Apple is now running one of the largest neobanks in the world 🤯; PayPal's latest earnings is a blessing in disguise 🤑; EMEA FinTech gets hit the hardest in funding downturn 📉🫣

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

Financial Template Bundle for VCs 📚 [se this to navigate the VC terrain with precision 🧭]

Embedded finance is a $242B opportunity in APAC by 2025 😳 [why you can’t ignore it + more bonus reads]

AI takes center stage in the Front Office to help marketers and customer service teams in financial services 🤖💸 [value-adding use cases + a bonus read on the key building blocks of AI Bank of the Future & lots of deep dives on AI + Finance]

US banks will soon be subjected to more stringent capital requirements💰

A list of new VC funds at/below $200M in size 🤑 [150+ VC funds + more invaluable startup resources]

As for today, here are the 3 captivating FinTech stories that were changing the world of finance as we know it. This week was just insane in the financial technology space, so make sure to check all the above stories.

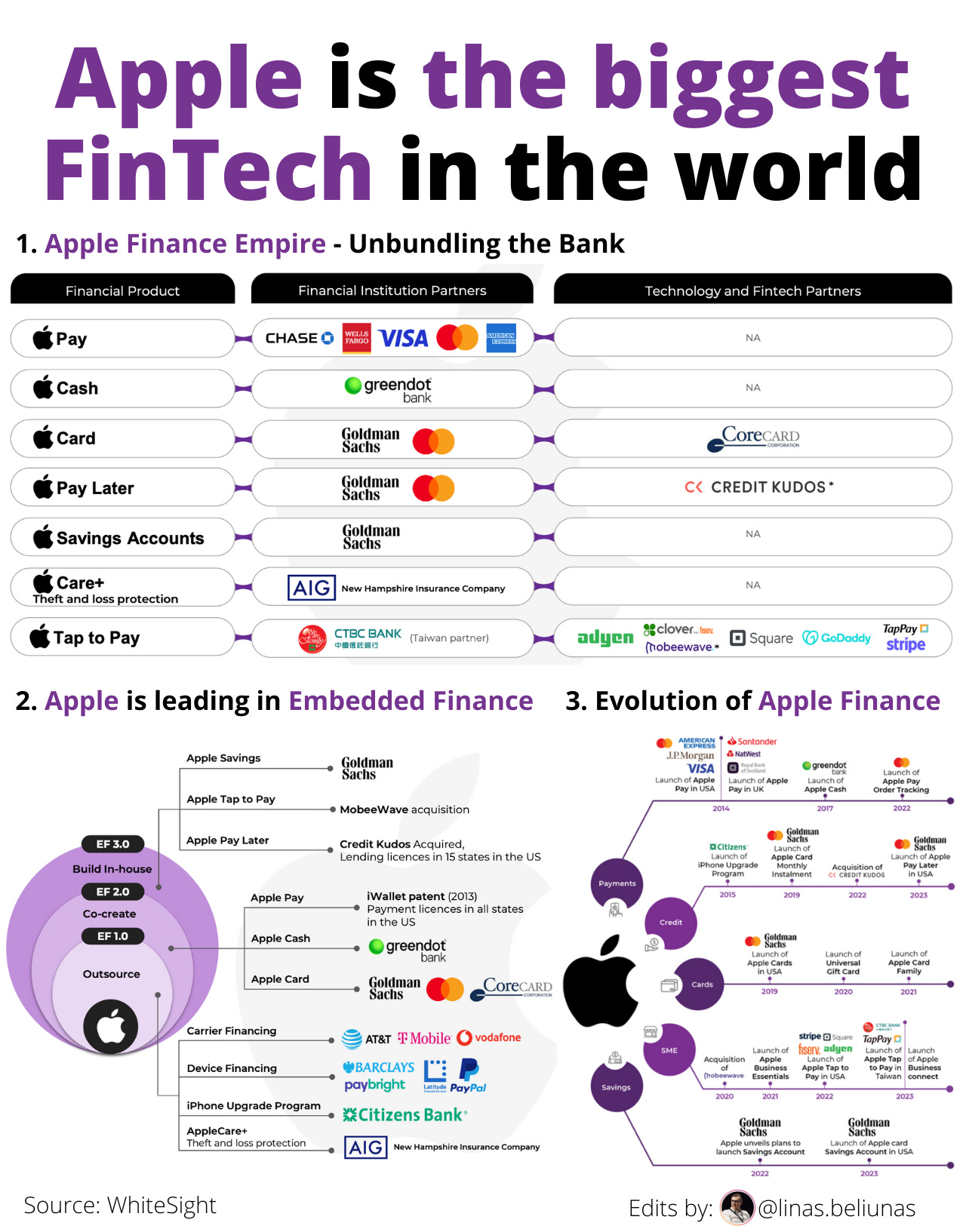

Apple is now running one of the largest neobanks in the world 🤯

The NEWS 🗞 Apple AAPL 0.00%↑ just announced that Apple Card's Savings Account has racked up more than $10 billion in deposits since launching in April.

That’s in less than 4 months 🤯

More on this 👉 We can remember that the long-trailed Apple Card savings account powered by Goldman Sachs GS 0.00%↑ was launched in mid-April with a headline-grabbing 4.15% annual percentage yield. That’s more than 10 times the national average, as per FDIC data.

All Daily Cash rewards earned through the Apple Card are automatically deposited into the savings account. Users can deposit additional funds through a linked bank account, or from their Apple Cash balance.

Apple now says that 97% of users have chosen to have their Daily Cash automatically deposited into their account.

The love affair might not last… 💔 Despite the impressive numbers, Goldman is currently seeking to exit its partnership with Apple as part of its retreat from the consumer market.

I recently did a deep dive into this, which you can access here (+ lots of bonus reads):

✈️ THE TAKEAWAY

Tech is eating Wall Street 🍎 During the launch of Apple Savings I said that this product is going to be a hit simply because Apple’s convenience and brand trust is second to none. 4 months and $10 billion in deposits later, Apple is effectively running one of the biggest challenger banks in the world. To put this into perspective: Monzo holds around $6B in customer deposits, Starling has >$10B, while Nubank NU 0.00%↑ - the biggest challenger bank in the world - has amassed over $16B in customer deposits. The key difference here is that Apple is just getting started. Zooming out, this is yet another good illustration of how carefully Apple is executing its long-term vision - block by block the tech giant is building the Apple Finance empire that's going to disrupt the financial services space as we know it. In other words, Apple is building JPMorgan 2.0, and it’s one of the reasons why in his shareholder letter, the CEO of JPM 0.59%↑, Jamie Dimon called out Apple by name as one of their biggest competitors. Huge.

Worth reread: Apple might become the First Super App of the West 🍎 [+4 more reads]

PayPal's latest earnings is a blessing in disguise 🤑

Earnings call 📞 Finance behemoth PayPal PYPL 0.00%↑ has released its latest earnings. Despite a strong performance, the stock has dipped.

Let’s take a closer look and see why it’s a blessing in disguise.

More on this 👉 Here are the key takeaways from PayPal's Q2 2023 investor update:

PayPal reported revenue of $7.3B, up 7% year-over-year and at the high end of guidance.

Total payment volume (TPV) grew 11% to $377B.

Operating margin expanded ~230bps to 21.4% on a non-GAAP basis. This was driven by an 11% decline in non-transaction expenses.

PayPal reiterated its full-year 2023 guidance, including:

Non-GAAP EPS growth of ~20% to ~$4.95

Non-GAAP operating margin expansion of at least ~100bps

Free cash flow of ~$5B

Finally, PayPal announced an agreement to sell its European BNPL receivables to KKR, which is expected to generate ~$1.8B in proceeds. This will help optimize PayPal's balance sheet.

What’s up with the stock? 🤔 Despite all this performance, the stock fell. Why?

Well, three main reasons got investors worried:

Weak Margins. PayPal's weak second-quarter margins have raised concerns about the company's growth potential. The company's enduring strength in unbranded volume is also creating profit challenges.

Slower Growth Rates. Although PayPal's sales are still increasing, growth rates have slowed down. As pandemic restrictions began to ease, PayPal's stock growth started to fall off.

Rising Competition. PayPal is facing rising competition in the digital payment space. While PayPal is still the leader in its industry and profitable, investors are concerned about the company's ability to maintain its position in the face of increasing competition (think Stripe, Adyen, Block SQ 0.00%↑ here).

✈️ THE TAKEAWAY

Looking ahead 👀 Overall, I’d argue that it was still a solid quarter for PayPal with disciplined execution driving double-digit TPV growth and 24% non-GAAP EPS growth. Also, the company seems on track to meet its full-year guidance. Furthermore, 4.53% growth in transaction revenue QoQ indicates the company's ability to generate revenue from its core business while 10.81% growth in TPV yet again reflects PayPal’s ability to attract and retain customers, as well as its potential for future revenue growth. Finally, given its free cash flow (FCF) of ~$5B is clear that PayPal is an underrated cash-generation machine.

Still not convinced? Read this:

ICYMI: PayPal's solid results and why it's one of the strongest companies in the digital money space 💸 [deed dive into PayPal + lots of bonus reads]

Disclaimer: this isn’t investment advice and I’m a shareholder of PayPal.

EMEA FinTech gets hit the hardest in funding downturn 📉🫣

The latest data is out 📊 In early July, I talked about European FinTech funding in the first half of 2023, and it wasn’t good. We now have data on the global FinTech funding for the first 6 months of 2023.

Let’s take a brief look at the most important things.

More on this 👉 Top things to know from the latest KPMG Pulse of FinTech report:

Global FinTech funding fell sharply from $63.2 billion in H2'22 to $52.4 billion in H1'23, with Q2'23 results particularly weak at just under $18 billion invested. This reflects a pullback by investors amid high inflation, rising interest rates, the Russia-Ukraine conflict, depressed valuations, and a lack of exits.

The US accounted for over two-thirds of global FinTech funding in H1'23 with $34.9 billion invested. The Americas overall saw funding rise from $28.9 billion in H2'22 to $36 billion in H1'23. Not bad! 👏

Funding in the EMEA and ASPAC regions declined significantly in H1'23 compared to H2'22. EMEA dropped from $27.3 billion to $11.2 billion and ASPAC went from $6.7 billion to $5.1 billion. Brutal… 🤕

Fintechs focused on improving operational efficiency and cash flows as funding sources dried up. Investors enhanced due diligence and prioritized profitable, sustainable business models.

Payments remained relatively resilient, attracting over $16 billion in H1'23. However, funding shifted from BNPL models to more mature, core payments capabilities.

Interest in AI and generative AI solutions accelerated, especially for cybersecurity, wealth management, and insurance use cases. This is likely to drive funding in H2'23.

Crypto funding slowed dramatically but interest persists in blockchain for ESG applications like carbon credits.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, funding is likely to remain subdued in H2'23 until macro conditions stabilize. But the long-term outlook is still positive. Key trends to watch for the future include increasing M&A (3 of them in today’s newsletter + resources below), more corporate ventures investing in operational efficiency solutions, accelerating the development of AI solutions, and resilient funding in payments. To be prepared and make the most of it, I’ve got some valuable stuff for you👇🏼

If you’re building and scaling, read this:

If you’re raising right now, check these:

If you’re looking to do an M&A, these are must:

🔎 What else I’m watching

Worldcoin in French is investigación 🇫🇷 France's privacy watchdog says that the legality of Worldcoin's biometric data gathering "seems questionable," according to Reuters. Launched just recently Worldcoin distributes tokens to people "just for being a unique individual". To prove their uniqueness and get the token, people have their eyeballs scanned by a piece of hardware called "The Orb". French regulator CNIL has now told Reuters: "The legality of this collection seems questionable, as do the conditions for storing biometric data." The regulator says that it is supporting an investigation into the issue by the Bavarian state authority in Germany, which has jurisdiction. ICYMI: Sam Altman's Worldcoin goes live 👁️

Brazil is showing us the way 🇧🇷 Brazil's Pix continues its runaway success, with more transactions made using the instant payments platform in the first quarter than credit and debit cards combined. Launched in late 2020 by the Central Bank of Brazil, the account-to-account payment option PIX saw transactions for Q1 hit 8.1 billion, compared to 4.2 billion for credit cards and 3.8 billion for debit cards. Data from the central bank, reviewed by vendor Matera, shows that Pix accounted for 35% of all transactions in Q1, up from 23% a year ago. In contrast, credit card transactions were 18% of the total, down from 20% one year ago. Debit card transactions were 16% of the total, down from 20%. QR codes are proving an important part of the Pix success story, accounting for nearly 30% of the platform’s transactions. Massive! ICYMI: All you need to know about the FedNow launch 🏦

💸 Following the Money

Bloom Money, a UK-based alternative banking provider for ethnic communities, has raised £1M in pre-seed funding.

UK-based debt management platform SuperFi has raised $1M in pre-seed funding.

Italian paytech Nexi has acquired a 30% stake in German payments processor Computop for an undisclosed sum. Under the agreement, Computop will expand its range of services in the areas of point-of-sale and e-commerce in the regions covered by Nexi.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: