Another weekend, another bank is on the brink of collapse 😳; Revolut's valuation suffers a serious blow 🤯; Adyen & Olo deal is what partnerships in FinTech are all about 🚀

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

2023 Outlooks & Updates from Top Investment Banks & Investment Managers [hundreds of pages of value + most interesting takeaways]

JPMorgan has built its own ChatGPT for Finance 😳 [this is super interesting + how generative AI will disrupt Finance forever]

Shopify’s quest to be a single-stop FinTech for merchants 🛍 [it’s a FinTech giant you must pay serious attention to!]

As for today, here are the 3 FinTech stories that were transforming the world as we know it. This week was the hottest week in the financial technology space this month thus far, so make sure to check all the above stories.

Another weekend, another bank is on the brink of collapse 😳

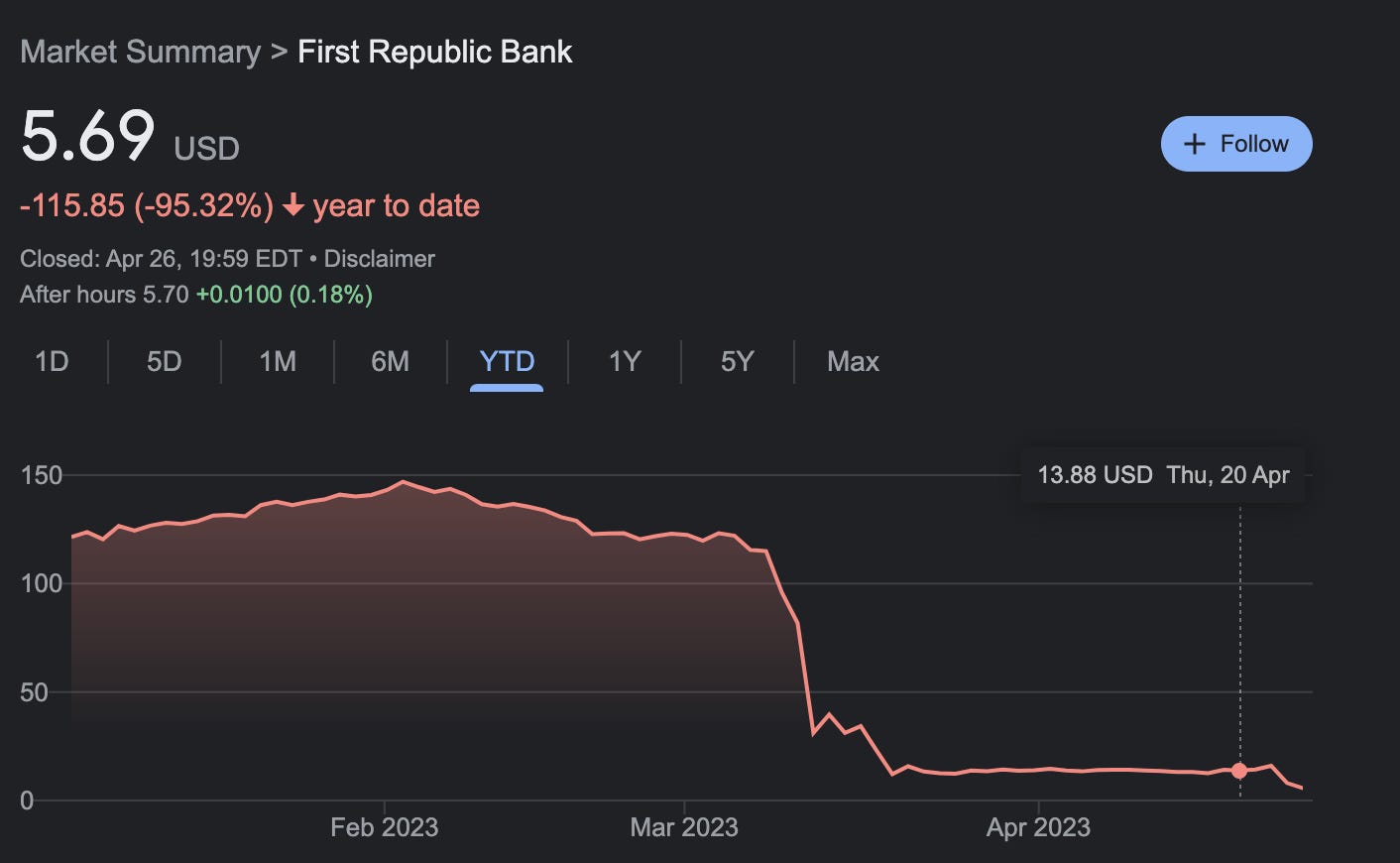

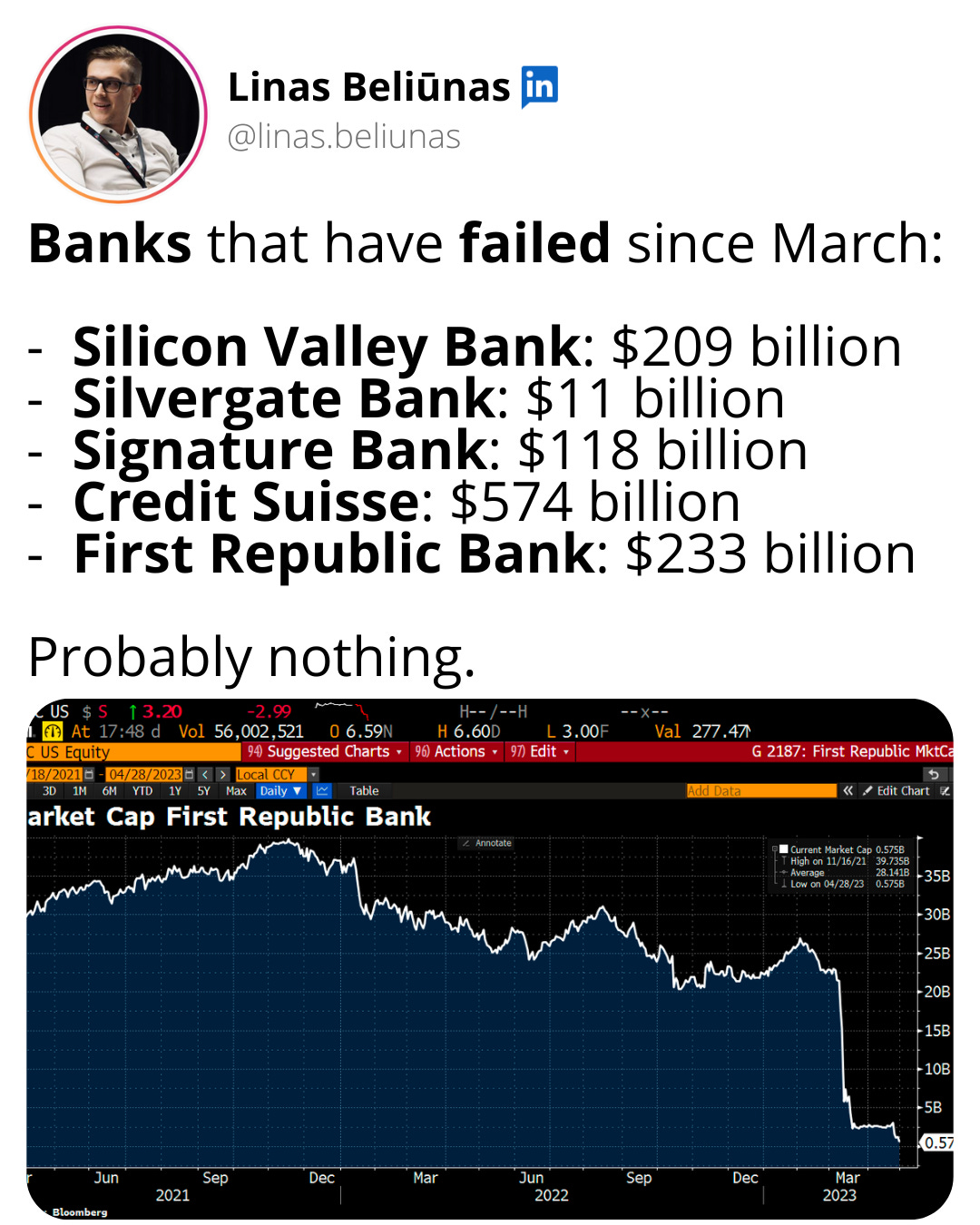

The news 🗞 First Republic Bank’s FRC -71.92%↓ market value plunged below $1 billion for the first time ever after a report said the US government was unwilling to intervene in the rescue process, hammering the lender’s stock.

First Republic Bank shares have fallen by more than 95% since the beginning of the year. Wow 🤯

How we got here? 🤔 On Monday, First Republic disclosed that it had lost about $100 billion in deposits in the first quarter, following the collapses of Silicon Valley Bank and Signature Bank. That prompted a group of 11 big banks to deposit $30 billion with First Republic last month in hopes of stabilizing it. It didn’t help.

The reason it didn’t help was that FRB’s issues are much bigger. First Republic specialized in making huge mortgages, often at low rates, to wealthy borrowers, and that business model no longer works, as per WSJ. Now the bank is sitting on a pile of loans that are mispriced for the current interest-rate environment.

And that’s a problem with no easy solution.

Zoom out 🔎 Once you zoom out, this draws one unpleasant parallel. If First Republic becomes the first bank the Fed is going to allow to fail, that’s basically the deja vu of Lehman Brothers…

Time is ticking 💣 Hence, US regulators are now racing to find a buyer for FRB before the markets open on Monday in a bid to end the banking crisis. JPMorgan JPM 0.00%↑ and PNC PNC 0.00%↑ are the most likely bidders.

ICYMI: JPMorgan is the Microsoft of Banking 😎

The next 24 hours are going to be monumental, and we might see another shotgun wedding in just two months.

Worrying.

✈️ THE TAKEAWAY

Looking ahead 👀 One must remember that at its peak in November 2021, First Republic had a market cap of more than $40 billion. Right now, FRB is nearly worthless in its current state and it’s hard to see any good outcome out of this. Looking at the big picture, we need to remember that Silicon Valley Bank was the 16th largest bank, and when it failed it was the second-largest bank failure in US history. First Republic Bank was the 13th largest bank with $200B in deposits, and it is about to fail. Here we go again 🤷♂️

ICYMI: The banking crisis is far from being over 🏦

Revolut's valuation suffers a serious blow 🤯

The (expected) news 🗞 Investment bank Schroders has slashed the valuation of its shareholding in Revolut by almost half after the firm was criticized for downplaying red flags from auditors BDO over its revenue statement, Finextra reported.

Founded in 1804 and based in London, Schroders manages nearly $1 trillion of wealth and investments across public and private markets.

More on this 👉 In a regulatory filing, the Schroders Capital Global Innovation Trust devalued its investment in the (neo)bank by around 46%. Schroders invested at the market peak in Revolut’s $800M Series E round in 2021.

The Trust said the value of its stake on 31 December 2022 was £5.4M, compared with £10.1M on 31 December 2021. This implies a similar reduction in the bank's valuation from $33 billion to $17.7 billion. Ouch 😳

✈️ THE TAKEAWAY

What does this mean? 🤔 Schroders’ actions come just 6 weeks after Revolut filed its much-delayed financial accounts and just 4 weeks after I argued that there’s no way Revolut is worth $33 billion right now. Here’s what I said back then:

I’m pretty confident we should see a solid correlation (30-50%) if Revolut raises anytime soon.

Well, Revolut didn’t raise any external capital but devaluation happened regardless. On top of that, we must remember that earlier one of the world’s leading secondary brokers, Setter Capital, also has Revolut holdings listed at a discount of more than 50%. Looks like nature is healing.

ICYMI: There’s no way Revolut is worth $33B now 🙅🏽♂️

Bonus: N26 is unbelievably overvalued 🤯

Adyen and Olo deal is what partnerships in FinTech are all about 🚀

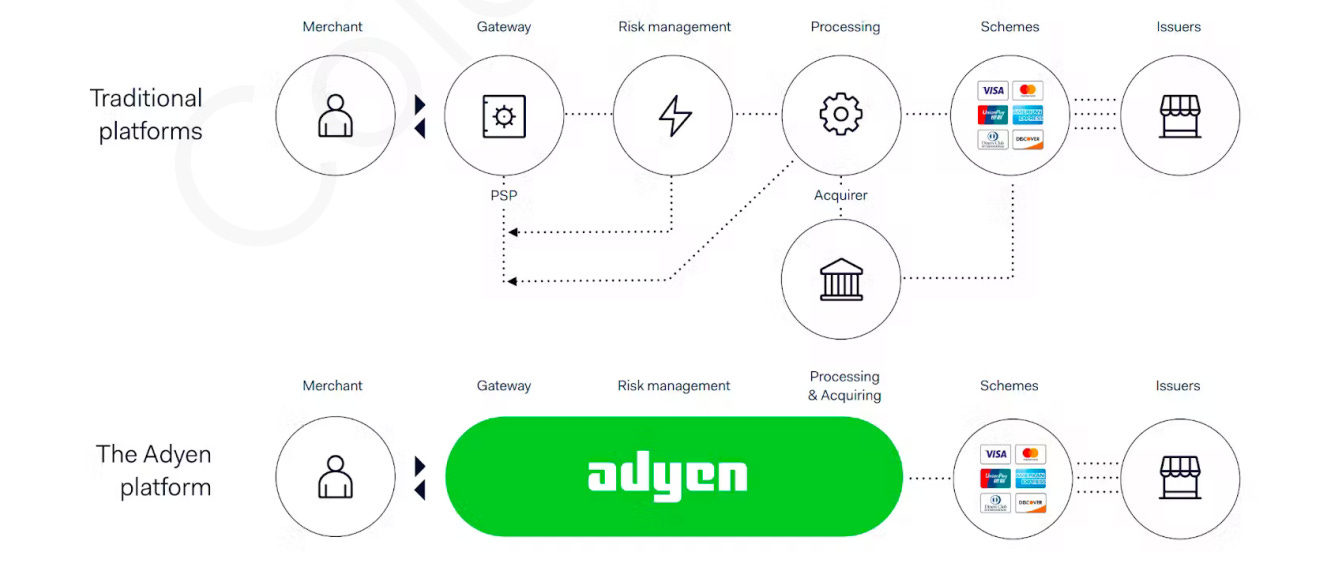

The deal 🤝 Dutch FinTech giant Adyen has partnered with the SaaS platform for restaurants Olo to help restaurant brands consolidate payments, apply for capital, and manage cash flow.

More on this 👉 Olo Pay is Olo’s modern payment tech-stack purpose-built for restaurants that provides fraud and chargeback features while aiming to increase conversion rates, with the service having processed up to this point digital payments of the likes of online orders, QR code order-at-table, and mobile wallets.

By collaborating with Adyen, Olo Pay is going to enable its customers to accept and oversee digital and in-store payments alike from the same Olo platform leveraged to manage the remaining of their business.

✈️ THE TAKEAWAY

A win-win 🤝 Adyen and Olo deal is what partnerships in FinTech are all about. For Olo, it further strengthens their positions as the ultimate SaaS platform for restaurants (the biggest competitor to Square? 👀). When it comes to Adyen, the deal will further expand the FinTech giant’s reach in the hospitality sector. Looking ahead, by adding embedded financial services such as Capital, Accounts, and Card Issuing in the future, both firms would be able to build additional revenue streams, grow customer stickiness and reduce churn. We need more stuff like this across the board.

ICYMI: Adyen is the fastest-growing global payments platform 🚀 [deep dive into the FinTeh giant + 2 more reads]

🔎 What else I’m watching

France doubles down on crypto 🇫🇷 Existing crypto companies could get a “fast-track regime” to new European crypto rules, France’s Financial Markets Authority said in a Friday statement. France recently toughened its crypto registration procedures in the wake of crypto exchange FTX's collapse and in preparation for the European Union’s Markets in Crypto Assets law. The European Parliament voted in favor of MiCA last week, and the rules are set to take effect starting around July 2023. There will now be “consideration of a possible fast-track modular licensing" between France’s existing regime, known as PSAN, and MiCA, which includes much tougher governance, consumer protection, and financial stability rules, the AMF said. Reread: The landmark EU crypto regulation has officially been passed 🇪🇺

India📍Crypto company Gemini is set to expand to APAC and will open its first office in Gurgaon, India, despite the country’s reticent policy efforts around crypto assets. Gemini’s global CTO, Pravjit Tiwana, will also be taking on the responsibility of APAC CEO for the company. In this position, Tiwana will be leading new product launches from the region and ensuring financial stability. The crypto exchange claims to have “big plans” for the APAC region. We must remember that the news comes after Gemini’s former partner Genesis filed for bankruptcy and both companies were charged by SEC for offering and selling unregistered securities over the Earn product. Reread: India is the Next BIG Thing 🇮🇳🚀

We had enough! 🥊 That’s what crypto exchange Coinbase is saying. Coinbase sued the U.S. Securities and Exchange Commission so that the SEC would respond to a months-old petition asking whether the securities regulator would allow the industry to be regulated using existing SEC frameworks. Remember: Coinbase’s Bermuda Triangle 🇧🇲

💸 Following the Money

S&P Global and Coinbase Ventures have joined a $6M funding round for Credora, a startup that has built privacy-preserving technology for real-time credit analytics.

Plumery, a component-based banking technology startup founded by Ben Goldin, former CTO and CPO of Mambu, has raised $4.5M in seed funding.

Belvo has acquired Brazilian payment institution Skilopay to further develop its strategic position as a leading account-to-account payments provider in Brazil and Latin America. The terms of the deal were not disclosed.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: