Mastercard wants to be the toll road for AI shopping 🤖💳; NYSE’s tokenization play is really about survival 🪙🏦; PayPal is betting AI Agents need a middleman 📈🤖

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Agentic Singularity 🤖🌀 [Deconstructing OpenAI’s operating system strategy and the eclipse of the application era]

The Stock Picks That Quietly Beat the Market (Again) 📈💸 [My 2025 portfolio outperformed the S&P 500 by 2× and surpassed most top hedge funds. Here’s how each company actually performed & what it means for investing in 2026]

Google’s Universal Commerce Protocol: the new default for how AI buys things 🤖🛍️ [2,000+ words dive into Universal Commerce Protocol (UCP), why it’s huge, how it changes everything, and how each player needs to adapt to the new AI-first economy + bonus list of top 10 AI startups to watch in 2026 & AI leader playbook inside]

The largest bank-FinTech M&A in history: Brex just sold to the banks it once mocked 💳🏦 [who wins the most here, why it matters & what to expect next + bonus deep dives into Brex, its biggest competitor Ramp that’s now fully AI-native, and the list of priceless M&A resources inside]

Top 10 AI Startups to Watch in 2026 🤖🦄 [Strategies, stories, and GTM blueprints from the fastest-growing AI companies that have collectively raised $500M+]

120+ AI Use Cases From Leading Startups & Internet Companies 🚀🧠 [Learn how real companies are using AI to ship products, cut costs, and change entire industries]

The AI Leader Playbook 📚🧠 [A First-Principles Guide to Building AI-Powered Engineering Teams and Products]

Revolut’s bet that AI would kill the checkout page 🤖🛍️ [why they are the first in Europe to support Google’s AP2 & how they are seeing the bigger picture here + bonus deep dive into Google’s UCP, and how it change’s everything]

Bermuda is now a laboratory for onchain finance 🪙🇧🇲 [what Coinbase & Circle are trying to do and why it’s one of the most interesting experiments in FinTech + bonus deep dives into Coinbase & Circle inside]

The Ultimate List of 340+ Real-World AI Systems 🧠⚙️ [How the world’s most important companies actually use AI - in products, payments, risk, healthcare, and everyday decisions]

As for today, here are the 3 awesome FinTech stories that are changing the world of financial technology as we know it. This was yet another wild week in the financial technology space, so make sure to check all the above stories.

Mastercard wants to be the toll road for AI shopping 🤖💳

Following the (AI) money 💸 The most important infrastructure in any gold rush isn’t the pickaxe - it’s the assay office that certifies the gold is real.

That’s exactly why payments giant Mastercard just announced it’s joining Google’s Universal Commerce Protocol while simultaneously integrating its Agent Pay product into Microsoft’s Copilot Checkout and OpenAI’s Instant Checkout in ChatGPT. The company is also refocusing Start Path, its decade-old startup accelerator, on AI commerce ventures.

On the surface, this looks like a payments giant doing routine partnership deals. Look closer, and you’ll see a company making an aggressive bet on who captures value when machines start spending money.

Let’s take a quick look at this, break it down to understand why it matters.

More on this 👉 The strategic logic is clear here. Mastercard isn’t building AI agents. It’s not competing with OpenAI, or Google, or Microsoft on model capabilities.

Instead, it’s positioning itself as the verification layer that sits beneath all of them. “Agentic commerce will only scale at the speed of trust,” Sherri Haymond, Mastercard’s EVP of global digital commercialization, told Axios. Translation: when an AI agent tries to buy something on your behalf, someone needs to confirm the agent is legitimate, the intent is real, and the payment is secure. Mastercard wants to be that someone.

Zoom out 🔎 The multi-protocol approach is telling. By working with Google’s Agent2Agent Protocol, OpenAI’s Agentic Commerce Protocol, and others simultaneously, Mastercard is explicitly betting against platform lock-in. “We believe that no single company is going to define the agentic economy,” said Sabrina Tharani, SVP of global fintech programs.

If she’s right, the winner isn’t the best agent - it’s whoever provides the common trust infrastructure across all of them.

THE TAKEAWAY ✈️

What’s next? 🤔 The open question now is whether any of this matters yet. AI shopping remains largely theoretical. Consumers haven’t demonstrated they want agents making purchases autonomously, and retailers haven’t built the infrastructure to handle them at scale. Mastercard is essentially pre-building toll roads before traffic exists. But that’s exactly the point. If agent-driven commerce does take off, the companies that established trust protocols early will have an enormous structural advantage. Mastercard is therefore trying to replicate what it did for e-commerce twenty years ago: not owning the stores, not owning the goods, but owning the verification that makes the whole system work. Watch whether merchants actually implement these protocols. That’s when theory becomes reality.

ICYMI: Google’s Universal Commerce Protocol: the new default for how AI buys things 🤖🛍️ [2,000+ words dive into Universal Commerce Protocol (UCP), why it’s huge, how it changes everything, and how each player needs to adapt to the new AI-first economy + bonus list of top 10 AI startups to watch in 2026 & AI leader playbook inside]

Mastercard’s wide moat justifies premium valuation 📈💳 [breaking down the most important facts & figures from their 3Q 2025 earnings, understanding what they mean and whether Mastercard is worth your time and money in 2025 & beyond]

OpenAI’s integrated AI ecosystem: Browser, Payments, and Finance all converge in Agentic Commerce push 🤖🛍️ [how browser, payments & finance plays all tie perferctly together, what does this indicate & what it means for the future of payments & finance + bonus deep dives into each of them, the agentic AI survival guide & top AI agent startups of 2025 inside]

NYSE’s tokenization play is really about survival 🪙🏦

The news 🗞️ The 233-year-old exchange just admitted that blockchain infrastructure is coming for traditional markets, and decided to build it themselves rather than wait to be disrupted.

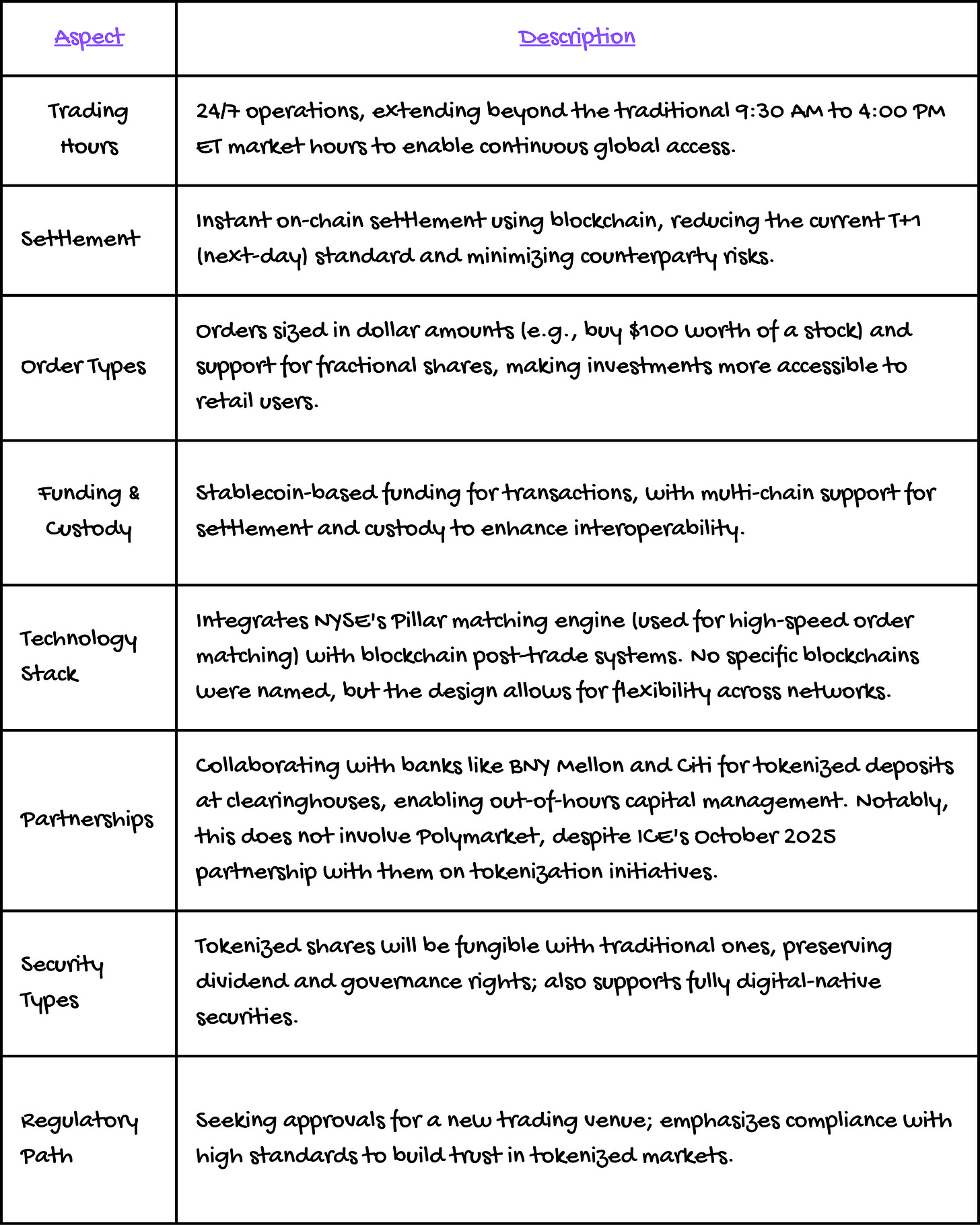

On Monday, NYSE announced it’s developing a separate venue for trading tokenized stocks and ETFs around the clock, with instant settlement and stablecoin-funded transactions. The platform, pending SEC approval, would run on private blockchain networks while using NYSE’s existing Pillar matching engine for order matching.

Michael Blaugrund, ICE’s VP of strategic initiatives, framed it as enabling retail investors to “trade something at 5:04 p.m. on a Saturday and then use that money to buy something else at 5:05 p.m.”

Let’s take a look at this, understand why it matters, and what’s next.

More on this 👉 The real story here isn’t about 24/7 trading at all. Robinhood already offers overnight sessions in megacaps.

The real story is settlement.

Current T+1 settlement - the one-day delay between trade and actual exchange of cash and shares - forces brokers to hold capital against counterparty risk and contributed to Robinhood’s infamous GameStop halt in 2021. Instant on-chain settlement eliminates that buffer entirely. For clearing members, this could free billions in trapped capital. For NYSE, it’s a land grab for the plumbing layer that will define market structure for the next decade 😎

Zoom out 🔎 The decision to build a separate venue rather than retrofit the existing exchange (Nasdaq’s approach) also reveals strategic caution. NYSE can experiment without regulatory risk to its core business, and tokenized shares will remain fungible with traditional ones - same dividend rights, same governance - thus preventing liquidity fragmentation.

ICE’s partnerships with BNY Mellon and Citi for tokenized deposits solve the “banking hours” problem that has plagued after-hours clearing, letting capital move across blockchain networks even when traditional rails are closed. Win-win 👏

THE TAKEAWAY ✈️

What’s next? 🤔 What happens next depends almost entirely on the SEC. Chairman Paul Atkins has signaled support for tokenization, and the DTC’s December approval to handle tokenized assets starting mid-2026 creates a compliant pathway. If NYSE gets the green light by Q2, expect the first tokenized trades by year-end, likely in liquid ETFs and megacaps where overnight demand is already proven. The second-order effect worth watching is this: if NYSE’s infrastructure becomes the standard settlement layer, crypto-native exchanges like Coinbase and Bitget - who captured 89% of the fragmented tokenized equity market in 2025 - will face a choice between connecting to NYSE’s rails or remaining in regulatory purgatory. Turns out, Wall Street didn’t adopt crypto’s ideology. It adopted its infrastructure and kept the keys 🔐

ICYMI:

ICOs 2.0, or Coinbase’s another step towards The Everything Exchange 🏦📈 [what their digital token offerings platform is all about, why it could be huge & what it means for the future of FinTech + bonus deep dive into Coinbase’s 3Q 2025 financials]

PayPal is betting AI Agents need a middleman 📈🤖

Following the money 💸 The fight for agentic commerce isn’t about who processes the payment. It’s about who connects the product to the AI in the first place.

That’s exactly why finance giant PayPal just acquired Cymbio, a Tel Aviv startup that helps merchants pipe their product catalogs into AI platforms like Microsoft Copilot and Perplexity.

Terms of the deal weren’t disclosed, but estimates put it at $150-200 million. Not too shabby! For a company generating $5 billion+ in annual free cash flow, this is just a rounding error. But the strategic intent is way larger than the check.

Let’s take a closer look at this, break it down, and see what’s next.

More on this 👉 Here’s what PayPal is actually buying: a layer of infrastructure that sits upstream from the transaction. Cymbio’s software synchronizes inventory, pricing, and order data across dozens of channels, now including AI chatbots that are beginning to handle product discovery. PayPal and Cymbio have been partners since October, with PayPal Ventures having invested back in 2022.

Bringing the 2015-founded company in-house thus gives PayPal full control over what it calls Store Sync, which routes AI-generated orders directly into merchants’ existing fulfillment systems.

Zoom out 🔎 Most importantly, the timing reflects a specific bet here: that AI-driven shopping will scale before competitors build equivalent infrastructure. Abercrombie & Fitch, Fabletics, and Newegg are already live on Copilot and Perplexity through Store Sync. ChatGPT and Gemini integrations are coming. PayPal is therefore racing to become the default plumbing before anyone else finishes laying pipe.

One detail worth watching: merchants remain the merchant of record under this model. They keep customer data and brand control. PayPal is explicitly positioning against Amazon-style aggregation, where the platform owns the customer relationship.

That’s a pitch to mid-market brands terrified of disintermediation.

THE TAKEAWAY ✈️

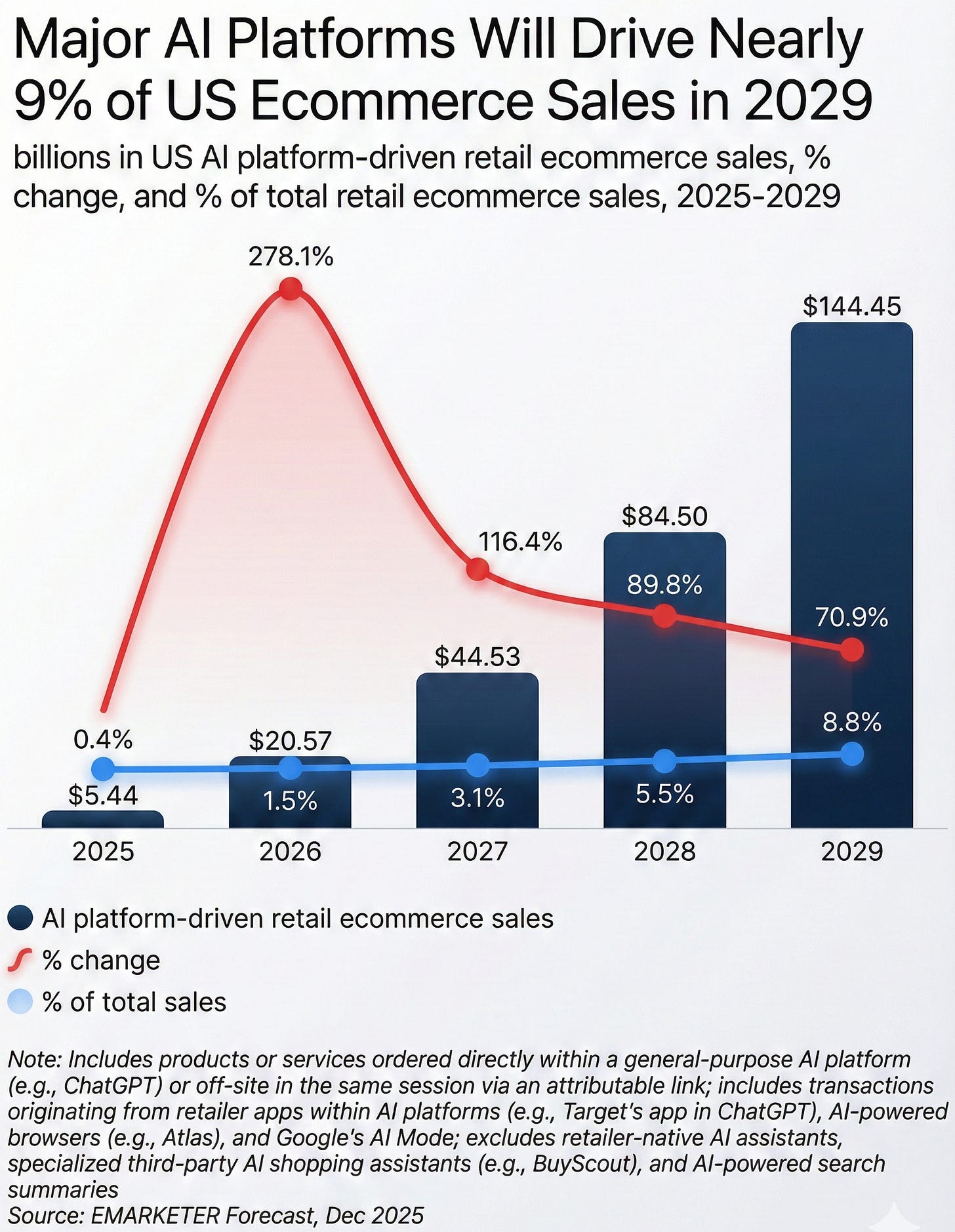

What’s next? 🤔 Looking ahead, the harder question now is whether agentic commerce will actually matter at scale. Forecasts vary wildly, from $20 billion in U.S. AI-platform-driven sales this year to $1 trillion by 2030. Nobody really knows 🤷♂️

What PayPal knows though is that if this market emerges, whoever owns the catalog-to-AI connection owns a toll booth (Klarna has already placed a similar bet too). Stripe and Adyen process payments. PayPal is trying to own the moment a product becomes discoverable. That said, watch whether Store Sync drives measurable TPV growth over the next two quarters. That’s the number that tells you if this was foresight or just a press release.

ICYMI: PayPal doubles down on Agentic Commerce as it aims to become the trust layer for AI Shopping 🤖🛍️ [why their Microsoft Copilot Checkout partnership could be huge & what’s next for agentic commerce + bonus deep dives into PayPal, PayPal Bank and the 120+ AI use cases from the world’s leading startups & top internet companies inside]

What else I’m watching

OnePay & Klarna Partner 💳 OnePay has teamed up with Klarna to let shoppers turn debit card purchases into BNPL loans. The Swipe to Finance option, launching soon, allows OnePay Cash customers to convert eligible purchases into four-part BNPL loans after checkout. Klarna’s CCO David Sykes emphasizes giving customers control over payments. This partnership includes conventional instalment loans and more products planned for 2026. ICYMI: Trump’s credit card rate cap shakes Wall Street, but Klarna CEO sees opportunity 👀💳 [what’s happening, why it matters and what it could mean for banks, card companies & where’s the opportunity for FinTech + bonus deep dives into Klarna & SoFi inside, and why I’m bullish on both of them]

Revolut Targets Peru 🇵🇪 Revolut has applied for a banking license in Peru as part of its global expansion plan. The fintech giant aims to invest £10 billion and create 10,000 jobs over five years, targeting 100 million customers by mid-2027 and entry into 30 new markets by 2030. Julien Labrot will lead operations in Peru, focusing on local strategy and compliance. ICYMI: Revolut’s bet that AI would kill the checkout page 🤖🛍️ [why they are the first in Europe to support Google’s AP2 & how they are seeing the bigger picture here + bonus deep dive into Google’s UCP, and how it changes everything]

FCA Launches Stablecoin Sprint 💷 The UK’s Financial Conduct Authority is inviting applications for a “stablecoin sprint” in March to explore the use of stablecoins in retail and cross-border payments, ecommerce, and B2B transactions. Participants include fintechs, banks, and tech companies, with applications due by February 4. The FCA will also hold a roundtable on trade payments in stablecoins in May, as it prepares to publish final crypto rules this year. ICYMI:

💸 Following the Money

London-based money transfer outfit Zepz has acquired Pomelo International, a credit-building remittance app and card. Financial terms of the deal were not disclosed.

Superstate raises $82.5M Series B funding to expand onchain equity issuance infrastructure.

Sinpex, the AI-powered platform for KYB / KYC lifecycle management, announced its €10M Series A financing round.

👋 That’s it for today! Thank you for reading, and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Epic read, so much to digest. Not sure how you do this, but it's amazing work - please don't stop sir!

Saving for Monday morning - too much to unpack!