Apple Savings account takes the industry by storm 🤑; Another massive US bank failure & the Microsoft of Banking 🤯; Revolut's debut in Brazil casts a long shadow of doubt🇧🇷

You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech.

If you’re not a subscriber, here’s what you missed this week:

The Amazon of LatAm is growing its FinTech biz on steroids 🤯

Neobanking consolidation continues in a bid to bring Black Banking to the next level 🏦

As for today, here are the 3 FinTech stories that were disrupting the world of finance as we know it. This week was one of the hottest weeks in the financial technology space this year, so make sure to check all the above stories.

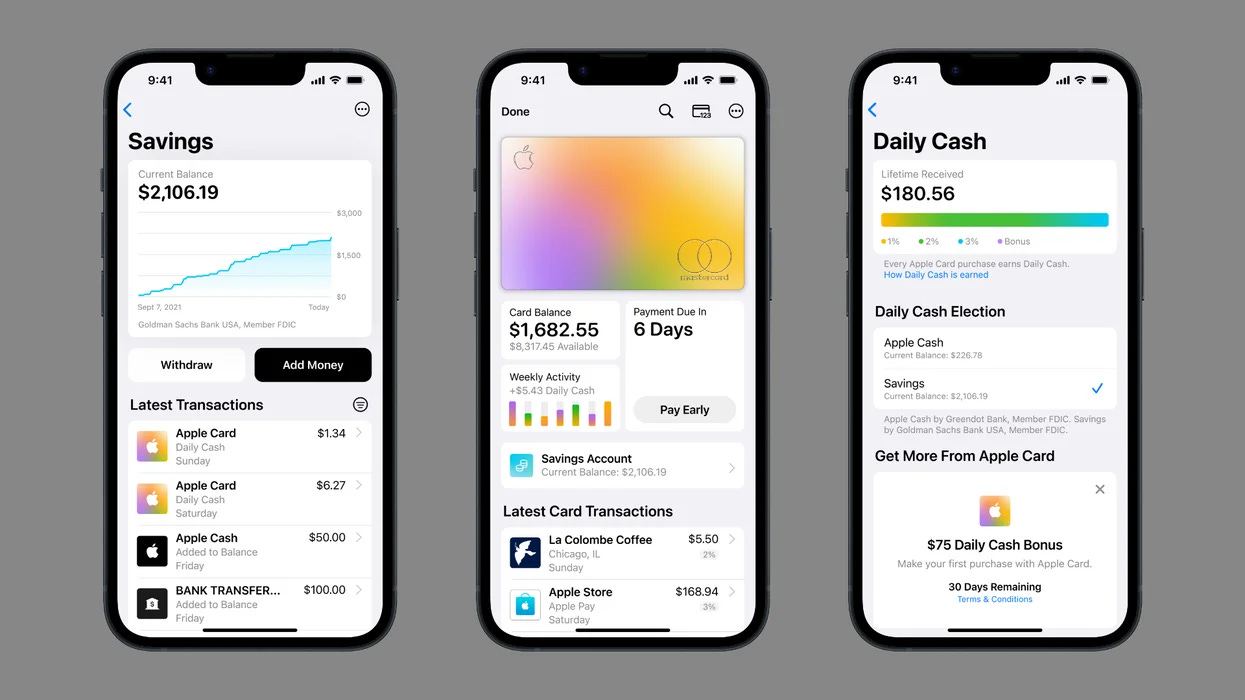

Apple Savings account takes the industry by storm 🤑

The news 📰 Big Tech might finally make banks run for their money as Apple's new savings account seems to be a massive hit.

More on this 👉 According to internal sources cited by Forbes, the consumer technology giant racked up nearly $1 billion in deposits. In just 5 days 🤯

In that time, more than 240,000 accounts signed up for the service.

The USP 🥊 We can remember that the long-trailed Apple Card savings account launched in partnership with Goldman Sachs GS was introduced in Mid-April with a headline-grabbing 4.15% annual percentage yield. This is more than 10X the national average, as per FDIC data.

The newest feature is part of the Apple Finance empire which seems to have resonated well with the users. The savings account not only represents a market-beating return on their cash but also a safe haven during rising interest rates and bank crashes.

✈️ THE TAKEAWAY

Looking ahead 👀 The early Apple success comes as no surprise and just further proves that the tech behemoth is building JPMorgan 2.0. Looking at the big picture, it also shows us what happens when tech companies are better than banks (not only in terms of APY but also UX, brand awareness, etc.). More importantly, Big Tech's mastery of user data coupled with their size and customer reach could really trigger rapid change in the financial services industry, leaving established banks behind and at a competitive disadvantage. So far, Apple is the Usain Bolt in this race.

ICYMI: Apple is building JPMorgan 2.0 😳 [deeper dive + lots of bonus reads]

Another massive US bank failure & the Microsoft of Banking 🤯

The breaking news🚨 First Republic Bank was seized and sold this week to JPMorgan in the second-largest US bank failure ever 🤯

In case you wonder how we got here: Another weekend, another bank is on the brink of collapse 😳

More on this 👉 The FDIC technically avoided another banking crisis by first seizing First Republic and then orchestrating a sale to JPMorgan Chase which took over $103.9 billion in deposits and $229.1 billion in assets from FRB.

JPMorgan now holds more than $2.4 trillion in deposits. To put this into perspective, that's almost the entire market cap of Apple 👀

But… ICYMI: Apple is building JPMorgan 2.0 😳

Also, it’s two times bigger than the total market cap of all cryptocurrencies out there. Wild! 🤯

And that's not even it.

The money 💸 JPMorgan recently said its acquisition of First Republic will generate an immediate gain of $2.6 billion and $500 million in yearly profit. Not bad, huh? 😌

On top of all this, the FDIC is covering $13 billion in losses and providing $50 billion in financing.

ICYMI: JPMorgan reports record revenue 🤑

Our government invited us and others to step up, and we did. Our financial strength, capabilities, and business model allowed us to develop a bid to execute the transaction in a way to minimize costs to the Deposit Insurance Fund. (Jamie Dimon, CEO, JPMorgan Chase)

✈️ THE TAKEAWAY

What’s next? 🤔 Following the sale, First Republic's 84 branches in eight states will reopen as JPMorgan Chase sites. This is another masterstroke from Jamie Dimon that further cements JPMorgan as the Microsoft of Banking. Zooming out, this is one among many steps where the big buys will become even bigger while the smaller ones might cease to exist. Buckle up because this might not be over yet.

Bonus: JPMorgan is the Microsoft of Banking 😎 [+ a dive into JPM’s FinTech strategy]

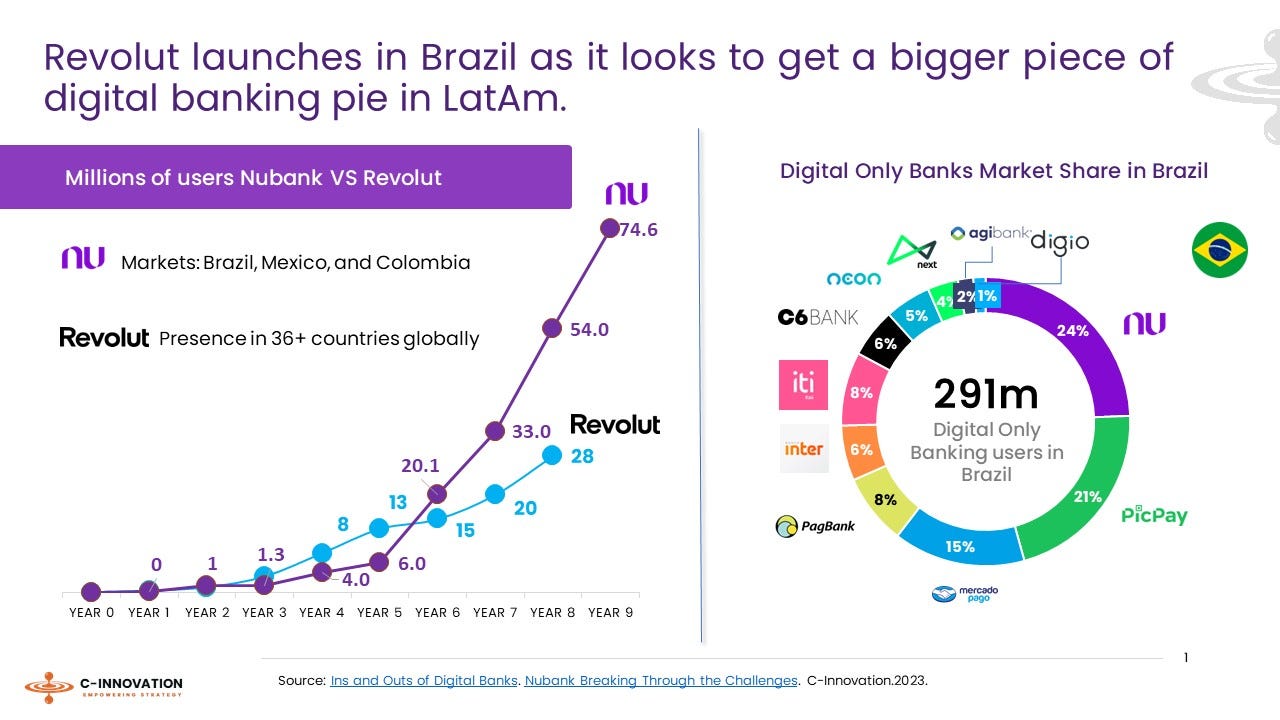

Revolut's debut in Brazil casts a long shadow of doubt🇧🇷

The launch 🚀 British challenger bank and super app wannabe Revolut has launched in its first country in Latin America, offering a multi-currency account and crypto investments in Brazil, Altfi reported.

We can remember that back in March last year, the neobank made its first steps into the region after hiring Glauber Mota as its Brazil business's CEO and opening a waitlist. This waitlist will now be expanded with existing names being added in a phased rollout.

Why Brazil? 🇧🇷 Brazil is LatAm’s largest market for financial services, a key corridor for the large remittances market, as well as an increasingly digital population. Back in 2021, research indicated it came out on top in adults using an app-only bank, with just over 32%. That’s a lot!

Following the launch, Revolut's global account is not offering locals foreign exchange and remittance capabilities in 27 currencies, in addition to having a card that is accepted in more than 150 countries.

Brazil is an exciting market for Revolut and holds enormous potential for our global expansion. Our mission is to unlock a borderless economy with financial products that are accessible and easy to use and that allow our customers to use their money efficiently. We will start with the global account and crypto investments, but this is just the beginning.

(Nik Storonsky, co-founder and CEO of Revolut).

✈️ THE TAKEAWAY

Seems impossible 😶🌫️ Revolut is entering a thriving FinTech arena in Latin America's largest market, joining local giants such as Nubank, Neon, Ebanx, C6, and Creditas. Nubank will obviously be the biggest headache for Revolut trying to make a difference in Brazil and later - in Mexico and/or Colombia.

With over 80M customers, a first-mover advantage, a super-strong brand, and local know-how, Nu will be a nearly impossible nut to crack for Revolut. Not to mention the fact that no foreign challenger has made it big in LatAm. On the other hand, it’s pretty clear why Revolut is doing what it’s doing right now. In its core markets (UK & Europe) the growth has probably plateaued, hence, FinTech is looking for new areas of growth, hence, aggressive plans for LatAm, India, and the US. More importantly, it also has to justify its $33 billion valuation somehow (it doesn't make any sense, by the way!) 🤷♂️ Thus, this Revolut’s endeavor seems to be doomed to fail right from the start… But time will show us really who’s who.

ICYMI: There’s no way Revolut is worth $33B now 🙅🏽♂️

The future is purple. Nubank Purple 💜

🔎 What else I’m watching

Banks go AI 🤖 The Bank of New York Mellon (BNY Mellon) has been implementing an artificial intelligence (AI) based tool to help with entity resolution in its customer database. The implementation of this tool is part of the bank's continuous efforts to improve data management and meet regulatory requirements for identifying customers and their relationships. Improving the in-house solution would have been time-consuming, so the bank turned to a third-party vendor, Quantexa, a British software developer that uses machine learning and multiple public data sources to enhance the entity resolution process. Quantexa's software platform can not only do entity resolution but also map networks of connections in the data - who trades with whom, who shares an address, and so on. ICYMI: Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦

Mastercard + Web3 👀 Mastercard is teaming up with Web3 players on an on-chain identity and verification framework covering a variety of applications in payments, remittances, ticketing, and NFTs. Mastercard Crypto Credential is designed to help companies, developers, and individuals to realize the full potential of powering payments, commerce, and economic value on-chain and across borders. Among the partners onboard are crypto wallet providers Bit2Me, Lirium, Mercado Bitcoin, and Uphold, which are working on an initial project to enable transfers between the US and Latin America and the Caribbean corridors. This is a good and expected move because Mastercard really, really loves crypto ❤️🧡

NFTs in trouble 😳 A former OpenSea employee has been accused of making illicit profits from insider trading of NFTs, raising concerns about the transparency and regulation of the rapidly growing NFT market. Prosecutors claim the ex-employee used confidential information to purchase NFTs at lower prices before public release, selling them at a significant profit once demand increased, highlighting the need for greater oversight in the largely unregulated NFT space. Remember: NFTs have insider trading problem 👀

💸 Following the Money

Swedish open banking startup Kreditz has raised €10M from investment company Creades and the venture arm of retail furniture giant Ikea. Kreditz uses open banking and PSD2 data to enable automated information retrieval and analysis of a loan applicant's current income and expenses. More fuel for the Increased adoption of Open Banking 🚀

Canada’s TD Bank has pulled its planned purchase of US bank First Horizon, stating that questions around the approval of the £13.4B deal from regulators was to blame.

Zodia Custody, a London, UK-based regulated crypto custodian, reportedly raised $36M in Series A funding. The round was co-led by SBI Holdings and SC Holdings. The company intends to use the funds to expand operations and its business reach.

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: