Top FinTech & AI Stories of 2025: A Year of Convergence 🔗⚡

In 2024, we built the pieces. In 2025, they finally connected 🧩

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & the most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 360k+ FinTech leaders:

The financial technology industry moves in cycles. Each year brings waves of innovation - payment startups, blockchain experiments, AI applications - but most operate in isolation, competing in their own lanes without acknowledging what’s happening elsewhere.

2024 felt that way. We had AI breakthroughs, stablecoin experiments, crypto legitimization attempts, and traditional banks cautiously eyeing digital assets. All interesting. All separate.

2025 proved different. This year, the pieces converged into unified platforms. Stripe became an agentic commerce operating system. Revolut evolved into a financial OS. Coinbase transformed into a global finance infrastructure. Stablecoins became the settlement layer connecting everything together. These weren’t new products - they were integrations that revealed a deeper architectural shift in how financial systems organize themselves.

What looked like independent innovations in 2024 showed themselves to be something inevitable in 2025: the reorganization of financial infrastructure around three core foundations - autonomous AI agents, instant crypto settlement, and platforms that integrate rather than specialize.

Below are the top 10 FinTech and AI stories of 2025. These are the moments that mattered. The inflection points. The signals of what comes next.

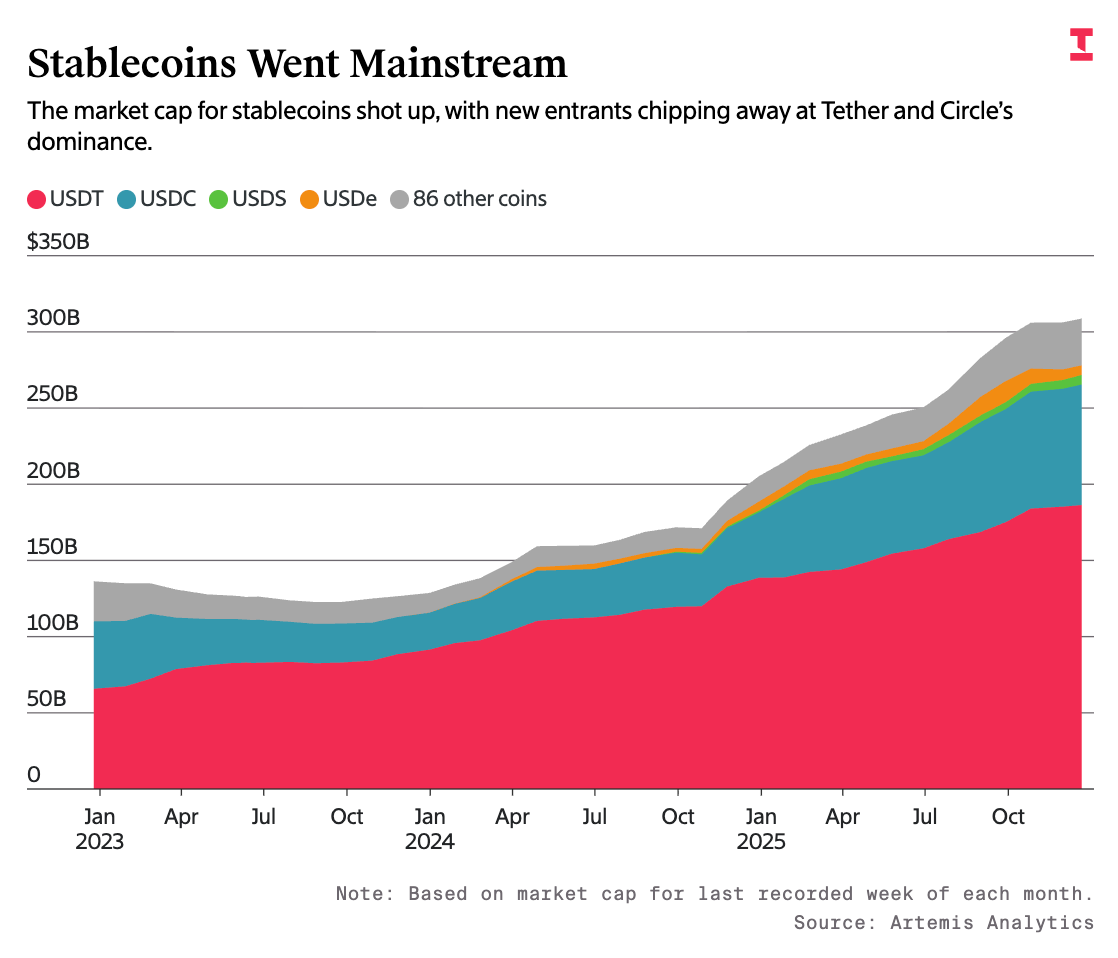

#1 Stablecoins went mainstream

PayPal PYPL 0.00%↑ expanded PYUSD strategically, Klarna KLAR 0.00%↑ announced KlarnaUSD, Amazon and Walmart explored stablecoin launches, while JPMorgan JPM 0.00%↑ issued JPMD deposit tokens. Most importantly, the GENIUS Act was signed by President Donald Trump on July 18, 2025, establishing the country’s first comprehensive regulatory framework specifically for payment stablecoins. Later in the year, Stripe went all-in and built a comprehensive stablecoin suite, positioning itself as a full-stack digital asset infrastructure.

A year ago, stablecoins were largely a crypto curiosity. By year-end, they started to become the plumbing of digital commerce.

In 2026, expect stables to become the default payment method for remittances & B2B cross-border transactions.

Go deeper and learn more here: SoFi becomes first US bank to issue public blockchain stablecoin 😳🪙 [what’s the USP here and what value will it unlock + bonus deep dive into SoFi’s latest financials]

Stripe launches comprehensive stablecoin suite, positioning itself as a full-stack digital asset infrastructure provider 💳 🪙 [what it’s all about & why it could be huge + bonus dives into Agentic Commerce Protocol launched with OpenAI, recap of their L1 Tempo & the ultimate list of stablecoin resources inside]

#2 AI & AI Agents started to revolutionize financial services

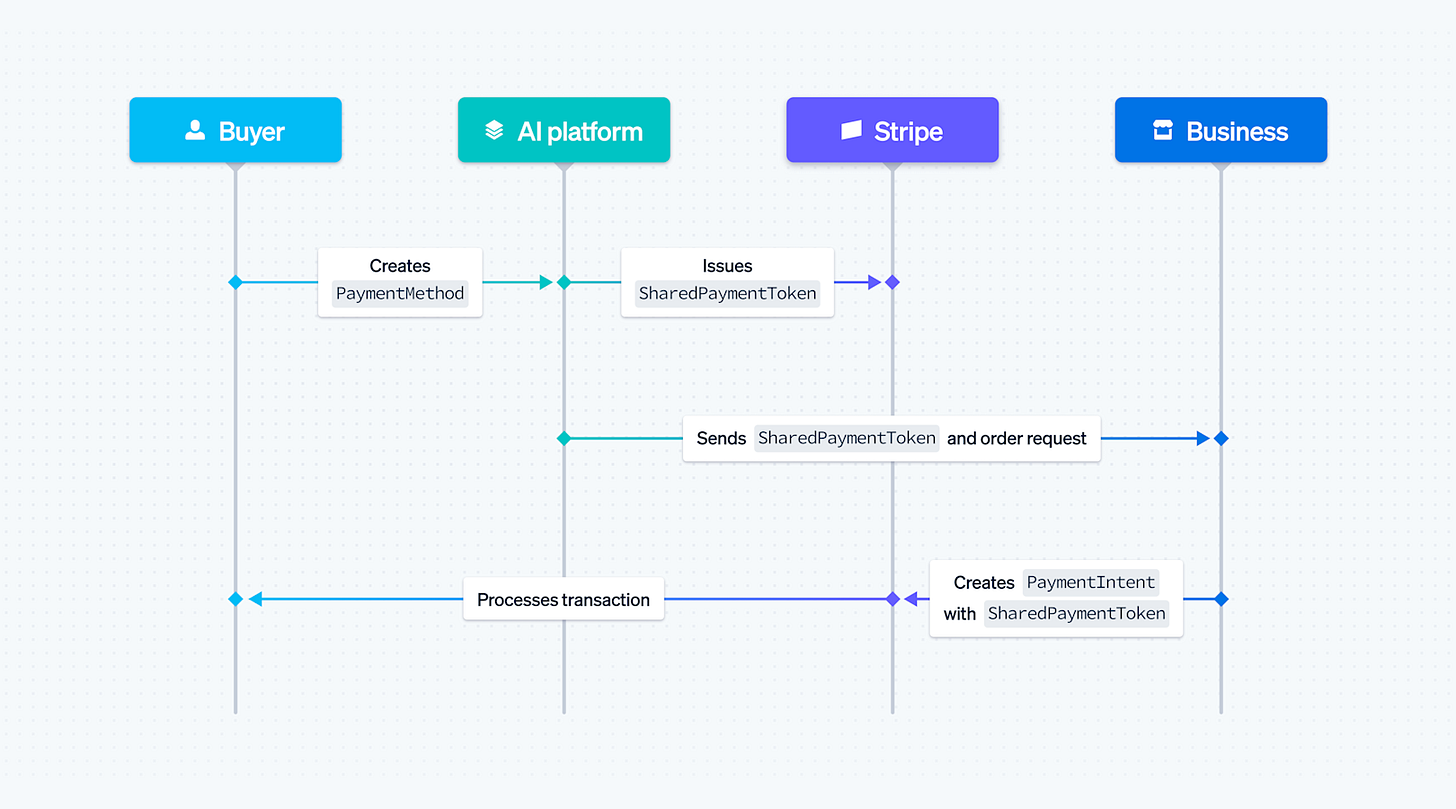

Stripe built AI, but for payments. Agentic Commerce took off with OpenAI/Stripe's collaboration, while Visa, Mastercard, PayPal, and Perplexity AI all positioned themselves to control how AI agents will pay. Revolut launched an AI Financial Assistant, while Klarna positioned itself as the data backbone of AI-powered shopping. The shift happened quietly: AI moved from tool to autonomous system. Companies discovered their financial infrastructure could be operated by machines, not just humans.

The difference matters. A tool improves what humans do. An agent replaces what humans do entirely.

In 2026, expect AI agents to become the default operating system for financial workflows. Human oversight shifts to exception management and high-value decisions.

Go deeper and learn more here: Klarna bets big on becoming the data backbone of AI-powered shopping 📊🛍️🤖 [what their Agentic Product Protocol is all about, how it stacks into the AI-powered tech stack, what to expect next + bonus deep dive into Klarna, Stripe and their ambition to own the full AI payments stack & 25 most interesting AI startups from 2025 and their pitch decks inside]

Ramp’s $32 billion valuation, or the dawn of autonomous finance 🤖💸 [latest numbers, why they matter, and what’s the big picture here + bonus dives into Ramp’s biggest competitor Brex and more resources on Agentic Finance inside]

Stripe’s Agentic Commerce Suite signals a new era in AI-powered payments 🤖💳 [what it’s all about & why it’s huge, why FinTech giant’s strategy here is brilliant & what to expect next + bonus dive into Stripe’s quest to become the financial backbone of the AI economy & 100+ battle‑tested tools and frameworks to accelerate your AI projects inside]

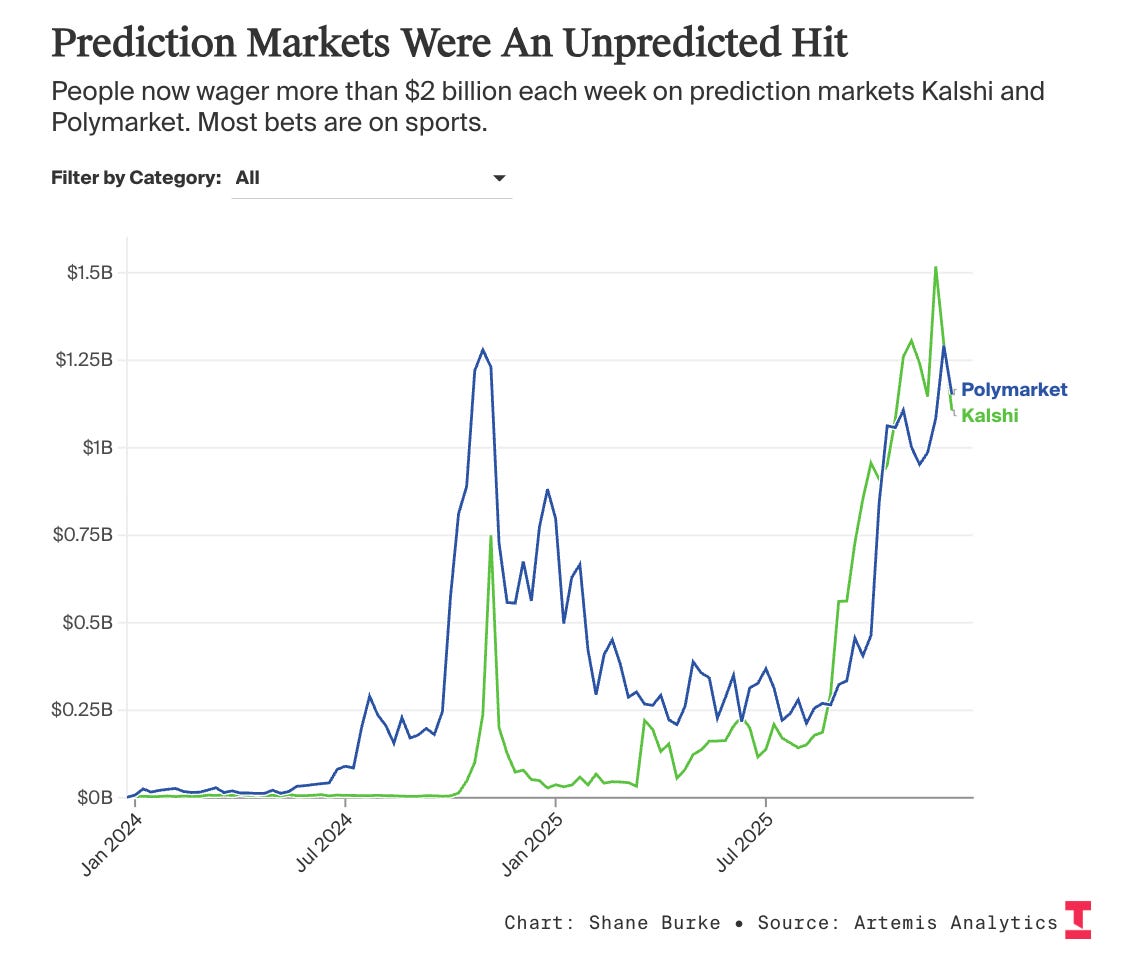

#3 Prediction Markets entered the mainstream

Throughout 2025, prediction markets basically evolved from novelty to a trillion-dollar opportunity. Wall Street giants began backing them, while VCs positioned them as the future of forecasting.

Prediction markets price uncertainty in ways traditional markets cannot. When institutional capital starts allocating to them, it signals a fundamental shift in how sophisticated investors think about risk and forecasting.

In 2026, expect prediction markets become even more embedded in corporate decision-making.

Go deeper and learn more here: From $5 billion to $11 billion in 60 days: inside the most aggressive valuation jump in FinTech history 🤯📈 [latest $1 billion fundraise & what it indicates, what to expect next]

Robinhood is building the Nasdaq of Reality, where every headline becomes a trade 🤑📈 [why the latest M&A of LedgerX is a masterstroke and how it ties into their bigger vision in the space + bonus deep dive into Robinhood’s latest financials, why I’m bullish & more reads on their biggest competitor Coinbase inside]

#4 OpenAI’s Everything App strategy

OpenAI moved strategically into payments, commerce, and financial services. ChatGPT integrated with Shopify, Walmart, and other platforms to transform online shopping, positioning itself as a financial platform competitor, not just an AI provider.

OpenAI didn’t become a FinTech company overnight. Instead, it recognized that AI infrastructure plus financial infrastructure creates a new category of application entirely. By December 2025, OpenAI launched its app store within ChatGPT, further positioning itself as a platform for financial and commercial applications.

In 2026, expect OpenAI to go deeper into payment and banking services, forcing traditional financial players to compete on AI-powered experience.

Go deeper and learn more here: OpenAI’s App Store just launched, and it could be the Apple App Store moment for AI 🤖🛍️ [what it’s all about & why it could be huge + bonus deep dives into ACP & OpenAI’s quest to become the Super App of the West inside]

The browser died today: OpenAI and Stripe launch Instant Checkout & the Agentic Commerce Protocol 🤖💳🤖 [why it’s a game-changer that just killed the browser, what’s next & how FinTechs and other finance firms must adapt + bonus deep dives into Shopify, Google’s & Coinbase’s agentic payments protocols, top AI agent startups and more inside!]

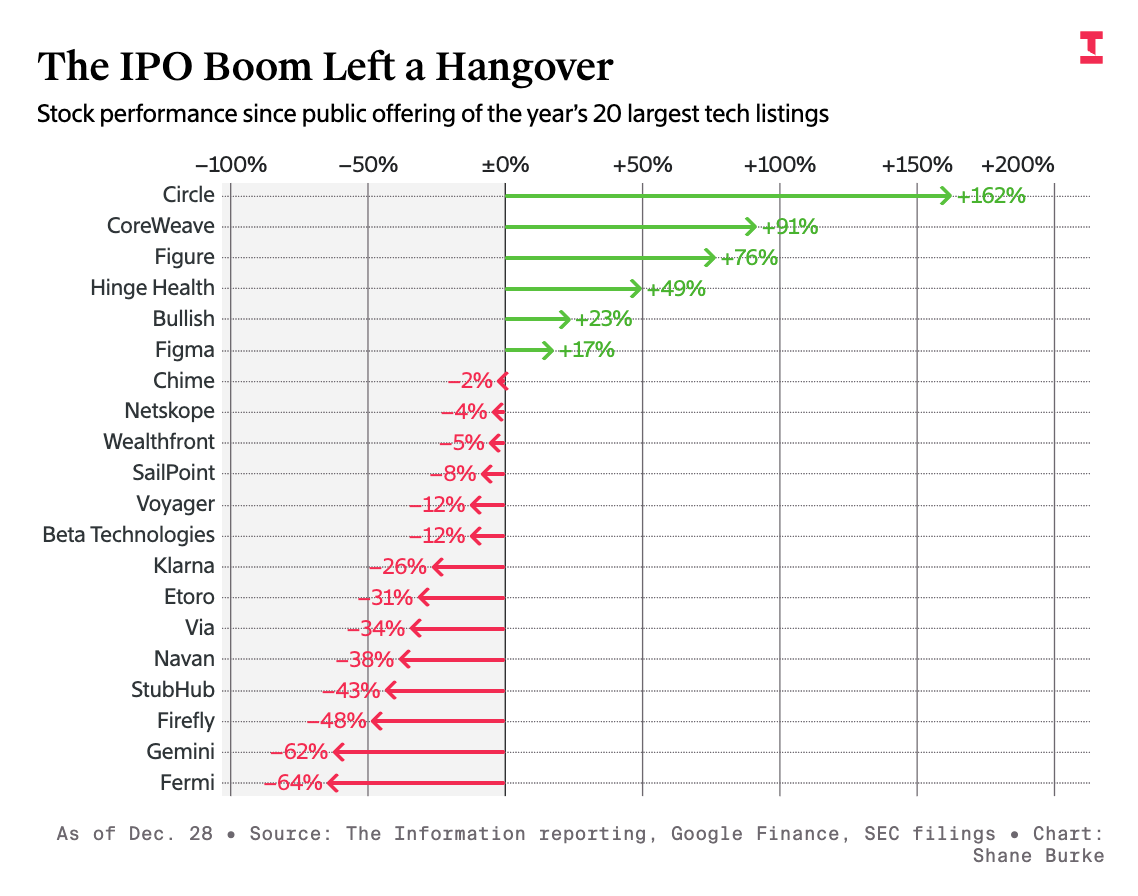

#5 The FinTech IPO Renaissance, or unicorns finally went public

Klarna (September 10), Chime (June 12), eToro (May 14), Gemini (September 12), Bullish (August 13), Circle (June 5), and other FinTech unicorns finally went public. This newsletter tracked this arc relentlessly throughout the year, delivering deep dives and quarterly report analyses.

After years of regulatory and market skepticism, sophisticated investors aggressively bid for FinTech shares. That appetite signals something important: the business models work, the scale exists, and the regulatory environment has matured enough for IPOs to happen.

In 2026, we should see a second wave of FinTech IPOs emerge as late-stage companies race to capitalize on market appetite. Consolidation through M&A will accelerate for companies unable to clear IPO requirements.

Go deeper and learn more here: Gemini’s -60% post-IPO crash: the most asymmetric risk/reward setup in digital assets today? 🤔 [breaking down’t their 3Q 2025 financials, understanding what they mean & what’s next for Gemini + bonus deep dives into Coinbase, Robinhood & eToro inside]

eToro, or social investing’s hidden gem trading at a discount 👀📉 [breaking down their most important 3Q 2025 financial facts & figures, understanding what they mean, and why eToro might be worth your time and money + bonus deep dive into Robinhood]

Klarna’s 3Q 2025: AI-powered BNPL leader trading at 50% discount to intrinsic value? 🤯📉 [unpacking the most important 3Q 2025 financial facts & figures, understanding what they mean, and why Klarna might be worth your time and money in the years to come]

Circle’s 3Q 2025: minting dollars while printing questions 🤔💸 [deep dive into Circle’s 3Q 2025, breaking down the most financial facts & figures, and whether it’s worth your time and money in 2025 & beyond]

#6 Revolut’s transformation from challenger bank to operating system for all things money

Revolut officially reached a $75 billion valuation in November 2025, becoming Europe’s most valuable startup and one of the biggest private FinTechs in the world. In 2024, revenue surged 72% to $4 billion, while profit before tax grew 149% to $1.4 billion. The company also expanded into private banking, secured a British banking license, and positioned itself as an AI-powered financial operating system. The arc was clear: Revolut transcended “challenger bank” classification and became something closer to a financial OS.

This matters because Revolut proved the template. Succeed by integrating - payments, banking, crypto, AI agents - into a unified platform. Specialization lost. Integration won.

In 2026, expect Revolut to achieve even bigger profitability, launching new financial products built on AI & data infrastructure, and potentially hitting a $100 billion valuation.

Go deeper and learn more here: Revolut’s profit machine reaches escape velocity with 72% revenue surge and 149% profit growth in 2024 🤯🚀 [deep dive into their 2024 annual report, breaking down the most important numbers, what they mean & why you should be bullish on Revolut + lots of bonus reads inside]

#7 The mainstreamification of crypto and stablecoin companies becoming banks

In 2025, digital asset firms secured historic federal banking charters, the gold standard of financial legitimacy. Bank of America signaled readiness for cryptocurrency integration, Standard Chartered expanded digital asset services, and Intesa Sanpaolo made Bitcoin investment history. The regulatory gatekeeping fell away.

This wasn’t merely a lobbying victory. It was structural recognition that crypto and banking had merged. Regulators were simply making it official.

In 2026, expect most major banks offer cryptocurrency services natively. Stablecoins will become the preferred rails for institutional transfers.

Go deeper and learn more here: The perfect partnership: PNC Bank teams up with Coinbase 🤝💸 [why it’s a perfect partnership for both companies & what does it indicate about the future of FinTech & FinServ+ bonus deep dives into Coinbase]

#8 Stripe evolution from payments to (AI) infra powerhouse

Stripe reached ~$107 billion valuation, while also becoming the de facto financial infrastructure provider for the internet. The company’s AI-powered payments strategy, agentic commerce suite, comprehensive stablecoin infrastructure, and strategic M&A (including the Orum acquisition and Bridge acquisition for roughly $1.1B) positioned the FinTech giant as the operating system for modern commerce. A company that started processing payments became the backbone enabling AI agents to conduct commerce autonomously.

Stripe’s evolution demonstrates future thinking and boldness at its finest. Build infrastructure for both human and agentic commerce, and you own the future.

In 2026, I’d love for Stripe to go public on the strength of AI/agentic commerce becoming the global standard for next-generation commerce infrastructure.

Go deeper and learn more here: Stripe’s Agentic Commerce Suite signals a new era in AI-powered payments 🤖💳 [what it’s all about & why it’s huge, why FinTech giant’s strategy here is brilliant & what to expect next + bonus dive into Stripe’s quest to become the financial backbone of the AI economy & 100+ battle‑tested tools and frameworks to accelerate your AI projects inside]

Stripe’s strategic bet on becoming the financial backbone of the AI economy 💸🤖 [what the acquisition of Metronome is all about & how it stacks into Stripe’s bigger strategy, why the FinTech giant wants to own the full AI stack of financial services + bonus dives into Agentic Payments/Finance & the ultimate list of M&A resources to save you $$$]

#9 Global Payments’ $24.25B Worldpay acquisition was the FinTech Deal of the Year

Global Payments announced its agreement to acquire Worldpay for $24.25 billion in April 2025, reshaping the payment processing landscape. The deal demonstrated that consolidation at massive scale still drives value creation.

In 2026, expect more $10B+ payments/FinTech consolidation deals emerge as companies race to achieve the scale necessary to compete with AI-native financial platforms.

Go deeper and learn more here:

#10 Coinbase’s transformation from crypto exchange to operating system for global finance

Coinbase evolved from just a crypto exchange to basically an operating system for global finance. The company made ~10 M&As, launched crypto trading with regulated perpetual futures, and positioned itself as the institutional and consumer access point for digital finance.

In 2026, expect Coinbase to leverage its banking infrastructure to become a direct competitor to traditional banks and further expand its leadership beyond just the US.

Go deeper and learn more here: Inside Coinbase’s blueprint to become the Operating System for Global Finance ⚙️💸 [unpacking their System Update 2025 event, key new products/features and why they matter + bonus deep dive into Coinbase’s latest financials & their pitch deck teardown that started it all inside]

What 2025 Revealed

The pieces built in 2024 connected in 2025.

AI merged with finance. Crypto merged with banking. Payments merged with commerce. Stablecoins merged with institutional infrastructure. Challenger banks merged with operating systems.

The companies that won weren’t doing one thing better. They were building platforms where AI, crypto, payments, and banking converged into unified systems. The winners - Stripe, Revolut, Coinbase, OpenAI - all followed the same pattern: integrate, don’t specialize.

2026 will be about scaling what 2025 revealed. The pieces are connected now. What gets built on top of that connection is the story that comes next.

If you found this useful, first - go Premium:

P.S. Don’t tell anyone but join the leading FinTech community today and save 35% on your subscriptions. Prices are going up on 1 January for all new subscribers.

Then - share it with others and spread the word:

Really enjoyed the write up - thank you!

I agree with the convergence you describe.

But I believe 2026 and onward will be about quality — because quality is the only thing that truly scales into a positive bottom line.

And quality doesn’t emerge from integration alone.

It comes from responsibility, deep expertise, and doing something genuinely unique inside those unified systems.