The mindblowing collapse of FTX-linked stocks 🥶; Is Binance having an FTX moment? 🤯🤯🤯; Checkout.com’s valuation cut by 72% 😳

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Visa knows that Africa is the world's next superpower. You should pay attention too💡

Walmart is going deeper into FinTech & bringing BNPL product in-house 👀

Galileo's latest feature proves what many still ignore about BNPL🚨

Microsoft & London Stock Exchange — a marriage made in Heaven? 🤔

Mastercard & Marqeta are making a major push into B2B payments 🚀

As for today, here are the 3 FinTech stories that were making a massive difference this week. It was one of the most intense and wild weeks this year so far, so definitely check out all the above stories.

The mindblowing collapse of FTX-linked stocks 🤯

Following the money 💸 The sun was just beginning to rise again when the new reports started to emerge. The contagion continues 😷

I have written quite a few times about how big FTX’s tentacles are 🦑 In addition to hundreds of startups and some of the most prominent crypto firms, they apparently got to stocks too. FTX-linked stocks, which had been on a seemingly unstoppable rise, are now collapsing in a mindblowing display of market turbulence.

One by one 👀 The elephant in the room - Silvergate Bank SI 0.00%↑. The largest crypto bank in the US and one of the few allowing customers to move fiat currencies onto crypto exchanges, has lost a whopping 60% of its value since the start of November, according to Kaiko. For the perspective, earlier this year, Silvergate managed more than $16B in assets (up from less than $1B in 2019, so 16X growth 😳).

In case you missed it, Silvergate was accepting FTX and Alameda deposits and processing wire transfers for companies and individuals to the exchange. It was heavily criticized for that, and now it seems that the market is punished it badly.

As you can see from the above graph, Galaxy Digital and CoinShares, which both had a multi-million exposure to the fallen exchange, are also down quite a bit (35% to be exact). Yet, they have seen their share prices stabilize in December while Silvergate is still in freefall. Ouch 🤕

Zooming out 🔎 But it’s not only the companies that had a direct or close relationship with a fallen FTX that are suffering. In essence, pretty much every public company that has exposure to cryptocurrency is down, and often down badly. Examples here could be the regulated lenders with ties to the crypto industry such as Provident Bancorp PVBC 0.00%↑ and Signature Bank SBNY 0.00%↑. They recently announced losses and plans to significantly reduce their crypto exposure.

This isn’t surprising at all given both banks are down around 60% in the public markets. For the perspective, that’s 2-4X more than traditional, old-school banks (though, even they have some exposure to crypto i.e. JPMorgan JPM 0.00%↑). That tells you a lot.

✈️ THE TAKEAWAY

So what does this mean? 🤔 First and foremost, we already know that FTX's sudden collapse presents a larger reputational problem for crypto. Then there’s also a crypto contagion risk stemming from the meltdown (that’s already happening though on a somewhat small scale now). More importantly, as you can see from the above-presented cases, FTX has clearly sent shockwaves through the traditional financial world too, especially those with direct exposure to crypto. Billions of dollars had been wiped out in a matter of days and months. The worst part? The situation might only worsen before it gets better.

Bonus: The FTX story just keeps getting crazier 😳

In case you missed it: The FTX story is getting wilder and wilder 🤯

FTX is much worse than anyone imagined 🤯🤯🤯

The aftermath of the FTX collapse could be bigger than the earthquake 🌋

Contagion of contagion, or how Genesis could cause Crypto Armageddon 😳

WTF: Binance walks away from FTX takeover 😳🥶

Is Binance having an FTX moment? 🤯🤯🤯

BREAKING: Binance?🔥 Since FTX went out of business, more and more attention and public spotlight have been put on Binance, the dominant (a monopoly?) crypto exchange in the world. Even with FTX in place, it was already big, but now it’s an absolute beast.

So what’s happening with Binance? Are fears that it might follow the path of FTX rational? What’s up with all the FUD? Let’s take a look at it and find out.

More on this 👉 Here are the most important developments and revelations about Binance that happened in circa one week.

Let’s set some context first. Since FTX filed for bankruptcy, over 80% of Bitcoin trading volume has consistently occurred on Binance. That’s how massive it is.

Former paid spokesperson of FTX, Kevin O’Leary, blamed Binance for the collapse of FTX. That’s clear BS.

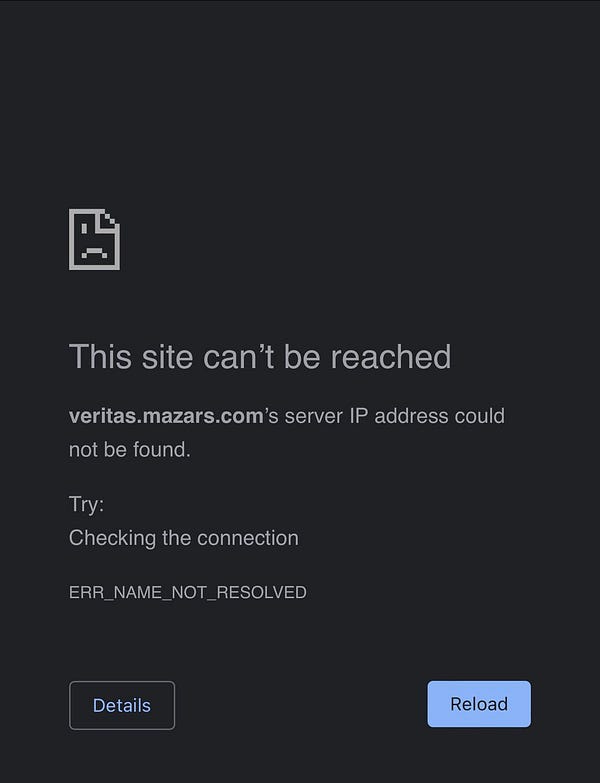

PoR. Last week, to calm the market Binance released the long-awaited proof of reserves. It was performed by the global financial audit, tax, and advisory firm Mazars and showed that Binance's reserves are overcollateralized. Yet, today the same firm Mazars has deleted the proof of reserves from its website. In addition to that, Mazars is pausing all work with Binance and its other crypto clients. Seems like a major red flag to me 🚩

See how their site looked before and after the nuke:

Although on-chain analysis indicates that the PoR data might be correct…

You should still be cautious and take it with a grain of salt. Because at the end of the day, without proof of liabilities, this is rather meaningless. Michael Burry has a good analogy here:

Withdrawals. Because of the above, lots of Binance users started to take their money off the exchange. Many speculated it could cause a bank run on Binance. But let’s look at the data.

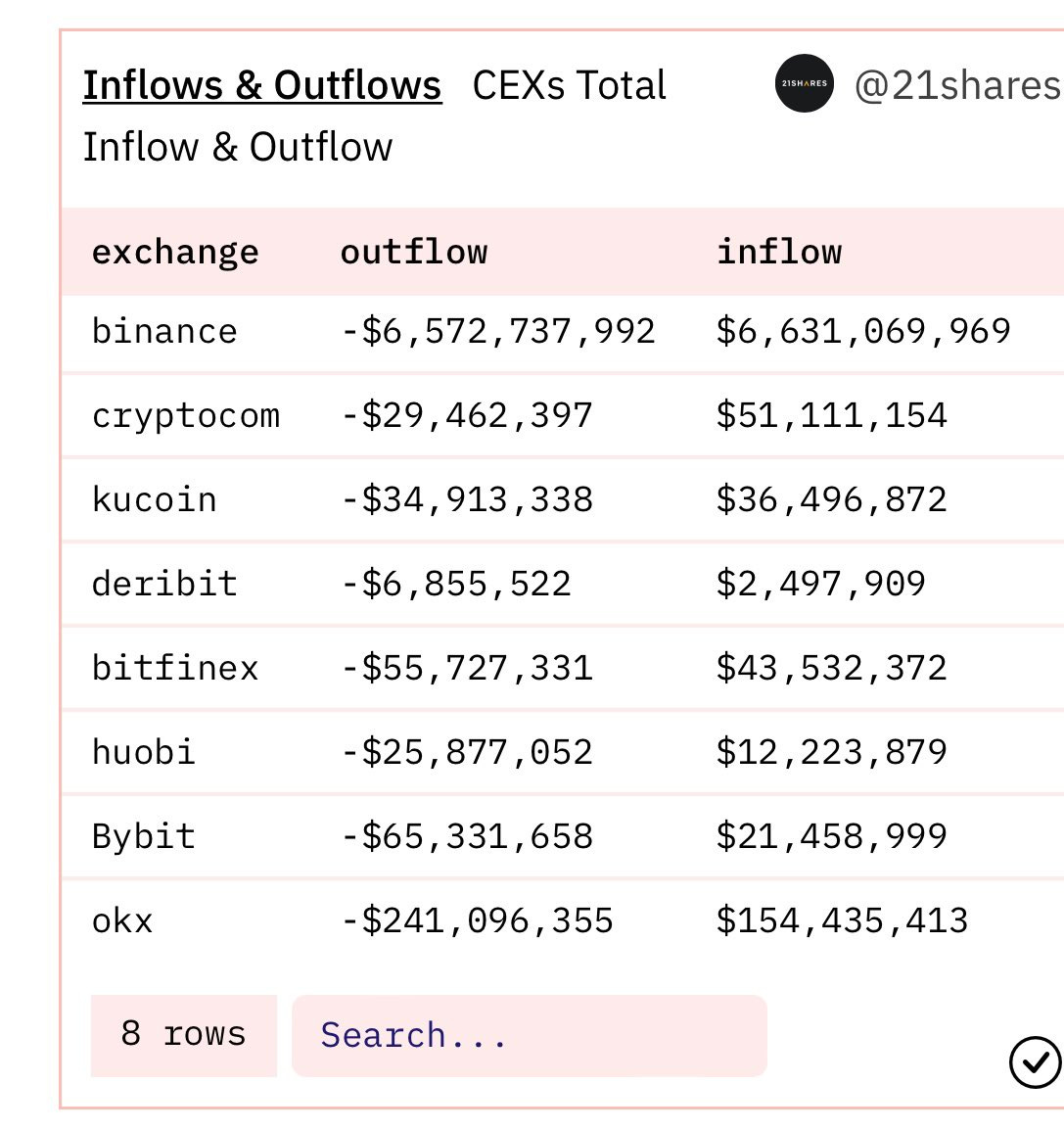

A few days ago, has been processing $6B in withdrawals per day. They also processed $6B in deposits from their wallets to pay everyone. Now that number is reportedly $8-10B:

If that wouldn’t be enough, on Monday, Reuters reported that U.S prosecutors are considering criminal charges against crypto exchange Binance and individual executives, including founder and CEO Changpeng Zhao.

The Department of Justice has also discussed possible plea deals with Binance's lawyers, the report added.

Finally, Binance CEO CZ has been acting quite strangely on TV and on Twitter, showing similar traits to FTX’s SBF and Alex Mashinsky of Celcius. Here’s one interview that didn’t go very well:

✈️ THE TAKEAWAY

What does this tell us? 🤔 Let’s be honest - there are a ton of red flags out there, and given all the circumstances and surprises that 2022 has brought us, you can never be too safe. Especially right now. So if there’s any advice I can give you it’s this - take your crypto off the exchange. Doesn’t matter which one is it, but you better be safe than sorry. Zooming out, we must note that Binance has just dealt with circa $10B withdrawal stress test in about a week and is still operating. This amount would have certainly put every single exchange out of business. That tells you something. BUT… When you really think about it, this situation still seems like a classic scenario for crypto exchanges: everything is fine, users and assets are safe until they are not. So, let’s watch this closely and be very careful. If Binance survives this (and I really hope so as they have onboarded more people to crypto than anyone else out there), they will definitely become even stronger.

Bonus: Binance wants to be your Crypto Bank 🏦

Checkout.com’s valuation cut by 72% 🤯

The news 🗞 One of Europe’s most valuable FinTechs Checkout.com has just slashed its internal valuation to $11 billion. That’s a massive drop compared to the $40B price tag that the company reached a little less than a year ago.

For context, Checkout.com in January almost tripled its value to external investors to $40B on the back of a whopping $1B Series D funding round.

More on this 👉 According to Financial Times, the payments FinTech is doing the adjustment in an effort to galvanize the workforce. The firm thus is lowering the price at which employees can exercise their stock options (and effectively - the potential upside), from $252 a share to $65 a share under the new internal tax valuation - which is separate from the investor-determined valuation

In that sense, Checkout.com seem to be similar to payments giant Stripe (which is also Checkout.com’s competition). The latter this summer lowered its own internal valuation to around $74B from $95B.

✈️ THE TAKEAWAY

What does this mean? 👀 In short, not much. This year more than in any prior year we have learned that valuations are mostly vanity metrics. Zooming out, this move together with Klarna’s valuation collapse is the ultimate illustration of how brutal 2022 was for startups. Especially those in FinTech. But there’s a reason for that, so let’s look at some numbers. According to currently available data, Checkout.com’s $40B valuation implied a whopping 79x multiple on its estimated 2020 global revenues. That’s pretty nuts when you think about it… Meanwhile, FinTech giant Adyen, whose performance is a useful barometer for making sense of this multiple, was trading at a roughly 39x revenue multiple at the time. With that in mind, a 39x multiple for Checkout.com would suggest a valuation of $9.87B. Seems pretty close to where we are now 🙃 Expect more companies to follow this route. Otherwise, layoffs, M&As, and bankruptcies are inevitable.

Bonus: Stripe slashes internal valuation from $95B to $74B 🤯 What does it mean?

🔎 What else I’m watching

Transaction business 💸 Crypto exchange giant Binance generates 90% of its revenue from transaction fees, CEO Changpeng Zhao said in an interview with TechCrunch. Zhao added that Binance had removed all ads from the data site CoinMarketCap, which it acquired in 2020, to make for a cleaner experience. "We can turn that back on, that’ll give us $40M a year. But we don’t need to today," Zhao said. It is estimated that Binance had about $20B in revenue in 2021, according to a Bloomberg analysis. So DeFi is the ultimate Binance killer then? 🤔 Read this and decide.

Crypto, corruption & EU🇪🇺 Eva Kaili, one of crypto's biggest fans in the European parliament, was arrested in a corruption probe involving Qatari influence peddling. Kaili, vice-president of the parliament, was expected to lead the European Parliament’s report on NFTs and contributed to the DLT Pilot Regime project, launching in March, as per The Block. She has played a major role in shaping policy on crypto assets and blockchain since 2018. Seems it’s always about the money…

💸 Following the Money

Shibuya, a decentralized video platform co-founded by Emily Yang, aka. pplpleasr, raised $6.9M in seed funding.

9fin, an analytics platform for debt capital markets, has announced a $23M Series A+ led by new investor Spark Capital.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: