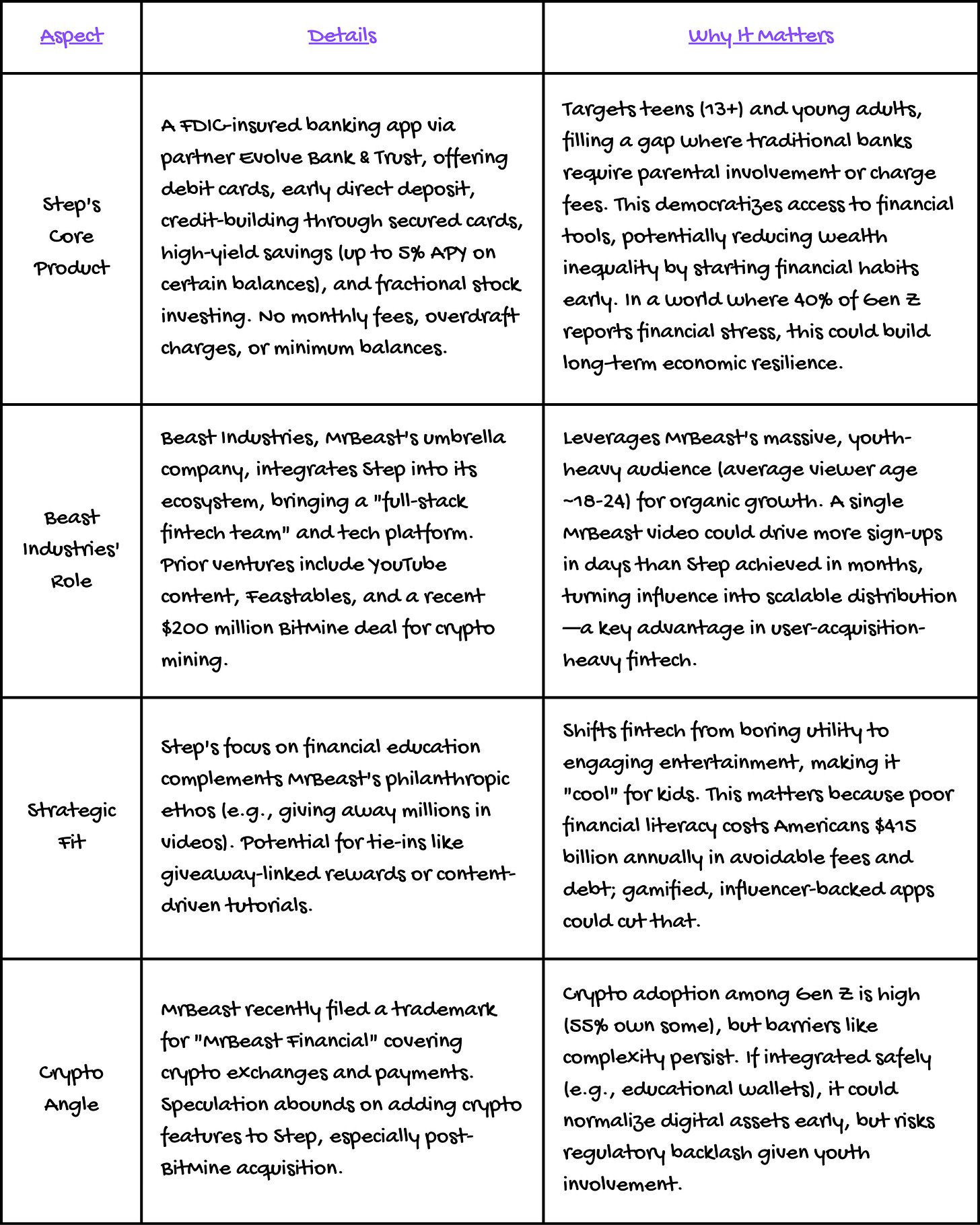

The news 🗞️ The most expensive thing in fintech isn’t technology. It’s acquiring a young customer who will stick around for decades. MrBeast just bought 7 million of them 😳

Beast Industries, the $5.2 billion company behind YouTube’s biggest creator, announced yesterday it acquired Step, a teen-focused banking app, for what market observers estimate was under $200 million. Step raised $175 million in equity at a roughly $920 million valuation in 2021, plus $300 million in debt. The markdown tells the fintech downturn story in miniature, but the buyer is what makes the deal interesting.

Let’s unpack this, understand what this deal is really all about, and what to expect next. Both for MrBeast venturing into finance, and the broader fintech space.

More on this 👉 MrBeast brings 466 million YouTube subscribers, most of them aged 18 to 24. That’s not a marketing channel. That’s a distribution moat. A single video could drive more sign-ups than Step managed in quarters of paid acquisition.

Beast Industries CEO Jeff Housenbold, formerly of SoftBank’s Vision Fund, was blunt about the strategy: “We’re taking that fire hose of attention and pointing it at our consumer products and services division.”

Step will run standalone for now, but the company has already filed a trademark for “MrBeast Financial” covering crypto, advisory services, and payments.

ICYMI: Would you trust a YouTuber with your money? MrBeast bets 445M followers will 📺💸 [what’s the USP here, what it tells us & what to expect next]

Zoom out 🔎 If you’re PayPal, this deal deserves more than a passing glance. PayPal has spent years trying to make Venmo a primary financial relationship for younger users, pushing debit cards, direct deposit, and credit products with mixed results.

The problem was never the product. It was relevance. Teens don’t form banking habits because an app has good APY; they form them because someone they trust told them to. PayPal spent $1.2 billion acquiring Honey in 2019 to get closer to younger consumers through commerce. MrBeast got closer to them for a fraction of that, and he already had their attention.

And that’s a massive difference.

THE TAKEAWAY ✈️

What’s next? 🤔 Looking ahead, if this works, every creator with a nine-figure audience becomes a potential acquirer of distressed fintech infrastructure. The 2021 vintage of neobanks, flush with users but starved of growth capital, suddenly has a new exit path. PayPal and its peers won’t just compete with each other for Gen Z wallets. They’ll compete with whoever those wallets already follow. That said, the regulatory picture is genuinely unresolved. Step is FDIC-insured through Evolve Bank & Trust, which keeps Beast Industries out of the charter business for now. But the MrBeast Financial trademark filing from October covers crypto exchanges, microloans, and investment management. The SEC has already been tightening oversight of financial influencers, and a creator with half a billion followers launching deposit-taking and investment products will force regulators to decide where personal brand ends and fiduciary duty begins. No existing framework was built for this. More importantly, the deeper question is whether creator-led distribution actually improves financial outcomes or just accelerates sign-ups. MrBeast’s philanthropic brand and Step’s financial literacy tools suggest good intentions. But gamified savings challenges and viral giveaways sit uncomfortably close to the engagement tricks that got other fintech apps in trouble with the CFPB. The gap between “making finance fun for teens” and “exposing minors to inappropriate financial products” is narrower than most pitch decks admit. Watch what the first MrBeast-branded Step promotion actually looks like. That will tell you whether this is a financial inclusion story or a customer acquisition story wearing one as a costume.

What else I’m watching

Westpac Adopts Microsoft Copilot 🤖 Westpac is rolling out Microsoft 365 Copilot to its global workforce, following a successful pilot in Australia. The AI assistant aims to accelerate work and support customers. The bank is providing AI education courses and has introduced Copilot Studio and an innovation sandbox on Microsoft Azure. ICYMI:

AI Tools Impact Financial Stocks 📉 Shares in wealth management firms and financial comparison sites have tumbled due to concerns about new AI tools. Altruist Corp’s service for personalized tax strategies and Insurify’s tool for comparing car insurance quotes have led to significant drops in share prices for companies like St James’s Place, Quilter, AJ Bell, Moneysupermarket, and Go. Compare. This follows declines in legal and data publishing firms after Anthropic unveiled a tool to automate legal work. ICYMI:

BBVA Joins Euro Stablecoin Venture 💶 BBVA BBVA 0.57%↑ has joined Qivalis, a bank-backed joint venture aimed at creating a euro-pegged stablecoin to facilitate secure and efficient payments between banks using blockchain technology. The consortium includes major European banks and is awaiting authorization from the Dutch central bank. The stablecoin aims to offer new payment solutions and settlement of tokenized financial assets. The commercial launch is planned for the second half of 2026. ICYMI:

💸 Following the Money

Anchorage Digital, America’s first federally chartered crypto bank, announced a $100M strategic equity investment from Tether.

UK digital savings and mortgage platform Tembo has raised £16M in growth investment.

Porters, a European startup specialising in AI-powered banking operations automation, has secured €2.7M in pre-seed funding to transform how financial institutions handle mission-critical back-office processes.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

The Stripe tender offer model is worth watching. If more large private companies follow suit, it changes how liquidity flows through the system.

Stables are indeed here to stay...